Utah Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a wide range of legal templates that you can download or print.

By using the site, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Utah Monthly Retirement Planning in just a few minutes.

If you have a monthly subscription, Log In to obtain the Utah Monthly Retirement Planning from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, edit, print, and sign the downloaded Utah Monthly Retirement Planning. Each template you add to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Gain access to the Utah Monthly Retirement Planning with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/county.

- Use the Preview button to review the form's content.

- Check the form description to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

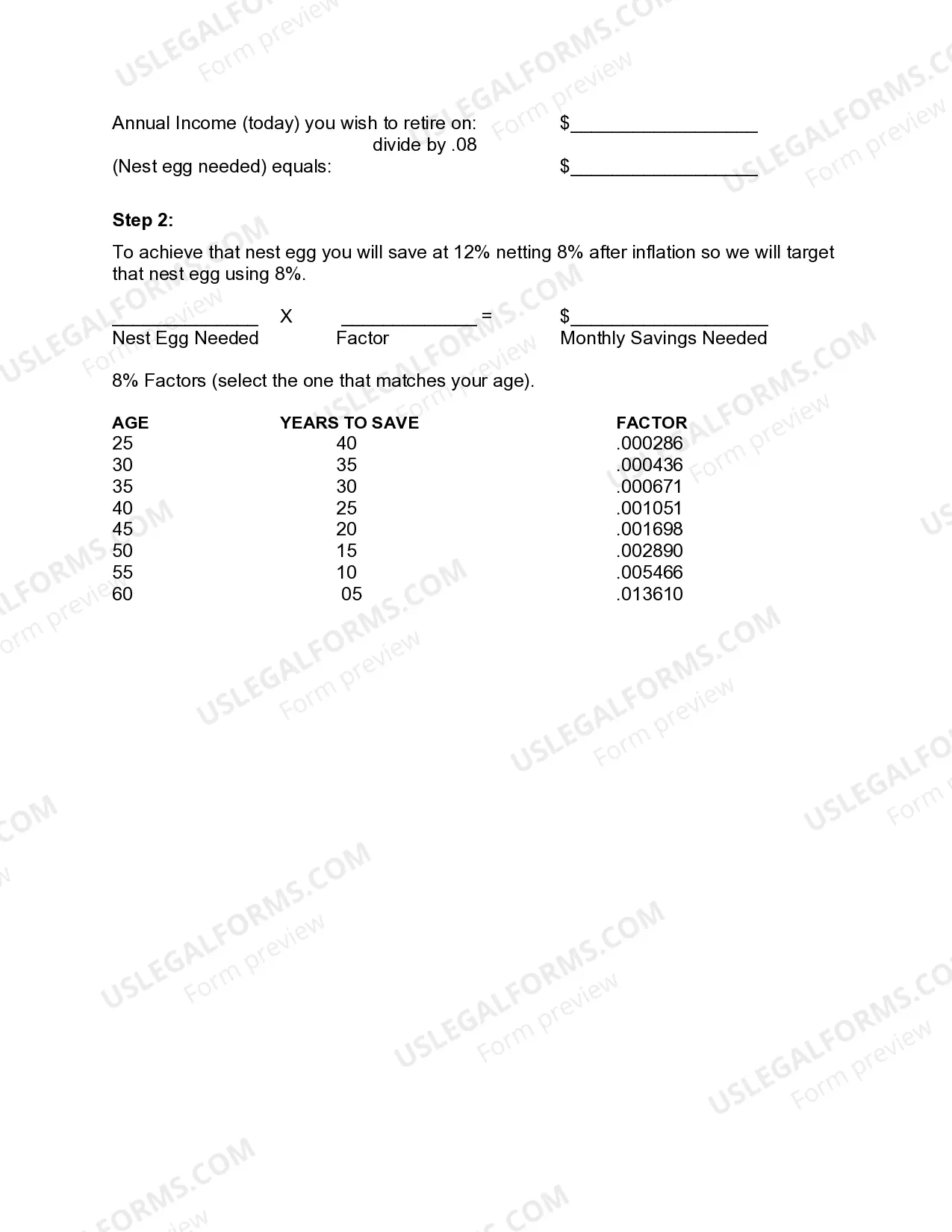

Turnover in Utah. The average retirement benefit is $17,894 per year, or $1,491 per month. The contributory pension covers 82,259 active school employees and 40,456 retired school employees and beneficiaries.

You qualify for a monthly retirement benefit if you are: 65 with 4 years of service. 62 with 10 years of service. 60 with 20 years of service. Any age with 25 years of service with full actuarial age reduction.

Eligibility. You are eligible to retire at any age after completing 20 years of creditable service. You may also receive a service retirement benefit at age 62, even if you do not have 20 years of creditable service.

Frequently Asked Questions Retirement Since you can earn 4 credits per year, you need at least 10 years of work that subject to Social Security to become eligible for Social Security retirement benefits.

The system provides retirement benefits public employees in Utah, including public school employees. The noncontributory system provides a defined benefit (DB) pension, a retirement plan that typically offers a modest but stable monthly retirement income that lasts the remainder of a retiree's life.

Many retirement planners suggest the typical 401(k) portfolio generates an average annual return of 5% to 8% based on market conditions.

Utah Retirement Systems administers a defined benefit plan intended to provide a meaningful retirement benefit to employees who have chosen a career in public service. It's a qualified tax-deferred plan under Internal Revenue Code Section 401(a). The laws governing this retirement system are set forth in Utah Code Ann.

Your retirement benefit is paid monthly. Retirement checks for the month of payment are mailed the last working day of each month. Although your first check may be delayed up to three months following your effective retirement date, the amount of your check is retroactive to the date your retirement began.

The full basic state pension in 2020 is £134.25 per week. This is significantly below the average A£304 retirement income, which means that retirees are filling the gap using private (workplace or personal) pensions. Those who do pay into private pensions should hopefully continue to meet this shortfall.