Utah Price Setting Worksheet

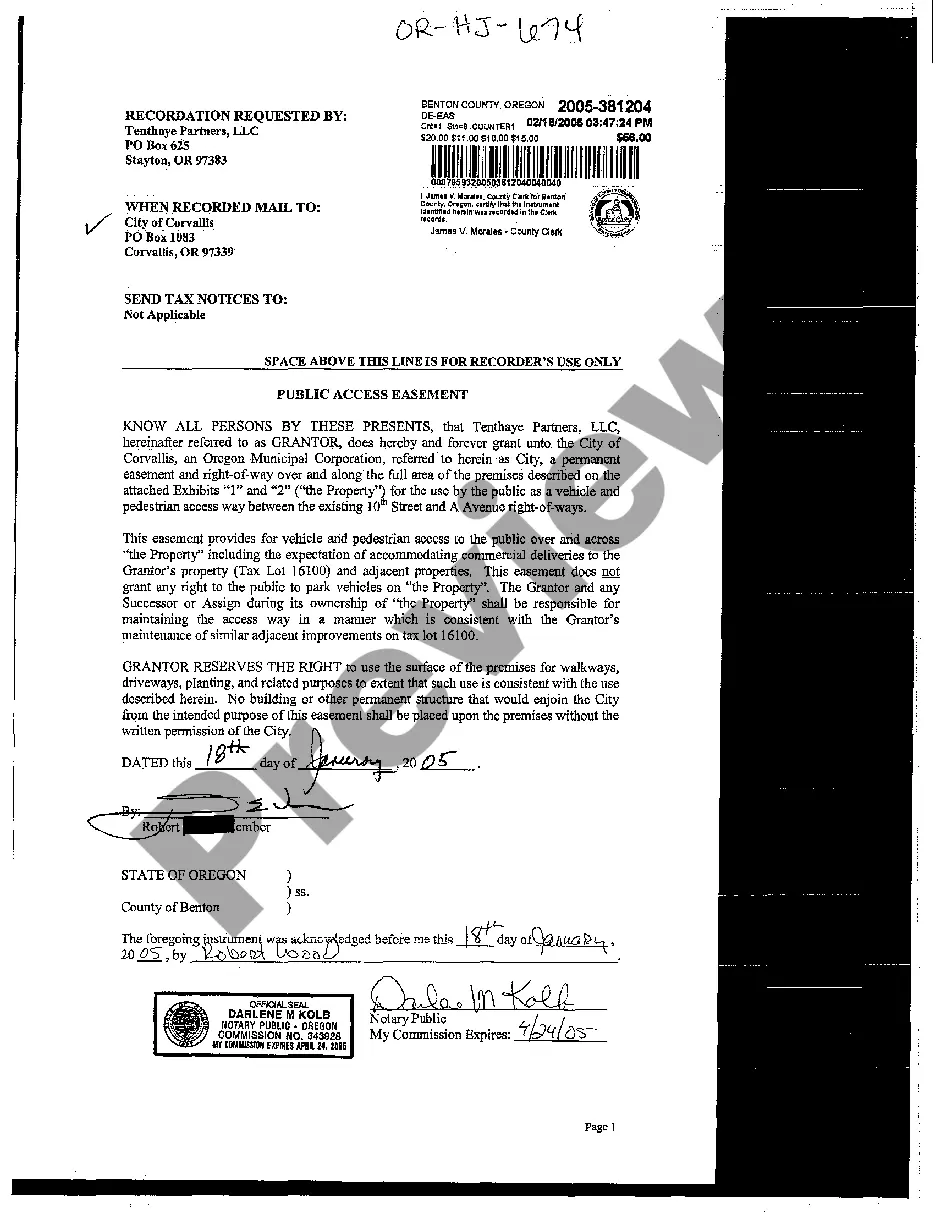

Description

How to fill out Price Setting Worksheet?

US Legal Forms - one of the largest collections of legal documents in the US - offers a vast selection of legal template records available for download or printing.

By utilizing the website, you can access thousands of forms for personal and business purposes, organized by type, state, or keywords.

You can find the latest editions of forms such as the Utah Pricing Worksheet within seconds.

Check the form details to confirm the selection is correct.

If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- If you already have a monthly subscription, sign in to download the Utah Pricing Worksheet from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have chosen the appropriate form for your city/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

TC40 is the name of the report that issuing banks send to Visa to report fraudulent transactions as part of its Risk Identification Service, and SAFE (System to Avoid Fraud Effectively) is Mastercard's analogous fraud monitoring program.

You may request a pay plan for individual income tax online at tap.utah.gov, or over the phone at 801-297-7703 (800-662-4335 ext. 7703), or by sending in form TC-804, Individual Income Tax Payment Agreement Request to the Utah State Tax Commission. Pay plan requests are considered after your return is processed.

If you are an individual, you may qualify to apply online if: Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns. Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

Withholding Formula (Effective Pay Period 16, 2020)Multiply the adjusted gross biweekly wages by the number of pay dates in the tax year to obtain the gross annual wages. Multiply the annual taxable wages by 4.95 percent to determine the annual gross tax amount. Calculate the annual withholding allowance.

2021 TC-40S Utah Individual Income Tax Credit for Income Tax Paid to Another State. Page 1. NOTE: Part-year residents rarely qualify for this credit. Nonresidents do not qualify for this credit. See instructions.

How to pay your taxesElectronic Funds Withdrawal. Pay using your bank account when you e-file your return.Direct Pay. Pay directly from a checking or savings account for free.Credit or debit cards. Pay your taxes by debit or credit card online, by phone, or with a mobile device.Pay with cash.Installment agreement.

General Information. Use TC-40B to calculate the Utah tax for a nonresident or a part-year resident.

How do I get a sales tax number?Taxpayer Access Point TAP. tap.utah.gov. Choose Apply for a Tax Account (TC-69).OneStop Business Registration OSBR. osbr.utah.gov.Paper form TC-69, Utah State Business and Tax Registration. This form can be mailed or you can take it to one of our offices.

Utah Form TC-40 Personal Income Tax Return for Residents. Utah Form TC-40A Income Tax Supplemental Schedule. Utah Form TC-40B Nonresident or Part-Year Resident Income Schedule. Utah Form TC-131 Statement of Person Claiming Refund Due a Deceased Taxpayer.

2019 TC-40A, Income Tax Supplemental Schedule. Page 1. Part 1 - Additions to Income (write the code and amount of each addition to income)