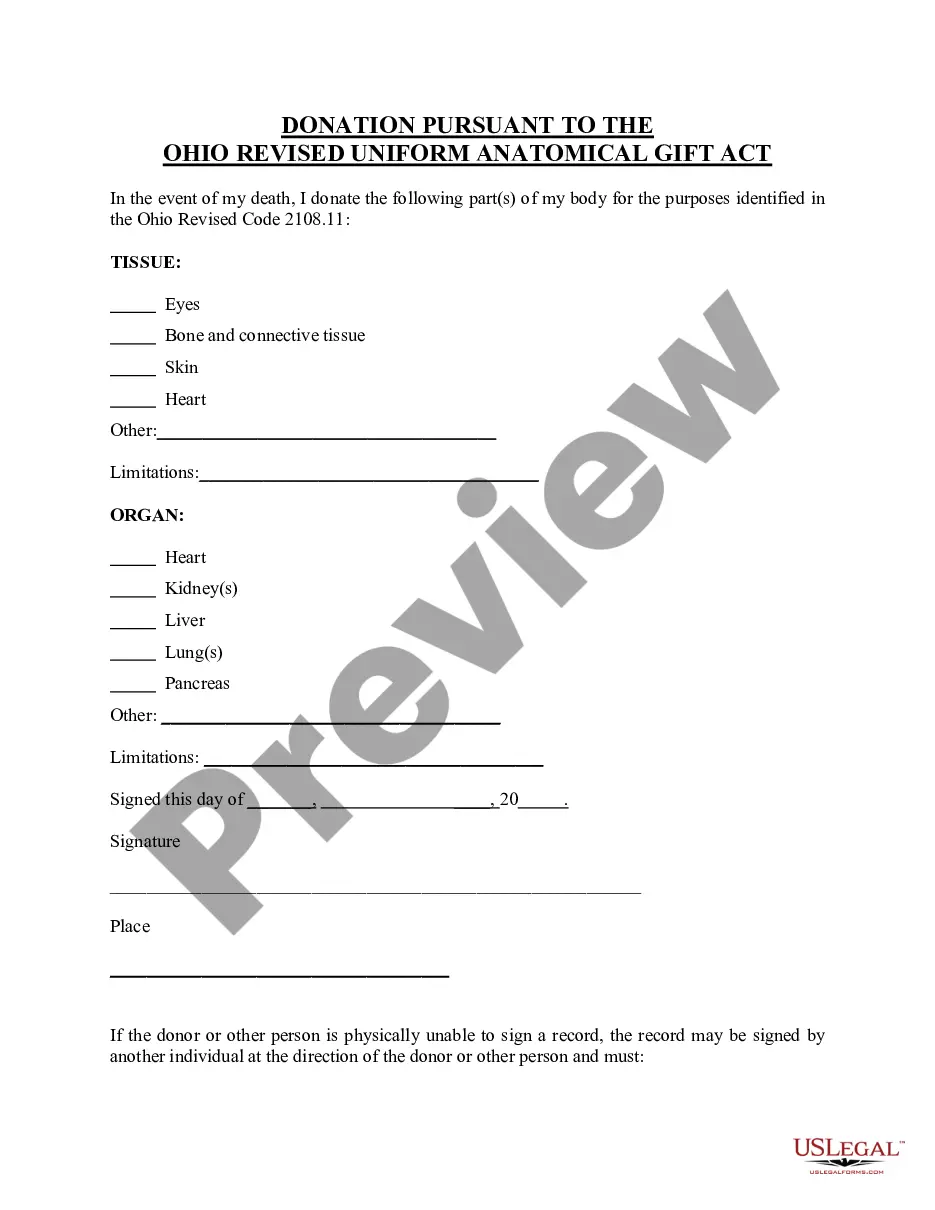

Utah Financial Record Storage Chart

Description

How to fill out Financial Record Storage Chart?

You can allocate time online attempting to locate the authentic document template that meets the national and regional regulations you need.

US Legal Forms provides thousands of official templates that are examined by professionals.

You can indeed download or print the Utah Financial Record Storage Chart from the service.

If available, utilize the Preview option to examine the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Utah Financial Record Storage Chart.

- Every legal document template you purchase is yours indefinitely.

- To acquire an additional copy of any purchased form, visit the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/city of preference.

- Review the form description to confirm you have chosen the right form.

Form popularity

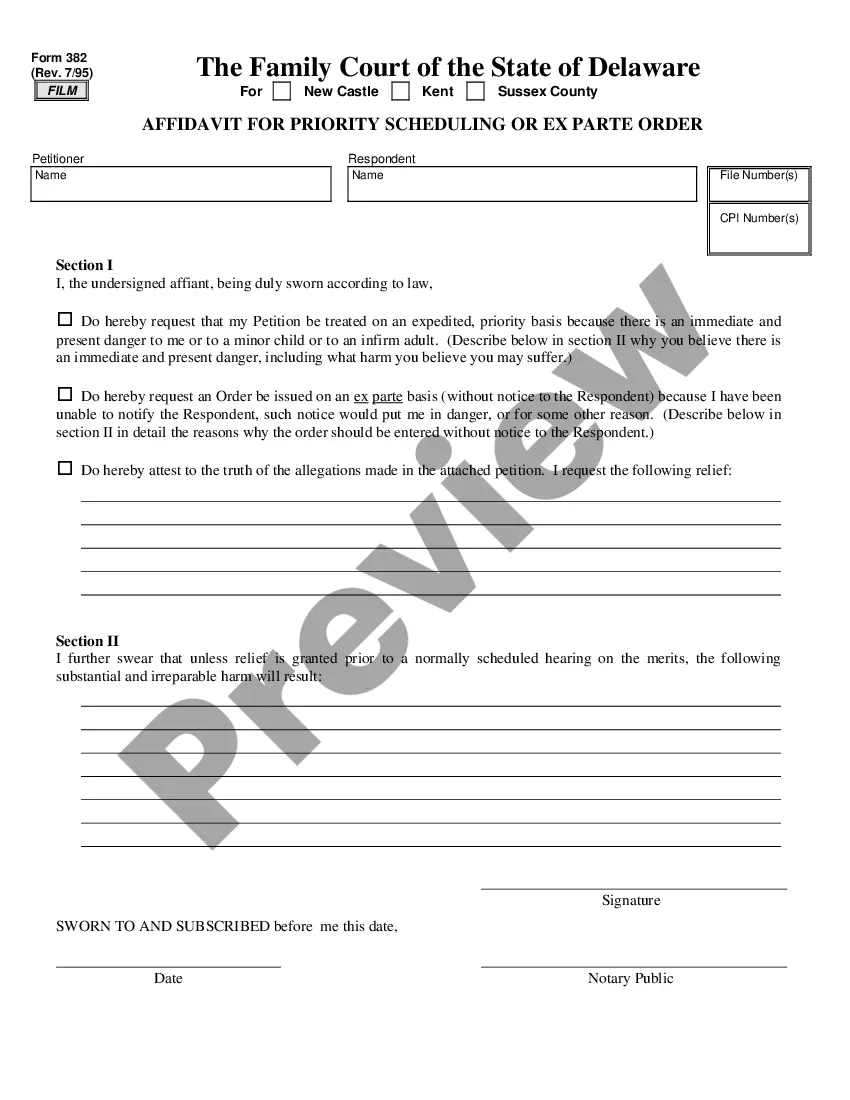

FAQ

Creating a retention plan involves assessing your records, categorizing them, and deciding on appropriate retention periods. Start by considering legal requirements, your organization's needs, and best practices. Implement regular reviews and updates to your plan to keep it relevant. The US Legal Forms platform provides tools that help streamline the development of your retention plan, including access to the Utah Financial Record Storage Chart for reference.

Yes, many records in Utah are considered public records, which means they can be accessed by the public. However, there are specific exceptions that protect sensitive information from being disclosed. Understanding what is publicly accessible and what is not can be complicated. The Utah Financial Record Storage Chart offers guidance on navigating these nuances effectively.

To create a record retention schedule, start by identifying all types of records your organization generates. Next, determine how long each type of record needs to be retained based on legal, operational, and historical needs. Document this information in a clear schedule for easy reference. Consider using the Utah Financial Record Storage Chart as a template to ensure compliance and efficiency.

The seven-year retention rule refers to the guideline that suggests keeping financial records for at least seven years for tax purposes. This time frame allows individuals and organizations to provide necessary documentation if needed during audits or inquiries by tax authorities. Adhering to this rule can save you from potential legal and financial complications. The Utah Financial Record Storage Chart offers explicit details about this rule in various contexts.

The first step in establishing a records retention program is to assess your organization’s current records and classify them according to their importance and retention needs. Identify which records are permanent, which should be kept for a limited time, and which can be discarded. This segregation lays the groundwork for a well-structured retention system. Utilizing the Utah Financial Record Storage Chart can guide you in making informed decisions.

Yes, banks are generally required to keep financial records for a minimum of seven years. This practice helps ensure compliance with regulations and allows for proper audits. Maintaining these records is crucial for protecting both the institution and its customers. The Utah Financial Record Storage Chart can help you understand how long different types of records should be stored.

The IRS typically advises retaining employee records for at least four years after filing the associated taxes. However, keeping some records longer—up to seven years—might be prudent, especially concerning any claims or disputes. The Utah Financial Record Storage Chart can guide your organization through these requirements. With tools from the US Legal platform, you can keep your records in order and ensure adherence to IRS guidelines.

Employee records such as payroll documents, tax forms, and other important financial information usually need to be retained for seven years. This duration helps protect your organization from potential audits and legal challenges. Utilizing the Utah Financial Record Storage Chart can provide clear guidance on what needs to be retained for this length of time. The US Legal platform also offers valuable resources that streamline record-keeping processes.

Typically, employer obligations regarding record retention can extend well beyond six years, particularly for certain types of documentation. For example, payroll records must generally be kept for seven years. The Utah Financial Record Storage Chart can help clarify specific requirements based on your business needs. By leveraging the US Legal platform, you can ensure that your HR department stays compliant and organized.

In Utah, employers are generally required to keep employee records for a minimum of three years after an employee's termination. It's crucial to retain this documentation for proper compliance with state laws and for any potential disputes that may arise. For more detailed information, the Utah Financial Record Storage Chart serves as a handy reference. By utilizing the US Legal platform, you can efficiently manage these records and stay informed about local regulations.