When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

Utah Disclaimer of Partnership

Description

How to fill out Disclaimer Of Partnership?

Are you presently in a location where you frequently require documents for both professional or personal purposes.

There are numerous legitimate document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of document templates, including the Utah Disclaimer of Partnership, designed to comply with national and state regulations.

Choose the pricing plan you want, complete the necessary information to create your account, and process your order using PayPal or a credit card.

Select a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Utah Disclaimer of Partnership template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Identify the document you need and ensure it corresponds to the correct city/state.

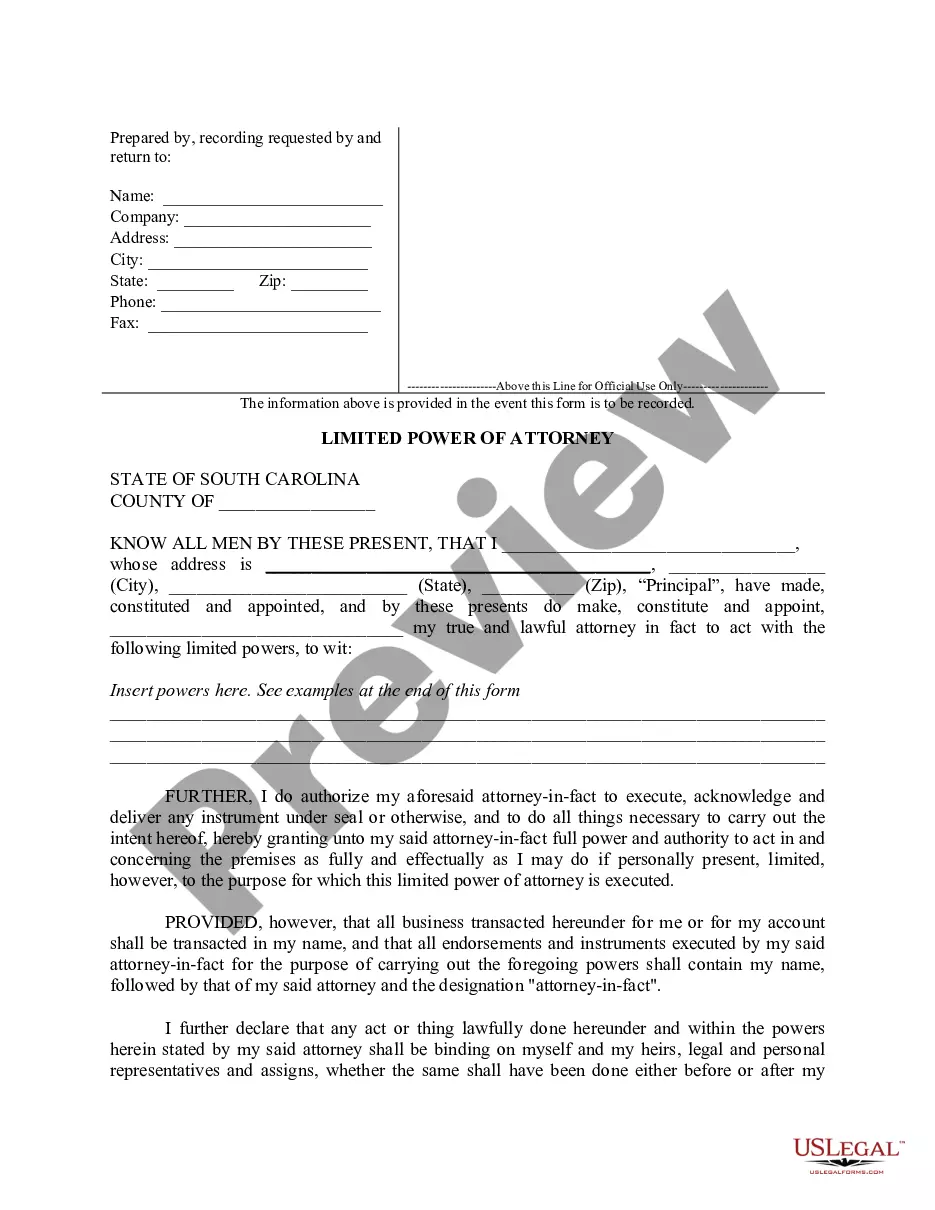

- Utilize the Review button to examine the document.

- Read the description to confirm you have selected the appropriate document.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs.

- Once you find the correct document, click on Acquire now.

Form popularity

FAQ

Partnerships in Utah typically need to fill out Form TC-65, which is the Partnership or Composite Income Tax Return. This form allows the partnership to formally report its income, deductions, and tax obligations. If you are navigating the Utah Disclaimer of Partnership rules, ensure you complete this form accurately to meet state compliance. Using resources like US Legal Forms can streamline this process and provide the necessary forms.

Filing taxes for an LLC in Utah requires several essential steps. First, ensure you have your LLC’s Employer Identification Number (EIN) and any necessary business licenses. In relation to the Utah Disclaimer of Partnership, if your LLC has multiple members, consider how partnership tax rules may apply to your filings. Platforms like US Legal Forms can help simplify the tax filing process with tailored forms and instructions.

To make a Utah PTE election, you must complete the necessary forms to inform the state that your entity will be treated as a pass-through entity for tax purposes. It's important to file the election with the Utah State Tax Commission, typically within a designated time frame after the beginning of the tax year. By doing this, you can benefit from favorable tax treatment, effectively utilizing the Utah Disclaimer of Partnership provisions if you are part of a partnership. Consider using online resources like US Legal Forms for accurate guidance and templates.

You should file the Utah TC 65 with the Utah State Tax Commission. This form is meant for partnerships to report their income and expenses. Properly filling out the TC 65 can help you avoid complications that may arise from misunderstanding partnership regulations. US Legal Forms can provide assistance in completing and filing the TC 65 accurately.

In Utah, whether a partnership return is required depends on the nature of your partnership. If your partnership doesn't earn income or is not subject to taxation, you may not need to file a return. However, understanding the regulations surrounding a Utah Disclaimer of Partnership can help clarify your obligations. Consider consulting resources on US Legal Forms for further guidance.

Proof of a domestic partnership in Utah can typically be obtained from the office where the partnership was registered. After filing a Utah Disclaimer of Partnership, you may also receive documentation of the dissolution. If you need help with this process or require specific forms, US Legal Forms offers resources to assist you in acquiring the necessary proof of your partnership.

To end a domestic partnership in Utah, you need to file a Utah Disclaimer of Partnership. This process involves completing specific forms and submitting them to the appropriate state office. Each partner should be aware of their rights and responsibilities during this process. If you have any uncertainties, consider using a service like US Legal Forms to guide you through the steps.

While Utah does not mandate written articles of partnership for a general partnership, having a written agreement is highly recommended. A written document helps solidify the terms of the partnership, outlining each partner's rights, duties, and ownership stakes. This practice not only promotes clarity but also serves as a valuable resource in case of disputes. To ensure you're adequately protected, consider creating a Utah Disclaimer of Partnership that highlights all essential details of your agreement.

Code 76 9 402 in Utah addresses various aspects of partnership liability and responsibilities concerning partners' actions. Understanding this code is essential for anyone involved in a partnership, as it outlines how partners can be held accountable. Knowledge of this code helps partners navigate legal obligations and reduces the chances of disputes. A Utah Disclaimer of Partnership can provide additional clarity regarding each partner's legal standing.

A general partnership in Utah is a business arrangement where two or more individuals agree to operate a business for profit. Each partner bears personal liability for the debts and obligations of the partnership. While formal paperwork is not strictly necessary, partners should outline their agreement to ensure everyone understands their rights and responsibilities. Utilizing a Utah Disclaimer of Partnership can safeguard against misunderstandings and help establish clear expectations.