This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

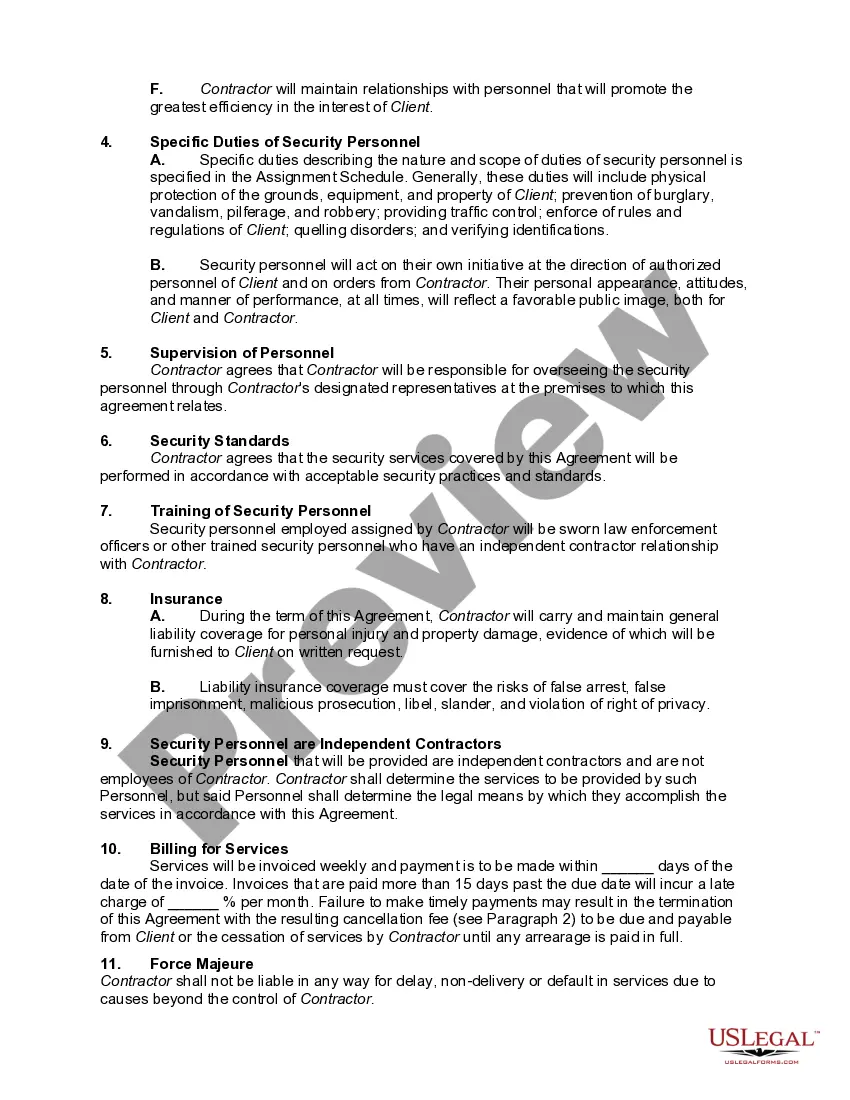

Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed

Description

How to fill out Agreement To Provide Security Or Alarm, Surveillance And/or Traffic Control Services - Security Personnel To Be Independent Contractors - Self-Employed?

You can spend considerable time online trying to find the legal document template that meets the state and federal requirements you require.

US Legal Forms provides a vast selection of legal forms that are vetted by professionals.

You can effortlessly download or print the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel as Independent Contractors - Self-Employed from the service.

First, make sure you have selected the correct document template for the county/area of your choosing. Read the form description to ensure you have selected the correct type. If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of a purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

Yes, if you decide to work under the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, you must register as an independent contractor in Utah. This registration process is essential for legal compliance and helps establish your status as a self-employed individual. Additionally, it allows you to manage your taxes effectively and operate your business with the necessary permits. By using platforms like uslegalforms, you can easily find resources and forms needed to complete your registration correctly.

The terms self contractor and independent contractor are often used interchangeably, yet they can have nuanced differences in specific contexts. A self contractor usually refers to someone who undertakes projects independently, while an independent contractor implies a formal contract for service. When involved with the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, clarity in these definitions helps streamline operations and agreements.

The IRS defines self-employed individuals as those who work for themselves rather than for an employer. This includes independent contractors and freelancers who earn income from their services. If you operate under the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, understanding the IRS guidelines is important for tax reporting.

In Utah, independent contractors may need a business license, depending on the services they offer. If you plan to provide security, alarm, or surveillance services under the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, it is crucial to check local regulations to ensure compliance with licensing requirements.

Yes, self-employed individuals and independent contractors refer to similar employment types. Both operate under a contract rather than as a traditional employee. When engaging in the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, understanding this distinction helps clarify legal rights and responsibilities.

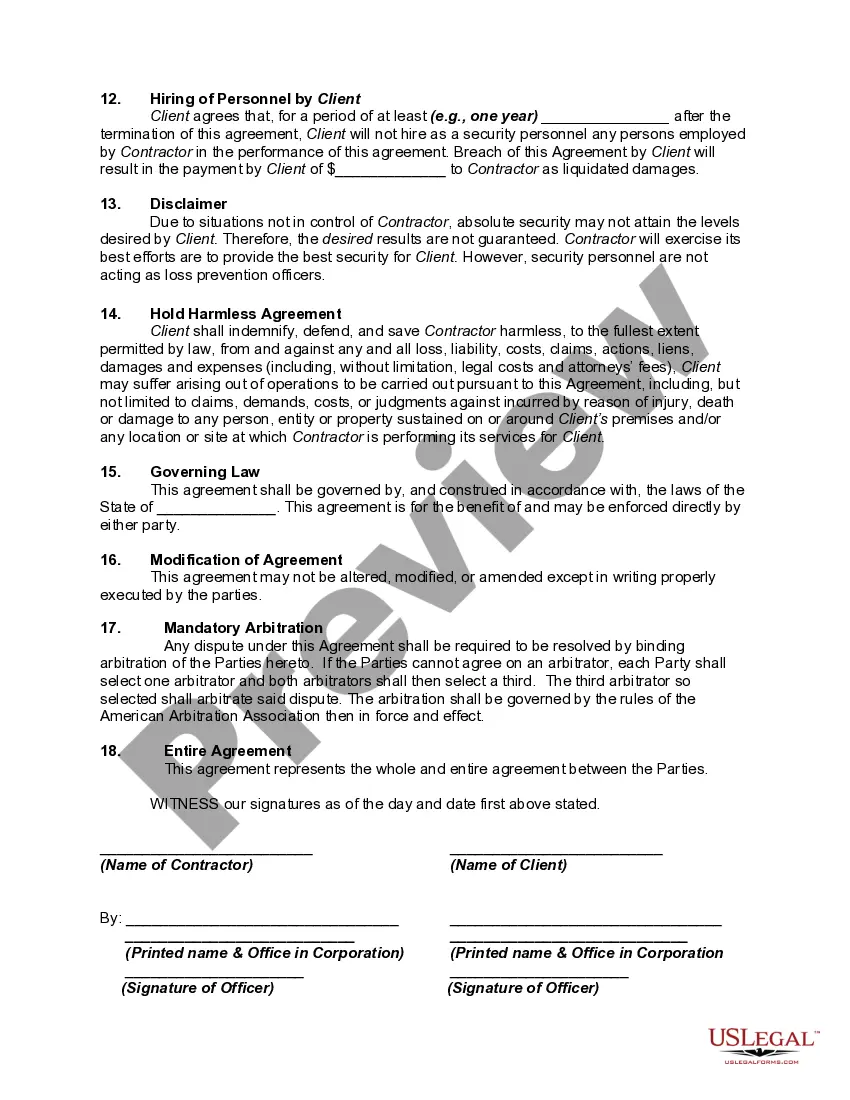

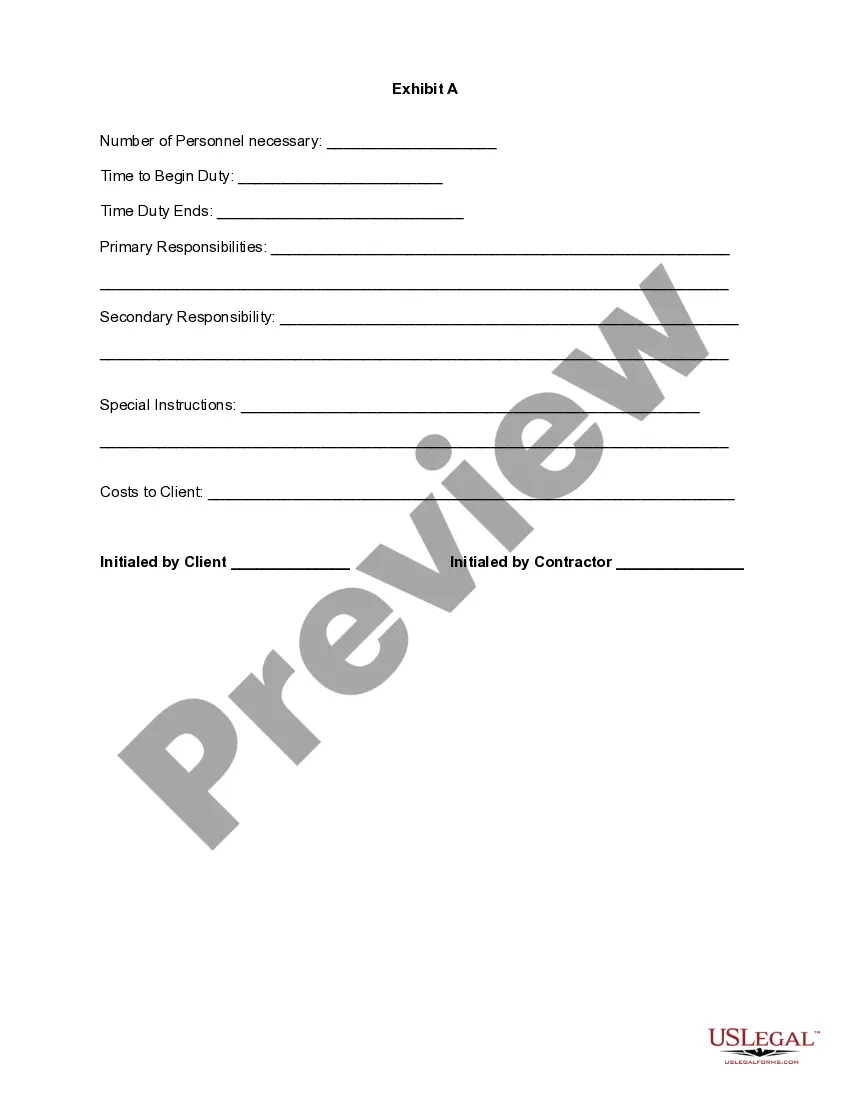

In Utah, an independent contractor agreement outlines the terms between a client and a self-employed worker. This document clearly defines the scope of work, payment terms, and project timelines. For those involved in the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, having a robust agreement is essential to prevent misunderstandings.

employed general contractor oversees construction projects from start to finish. They manage resources, hire subcontractors, and ensure compliance with local regulations. In the context of the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services Security Personnel to be Independent Contractors SelfEmployed, these contractors may hire skilled security personnel to enhance project safety.

In Utah, a 1099 form is used for independent contractors, while a W-2 form is for employees. If you are classified as an independent contractor under the Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, you will receive a 1099. This means you are responsible for paying your own taxes. Conversely, W-2 employees have their taxes withheld by their employer, making it crucial to understand your classification to manage your finances correctly.

Breaking an independent contractor agreement may lead to legal consequences, including financial penalties or breach of contract claims. It's essential to understand the terms laid out in a Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed to avoid such situations. Engaging with legal resources can help clarify obligations and provide guidance on resolving disputes.

The independent contractor agreement outlines the specific terms and conditions of a working relationship between a contractor and a client. This agreement is crucial in defining roles, responsibilities, and payment structures, especially in services like a Utah Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed. It helps prevent misunderstandings and ensures both parties are on the same page.