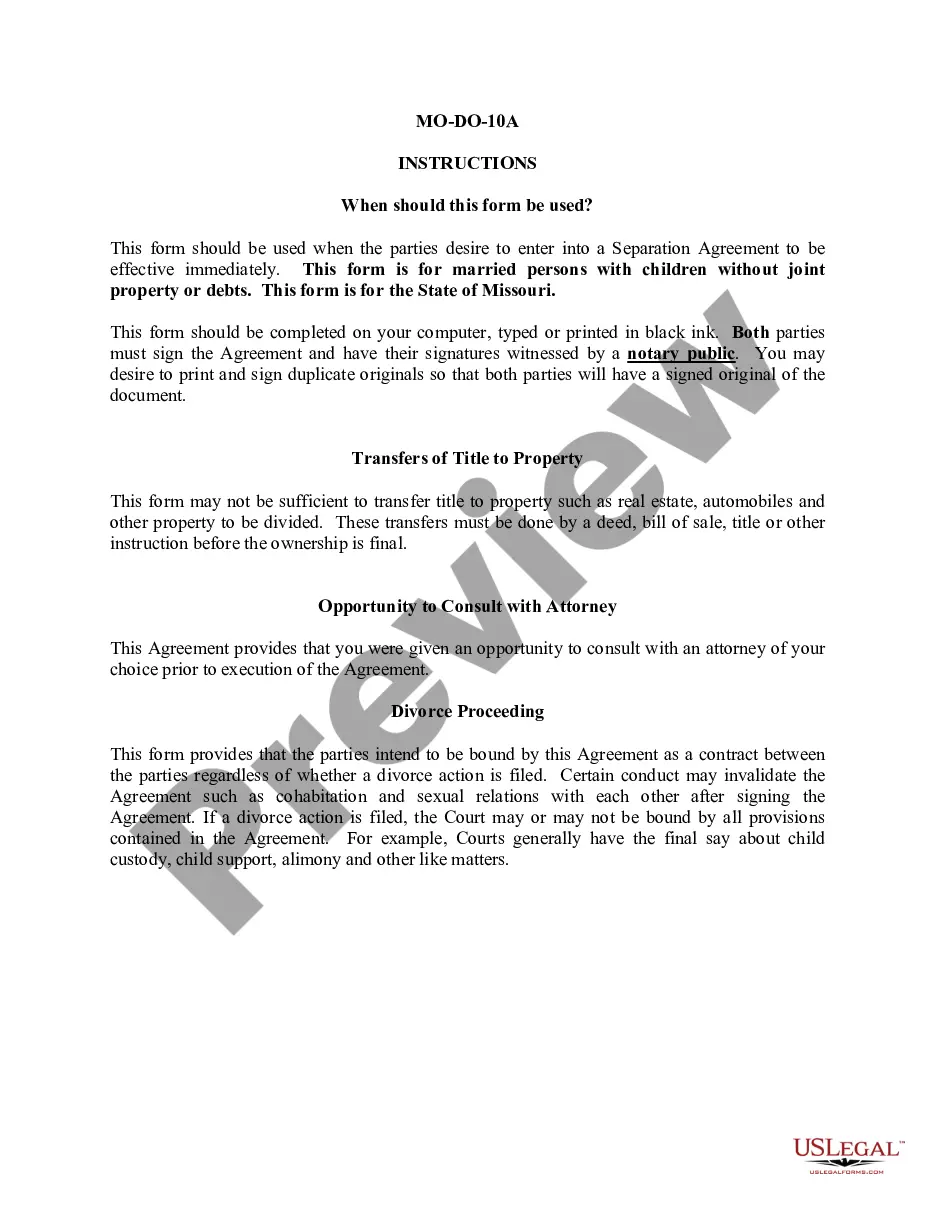

Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

You can dedicate countless hours online seeking the authentic document template that satisfies the federal and state requirements you desire.

US Legal Forms offers an extensive collection of legal documents that have been vetted by experts.

You can effortlessly access or create the Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping through your assistance.

If available, utilize the Preview button to view the document template as well.

- If you already possess an account with US Legal Forms, you may Log In and click the Download button.

- Following that, you may fill out, modify, create, or sign the Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any form you have purchased, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your desired region/town.

- Review the form description to confirm that you have chosen the appropriate document.

Form popularity

FAQ

Agreed-upon procedures can be performed by accountants who have the necessary expertise, as defined under a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. These procedures can be conducted by qualified professionals who understand the specific needs of the client. Utilizing a platform like US Legal Forms can help find experienced consultants tailored to your requirements.

An accountant does not need to be independent to conduct agreed-upon procedures as per a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. While independence can enhance trust, these procedures are based on specific agreements with the client, focusing on the tasks at hand. Clients should discuss their expectations with the accountant for optimal results.

For a compilation engagement under a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, independence is not mandated. Accountants can perform compilations while still being involved with the client, but they must disclose any lack of independence. This transparency helps clients make informed decisions and rely on the accountant's advice.

In the context of a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, independence is not necessarily required to perform agreed-upon procedures. However, maintaining a level of objectivity and neutrality enhances the credibility of the work performed. Clients often benefit from having consultants who demonstrate integrity and a commitment to impartiality.

The segment of the accounting profession dedicated to providing audit, tax, and consulting services is known as public accounting. It plays a vital role in ensuring that businesses adhere to legal standards while optimizing their financial health. Establishing a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is often the first step towards achieving effective collaboration with experienced accounting professionals, ensuring your business thrives.

Organizations that provide tax compliance auditing and consulting services are typically public accounting firms. These firms specialize in helping clients meet their regulatory requirements while offering strategic advice to enhance financial performance. By engaging with a company that understands the intricacies of tax law through a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, businesses can find tailored solutions that address their unique challenges.

Various accounting professionals cater to clients, including Certified Public Accountants (CPAs), tax advisors, and financial consultants. These experts offer a range of services, from tax preparation to financial reporting and strategic advisory. Enlisting their help through a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping ensures clients receive precise guidance tailored to their specific needs.

The area of accounting that specializes in offering tax advice and auditing services is public accounting. It encompasses the roles of Certified Public Accountants (CPAs) who provide essential insights into financial reporting and tax compliance. By utilizing a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, you can clarify the objectives of your consulting engagement, helping clients navigate their financial obligations efficiently.

Starting a CPA tax firm involves several critical steps. First, obtain the necessary licensing and certifications to practice as a CPA in your state. Next, consider drafting a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, as this can establish strong client relationships and define the scope of your services, enhancing trust and professionalism.

The area of accounting that focuses on audit, tax, and consulting services is called public accounting. Professionals in this field offer expertise to help businesses manage their financial practices effectively. By entering a Utah General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, you can secure valuable support from knowledgeable accountants who guide you through complex financial challenges.