Utah Revocable Trust for House

Description

How to fill out Revocable Trust For House?

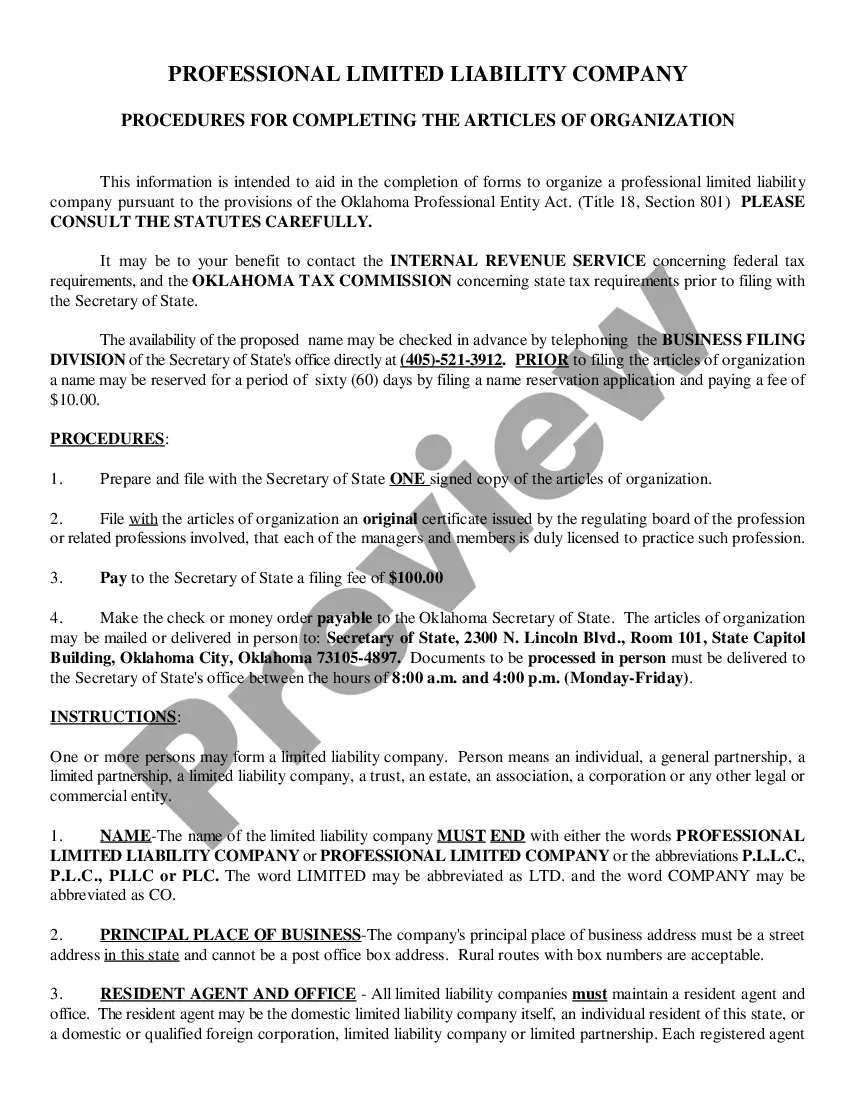

You can waste numerous hours online searching for the authentic document template that meets the state and federal requirements you require.

US Legal Forms provides a vast array of authentic forms that are reviewed by experts.

It is effortless to download or print the Utah Revocable Trust for House from their service.

If available, utilize the Review option to examine the document template as well. If you need to find another version of the form, take advantage of the Search field to locate the template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and click on the Get option.

- Following that, you may complete, modify, print, or sign the Utah Revocable Trust for House.

- Every authentic document template you obtain belongs to you indefinitely.

- To acquire another copy of any purchased form, navigate to the My documents section and select the appropriate option.

- If it's your first time using the US Legal Forms site, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your desired county/city.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

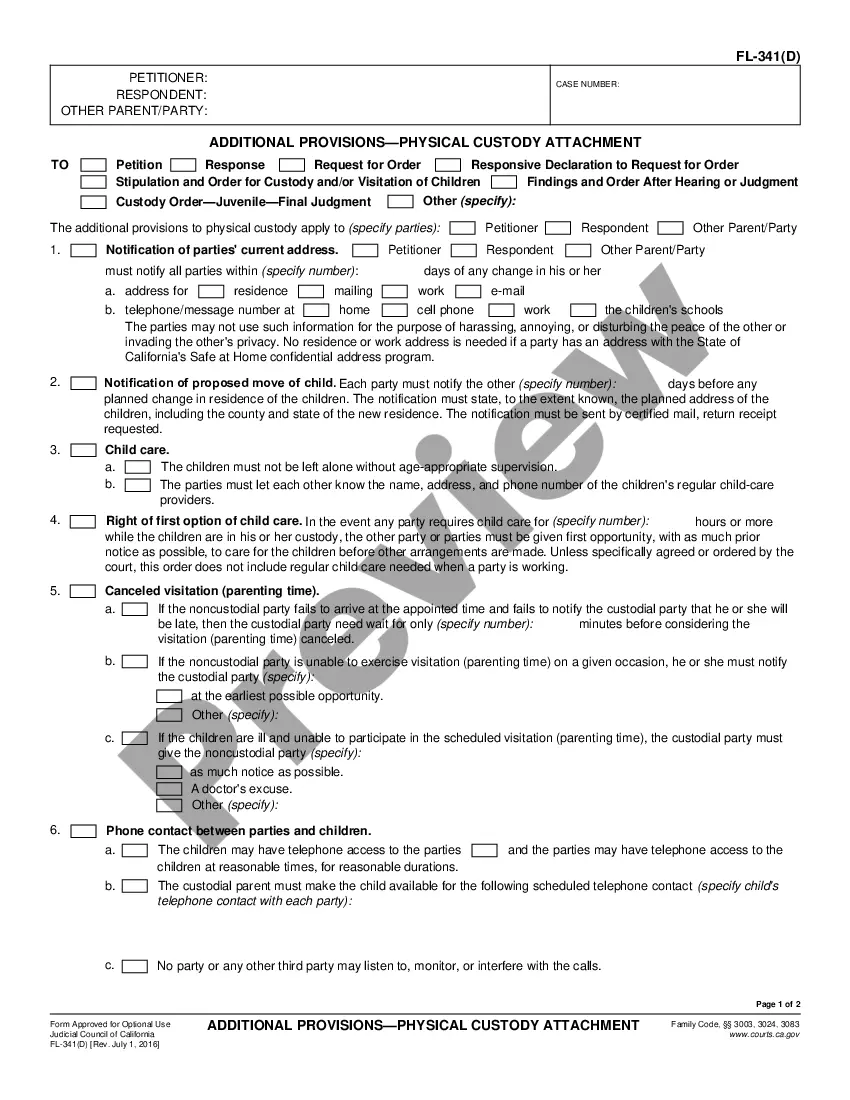

You might consider putting your house in a Utah Revocable Trust for House to simplify the transfer of property after your death. This setup can help your heirs avoid the lengthy and often costly probate process. Additionally, it can offer you more control over your property during your lifetime, allowing you to manage your assets effectively and confidently.

Choosing to place your house in a Utah Revocable Trust for House can be a wise decision for many. It helps avoid probate, ensuring your home transfers to beneficiaries smoothly after your passing. Furthermore, a revocable trust provides flexibility, allowing you to amend its terms as your circumstances change. Ultimately, it can enhance your estate planning efforts.

To transfer your property into a trust in Utah, you first need to create a Utah Revocable Trust for House. After setting up the trust, you will execute a new deed that changes the ownership from your name to the trust's name. It's advisable to consult with a legal professional or use a platform like UsLegalForms to ensure the transfer is completed correctly and efficiently.

While a Utah Revocable Trust for House offers benefits, it also has some drawbacks. You may face ongoing administrative responsibilities to maintain the trust. Furthermore, if not managed properly, a trust may not shield your assets from creditors, making it essential to seek legal guidance. Evaluating these disadvantages is important when considering a trust for your home.

For many, a Utah Revocable Trust for House is often considered the best option for placing a home. It allows for flexibility, as owners can modify or revoke the trust during their lifetime. Additionally, this type of trust helps avoid probate, making it easier and faster for beneficiaries to receive their inheritance.

A disadvantage of a family trust is the complexity involved in managing it, particularly a Utah Revocable Trust for House. The families must stay informed about changes in tax laws and make necessary adjustments to the trust. This ongoing responsibility can be daunting for some, especially if they prefer a more straightforward estate plan.

To put your house in a trust in Utah, start by creating a Utah Revocable Trust for House with the help of a legal professional, if needed. Next, prepare a new deed that transfers ownership from you to the trust. Once completed, file the new deed with the county recorder’s office to ensure the trust owns the property legally.

Yes, you can place your house in a revocable trust even if it has a mortgage. When using a Utah Revocable Trust for House, the mortgage does not prohibit the transfer; however, you should inform your lender. Most lenders allow this arrangement, but it is wise to verify the terms to avoid any possible complications.

Yes, placing assets in a trust can be beneficial for your parents, especially a Utah Revocable Trust for House. This type of trust allows for flexibility and control, enabling them to designate how their assets are distributed after their passing. It can also help streamline the process for heirs, aiding in avoiding the complexities of probate.

One significant downfall of having a trust is the potential for administrative costs. Setting up a Utah Revocable Trust for House may involve legal fees and ongoing expenses to keep it compliant with state laws. This can be a concern for some families, so it's important to weigh these costs against the benefits the trust offers.