Utah Receipt Template for Child Care

Description

How to fill out Receipt Template For Child Care?

If you require extensive, retrieve, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Utah Receipt Template for Child Care. Every legal document template you purchase is yours indefinitely. You have access to each form you acquired in your account. Visit the My documents section and select a form to print or download again. Be proactive and download, print, and utilize the Utah Receipt Template for Child Care with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Utah Receipt Template for Child Care in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to find the Utah Receipt Template for Child Care.

- You can also access forms you have previously acquired in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

Yes, having receipts is essential when you want to claim childcare expenses on your taxes. The IRS requires proof of payment, and a Utah Receipt Template for Child Care can simplify this process. Using this template, you can create clear and organized records of your childcare expenses, making it easier to provide documentation if needed. By keeping track of these receipts, you can maximize your tax benefits and ensure compliance with IRS guidelines.

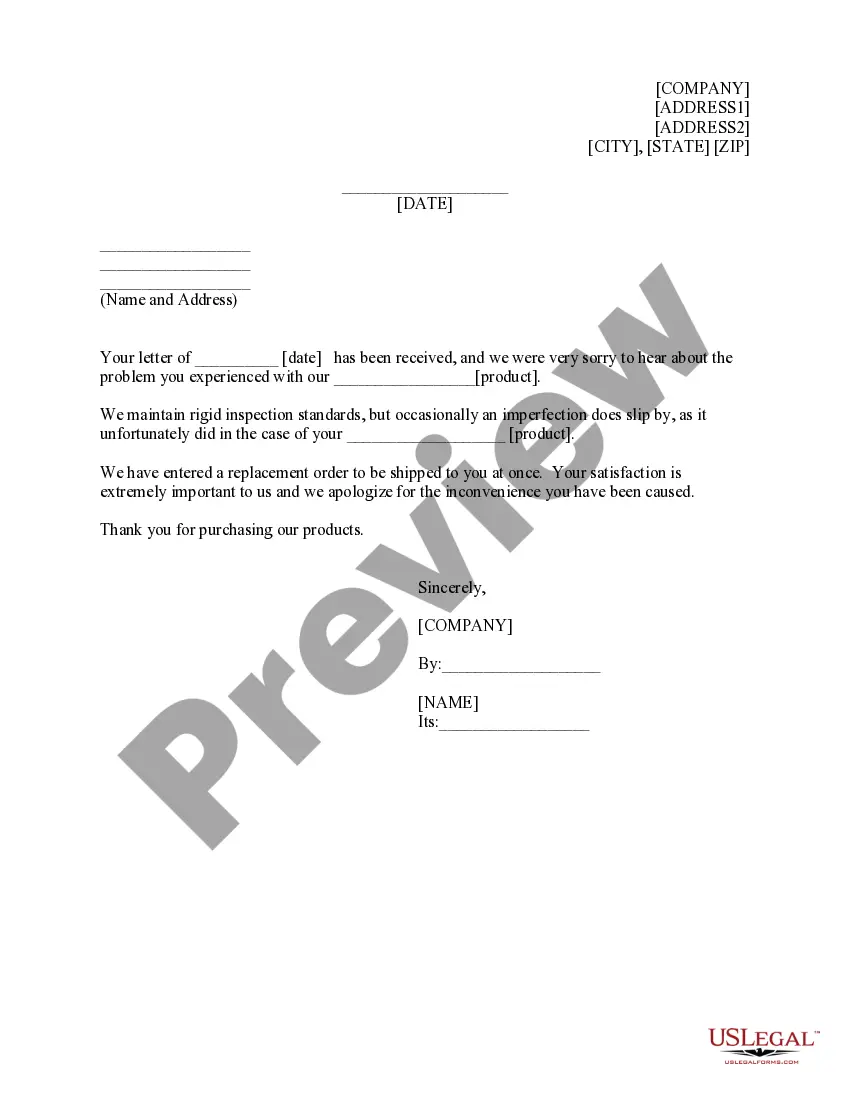

The IRS verifies child care expenses by examining documentation provided in your tax return. They may review receipts, invoices, or bank statements that validate your claims. Employing a Utah Receipt Template for Child Care can enhance your records, making it easier for you to provide accurate information and respond to any inquiries from the IRS.

To claim the child care tax credit, you need to provide specific information about your expenses. You'll require the name, address, and tax identification number of the care provider, along with documentation of the payments made. Utilizing a Utah Receipt Template for Child Care can simplify this process by ensuring that all necessary details are clearly recorded and prepared for submission.

Proving expenses without receipts can be challenging, but you have options. You can use bank statements, credit card transactions, or invoices to support your claims. Additionally, a Utah Receipt Template for Child Care can help you create documentation that outlines your child care costs, making it easier to substantiate your expenses during tax time.

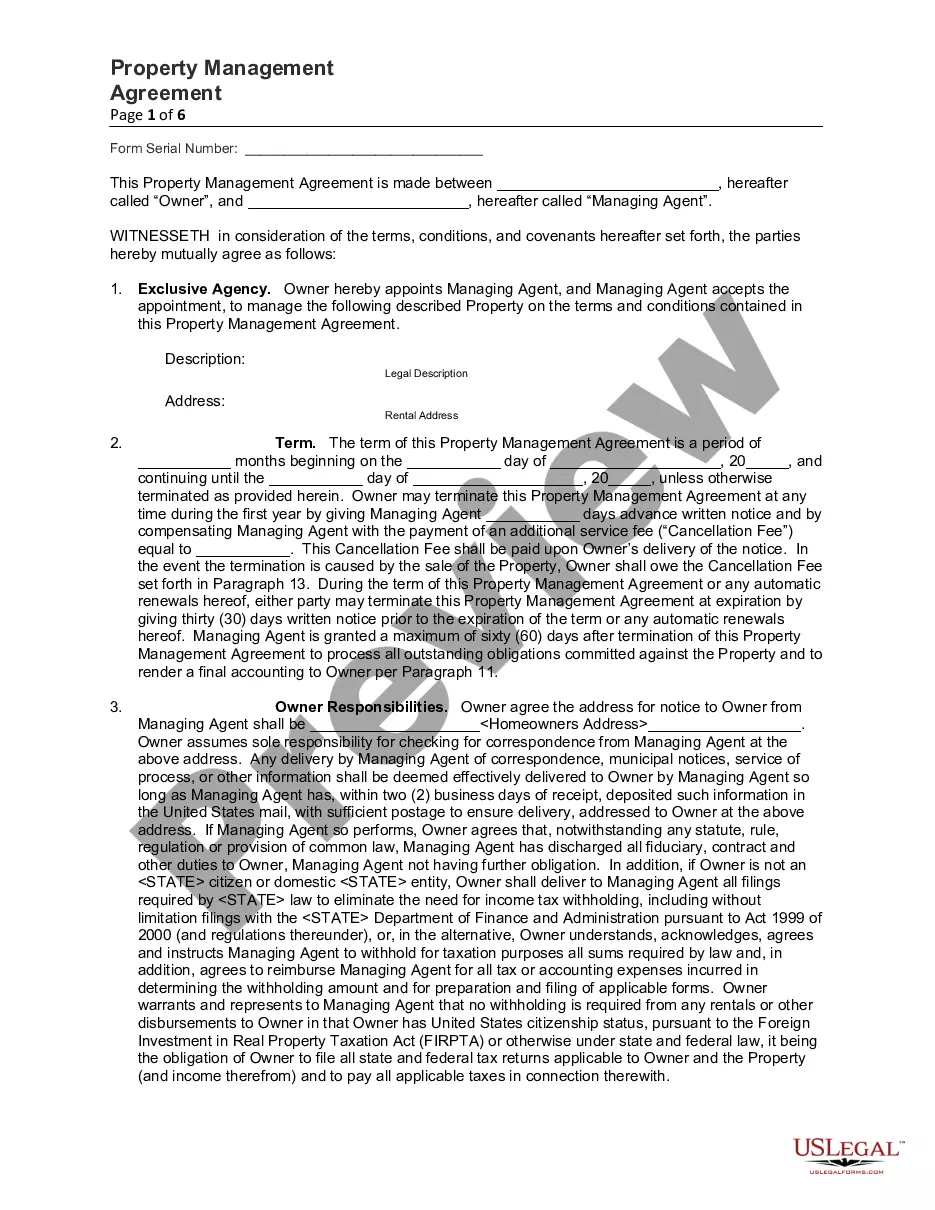

When writing a reference for child care, be sure to include your relationship with the caregiver and the context of their services. Highlight specific qualities and experiences that showcase their ability to care for children, including their reliability and communication skills. This type of documentation can greatly benefit from the structure provided by a Utah Receipt Template for Child Care, which can lend credibility to your recommendation.

Claiming child care expenses without receipts can be challenging, but you can use written records to demonstrate expenses incurred. Documents such as bank statements, canceled checks, or signed agreements may help substantiate your claim. Consider creating a detailed summary of your child care expenses and using a Utah Receipt Template for Child Care to assist in documenting these details.

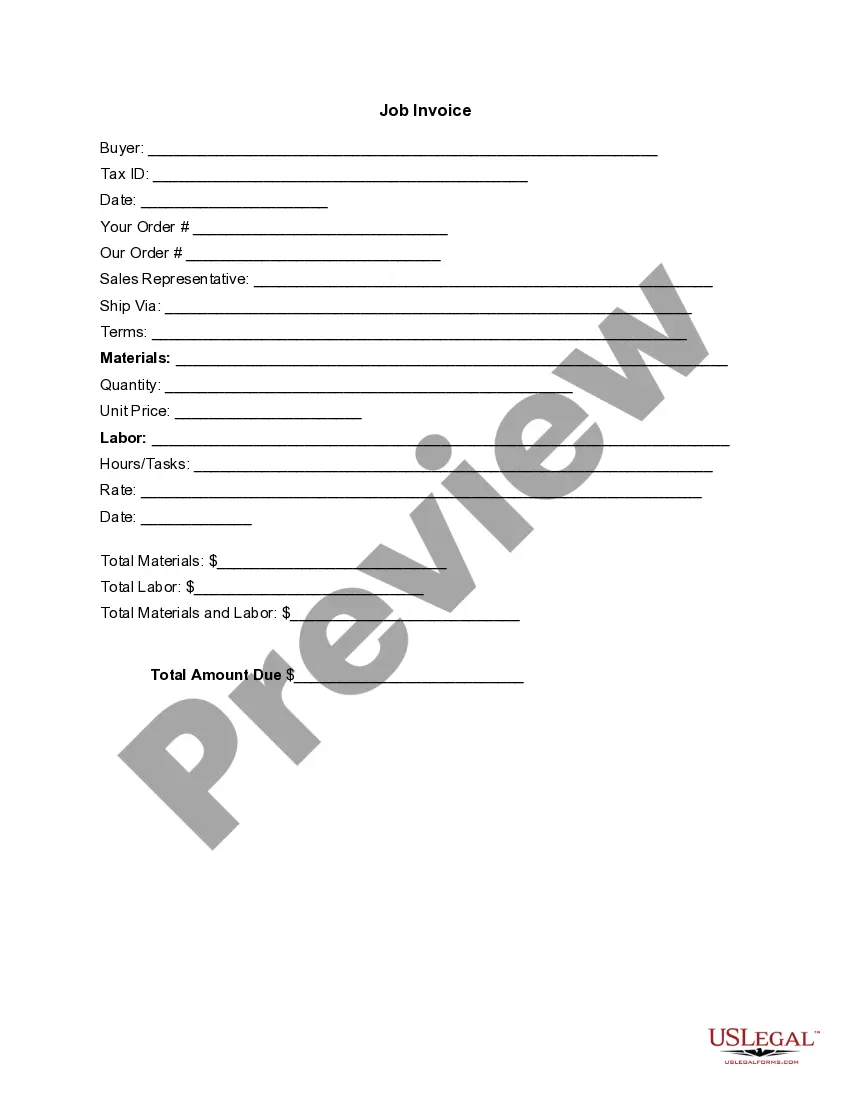

A receipt for child care should include the caregiver’s details, the parent's name, and contact information. Clearly list the date of service, hours worked, and total payment received. For convenience, many users turn to a Utah Receipt Template for Child Care, as it simplifies the writing process and ensures all essential details are captured.

In a proof of child care letter, clearly state the caregiver's name and the child's name. Include specific details about the care period, services rendered, and payment amounts. Additionally, referencing a Utah Receipt Template for Child Care can enhance the professionalism of your letter, ensuring it meets necessary requirements.

To prove child care, gather documentation that reflects the hours of care provided and payment made. Receipts, invoices, or bank statements serve as strong evidence. A Utah Receipt Template for Child Care is an excellent tool, as it standardizes your records and makes it easier to provide proof when necessary.

Creating a receipt for child care involves listing the caregiver's name, contact details, and the parent's information. Ensure to include the date of service, hours worked, and the total amount charged. Utilizing a Utah Receipt Template for Child Care can simplify this process, providing a professional format that you can easily customize as needed.