Utah Letter to Creditors Notifying Them of Identity Theft of Minor

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor?

Are you presently within a place the place you need files for possibly business or individual uses just about every day time? There are a variety of legitimate papers themes available on the Internet, but locating ones you can rely isn`t effortless. US Legal Forms provides 1000s of develop themes, such as the Utah Letter to Creditors Notifying Them of Identity Theft of Minor, which can be published to meet state and federal needs.

Should you be currently familiar with US Legal Forms site and get an account, simply log in. Next, you can acquire the Utah Letter to Creditors Notifying Them of Identity Theft of Minor web template.

Unless you have an bank account and would like to begin using US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for your proper metropolis/county.

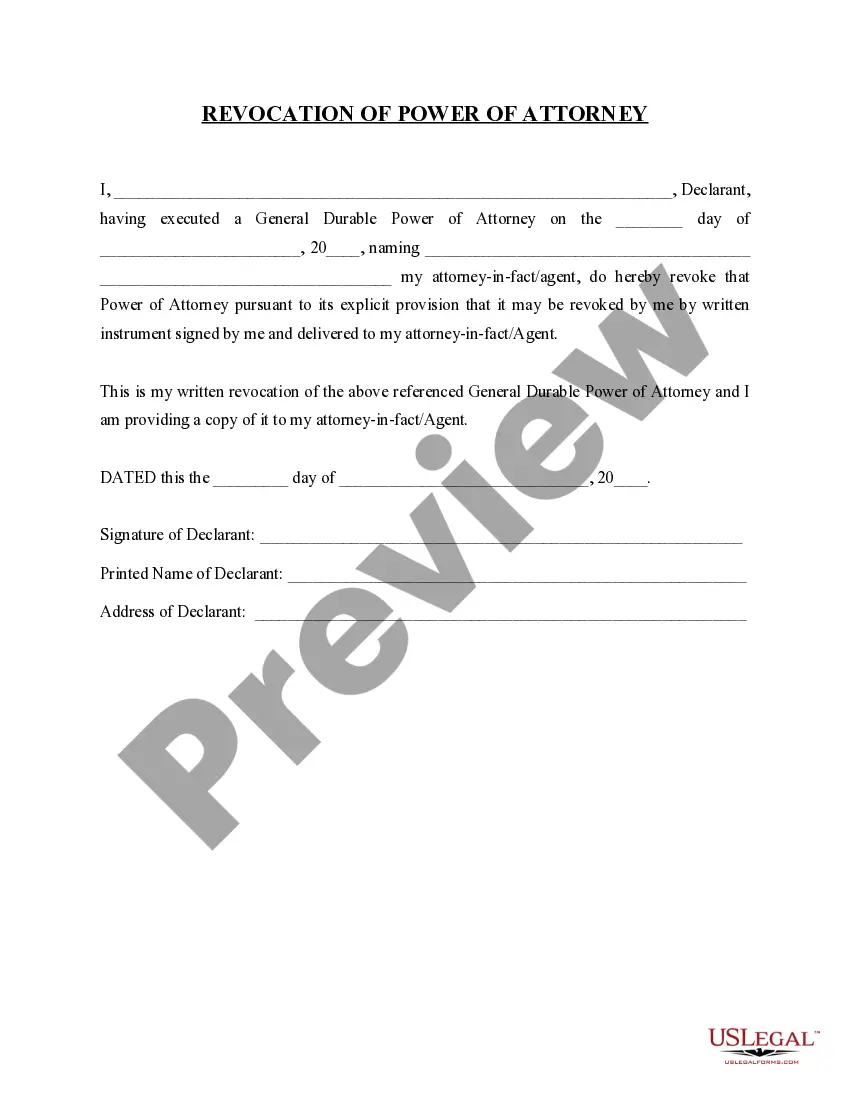

- Use the Review key to analyze the form.

- See the explanation to actually have chosen the proper develop.

- When the develop isn`t what you`re trying to find, utilize the Search field to get the develop that meets your requirements and needs.

- Once you obtain the proper develop, simply click Acquire now.

- Opt for the pricing prepare you would like, fill in the desired information to generate your bank account, and pay money for your order utilizing your PayPal or charge card.

- Select a handy file structure and acquire your copy.

Discover all of the papers themes you might have purchased in the My Forms menus. You may get a extra copy of Utah Letter to Creditors Notifying Them of Identity Theft of Minor whenever, if possible. Just select the essential develop to acquire or printing the papers web template.

Use US Legal Forms, one of the most considerable variety of legitimate varieties, to conserve time as well as stay away from faults. The assistance provides skillfully produced legitimate papers themes which can be used for a variety of uses. Make an account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

What should you do if you are a victim of identity theft or fraud? You should immediately notify the police, the bank, and the credit card holders.

Then visit IdentityTheft.gov or call 1-877-438-4338. Answer questions about what happened to you. Get a recovery plan that's just for you. You can create an account on the website. The account helps you with recovery steps. The account also helps you track your progress.

Identity Theft Victim? Steps to Take Contact the company or companies where you believe the fraud occurred, and let them know you believe your identity may have been compromised. Check your credit reports. ... Consider placing an initial one-year fraud alert on your credit reports.

Steps to take if your identity was stolen Alert your bank or credit card companies immediately. ... Change your passwords and enable two-factor authentication. ... Continue monitoring your financial statements and accounts. ... Google yourself. ... Notify law enforcement. ... Set up a fraud alert or credit freeze.

Warning signs of identity theft Bills for items you did not buy. Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

Reviewing your credit report is one of the most important steps you can take to ensure that you are not a victim of identity theft (ID theft). To review your credit report, contact one or all of the major consumer credit reporting agencies and request a copy of your credit report.

Explain that someone stole your identity and ask them to close or freeze the compromised account. Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report.