Utah Assumption Agreement of Loan Payments

Description

How to fill out Assumption Agreement Of Loan Payments?

Selecting the optimal legal document format can be challenging. Clearly, there are numerous templates accessible online, but how can you locate the legal form you require? Use the US Legal Forms website. The platform offers thousands of templates, including the Utah Assumption Agreement of Loan Payments, which can be utilized for both business and personal purposes. All the documents are verified by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Obtain button to retrieve the Utah Assumption Agreement of Loan Payments. Utilize your account to review the legal documents you have previously ordered. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple steps for you to follow: First, ensure you have selected the correct form for your city/county. You can preview the document using the Review button and examine the document description to confirm it is the correct one for you. If the form does not satisfy your needs, use the Search field to find the appropriate form. Once you are confident that the document is suitable, click the Buy now button to purchase the form. Choose the payment plan you want and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, modify, print, and sign the acquired Utah Assumption Agreement of Loan Payments. US Legal Forms is the largest collection of legal documents where you will find various record templates. Use the service to download professionally crafted files that adhere to state regulations.

The US Legal Forms platform provides an extensive range of legal templates designed to meet your specific requirements.

- Selecting.

- optimal.

- legal.

- document.

- format.

- challenging.

Form popularity

FAQ

Yes, assumptions are legally binding when properly executed. Once you enter into a Utah Assumption Agreement of Loan Payments, you and the other parties are obligated to adhere to the terms outlined in the agreement. This binding nature provides security for both the original borrower and the new party taking over the loan. To ensure your agreement meets all legal standards, consider using USLegalForms for professional assistance.

Assumption agreements, including the Utah Assumption Agreement of Loan Payments, are typically recorded to establish their validity. Recording these agreements provides legal protection and ensures that all parties' rights are safeguarded. It is essential to follow your local regulations regarding recording requirements. USLegalForms can guide you through the necessary steps to ensure your agreement is properly recorded.

Yes, an assumption of a mortgage is generally recorded. This process ensures that the new borrower is legally recognized as responsible for the loan. When you complete a Utah Assumption Agreement of Loan Payments, the recording protects all parties involved by providing a public record of the transaction. For clarity and ease, consider utilizing USLegalForms to navigate this process.

To complete a Utah Assumption Agreement of Loan Payments, you typically need several key documents. These include the original loan agreement, a written request for assumption, and any additional documentation that your lender may require. It’s wise to check with your lender for specific requirements, as they can vary. Using a platform like USLegalForms can help you gather and prepare these necessary documents efficiently.

Yes, many Utah housing loans can be assumable, depending on the lender’s policies and the type of loan. An assumable loan allows a new borrower to take over the existing mortgage under the original terms, which can be beneficial if interest rates have risen. However, not all loans are assumable, so it is essential to check the specific terms of your loan agreement. You can find guidance on this process through platforms like uslegalforms, which provide resources for navigating loan assumptions.

When preparing for a loan assumption, you will need several key documents, including the Utah Assumption Agreement of Loan Payments, the original loan documents, and any necessary disclosures from the lender. Additionally, you may require proof of income and credit history from the person assuming the loan. Gathering these documents early can streamline the assumption process and help you avoid delays.

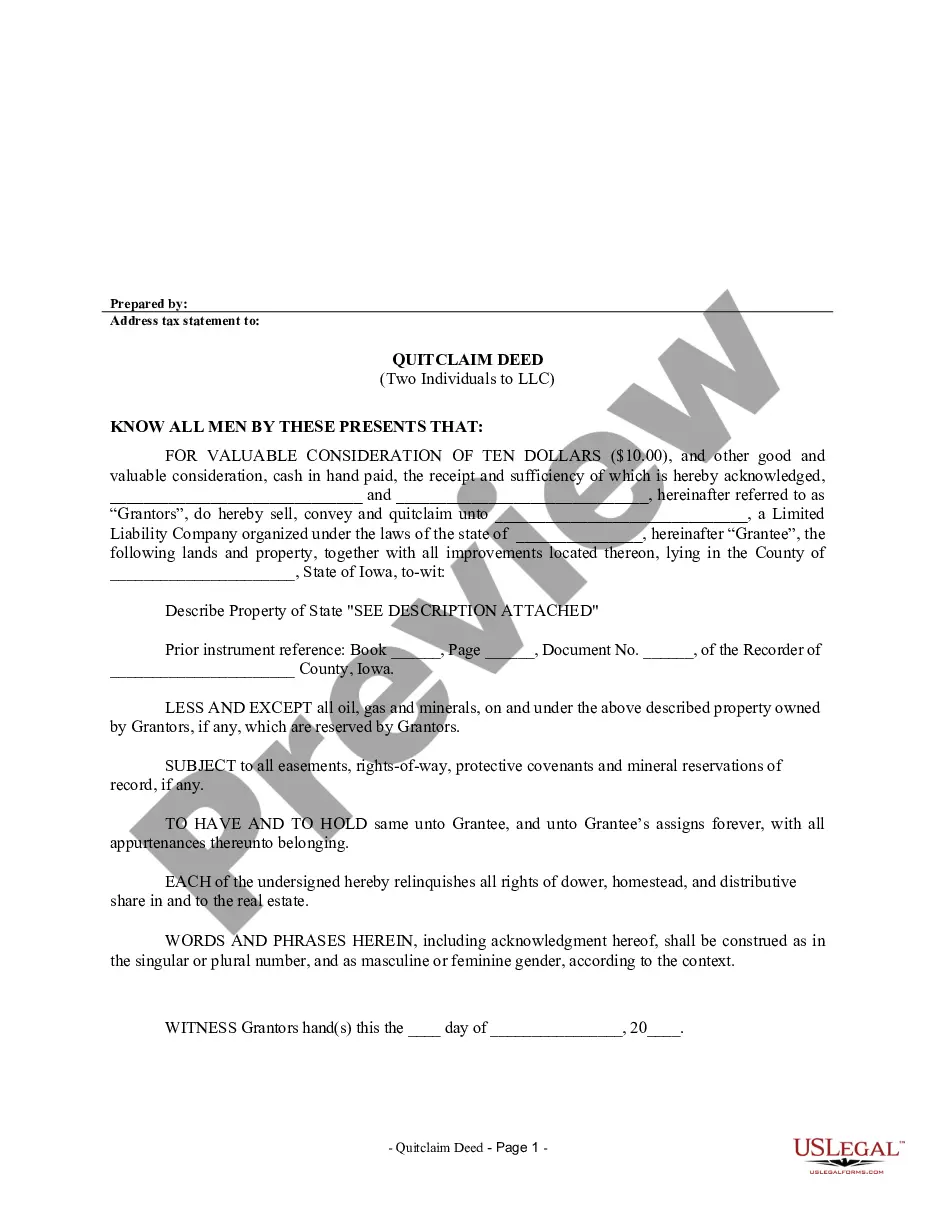

To document a loan assumption, you need a Utah Assumption Agreement of Loan Payments. This agreement outlines the terms under which the borrower takes over the existing loan. It typically includes details about the loan amount, interest rate, and the obligations of both parties. You should ensure that this document is signed by all involved parties and is submitted to the lender for approval.