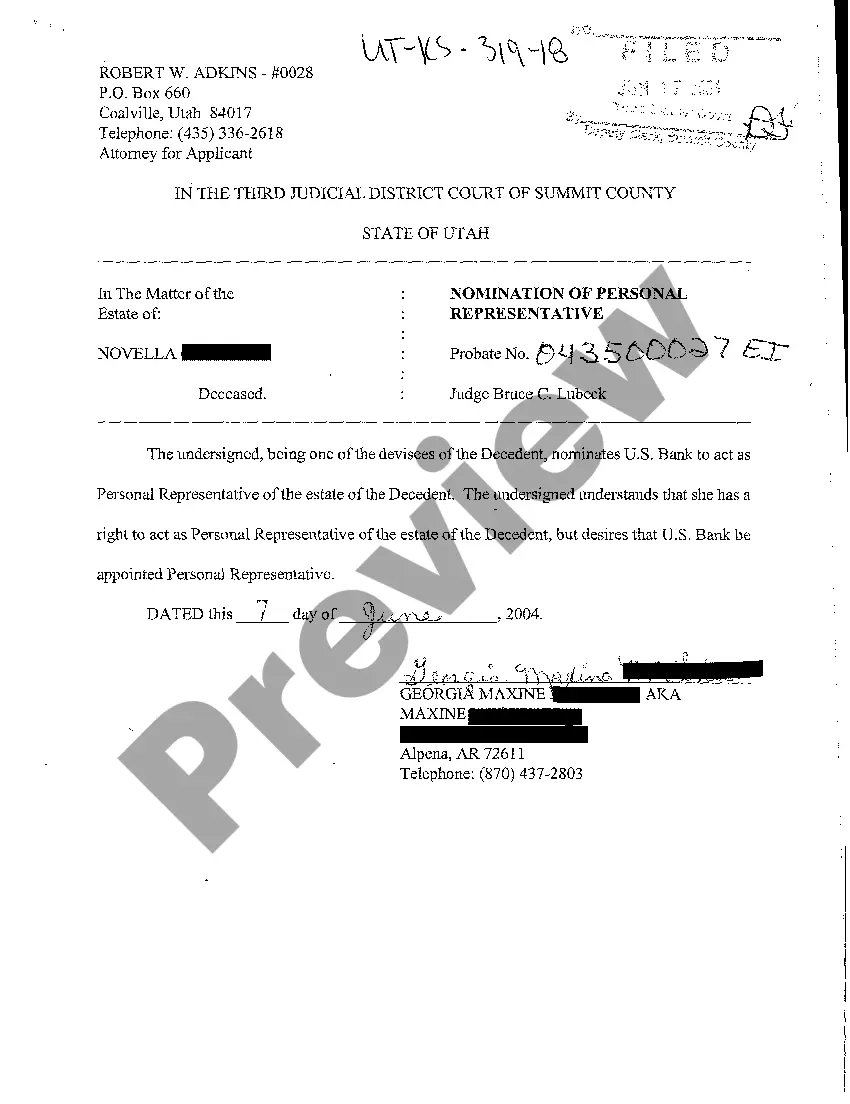

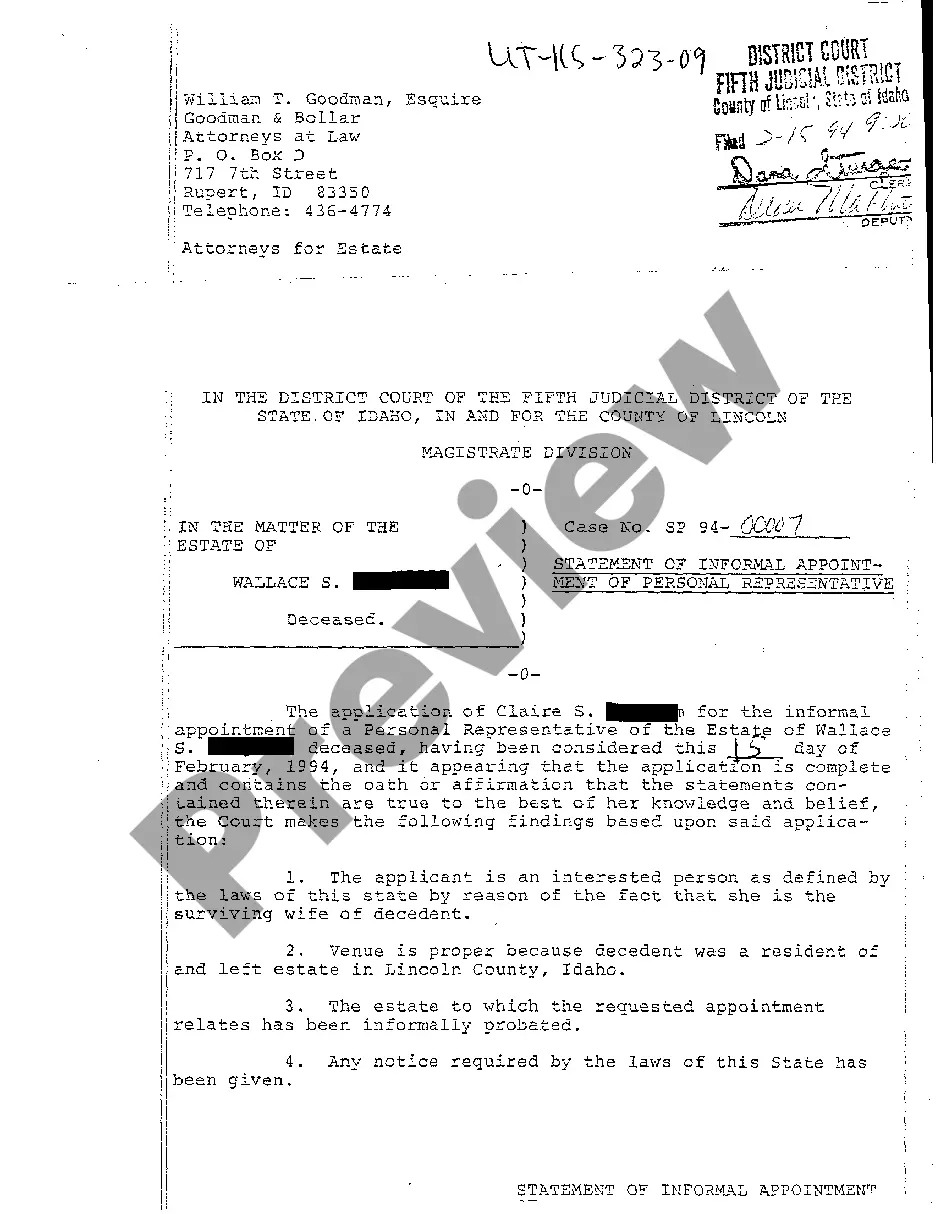

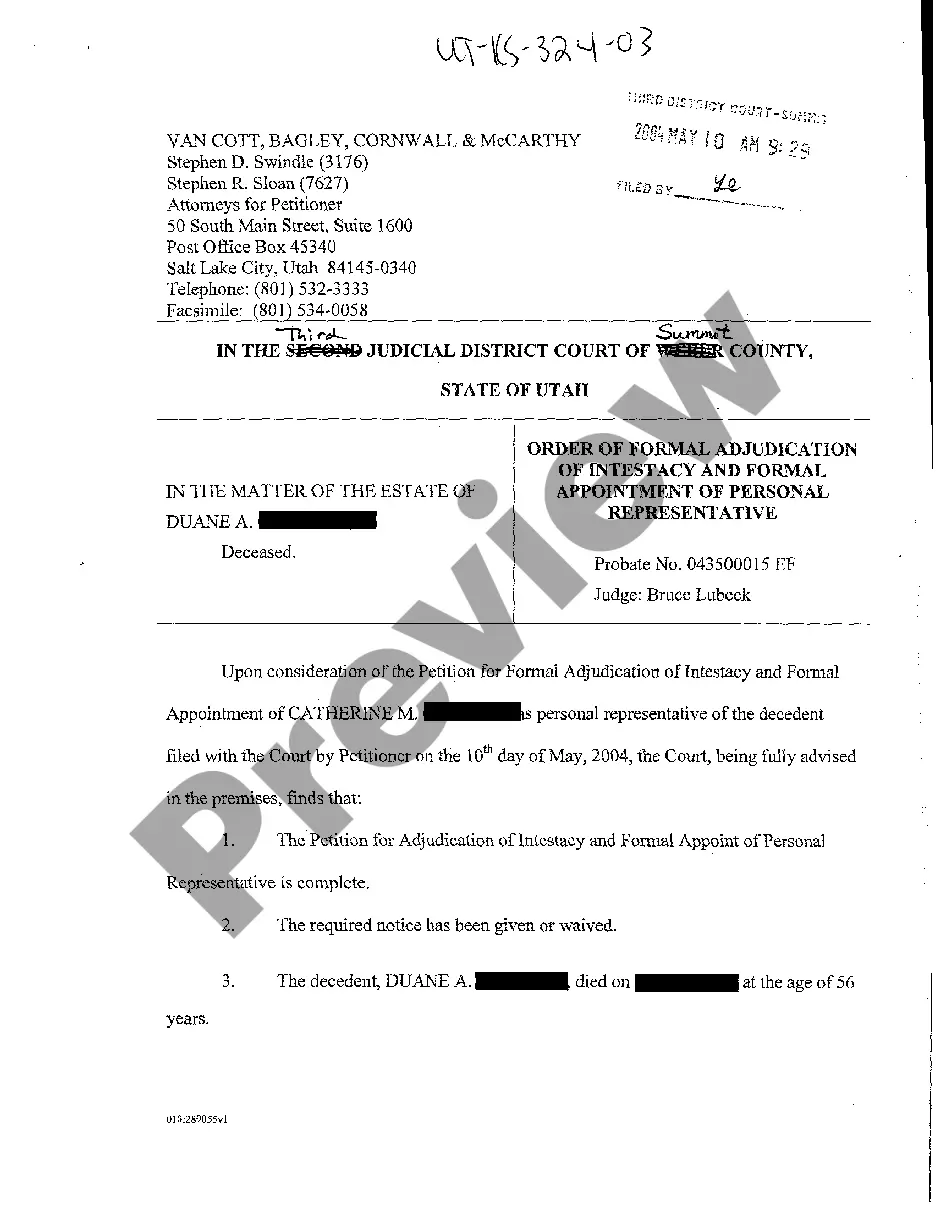

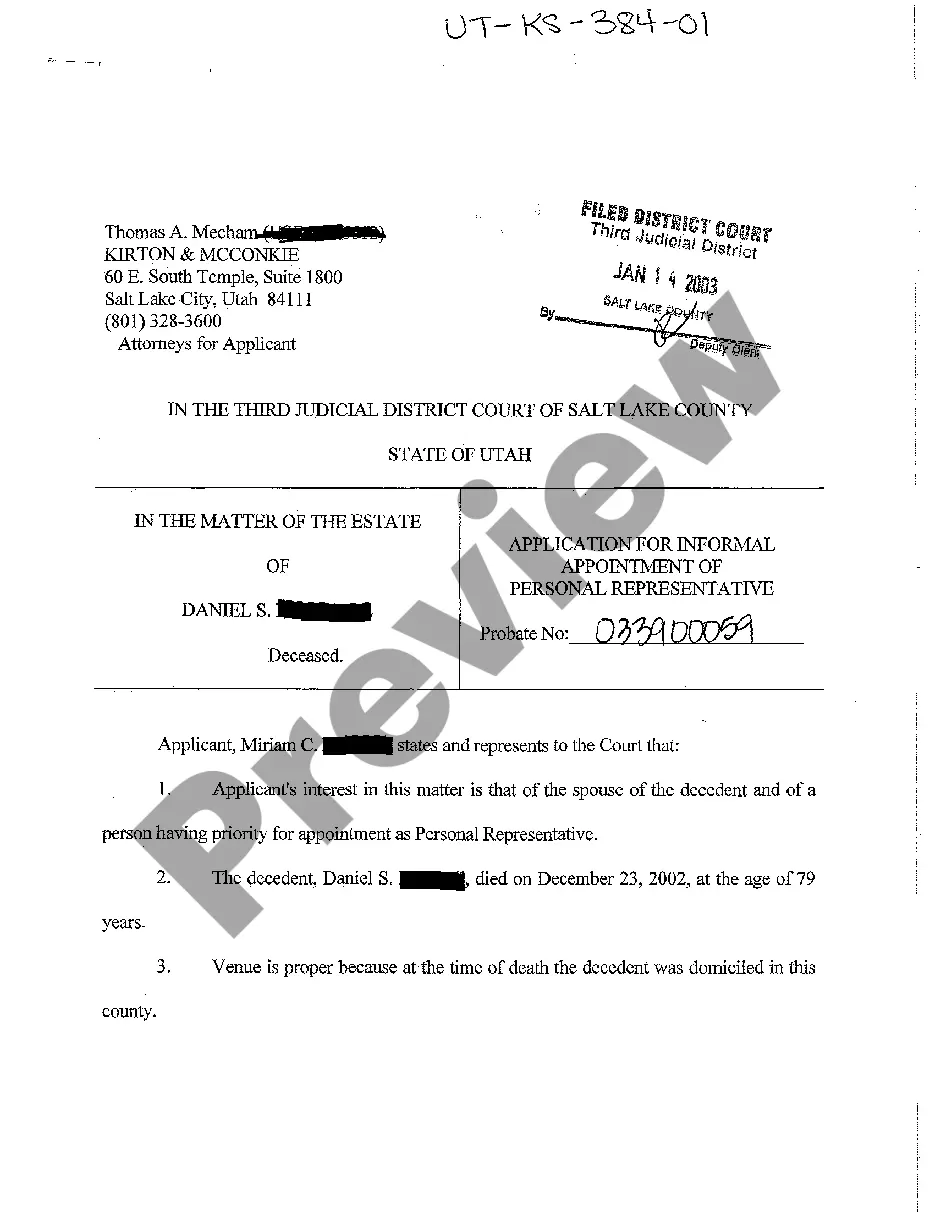

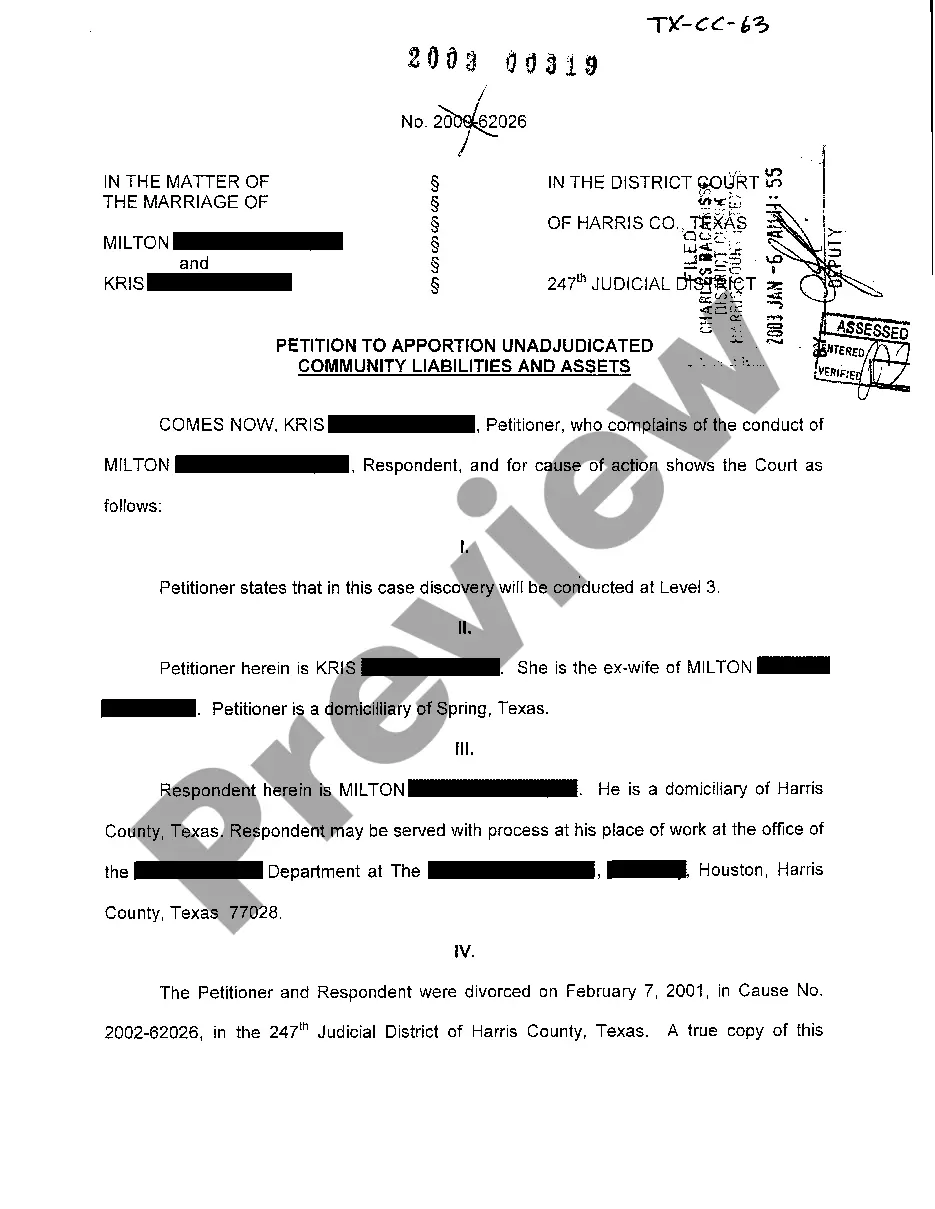

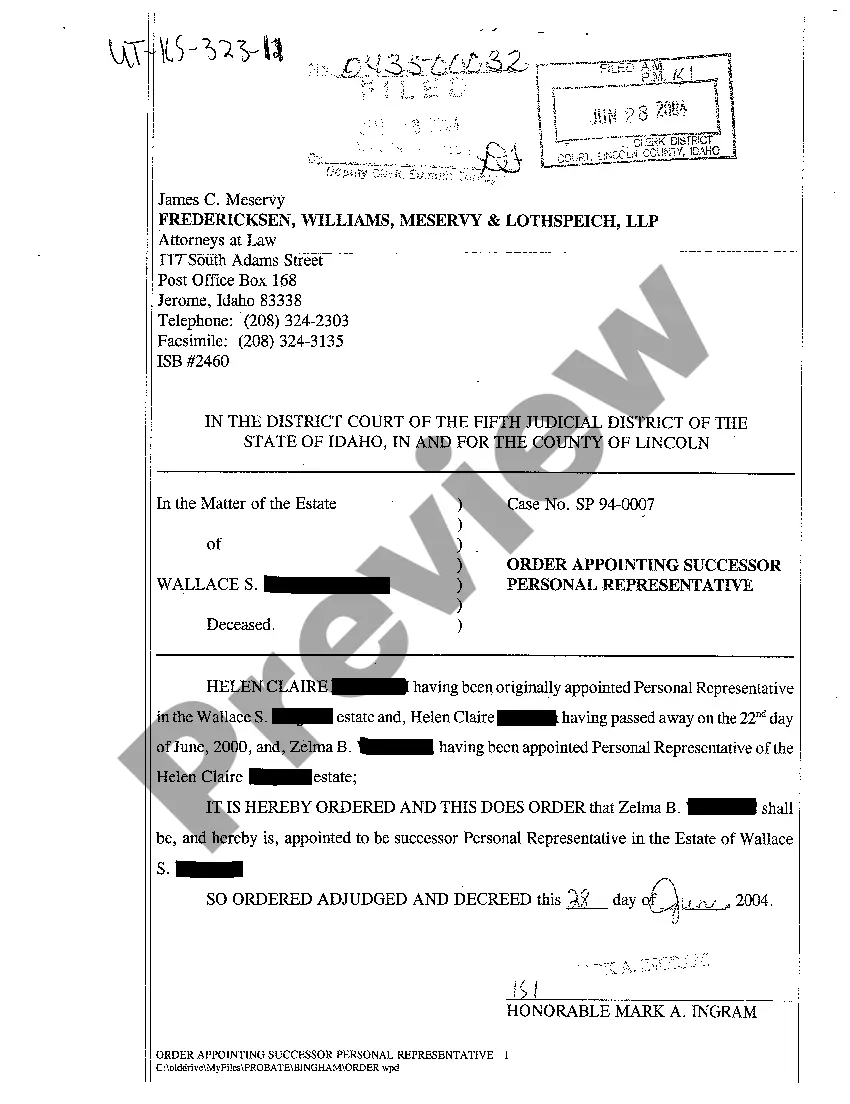

Utah Order Appointing Successor Personal Representative

Description

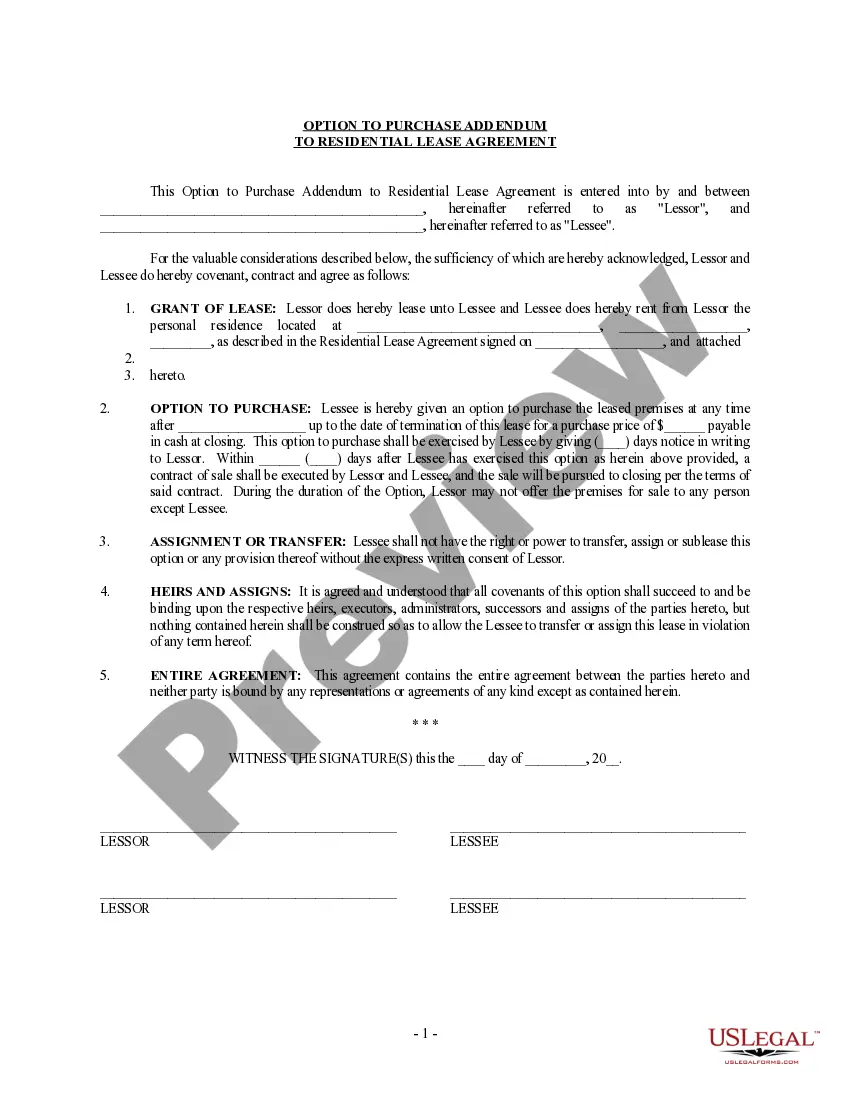

How to fill out Utah Order Appointing Successor Personal Representative?

Among lots of paid and free samples which you get on the internet, you can't be sure about their reliability. For example, who created them or if they are competent enough to deal with the thing you need these to. Always keep relaxed and use US Legal Forms! Discover Utah Order Appointing Successor Personal Representative samples developed by skilled attorneys and avoid the costly and time-consuming procedure of looking for an attorney and after that having to pay them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access all of your previously downloaded files in the My Forms menu.

If you’re using our service the first time, follow the instructions listed below to get your Utah Order Appointing Successor Personal Representative with ease:

- Make sure that the file you discover applies in your state.

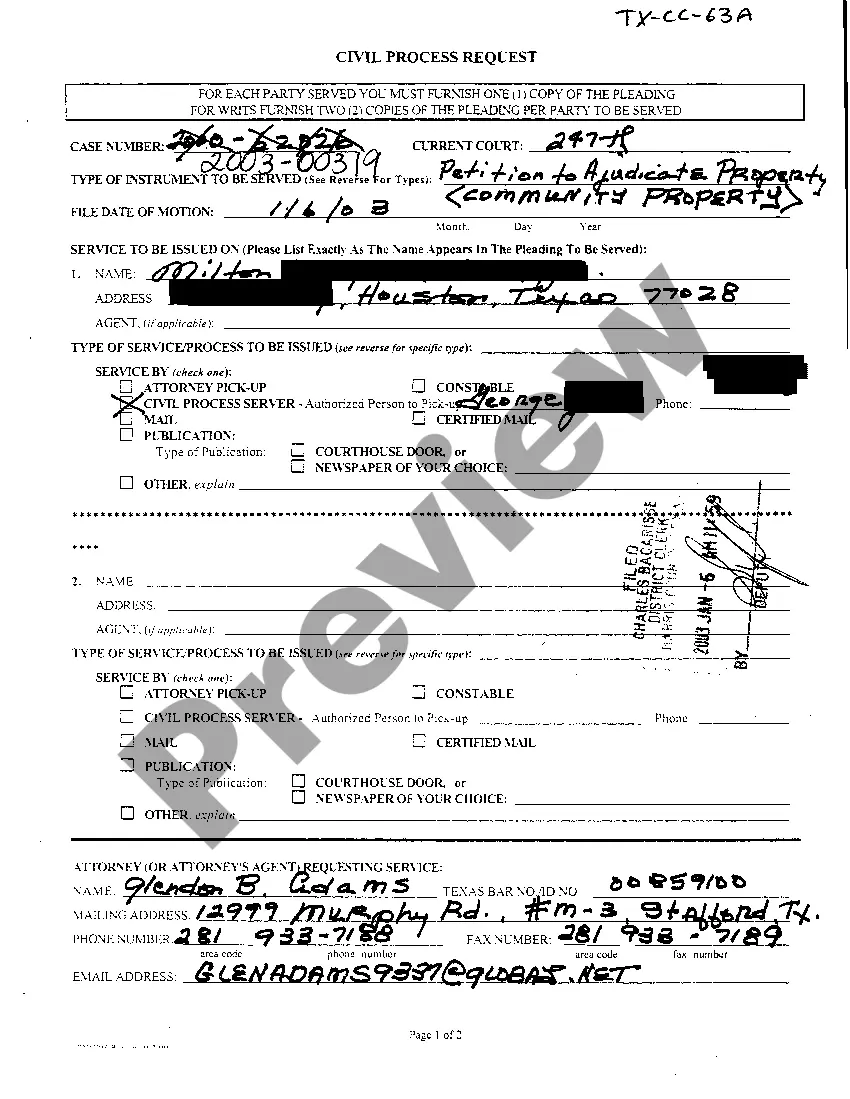

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or look for another template utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

When you have signed up and bought your subscription, you can utilize your Utah Order Appointing Successor Personal Representative as often as you need or for as long as it remains active where you live. Edit it in your preferred editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A personal representative is appointed by a judge to oversee the administration of a probate estate.In most cases, the judge will honor the decedent's wishes and appoint this person. When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

To be appointed executor or personal representative, file a petition at the probate court in the county where your loved one was living before they died. In the absence of a will, heirs must petition the court to be appointed administrator of the estate.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

Yes, there can be more than one personal representative (or executor) of an estate. Co-representatives can be appointed.

You can appoint just one person, or even multiple people, to handle your Probate Estate.For example, most financial institutions require that all Personal Representatives be present to open the Estate bank account.

Co-Executors are two or more people who are named as Executors of your Will. Co-Executors do not share partial authority over the estate; each person you name as an Executor has complete authority over the estate.Co-Executors must act together in all matters related to settling the estate.

If the will names multiple executors, but only one person wishes to take out a grant of probate, it is wise for at least one of the others to sign a power reserved letter, just in case the acting executor cannot complete the administration of the estate.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.