Utah Workers Compensation Employers First Report of Injury or Illness

Description

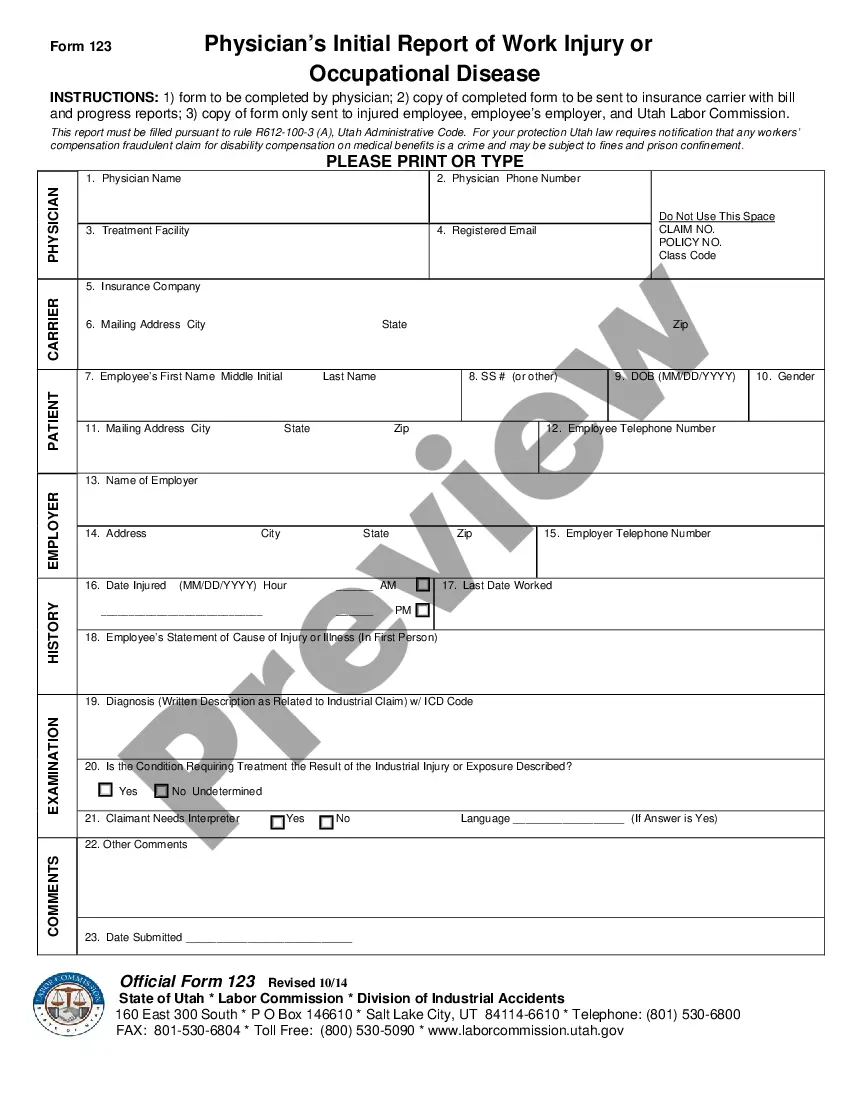

How to fill out Utah Workers Compensation Employers First Report Of Injury Or Illness?

Searching for a Utah Workers Compensation Employers First Report of Injury or Illness on the internet might be stressful. All too often, you find documents that you simply think are alright to use, but discover afterwards they’re not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Get any document you are looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be added to your My Forms section. If you don’t have an account, you should sign up and select a subscription plan first.

Follow the step-by-step instructions below to download Utah Workers Compensation Employers First Report of Injury or Illness from the website:

- See the form description and hit Preview (if available) to verify whether the form suits your requirements or not.

- If the form is not what you need, find others with the help of Search field or the listed recommendations.

- If it is right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the document in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms library. Besides professionally drafted templates, users are also supported with step-by-step guidelines regarding how to get, download, and fill out templates.

Form popularity

FAQ

All injuries, no matter how minor, must be reported within 24 hours of the injury.It must be reported to our workers' compensation department in case the injury becomes worse and needs medical attention in the future. That way, the reporting of the injury will not be considered late by the state.

Virtually all employers in Utah are required to carry workers' compensation insurance for their employees. The Utah workers' compensation system in Utah is a no-fault system designed to compensate injured workers for medical bills, lost wages, and permanent impairments resulting from their injuries.

How Long Does an Employer Have to Report an Accident? As with an employee notifying the employer of an accident, the employer should act as soon as possible in notifying the state's workers comp board.The minimum charge is typically $100, but missed or late reporting can result in a $2,500 fine in California.

In regards to getting fired for getting injured, every employee is granted legal protection from undue backlash and workplace penalties. As an extension of the whistleblower act, you cannot be terminated solely for being injured on-the-job.

In California, if you are injured on the job, you are entitled to receive two-thirds of your pretax gross wage. This is set by state law and also has a maximum allowable amount. In 2018, for example, the maximum allowable amount was $1,215.27 per week for a total disability. This amount is adjusted annually.

Compensation shall be 66-2/3% of the employee's average weekly wages at the time of the injury, but not more than a maximum of 66-2/3% of the state average weekly wage at the time of the injury and not less than a minimum of $45.00 per week plus $20.00 for a dependent spouse and $20.00 for each dependent child under

If you've been injured as a result of your work, you should be able to collect workers compensation benefits.Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company.

Your obligations Under NSW workers compensation legislation every employer is required to: have workers compensation insurance. display the If you get injured at work poster. have a documented return to work program describing the steps you will take if a worker is injured.

Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.