Affidavit of Heirship for Motor Vehicle

Definition and meaning

The Affidavit of Heirship for Motor Vehicle is a legal document used to establish the heirs of a deceased person, specifically for the purpose of transferring the title of a motor vehicle. This affidavit confirms the identity of heirs who are entitled to inherit the vehicle and is essential for ensuring that the ownership can be legally passed on without the need for a probate process.

How to complete a form

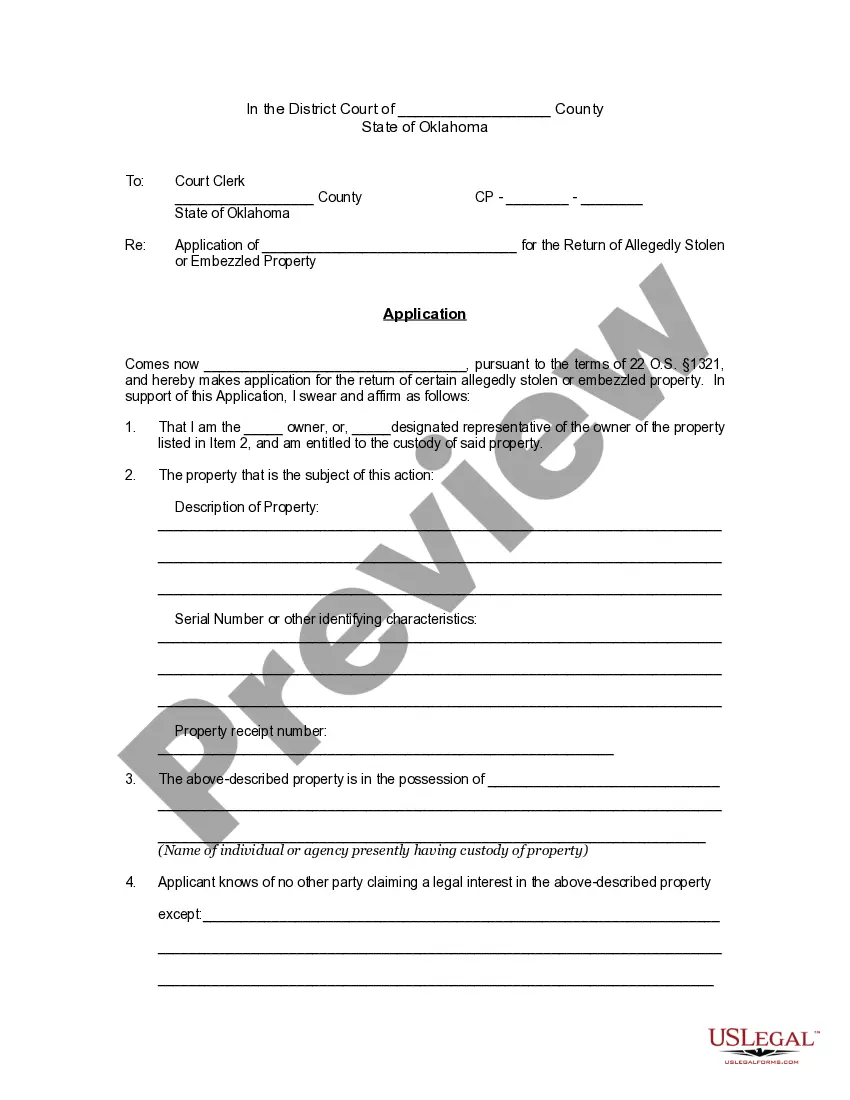

Completing the Affidavit of Heirship for Motor Vehicle involves the following steps:

- Provide the full name and address of the affiant, who declares the details of the decedent.

- State the decedent's name and the date and place of their death.

- Detail the decedent's marital history, including names and dates of spouses.

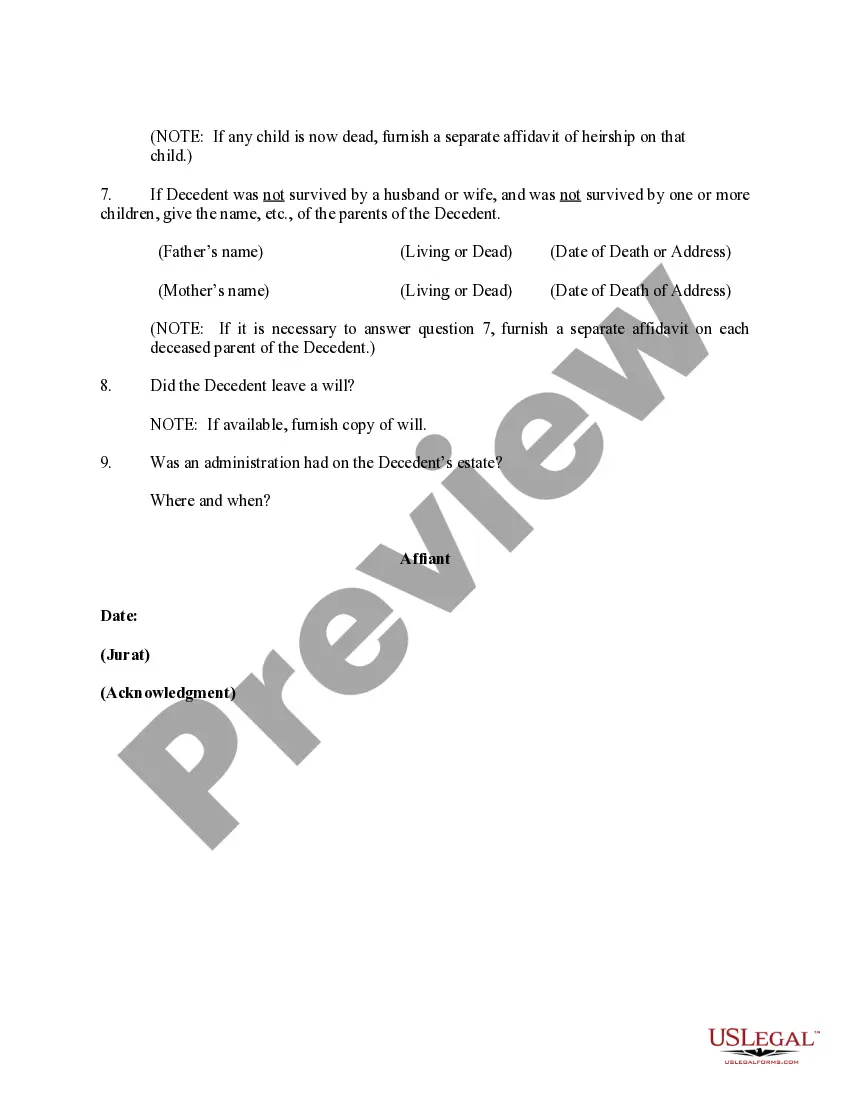

- List all children of the decedent, noting any that are deceased and providing their details.

- Include information about the decedent's parents if applicable.

- Declare whether the decedent left a will, and if so, include a copy.

- Sign the affidavit in the presence of a notary public.

Who should use this form

This form is intended for individuals who need to transfer ownership of a motor vehicle after the death of the owner. It is particularly useful for heirs of the deceased who wish to avoid the lengthy probate process or for those who need to establish their legal right to the vehicle as per the laws of their jurisdiction.

Key components of the form

The Affidavit of Heirship for Motor Vehicle includes several key components:

- Affiant information: name and address of the person completing the affidavit.

- Decedent information: full name, date of death, and details of marital history.

- Children and heirs: names and statuses (living or deceased) of all children.

- Parent information: names and statuses of the decedent's parents if no children are alive.

- Will declaration: statement regarding any existing will.

- Notary acknowledgment: signature and seal from a notary public.

What to expect during notarization or witnessing

Notarization of the Affidavit of Heirship for Motor Vehicle typically involves the following:

- The affiant must appear in person before a notary public.

- They will need to present valid photo identification to confirm their identity.

- The notary will witness the signing of the affidavit and may ask questions to ensure the affiant understands the document.

- The document will be stamped with the notary's official seal, which validates it.

Common mistakes to avoid when using this form

When completing the Affidavit of Heirship for Motor Vehicle, avoid these common mistakes:

- Incorrectly spelling names or providing inaccurate dates can result in delays.

- Failing to include all children or heirs may lead to legal challenges later.

- Not obtaining a notary's acknowledgment can invalidate the affidavit.

- Missing details about marriages or relationships can create confusion regarding heirs.

Benefits of using this form online

Using the Affidavit of Heirship for Motor Vehicle online provides several advantages:

- Convenience: Easily access and complete the form from anywhere, anytime.

- Guidance: Step-by-step instructions are often provided to simplify the process.

- Fast retrieval: Download your completed form immediately for submission or notarization.

- Reduced errors: Online forms usually include validation features to help prevent mistakes.

Form popularity

FAQ

(A judgment in this case is a court order, in writing, reciting that the deceased person is dead, the date of death and a list of who are the heirs.) Proof. Once the judgment is issued, copies of the judgment can be used to show proof as to who is entitled to estate assets.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

Inheritance Without a Will If there's no will, the heir or heirs of the deceased can transfer the title by completing Form VTR-262, "Affidavit of Heirship for a Motor Vehicle," and Form 130-U, "Application for Texas Title and/or Registration" (see Resources).

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).It does not transfer title to real property.

Title, if available. Evidence the loan is paid in full (original release of lien), if applicable. Completed Title and/or Registration Application (Form 130-U) Appropriate authority to transfer ownership. Completed Gift Affidavit. Applicant's current driver license or government-issued photo identification.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.