Generally, the members of a nonprofit corporation must exercise their control of corporate policies at regularly called meetings of the members. A corporation has a duty to keep a record of the meetings of its members, showing the dates such meetings were held and listing the members present or showing the number of voting shares represented at the meeting in person or by proxy. It is the duty of the secretary to prepare and enter the minutes of such meetings in the corporate records.

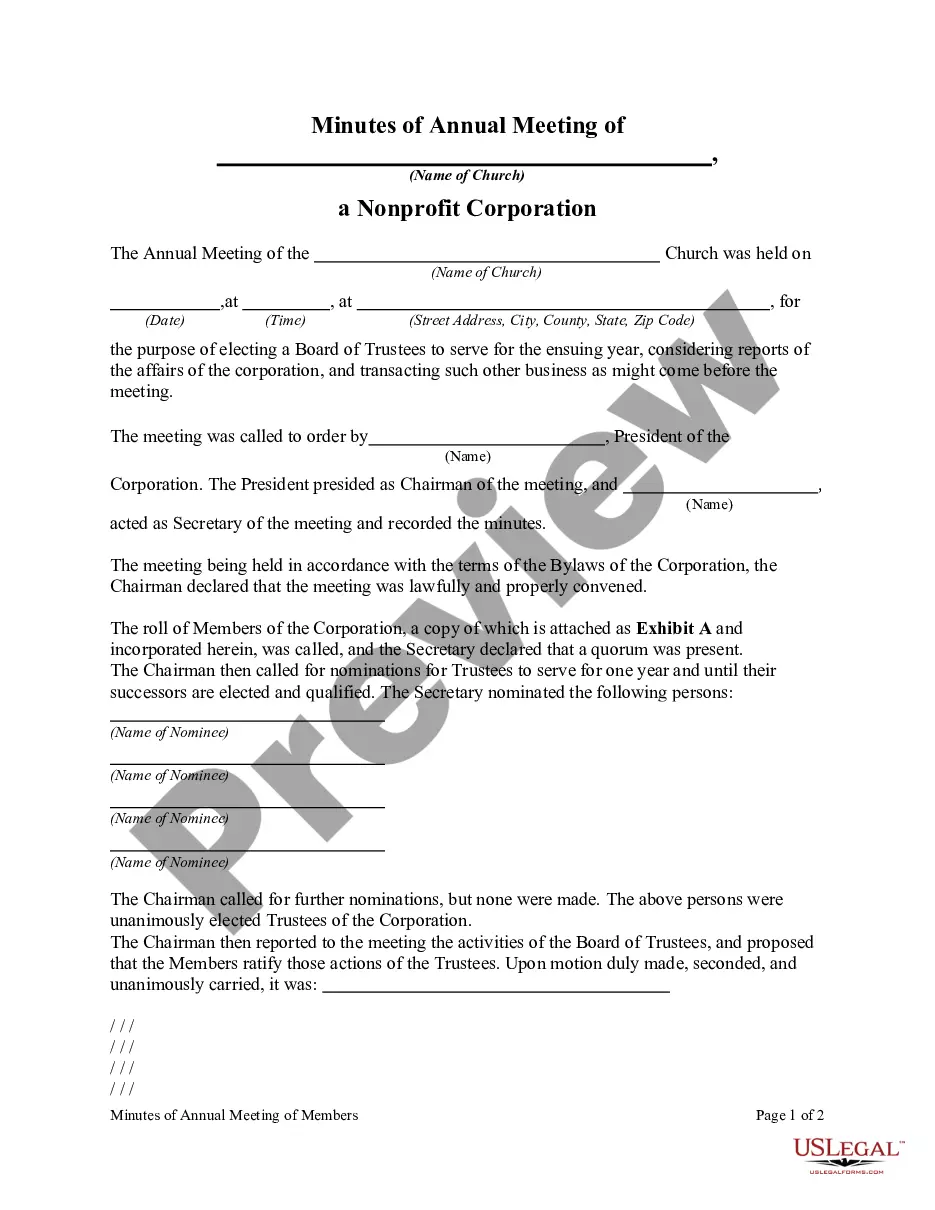

Minutes of Annual Meeting of a Non-Profit Corporation

Description

Definition and meaning

The Minutes of Annual Meeting of a Non-Profit Corporation are the official written records that document the discussions and decisions made during an organization's annual meeting. These minutes serve as a legal record of the proceedings and actions taken by the board and its members. Proper documentation is essential for maintaining transparency and consistency in governance.

Key components of the form

This form typically includes the following essential elements:

- Date and location: The date and the physical address where the meeting took place.

- Attendance: A list of members present, establishing quorum compliance.

- Nominations: Details of nominees for board positions and the election process.

- Resolutions: Recorded decisions or actions passed during the meeting.

- Signatures: The signature of the Secretary for authenticity.

How to complete a form

Completing the Minutes of Annual Meeting of a Non-Profit Corporation involves several steps:

- Gather information: Collect details about the meeting, such as date, time, and attendees.

- Document discussions: Write down the key points discussed, including reports and resolutions addressed during the meeting.

- List nominees: Include names of individuals nominated for board positions and any votes recorded.

- Review: Ensure all information is accurate and complete before finalizing the document.

- Sign: Have the designated Secretary sign the document to validate it.

Who should use this form

This form is intended for non-profit organizations that are required to hold annual meetings as part of their governance structure. Members of the board, secretaries, and administrators involved in the management of non-profit corporations will find this form essential for legal compliance and record-keeping.

Common mistakes to avoid when using this form

When completing the Minutes of Annual Meeting of a Non-Profit Corporation, consider avoiding the following errors:

- Neglecting to record significant discussions and decisions.

- Failing to list all attendees, which may impact the validity of the quorum.

- Not including resolutions passed during the meeting.

- Omitting the signature of the Secretary.

- Inaccurate dates or details about the meeting.

Benefits of using this form online

Utilizing online templates for the Minutes of Annual Meeting offers several advantages:

- Convenience: Accessing templates online ensures you can complete the form at any time without physical constraints.

- Time-saving: Pre-designed formats streamline the documentation process, making it faster to generate minutes.

- Accuracy: Online forms reduce the likelihood of errors through guided prompts and user-friendly interfaces.

- Storage: Digital records can be easily stored and shared among members for future reference.

How to fill out Minutes Of Annual Meeting Of A Non-Profit Corporation?

Employ the most comprehensive legal library of forms. US Legal Forms is the perfect platform for getting updated Minutes of Annual Meeting of a Non-Profit Corporation templates. Our platform provides a huge number of legal forms drafted by licensed lawyers and categorized by state.

To get a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our platform, log in and choose the document you need and purchase it. Right after purchasing forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- In case the form has a Preview option, utilize it to review the sample.

- If the template does not suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template meets your needs.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr credit/credit card.

- Choose a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill in the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Nonprofit boards don't have to share their meeting minutes, policies or audit results with the public. They don't have to share the contact information for board directors either.

Note the subject of the discussion. Include the name of the person who led the discussion. Include motions. Note voting outcomes. Include any decisions made.

Organization name. Date of meeting. Time the meeting was called to order. Board members present. Name of the presiding officer. Absent board members. Note whether the session meets quorum. Guests and organizational staff present.

Meeting Requirements for Corporations. State laws and a corporation's bylaws will dictate specific meeting requirements for corporations. In general, however, most corporations are required to have at least one shareholders' meeting per year. Corporations are also required to prepare and retain minutes of these meeting

Prepare corporate minutes. Notes kept at each shareholder and board meeting held by a corporation provide a written record of what occurred at the meeting. Approve corporate minutes. File the minutes with internal corporate records. In limited circumstances, file the corporate minutes with the state.

Meeting name and place. Date and time of the meeting. List of meeting participants. Purpose of the meeting. For each agenda items: decisions, action items, and next steps. Next meeting date and place. Documents to be included in the meeting report.

Use a template. Check off attendees as they arrive. Do introductions or circulate an attendance list. Record motions, actions, and decisions as they occur. Ask for clarification as necessary. Write clear, brief notes-not full sentences or verbatim wording.

The meeting's date, time, and location. Who wrote the minutes. The names of the members in attendance. Brief description of the meeting agenda. Details about what the members discussed. Decisions made or voting actions taken. The time that the meeting adjourned.