Business Credit Application

Definition and meaning

A Business Credit Application is a formal request submitted by a business to a financial institution or supplier to obtain credit. This document provides essential information about the business's financial status, ownership structure, and creditworthiness, enabling lenders and suppliers to evaluate the risk of extending credit. Completing this application thoroughly is crucial for securing favorable terms and conditions.

How to complete a form

To effectively complete a Business Credit Application, follow these steps:

- Provide your personal information, including your name, title, and contact details.

- Enter the business's name, address, and type of business structure (e.g., corporation, partnership).

- List the business's tax identification number and the date it began operating.

- Include the names and contact details of company principals who will be responsible for transactions.

- Provide bank references, including account details and contact information for your banking institution.

- List trade references to demonstrate your business's credit history.

- Sign and date the application, certifying the accuracy of the information provided.

Who should use this form

The Business Credit Application is suitable for any business seeking to establish or expand credit with suppliers, financial institutions, or other creditors. This includes small businesses, startups, or established companies planning to purchase goods or services on credit. Both business owners and authorized representatives should complete this application to ensure that adequate credit is granted based on sound financial information.

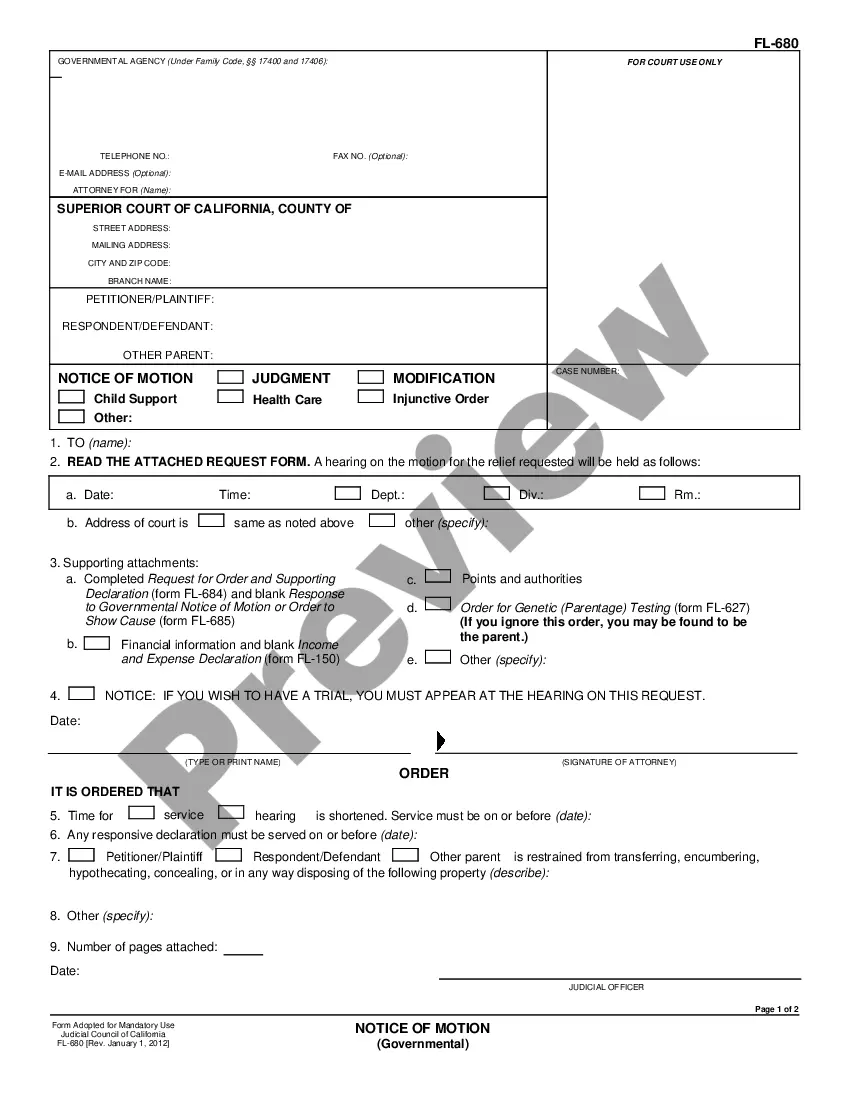

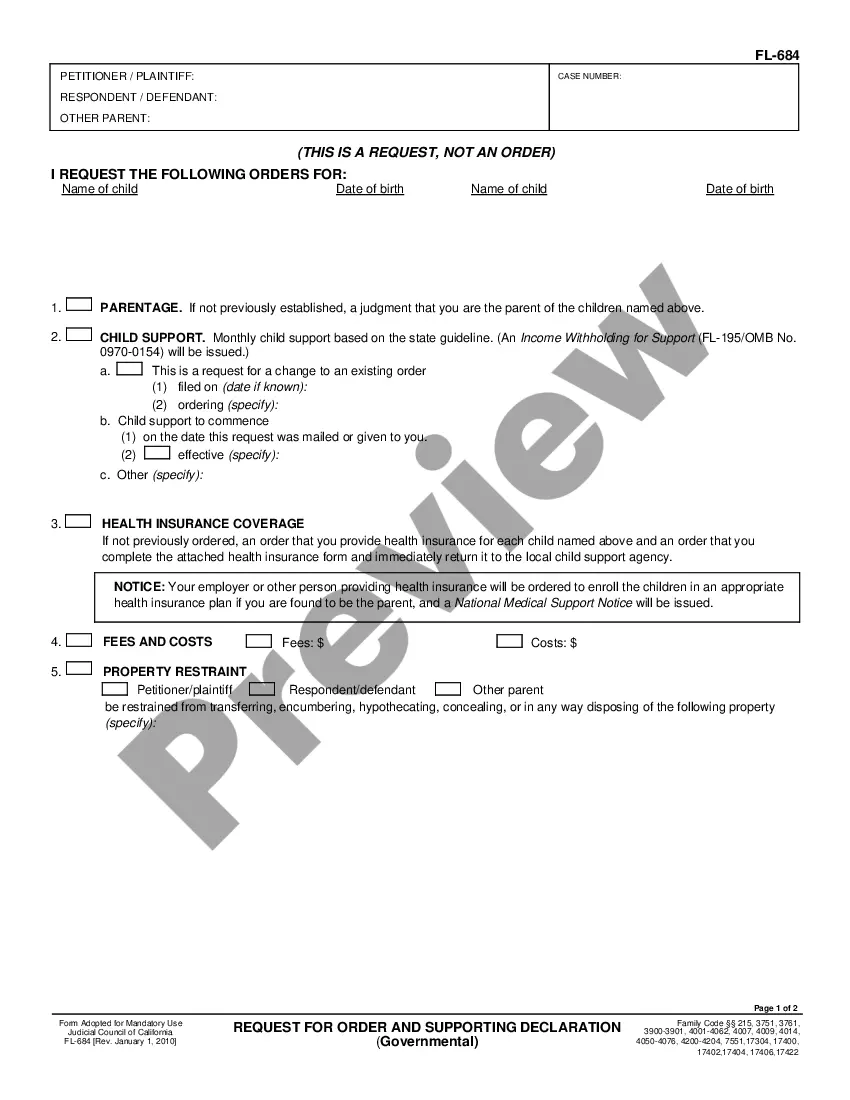

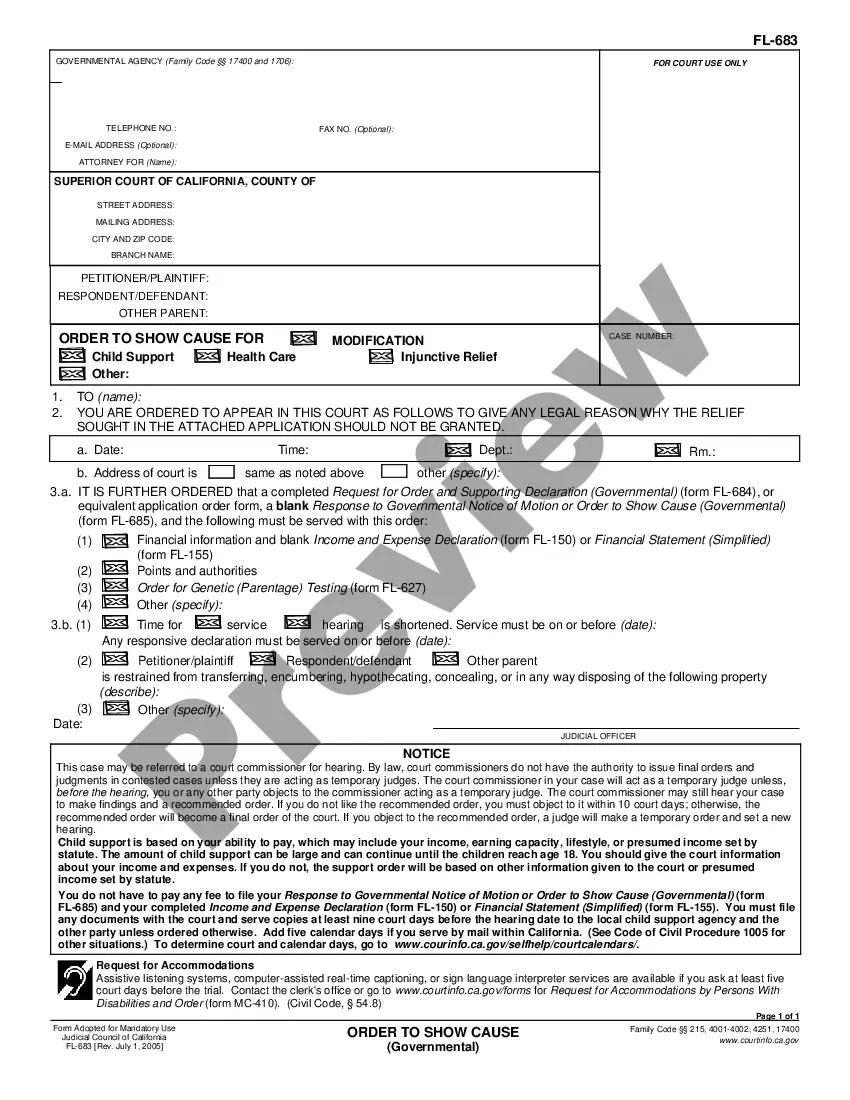

Key components of the form

A comprehensive Business Credit Application includes various key sections:

- Business Information: Details about the business, including its name, structure, and the date it was established.

- Principal Contact Information: Names and contact details of individuals responsible for business transactions.

- Bank References: Information about the business’s banking relationships, including account types and balances.

- Trade References: Lists of vendors or suppliers that provide credit to the business.

Common mistakes to avoid when using this form

When filling out the Business Credit Application, be aware of the following common errors:

- Failing to provide accurate contact details for business principals.

- Omitting important financial information, such as account numbers or balances.

- Not listing enough trade references to establish a solid credit history.

- Neglecting to sign and date the application, which could lead to delays or rejections.

What documents you may need alongside this one

To support your Business Credit Application, you may need additional documents, such as:

- Business licenses or permits

- Tax returns for the last two years

- Financial statements (e.g., balance sheet, income statement)

- Personal guarantees from business owners or principals

Form popularity

FAQ

Business credit is the ability of a business to qualify for financing. Businesses have credit reports and scores just like people do.Your business credit report may be used by lenders, creditors, suppliers, insurance companies and other organizations evaluating a credit or insurance application or business deal.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.

Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line. Interest and Attorney's Fees. Confirm that the Customer's Name is Correct.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

Two other goals for a credit application are to limit credit risk and to get a better understanding of a customer's business. The credit application is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit sales and/or fraud.

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

#1: Establish business credit. #2: Use good trade references. #3: Review your personal and business credit scores. #4: Know the line of credit's purpose. #5: Organize your financial records. #6: Prepare your business plan. #7: Fill out the application correctly.