Revocable Trust for Asset Protection

Description

Definition and meaning

A Revocable Trust for Asset Protection is a legal arrangement that allows individuals to place their assets into a trust, which they can modify or revoke during their lifetime. This type of trust offers flexibility while providing a degree of protection from creditors and claims. With a revocable trust, the trustor retains control over the assets, enabling them to make changes as personal circumstances evolve.

Who should use this form

This form is ideal for individuals looking to safeguard their assets while maintaining flexibility in asset management. Consider using a Revocable Trust for Asset Protection if you:

- Want to manage your assets during your lifetime and beyond.

- Seek to minimize probate costs and expedite the transfer of assets to beneficiaries.

- Wish to protect assets from potential creditors.

- Desire to outline specific terms for asset distribution after your death.

Benefits of using this form online

Using a Revocable Trust for Asset Protection online offers several advantages, including:

- Convenience: Complete and download your trust documents from the comfort of your home.

- Time-saving: Access templates tailored by licensed attorneys, which simplifies the process.

- Cost-effective: Typically, online legal forms are more affordable than hiring an attorney for drafting.

- Easy updates: Modify and manage your trust documents whenever personal circumstances change.

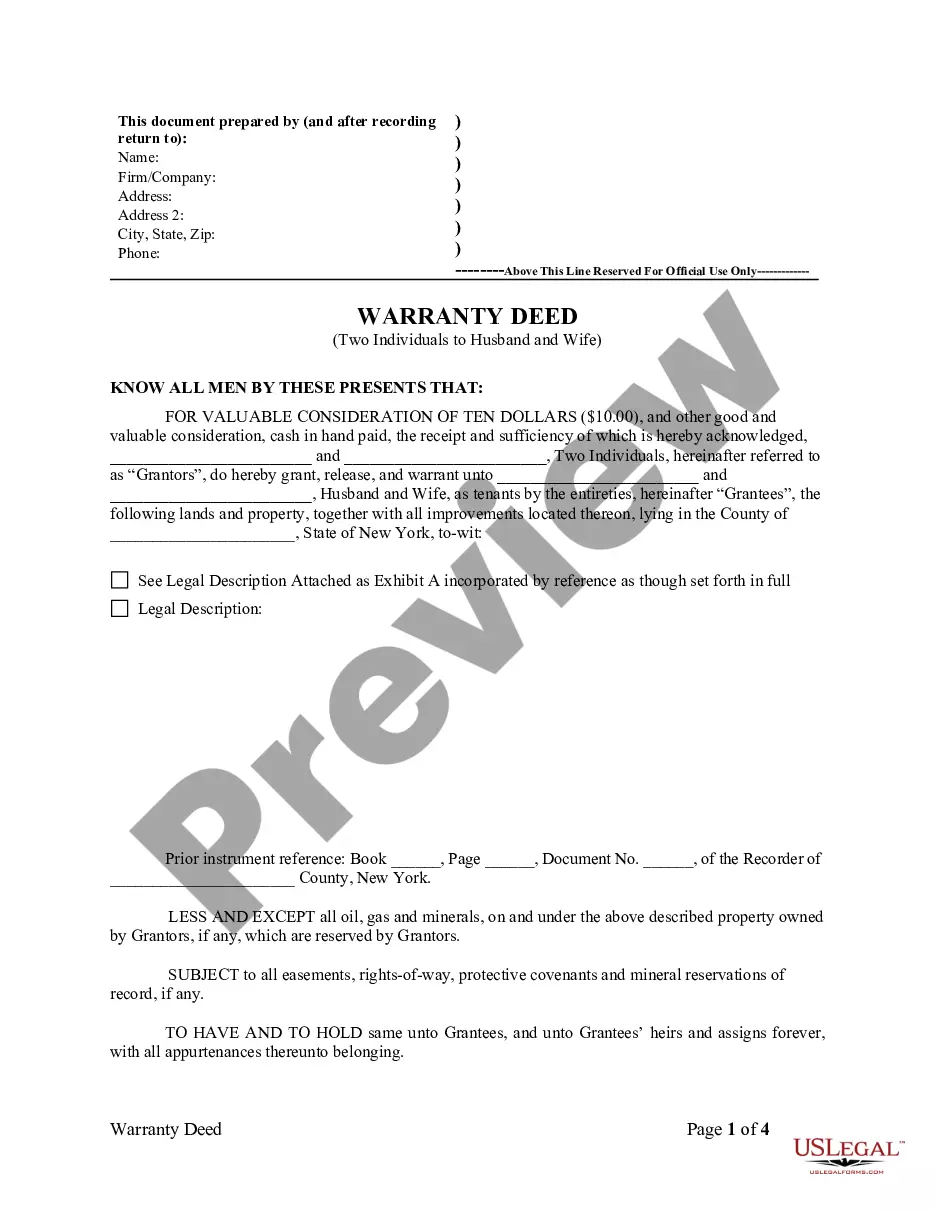

Key components of the form

A Revocable Trust for Asset Protection typically includes the following key components:

- Trustor and Trustee Information: Clear identification of the person creating the trust and the trustee managing it.

- Trust Property: A detailed description of the assets included in the trust.

- Revocation Clause: A statement granting the trustor the right to revoke or amend the trust at any time.

- Distribution Terms: Provisions outlining how assets will be distributed upon the trustor's death.

Common mistakes to avoid when using this form

When completing a Revocable Trust for Asset Protection, be mindful of these common pitfalls:

- Incomplete Information: Ensure that all required fields are filled out accurately to avoid issues later.

- Witness Requirements: Double-check state laws regarding witnessing and notarization of the trust.

- Failure to Fund the Trust: Remember to transfer assets into the trust after creation to ensure protection.

- Not Updating the Document: Regularly review and update the trust as life circumstances change.

How to fill out Revocable Trust For Asset Protection?

Use US Legal Forms to get a printable Revocable Trust for Asset Protection. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue on the web and offers affordable and accurate templates for customers and attorneys, and SMBs. The documents are grouped into state-based categories and a few of them can be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to quickly find and download Revocable Trust for Asset Protection:

- Check out to make sure you have the proper template in relation to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Hit Buy Now if it’s the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Revocable Trust for Asset Protection. Over three million users have utilized our service successfully. Choose your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

As far as the Internal Revenue Service is concerned, trust property belongs to the grantor. The grantor names a trustee to manage the assets, but during their lifetime, most people name themselves in this position. A successor trustee is named to carry on when the grantor dies or becomes incapacitated.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Real property. Bank accounts. Security accounts such as stocks, bonds, and CDs. Business interests (of a limited amount) Patents and copyrights. Antiques and valuable furniture/jewelry.

A Revocable Living Trust Defined Assets can include real estate, valuable possessions, bank accounts and investments. As with all living trusts, you create it during your lifetime.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

A revocable living trust will not protect your assets from a nursing home. This is because the assets in a revocable trust are still under the control of the owner. To shield your assets from the spend-down before you qualify for Medicaid, you will need to create an irrevocable trust.