This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Agreement for Credit Counseling Services

Description

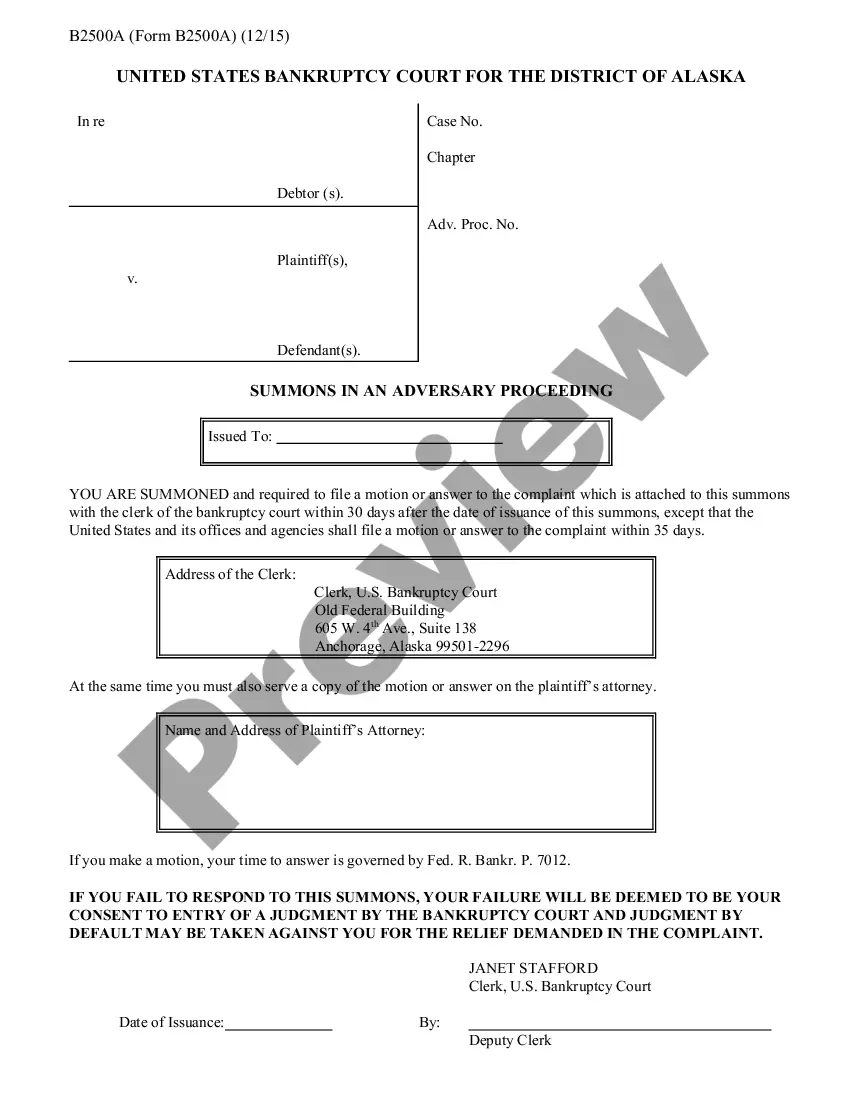

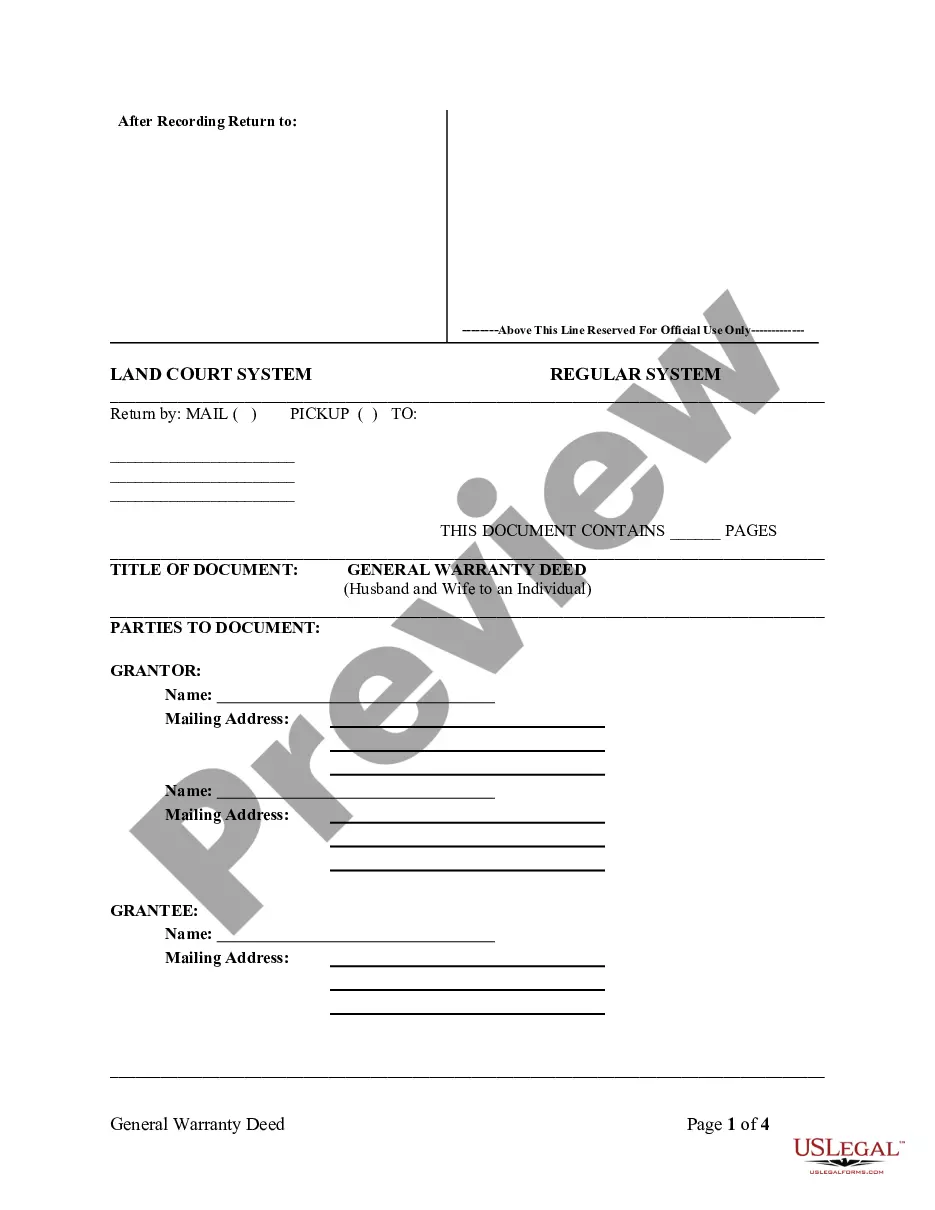

How to fill out Agreement For Credit Counseling Services?

Aren't you sick and tired of choosing from countless templates each time you need to create a Agreement for Credit Counseling Services? US Legal Forms eliminates the wasted time millions of Americans spend surfing around the internet for perfect tax and legal forms. Our skilled group of attorneys is constantly modernizing the state-specific Templates collection, to ensure that it always provides the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription should complete easy steps before having the capability to get access to their Agreement for Credit Counseling Services:

- Use the Preview function and look at the form description (if available) to make sure that it is the correct document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper template to your state and situation.

- Make use of the Search field on top of the page if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your document in a convenient format to complete, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always be able to sign in and download whatever file you need for whatever state you need it in. With US Legal Forms, completing Agreement for Credit Counseling Services templates or other legal paperwork is simple. Get going now, and don't forget to recheck your examples with accredited attorneys!

Form popularity

FAQ

Credit counseling simplifies your repayment process, ideally making it easier to pay off your debt. In some cases, credit counselors can negotiate lowered interest rates, reduced monthly payments and more with your creditors, which could save you money.

Again, credit counseling won't hurt your credit score. And while the actions you ultimately take as a result of that counseling might bring your score down a bit, taking control of your finances and paying off your debt will far outweigh any temporary dings to your credit.

Credit counseling organizations are usually non-profit organizations that advise you on managing your money and debts and usually offer free educational materials and workshops. Debt settlement companies offer to arrange settlements of your debts with creditors or debt collectors for a fee.

Credit counselors are trained to offer advice on debt management, budgeting and consumer credit. Through one-on-one counseling, workshops and educational materials, they can tailor a plan to your situation.Counselors can also advise on issues such as student loan debt, reverse mortgages and starting a small business.

A: ACCC does not charge a fee for budget counseling. There is a one-time fee of $39 for enrollment into the debt management program. The enrollment fee may be waived or reduced depending on your state's regulations or financial hardship.

Is your organization accredited? How much do I have to pay to use your service? Will your program affect my credit? Do you offer other services besides debt management programs? How long will your program take to complete? Who do I owe once I am in the program?

Credit counseling simplifies your repayment process, ideally making it easier to pay off your debt. In some cases, credit counselors can negotiate lowered interest rates, reduced monthly payments and more with your creditors, which could save you money.

Your counselor will contact your creditors in an attempt to reduce your interest rates, remove fees, and create a monthly payment plan you can work with. All of your debts will be combined into one monthly payment that will be made to the counseling agency and they will then pay each of your creditors.

Some services are offered for free and some are set based on specific regulations, says McClary. Your first consult is typically free. If you start with the debt management program, fees can range from $20 a month to $40 to $50 a month.