Affidavit of Lost Promissory Note

Definition and meaning

An Affidavit of Lost Promissory Note is a legal document used to declare that an individual has lost a promissory note. A promissory note is a written promise to pay a specified sum of money to a designated person or entity. This affidavit serves to affirm that the original document cannot be found and provides the necessary information regarding the note's details to prevent any disputes over payments in the future.

How to complete a form

To successfully complete the Affidavit of Lost Promissory Note, follow these steps:

- Fill in the state and county where the affidavit is being created.

- Identify yourself as the affiant and include your capacity (e.g., owner, holder).

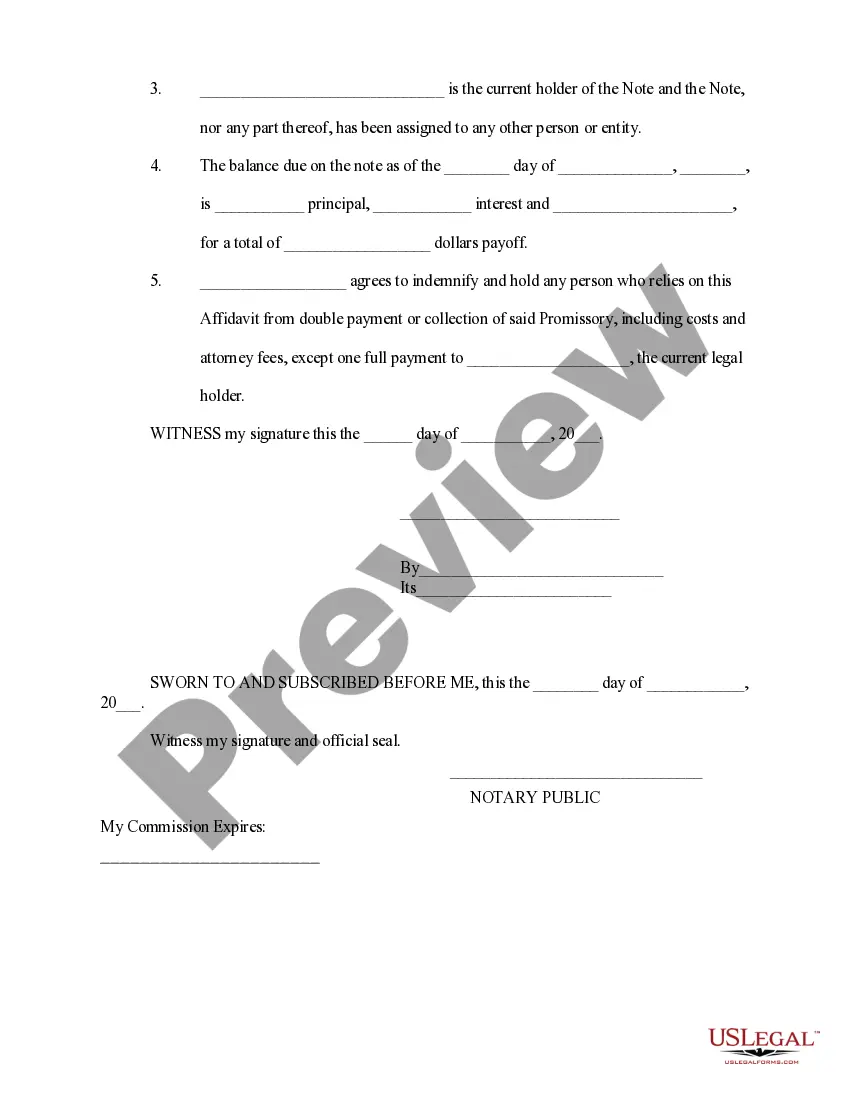

- Provide the details of the lost promissory note such as date, amount, interest rate, and the parties involved.

- State whether the original note is attached or explain why it's unavailable.

- Specify the current holder of the note and confirm it hasn't been assigned to anyone else.

- Wrap up by entering the balance due and divinely your indemnification agreement.

Who should use this form

This form is ideal for individuals or entities who have lost their promissory note and need to officially report the loss. It is commonly used by lenders, borrowers, or legal representatives to ensure that payments can continue without interruption and to avoid any potential litigation over lost documents.

Common mistakes to avoid when using this form

When completing the Affidavit of Lost Promissory Note, be mindful of the following common mistakes:

- Failing to provide complete information about the lost note, such as the amount or terms.

- Neglecting to sign the affidavit in front of a notary public, which is essential for it to be legally recognized.

- Not stating whether a copy of the original note is attached, which can create confusion.

- Forgetting to include all necessary parties involved in the note.

What to expect during notarization or witnessing

When notarizing the Affidavit of Lost Promissory Note, you will need to present a valid form of identification to the notary. The notary will verify your identity, witness your signature, and acknowledge the document officially. It's also important to ensure the document is signed in their presence for it to hold legal weight. You may also be required to provide additional information regarding the lost note as needed.

Key takeaways

The Affidavit of Lost Promissory Note is an important legal tool for documenting the loss of a financial instrument. Proper completion and notarization of the document protect your interests and provide clarity regarding payment responsibilities. Always provide accurate information, avoid common pitfalls, and ensure the affidavit is signed and notarized for it to be effective.

Form popularity

FAQ

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents. A lender is required under the Federal Servicer Act to provide you copies of your loan documents if you submit a written request.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

A promissory note, in simplest terms, is the acknowledgment of a debt.Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Search the county recorder's records. Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied.