Texas Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

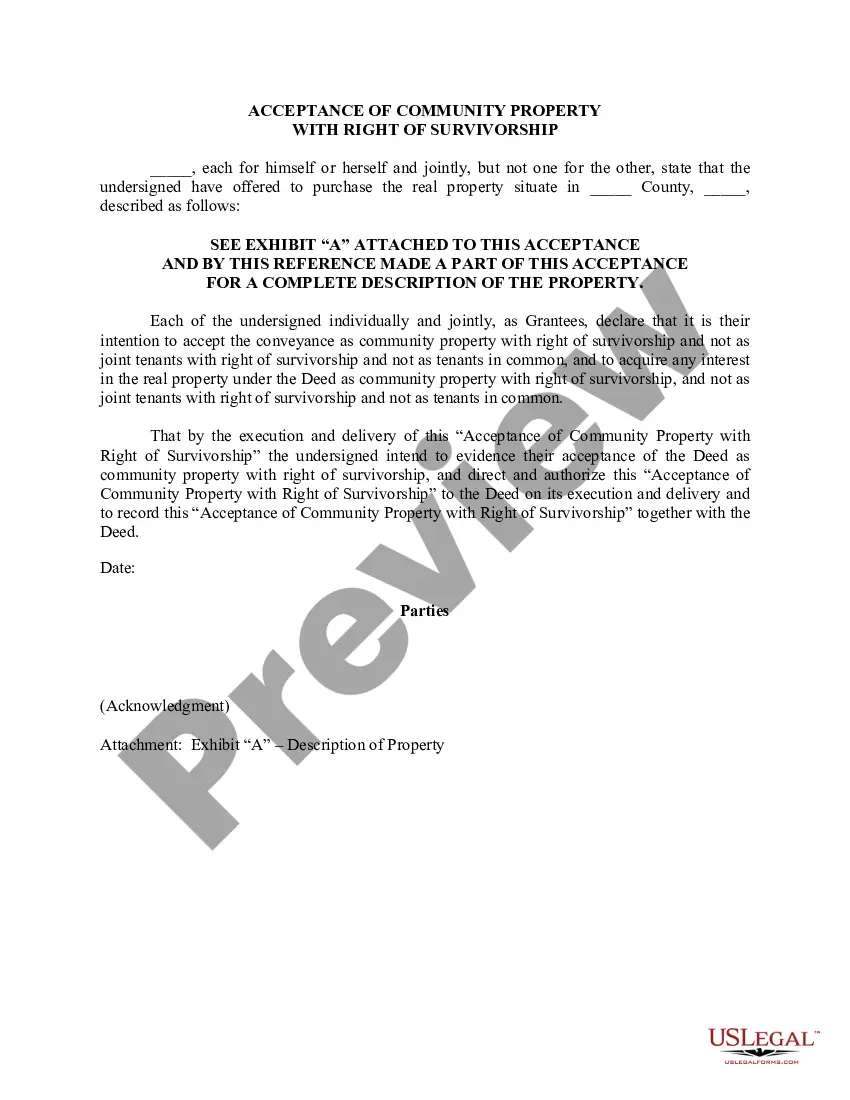

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

US Legal Forms - one of many most significant libraries of legal forms in America - provides an array of legal record themes you can acquire or print. While using internet site, you will get a huge number of forms for company and personal purposes, categorized by groups, says, or search phrases.You will find the most up-to-date variations of forms just like the Texas Deed (Including Acceptance of Community Property with Right of Survivorship) within minutes.

If you already have a subscription, log in and acquire Texas Deed (Including Acceptance of Community Property with Right of Survivorship) in the US Legal Forms local library. The Acquire key will show up on every single type you see. You get access to all formerly delivered electronically forms in the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, listed here are easy recommendations to help you get began:

- Make sure you have picked the right type for your personal city/state. Click on the Preview key to examine the form`s information. Browse the type outline to ensure that you have selected the correct type.

- In case the type doesn`t match your specifications, use the Look for area on top of the display to get the one who does.

- Should you be pleased with the form, affirm your decision by visiting the Purchase now key. Then, select the prices prepare you favor and give your qualifications to register to have an profile.

- Procedure the financial transaction. Use your charge card or PayPal profile to accomplish the financial transaction.

- Pick the file format and acquire the form on your product.

- Make alterations. Fill up, modify and print and sign the delivered electronically Texas Deed (Including Acceptance of Community Property with Right of Survivorship).

Every design you included with your bank account does not have an expiration time which is your own property for a long time. So, if you want to acquire or print one more backup, just go to the My Forms segment and click on about the type you will need.

Get access to the Texas Deed (Including Acceptance of Community Property with Right of Survivorship) with US Legal Forms, by far the most comprehensive local library of legal record themes. Use a huge number of professional and status-specific themes that satisfy your business or personal requirements and specifications.

Form popularity

FAQ

In Texas, a married couple can agree in writing that all or part of their community property will go to the surviving spouse when one person dies. This is called a right of survivorship agreement. The right of survivorship agreement must be filed with the county court records where the couple lives.

Right of survivorship in Texas When joint owners of real estate property have this agreement properly prepared, signed in front of a notary and filed in the county records, if one owner dies, the property becomes the sole property of the other owner. Immediately and automatically.

Community property means that spouses who acquire property during marriage own property equally, 50/50. That means that one spouse on death can leave his or her share as he or she wants and on divorce, it typically is divided 50/50 as well.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

Generally speaking, each spouse has a right to half of the community property and so, this is automatically distributed to a widow after their spouse's death.

Advantages of community property with a right of survivorship: The surviving spouse becomes the sole owner of property upon their spouse's death without the property having to pass through probate. The surviving spouses can maintain continuity in ownership.

Disadvantages of Community Property. This title type would be disadvantageous if the decedent's true intentions were to leave their property to someone other than their spouse. Even though title controls in this case, the probate court may encounter a dispute.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.