Texas Affidavit of Heirship for Motor Vehicle

Description

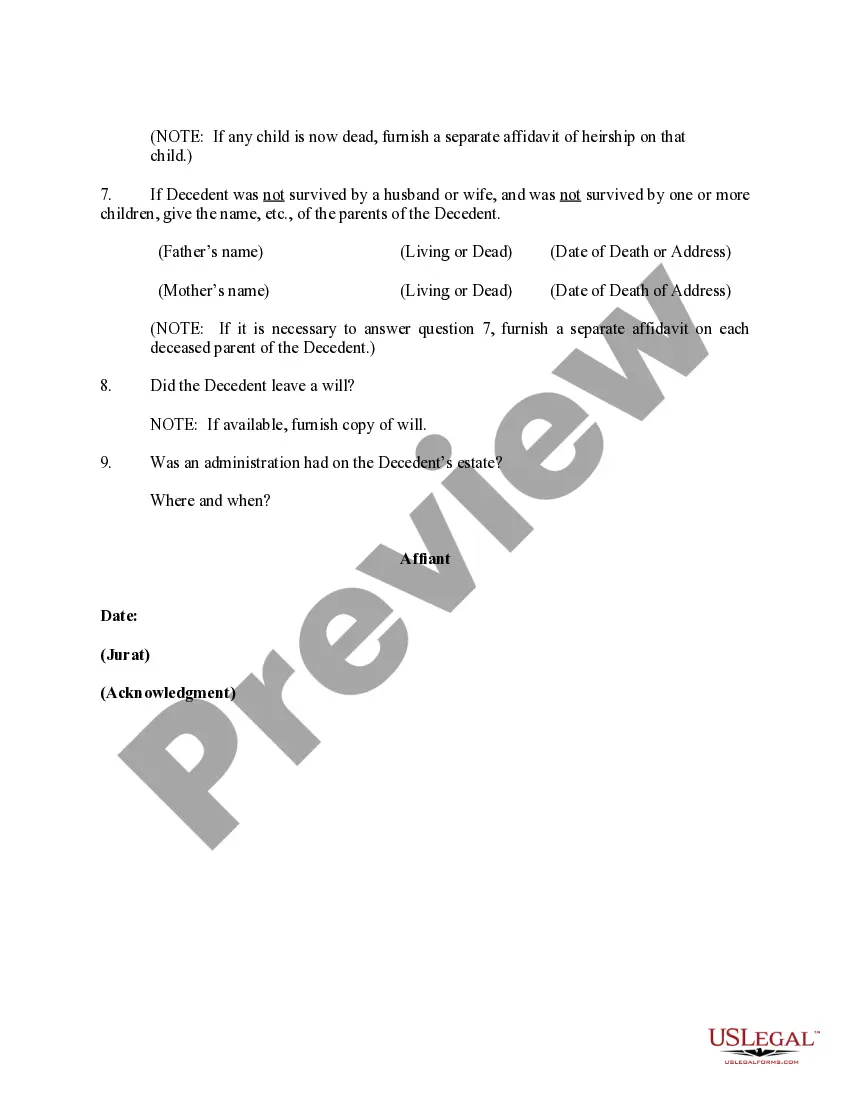

How to fill out Affidavit Of Heirship For Motor Vehicle?

US Legal Forms - one of many largest libraries of legitimate varieties in the United States - provides a wide range of legitimate file layouts it is possible to obtain or print out. Using the web site, you will get a huge number of varieties for business and person uses, sorted by types, claims, or keywords and phrases.You can get the most recent variations of varieties just like the Texas Affidavit of Heirship for Motor Vehicle within minutes.

If you currently have a subscription, log in and obtain Texas Affidavit of Heirship for Motor Vehicle through the US Legal Forms collection. The Down load key will appear on each develop you perspective. You get access to all previously delivered electronically varieties within the My Forms tab of your accounts.

If you wish to use US Legal Forms for the first time, allow me to share straightforward instructions to help you began:

- Be sure you have picked the correct develop for the metropolis/area. Click the Preview key to examine the form`s information. See the develop explanation to actually have selected the correct develop.

- In the event the develop does not match your demands, take advantage of the Research discipline at the top of the display to get the one who does.

- If you are content with the form, affirm your option by clicking on the Purchase now key. Then, choose the costs strategy you favor and provide your credentials to sign up for an accounts.

- Approach the financial transaction. Utilize your credit card or PayPal accounts to perform the financial transaction.

- Find the formatting and obtain the form on your own device.

- Make changes. Fill up, edit and print out and indicator the delivered electronically Texas Affidavit of Heirship for Motor Vehicle.

Every web template you included in your bank account lacks an expiration date and is your own property forever. So, in order to obtain or print out one more copy, just check out the My Forms area and click in the develop you want.

Obtain access to the Texas Affidavit of Heirship for Motor Vehicle with US Legal Forms, one of the most extensive collection of legitimate file layouts. Use a huge number of skilled and state-specific layouts that meet your business or person demands and demands.

Form popularity

FAQ

To claim the vehicle, the beneficiary must submit an Application for Texas Title and/or Registration (Form 130-U), the $28 or $33 title application fee, the Texas title in the deceased owner's name listing the beneficiary, and a death certificate.

If one or more of the persons that completed a Rights of Survivorship agreement dies, ownership of the vehicle transfers to the other person(s) that signed the agreement. A vehicle does not have to be titled or registered in the names of all persons in the agreement.

You do not need the vehicle's title to inherit it, but state law requires specific documentation before you can legally title and register the vehicle in your name, sell it or give it as a gift. In most cases an Affidavit(s) of Heirship - Form VTR-262 - is required.

Transfers by Heirs First, the heir(s) owes tax (either motor vehicle use tax or gift tax) on acquiring the vehicle from the estate. Second, the person receiving the vehicle from the heir(s) also owes motor vehicle tax.

REQUIRED: ? Must Sign and Date Transfer on Death Deed In Front of A Notary. Must Record Transfer on Death Deed Before Your Death: You must record (file) this deed before your death with the county clerk where the property is located or it will not be effective.

To transfer a Texas titled vehicle, bring in or mail the following to our offices: Texas title, signed and dated by the seller(s) and buyer(s). ... VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s). ... Proof of insurance in the buyer's name. Acceptable form of ID. Proof of inspection. Fees.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.