Texas Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

Selecting the ideal legal document web template can be a challenge. Clearly, there are numerous designs available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of designs, including the Texas Data Entry Employment Agreement - Self-Employed Independent Contractor, which you can use for business and personal needs. All of the forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Texas Data Entry Employment Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have previously purchased. Visit the My documents tab in your account and download another copy of the document you require.

Finally, complete, modify, print, and sign the acquired Texas Data Entry Employment Agreement - Self-Employed Independent Contractor. US Legal Forms serves as the largest repository of legal documents where you can discover various document templates. Use the service to obtain well-crafted paperwork that adheres to state regulations.

- If you are a new user of US Legal Forms, here are simple steps that you can follow.

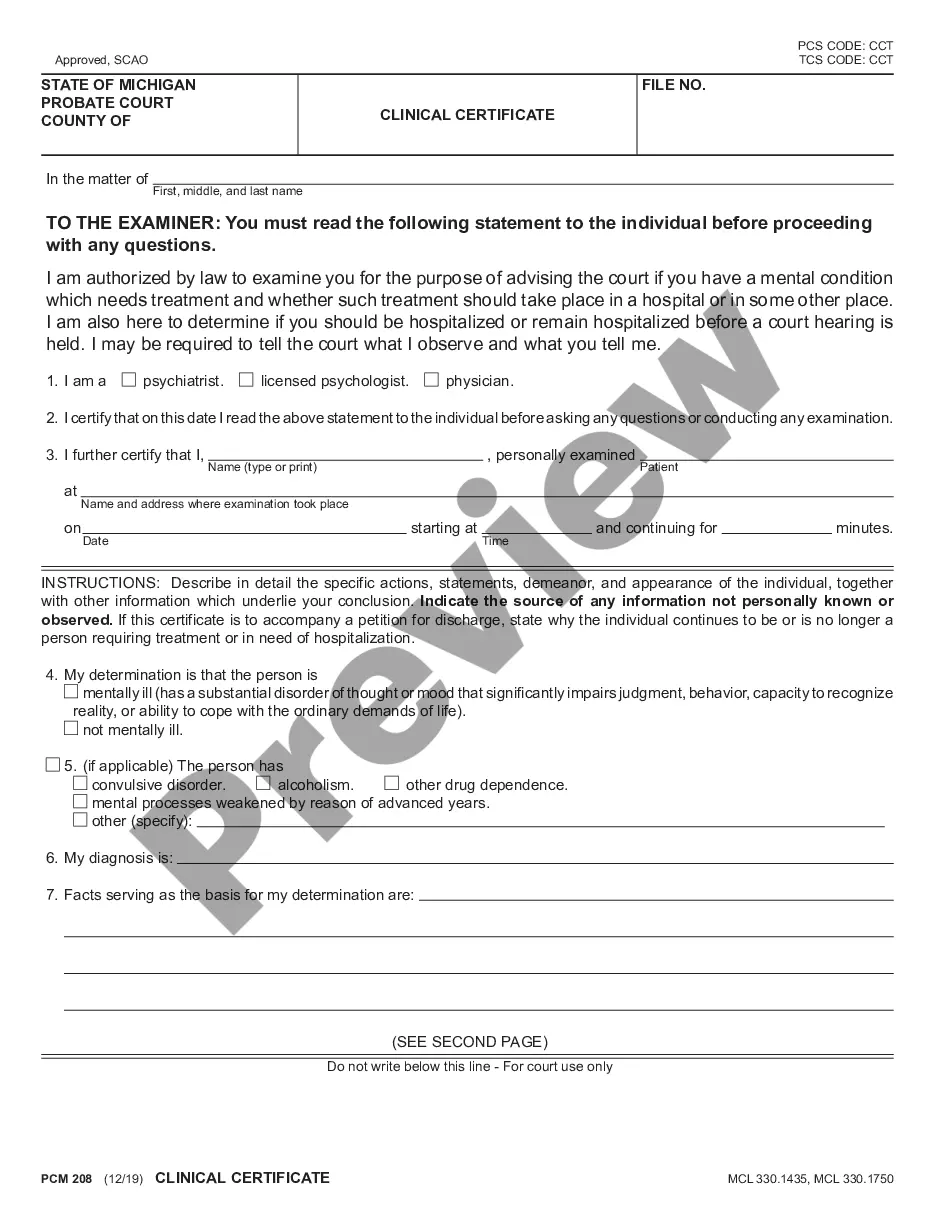

- First, ensure you have chosen the correct form for your locality/region. You can view the form using the Review button and examine the form details to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are confident that the form is appropriate, click on the Purchase now button to acquire the form.

- Select the pricing plan you wish and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Filling out an independent contractor form involves detailing your full name, address, and tax ID number. Describe the work to be performed and include information about payment methods and amounts. It is important to ensure that the content accurately reflects the Texas Data Entry Employment Contract - Self-Employed Independent Contractor. UsLegalForms provides easy-to-use forms to assist you in this process.

To fill out a declaration of independent contractor status form, provide your personal information and the business name you're contracting with. Include key details about your work, such as the nature of services provided and payment arrangements. Make sure this aligns with the Texas Data Entry Employment Contract - Self-Employed Independent Contractor to maintain clarity. For a streamlined experience, consider using UsLegalForms.

When filling out an independent contractor agreement, begin by entering the names and contact details of both parties involved. Next, specify the services to be provided, the payment structure, and deadlines. Ensure that the agreement complies with the terms of the Texas Data Entry Employment Contract - Self-Employed Independent Contractor. Using the templates from UsLegalForms can guide you through this process effectively.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and duration of the contract. Include details like the contractor's responsibilities, confidentiality clauses, and termination conditions. This Texas Data Entry Employment Contract - Self-Employed Independent Contractor should also clearly state that the individual is not an employee. UsLegalForms offers templates that simplify this process.

Yes, being a contractor indeed qualifies you as self-employed. As a self-employed independent contractor, you run your business and take on projects as needed. This status offers flexibility and autonomy in your work, which many find appealing. Utilizing a Texas Data Entry Employment Contract provides clarity and security in your self-employment journey.

Yes, as a self-employed individual, you can certainly have contracts that outline your work terms. A written agreement solidifies the expectations between parties and protects both sides. The Texas Data Entry Employment Contract is ideal for establishing these parameters, ensuring mutual understanding and legal protection. Using a formal contract elevates your business credibility.

In Texas, whether an independent contractor requires a business license depends on the services they provide. Many contractors, especially in data entry, may not need a specific license, yet they should verify local requirements. Having the proper licenses ensures compliance and fosters trust within your client relationships. The Texas Data Entry Employment Contract can help clarify these obligations.

The terms self-employed and independent contractor have distinct meanings, yet both signify a non-traditional employment status. A self-employed individual often runs a business, while an independent contractor typically completes specific tasks under a contract. Using either term depends on your circumstances and the context of your work. The Texas Data Entry Employment Contract is a perfect example of how these concepts intersect.

Recent changes in regulations for self-employed individuals focus on tax classification and benefits eligibility. As a self-employed independent contractor under the Texas Data Entry Employment Contract, you must meet certain criteria to assess your business status. These rules also emphasize the importance of clear contracts to define your work terms. Be sure to stay updated with local legislation to ensure compliance.

To show proof of income as a 1099 contractor, compile your Texas Data Entry Employment Contract - Self-Employed Independent Contractor along with your 1099 tax forms and invoices. These documents highlight your earnings from various clients and confirm your income for tax purposes. By keeping organized records, you can easily demonstrate your income and support your financial situation.