Texas Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

If you need to total, acquire, or produce lawful record layouts, use US Legal Forms, the greatest variety of lawful forms, that can be found on the Internet. Take advantage of the site`s basic and hassle-free lookup to find the documents you will need. Numerous layouts for enterprise and person purposes are categorized by types and says, or keywords and phrases. Use US Legal Forms to find the Texas Summary of Terms of Proposed Private Placement Offering within a number of clicks.

In case you are previously a US Legal Forms buyer, log in to your bank account and then click the Acquire key to find the Texas Summary of Terms of Proposed Private Placement Offering. Also you can gain access to forms you in the past acquired inside the My Forms tab of the bank account.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for the proper metropolis/region.

- Step 2. Take advantage of the Review method to check out the form`s information. Never overlook to learn the information.

- Step 3. In case you are not happy with all the kind, use the Lookup industry towards the top of the display screen to find other variations of your lawful kind web template.

- Step 4. After you have identified the shape you will need, select the Purchase now key. Choose the rates prepare you like and add your qualifications to register for an bank account.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the structure of your lawful kind and acquire it on your system.

- Step 7. Total, modify and produce or indication the Texas Summary of Terms of Proposed Private Placement Offering.

Each and every lawful record web template you acquire is yours for a long time. You might have acces to each kind you acquired with your acccount. Go through the My Forms segment and select a kind to produce or acquire again.

Contend and acquire, and produce the Texas Summary of Terms of Proposed Private Placement Offering with US Legal Forms. There are millions of specialist and status-distinct forms you can use to your enterprise or person requirements.

Form popularity

FAQ

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

What Should a PPM Include? Background Information on the General Partner and/or Investment Manager. Investment Objective, Strategy, and Limitations (if any) Management Fees, Incentive Compensation, and Other Fees and Expenses. Investment, Withdrawal, and Transfer Procedures and Limitations. Risk Factors.

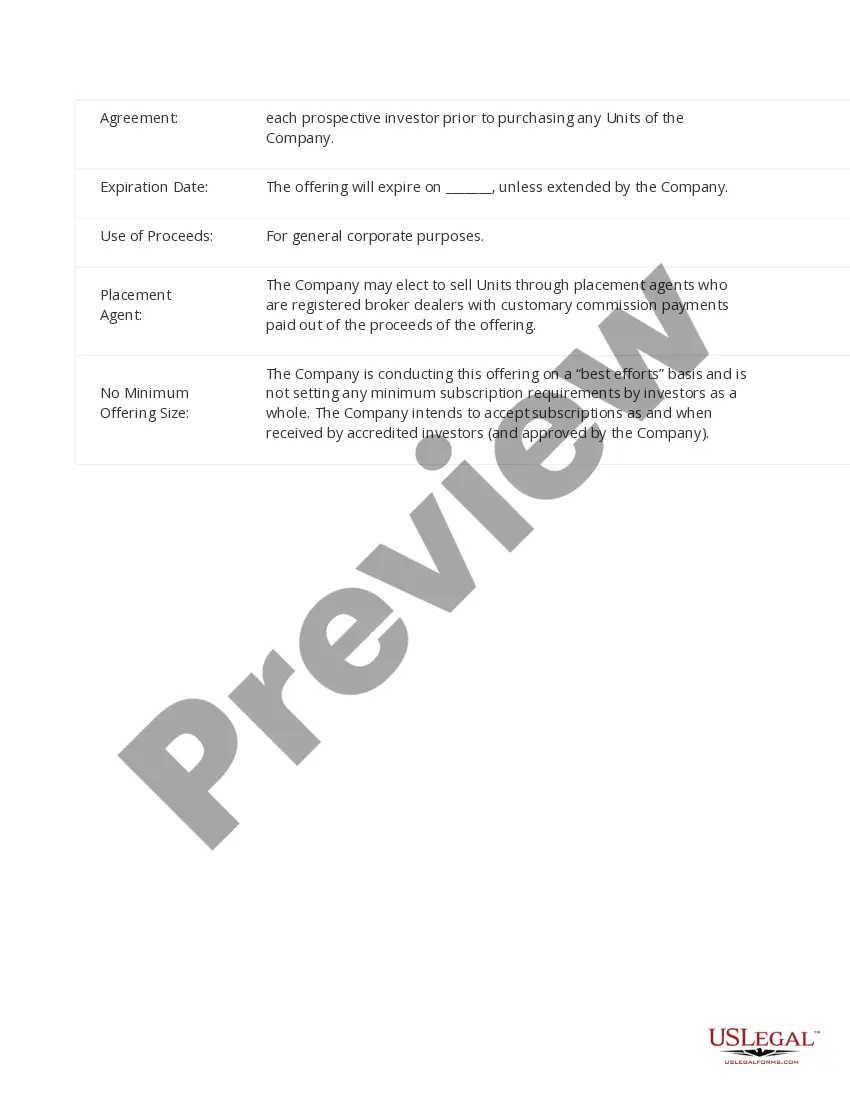

Outline of a PPM Introduction. ... Summary of Offering Terms. ... Risk Factors. ... Description of the Company and the Management. ... Use of Proceeds. ... Description of Securities. ... Subscription Procedures. ... Exhibits.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

An offering memorandum is a document issued to potential investors in a private placement deal. The offering memorandum spells out the private placement's objectives, risks, financials, and deal terms.

Each private placement includes a detailed analysis of the issuer and the investment, identification of prospective investors, and ultimately, the timely execution of the transaction. LGA adds value by understanding its clients and their proposed investment.

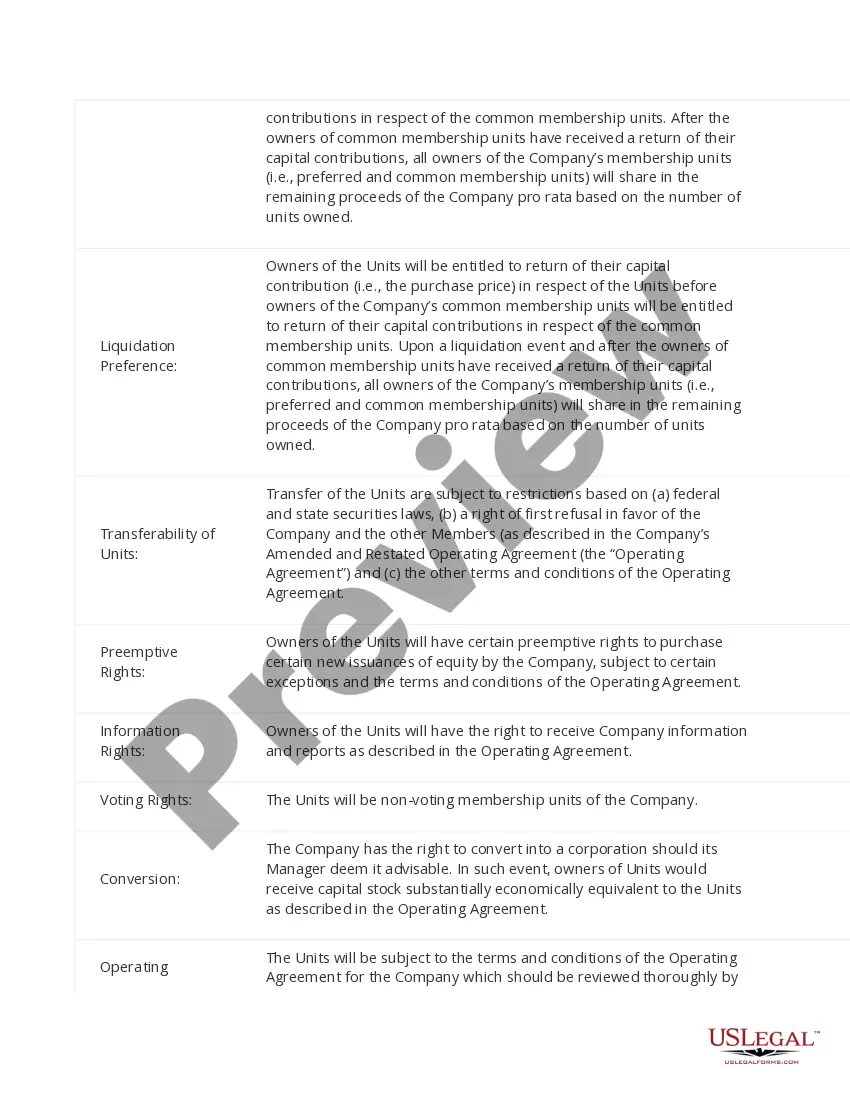

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

What are the key components of an Offering Memorandum? An Offering Memorandum typically includes an executive summary, details of the offering, company information, description of securities, use of proceeds, risk factors, legal matters and regulations, and financial statements and projections.