Texas Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

Have you been within a place in which you will need documents for possibly business or person uses nearly every time? There are plenty of authorized papers layouts available online, but locating kinds you can rely is not simple. US Legal Forms delivers a large number of form layouts, like the Texas Approval of deferred compensation investment account plan, that happen to be composed to fulfill state and federal requirements.

If you are already knowledgeable about US Legal Forms internet site and have a free account, simply log in. Afterward, you can download the Texas Approval of deferred compensation investment account plan web template.

If you do not come with an account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the form you will need and make sure it is to the right area/region.

- Utilize the Preview key to check the form.

- See the description to actually have selected the proper form.

- In case the form is not what you are looking for, take advantage of the Look for discipline to get the form that suits you and requirements.

- When you obtain the right form, click on Acquire now.

- Select the rates strategy you desire, fill in the desired information and facts to produce your account, and buy your order making use of your PayPal or credit card.

- Select a handy data file formatting and download your duplicate.

Discover all of the papers layouts you might have purchased in the My Forms food selection. You can aquire a additional duplicate of Texas Approval of deferred compensation investment account plan anytime, if needed. Just go through the needed form to download or printing the papers web template.

Use US Legal Forms, probably the most substantial collection of authorized types, to save time and prevent mistakes. The assistance delivers skillfully created authorized papers layouts that you can use for a variety of uses. Make a free account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

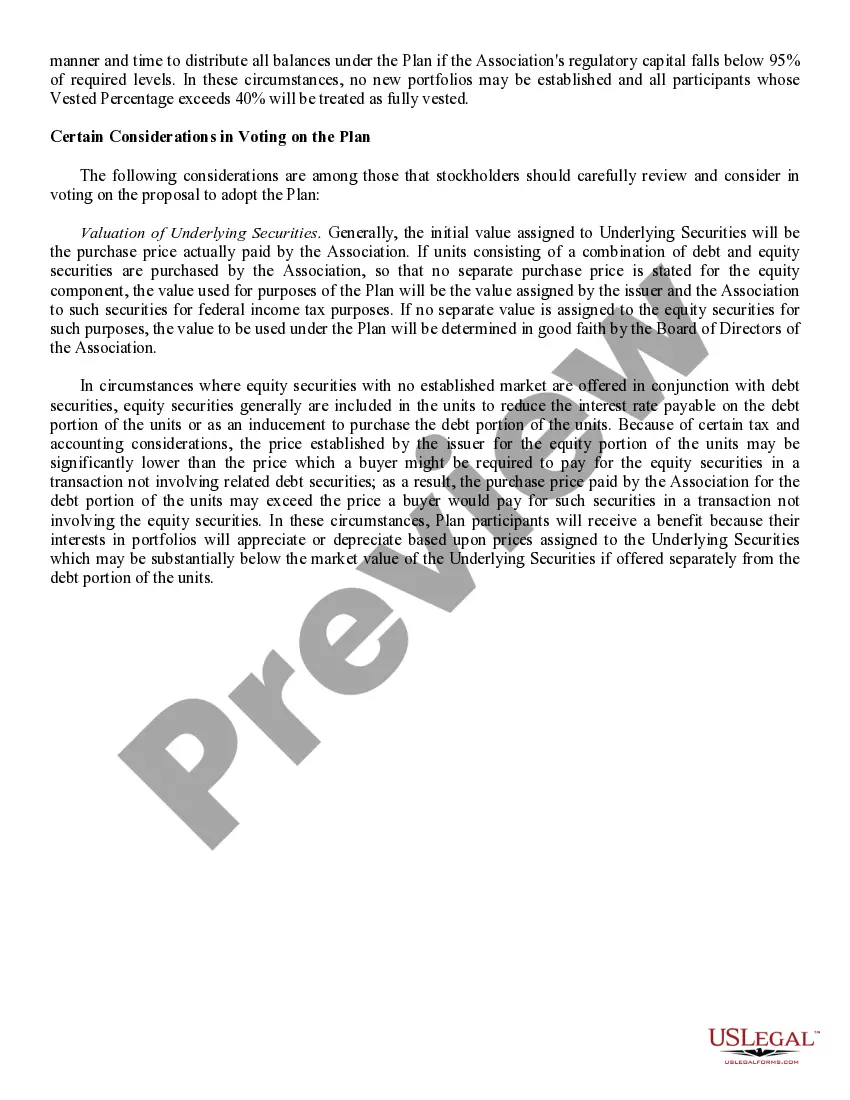

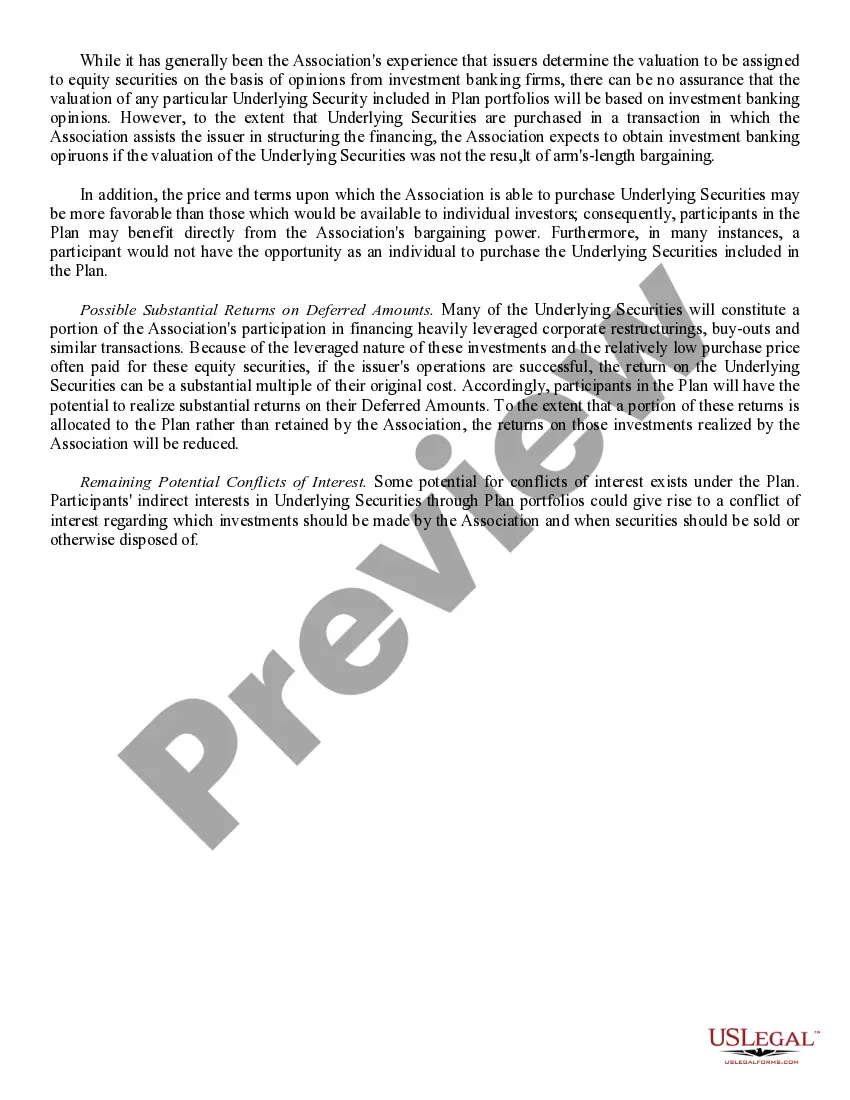

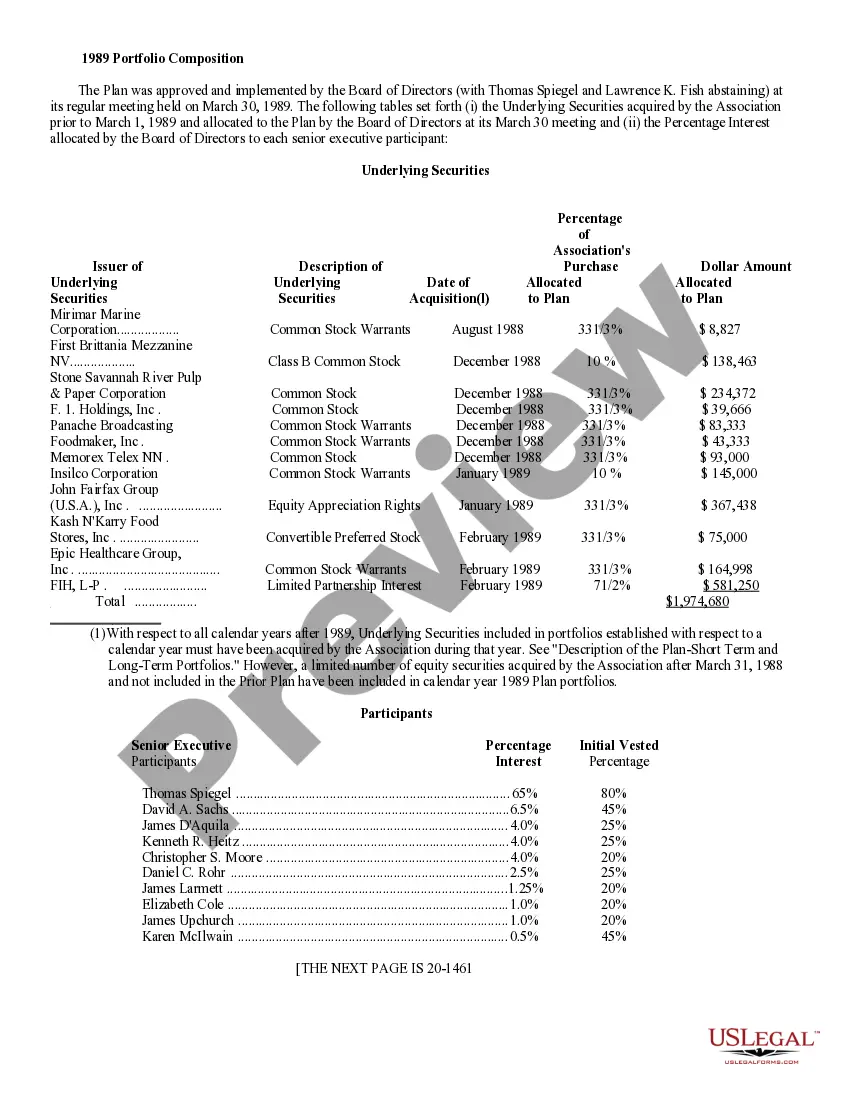

A governmental 457(b) deferred compensation plan (457 plan*) is a retirement savings plan that allows eligible employees to supplement any existing retirement/pension benefits by saving and investing before-tax dollars through voluntary salary deferral.

If you take your deferred compensation payments over a period of 10 years or more, those payments will be taxed in the state where you reside, rather than in the state in which you earned the compensation, possibly reducing your state income taxes.

Deferred Compensation Assets means assets included in a trust established by the Borrower or a subsidiary of the Borrower or assets otherwise so designated by a Financial Officer, in each case, to pay Deferred Compensation Obligations as they come due.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

A deferred compensation plan is another name for a 457(b) retirement plan, or ?457 plan? for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

Deferred compensation is a portion of an employee's income that is paid out at a date after which that income is earned. Common examples of deferred compensation include pensions, retirement plans, and employee stock options.

Note: Your deferred compensation is not placed directly into an investment, but you designate investment choices for bookkeeping purposes. Your employer uses your choices as a benchmark to calculate the appropriate investment returns owed during the deferral period.

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.