Texas Web Package

Description

How to fill out Web Package?

You can invest hours on the web attempting to find the authorized document format that meets the state and federal requirements you want. US Legal Forms offers a huge number of authorized types that happen to be analyzed by specialists. It is possible to obtain or produce the Texas Web Package from your assistance.

If you currently have a US Legal Forms account, it is possible to log in and click the Obtain switch. Afterward, it is possible to total, modify, produce, or sign the Texas Web Package. Every single authorized document format you acquire is your own for a long time. To get an additional version for any bought develop, go to the My Forms tab and click the related switch.

If you are using the US Legal Forms internet site initially, stick to the easy guidelines below:

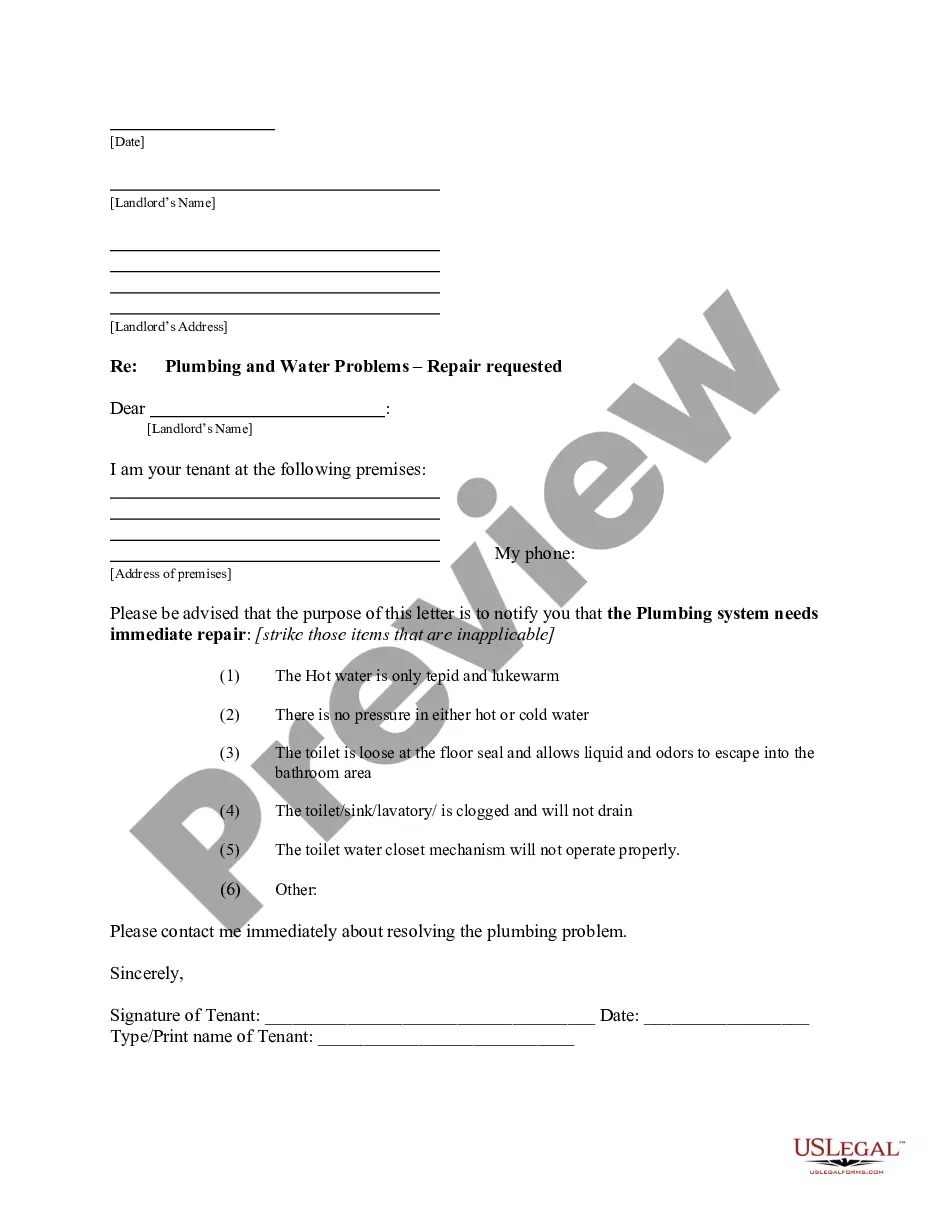

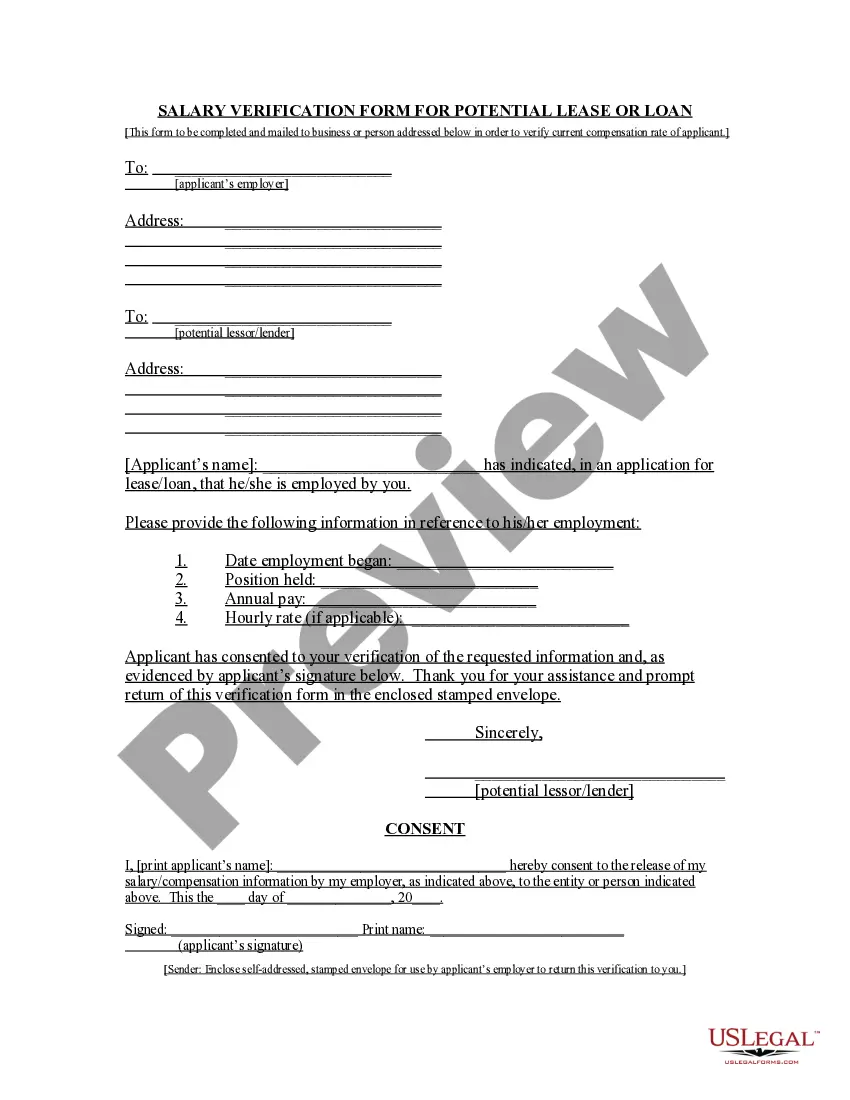

- Initially, be sure that you have selected the proper document format for your state/town of your choice. Read the develop outline to ensure you have chosen the correct develop. If offered, use the Review switch to check through the document format too.

- If you wish to find an additional variation in the develop, use the Research field to get the format that fits your needs and requirements.

- Upon having located the format you desire, simply click Purchase now to continue.

- Find the costs strategy you desire, type your qualifications, and register for an account on US Legal Forms.

- Total the transaction. You should use your Visa or Mastercard or PayPal account to purchase the authorized develop.

- Find the format in the document and obtain it to the gadget.

- Make changes to the document if needed. You can total, modify and sign and produce Texas Web Package.

Obtain and produce a huge number of document templates utilizing the US Legal Forms web site, which offers the largest collection of authorized types. Use specialist and status-specific templates to deal with your small business or specific needs.

Form popularity

FAQ

Tax Rates, Thresholds and Deduction Limits ItemAmountTax Rate (retail or wholesale)0.375%Tax Rate (other than retail or wholesale)0.75%Compensation Deduction Limit$450,000EZ Computation Total Revenue Threshold$20 million2 more rows Franchise Tax - Texas Comptroller Texas.gov ? taxes ? franchise Texas.gov ? taxes ? franchise

Hear this out loud PauseFranchise tax is based on a taxable entity's margin. Unless a taxable entity qualifies and chooses to file using the EZ computation, the tax base is the taxable entity's margin and is computed in one of the following ways: total revenue times 70 percent; total revenue minus cost of goods sold (COGS);

Filing Your Texas Annual Franchise Tax Report On the state website, go to the Franchise Tax page. If you wish to file online, click ?webfile eSystems Login.? If you wish you to file by mail, click ?Forms.?

The franchise tax rate for entities choosing to file using the EZ computation method is 0.331% (0.00331). No margin deduction (COGS, compensation, 70% of revenue or $1 million) is allowed when choosing the EZ computation method. 2023 Texas Franchise Tax Report Information and Instructions texas.gov ? forms texas.gov ? forms

The wage and cash compensation deduction for each 12-month period are as follows: $400,000 per person for reports originally due in 2022 and 2023. $390,000 per person for reports originally due in 2020 and 2021. Compensation - Franchise Tax Frequently Asked Questions texas.gov ? taxes ? franchise ? faq ? c... texas.gov ? taxes ? franchise ? faq ? c...

The EZ computation uses a reduced tax rate of 0.331% multi- plied by a business' revenue apportioned to Texas. Much like the no tax due threshold, the EZ computation has been adjusted since its enactment to provide more taxpayers with this option. Texas Franchise Tax Texas Taxpayers and Research Association ? FranchiseTaxReport_Final Texas Taxpayers and Research Association ? FranchiseTaxReport_Final PDF

You have three options for filing and paying your Texas sales tax: File online ? File online at the ?TxComptroller eSystems? site. You can remit your payment through their online system. ... File by mail ? You can also download a Texas Sales and Use tax return here. AutoFile ? Let TaxJar file your sales tax for you.

Hear this out loud PauseYour Webfile number is your "access code" to Webfile issued by the Comptroller's office. It is printed in the upper left corner of the tax report we mail to each taxpayer and on most notices. It is two letters followed by six numbers (Example: RT666666).