Texas Request for Accounting of Disclosures of Protected Health Information

Description

How to fill out Request For Accounting Of Disclosures Of Protected Health Information?

You can spend time online looking for the legal document template that fulfills the state and federal criteria you require.

US Legal Forms offers numerous legal forms that are reviewed by experts.

You can download or print the Texas Request for Accounting of Disclosures of Protected Health Information from our service.

If available, utilize the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Texas Request for Accounting of Disclosures of Protected Health Information.

- Every legal document template you obtain is yours indefinitely.

- To acquire another copy of a purchased form, proceed to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the locality/region you choose.

- Read the form description to make sure you have picked the appropriate form.

Form popularity

FAQ

Texas law allows individuals to request their medical records at any time, ensuring you have access to your personal health information. Providers must respond to your request within a specific time frame, typically within 15 days. Understanding your rights under Texas law enables you to effectively utilize your Texas Request for Accounting of Disclosures of Protected Health Information.

The authorization for the disclosure of PHI typically includes the individual's name, the information being disclosed, the purpose of the disclosure, and the expiration date of the authorization. It also outlines who can disclose the information and to whom it can be disclosed. Understanding these elements is crucial for anyone involved in the Texas Request for Accounting of Disclosures of Protected Health Information.

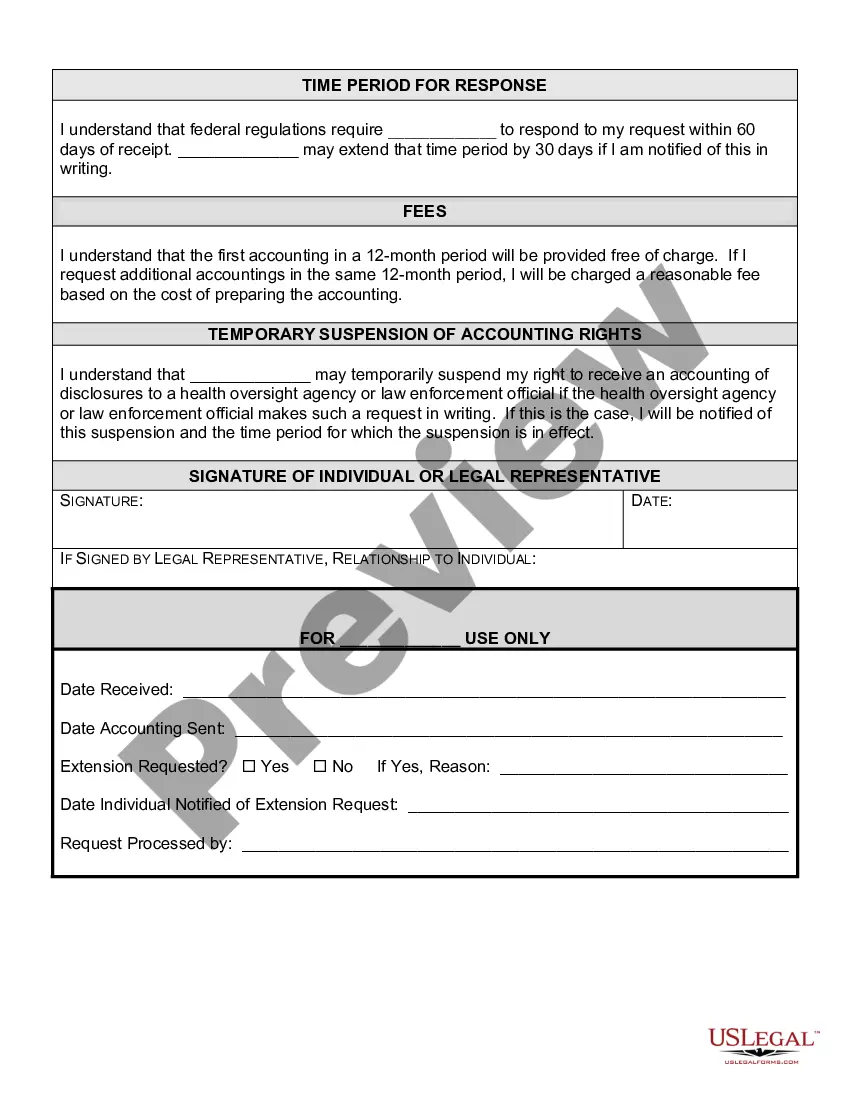

Required information is provided to the data subject when they request an accounting of disclosures made under HIPAA regulations. The Texas Request for Accounting of Disclosures of Protected Health Information allows individuals to receive this information within a specified time frame, usually no later than 60 days after the request. This ensures individuals are informed and can make informed choices about their health information.

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.

A covered entity must produce records 30 days from the date of request. HIPAA allows a covered entity one 30-day extension if it provides written notice to the patient stating the reason for the delay and the expected date. This applies to both paper and electronic records.

Other instances necessitating Accounting of Disclosures (AOD) include: Those Required by Law (Court Orders, subpoenas, state reporting, emergencies) Public Health Activities (Prevention of disease, public health investigations) Victims of abuse, neglect, or domestic violence.

When releases occur that are pursuant to Accounting of Disclosures, the log must include certain elements like: the date of the disclosure; the name and address of the organization / person who received the PHI; a brief description of the PHI disclosed; and.

Patients (or their Personal Representatives see Yale Policy 5038 - Personal Representatives) may request an accounting of disclosures by submitting a request in writing using the Request for Accounting of Disclosures of Protected Health Information form, or other sufficient written documentation requesting the

The maximum disclosure accounting period is the six years immediately preceding the accounting request, except a covered entity is not obligated to account for any disclosure made before its Privacy Rule compliance date.