Texas Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

If you need to thoroughly, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Take advantage of the site’s user-friendly and practical search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you acquire belongs to you permanently. You have access to every form you downloaded in your account.

Explore the My documents section and choose a form to print or download again. Be proactive and download and print the Texas Assignment of Accounts Receivable using US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to obtain the Texas Assignment of Accounts Receivable in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Texas Assignment of Accounts Receivable.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for the correct region/state.

- Step 2. Use the Review option to check the form’s content. Don’t forget to review the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to discover other versions of the legal document template.

- Step 4. Once you have identified the form you wish, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for the account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Texas Assignment of Accounts Receivable.

Form popularity

FAQ

The notice of assignment of accounts is a specific form that details the assigned accounts and notifies the relevant debtors. It provides clarity about who the new creditor is and serves as a reminder of the debtor's obligation. When dealing with Texas Assignment of Accounts Receivable, completing this notice correctly ensures legal compliance and enhances collection efforts.

A notice of assignment signifies that the rights to receive payment for a debt or account have been transferred to a different party. This document serves as proof of the assignment and outlines the new payment instructions for the debtor. In Texas Assignment of Accounts Receivable, such notifications are crucial to protecting the interests of both the assignor and the assignee.

To assign a contract in Texas, you generally must provide written notice to the other party and ensure compliance with the contract terms. It is crucial to include necessary details, such as the assignee's information and effective dates. Ensuring clarity in assignments is especially important when it involves the Texas Assignment of Accounts Receivable, as incorrect assignments can lead to disputes.

The adjusting journal entry for accounts receivable usually occurs to account for estimated uncollectible accounts. This involves debiting bad debt expense and crediting the allowance for doubtful accounts. Accurate adjustments are vital for maintaining the integrity of financial statements, especially in Texas Assignment of Accounts Receivable transactions.

To establish an account receivable, a business typically debits the accounts receivable account and credits the revenue account upon making a sale. This entry records the expectation of future payments from customers. It is a crucial step for any entity utilizing the Texas Assignment of Accounts Receivable framework.

The journal entry for accounts receivable typically involves debiting the accounts receivable account and crediting the sales revenue account. This action reflects that a sale has occurred, but payment has not yet been received. For businesses operating under the Texas Assignment of Accounts Receivable, these entries are critical for maintaining accurate financial records.

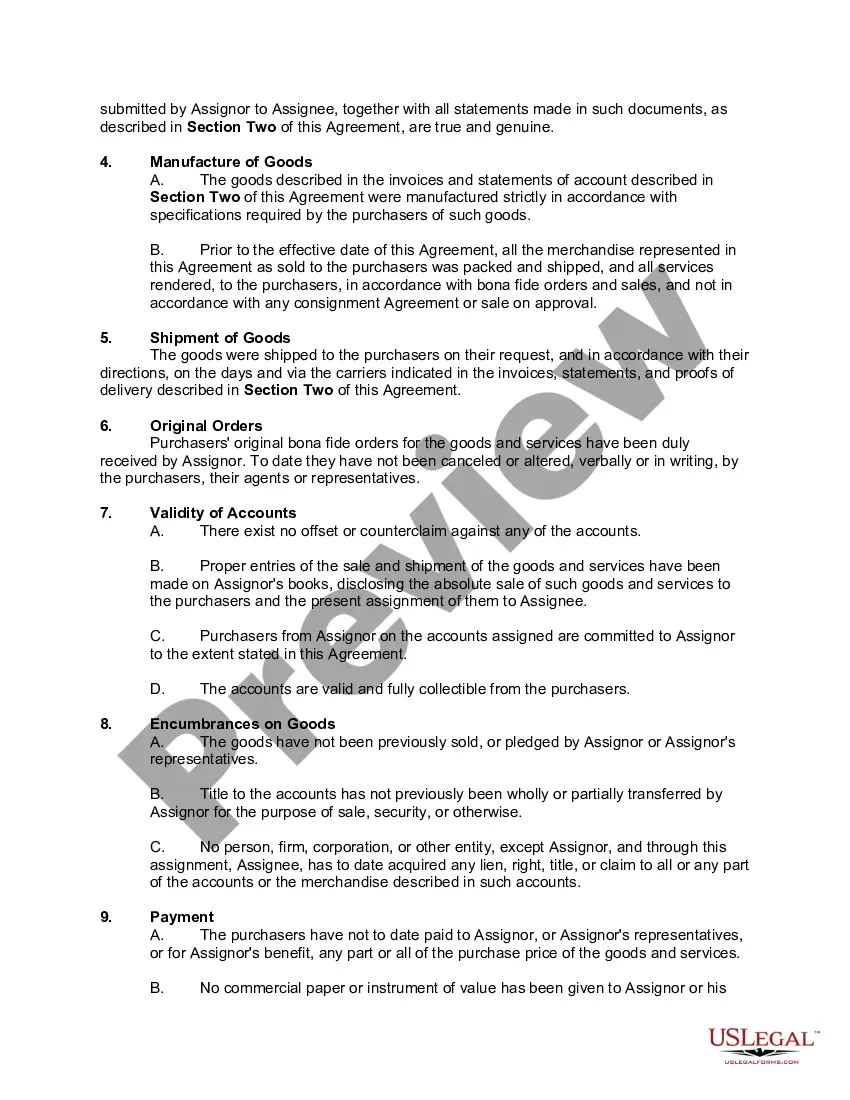

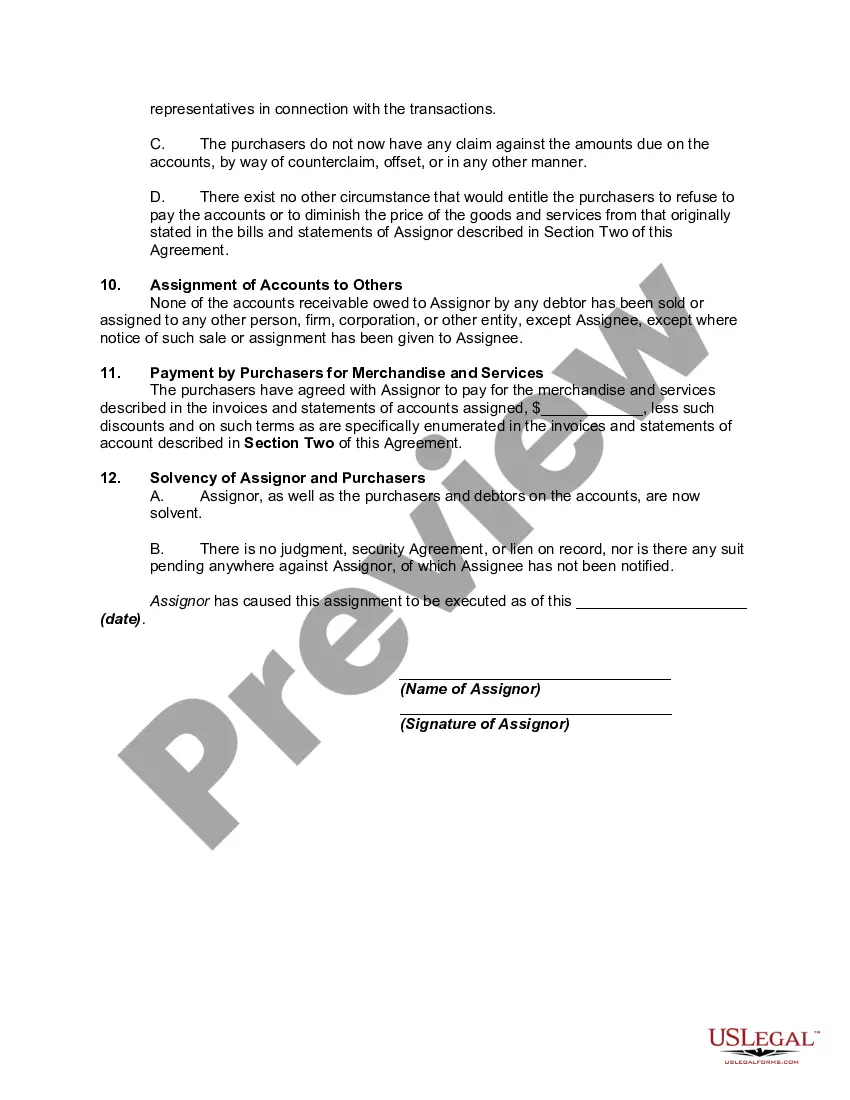

The assignment of receivables typically includes an agreement between the assignor and the assignee, outlining the terms of the transfer. Key elements often include the amount assigned, payment schedule, and conditions under which the assignment is executed. For businesses, understanding the specifics of Texas Assignment of Accounts Receivable is crucial for secure and effective transactions.

Businesses that engage in the assignment of accounts receivable must register with the Texas comptroller to ensure compliance with state laws. This registration establishes legal standing and helps protect the rights of all parties involved. Utilizing the Texas Assignment of Accounts Receivable can simplify this registration process, ensuring proper maintenance of records.

In Texas, the assignment of rights to refund allows an individual or entity to transfer their legal rights to receive a refund, typically from a government agency or vendor. This can be particularly beneficial for businesses seeking to streamline their receivable processes. Understanding Texas Assignment of Accounts Receivable helps businesses optimize how they manage such assignments.

Yes, assignments of benefits are legal in Texas, allowing individuals to transfer their rights to receive benefits under various contracts. This practice is particularly useful in situations involving accounts receivable, making it easier for businesses to manage their claims and collections. Just like any assignment, it is important to document the transaction properly to ensure enforceability.