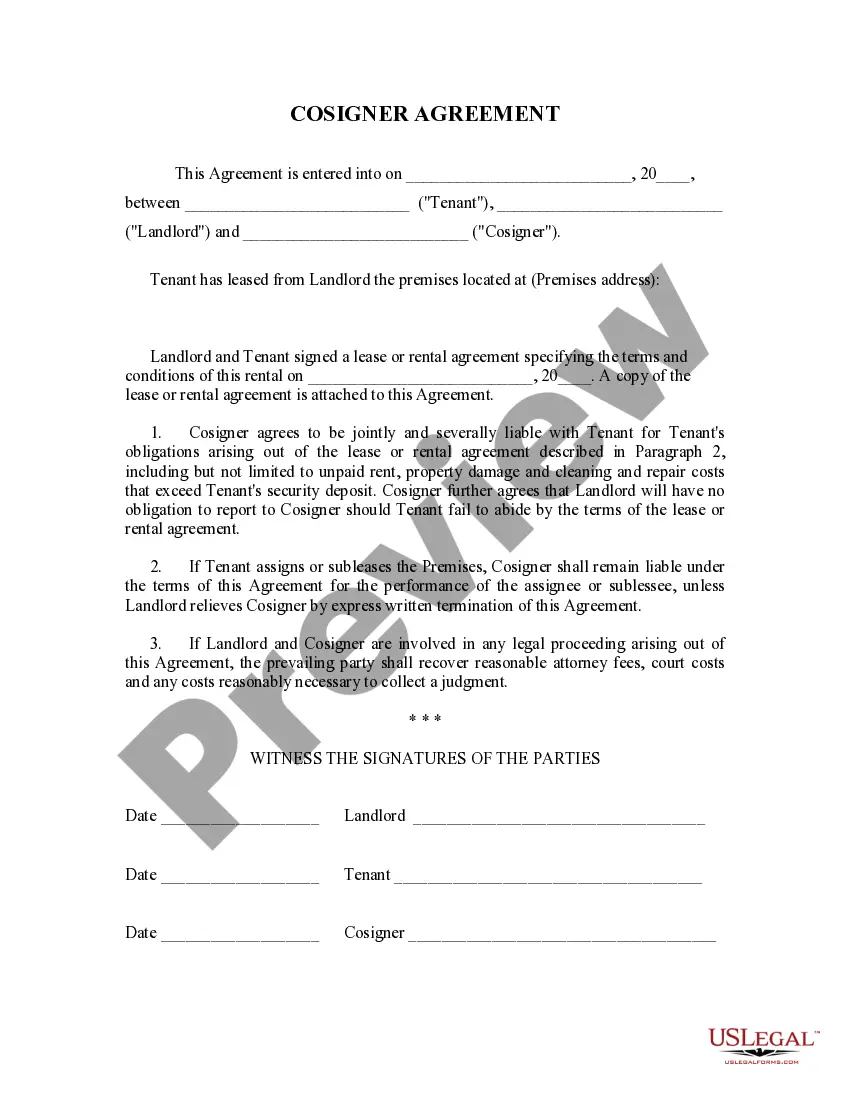

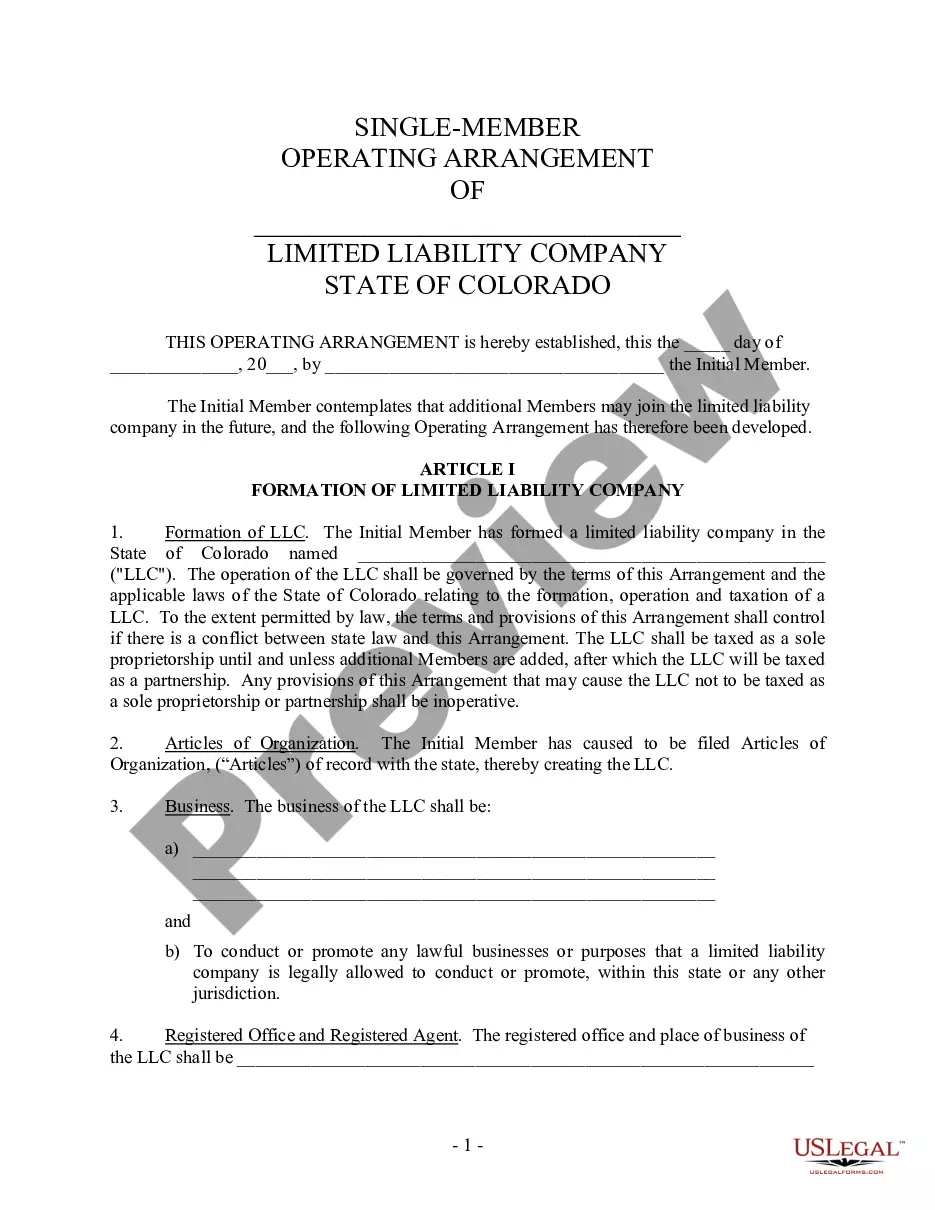

Texas Receipt of Payment for Obligation

Description

How to fill out Receipt Of Payment For Obligation?

US Legal Forms - one of several largest libraries of legitimate varieties in the USA - offers a wide range of legitimate document themes it is possible to obtain or print out. Using the internet site, you can find 1000s of varieties for organization and personal purposes, sorted by classes, suggests, or search phrases.You can get the newest models of varieties much like the Texas Receipt of Payment for Obligation within minutes.

If you already have a subscription, log in and obtain Texas Receipt of Payment for Obligation from your US Legal Forms catalogue. The Obtain option can look on each and every form you perspective. You have access to all earlier saved varieties from the My Forms tab of your respective profile.

If you want to use US Legal Forms the first time, listed here are simple recommendations to help you get started out:

- Be sure you have selected the correct form to your metropolis/county. Select the Preview option to examine the form`s content material. Look at the form description to actually have chosen the right form.

- When the form does not suit your specifications, make use of the Research discipline near the top of the display screen to find the the one that does.

- Should you be content with the shape, affirm your option by visiting the Get now option. Then, opt for the rates plan you want and give your qualifications to register on an profile.

- Process the deal. Utilize your charge card or PayPal profile to finish the deal.

- Pick the format and obtain the shape on the device.

- Make alterations. Load, revise and print out and indicator the saved Texas Receipt of Payment for Obligation.

Each and every template you added to your account lacks an expiration particular date and is yours forever. So, if you wish to obtain or print out yet another copy, just visit the My Forms segment and click on on the form you need.

Get access to the Texas Receipt of Payment for Obligation with US Legal Forms, by far the most substantial catalogue of legitimate document themes. Use 1000s of professional and status-particular themes that satisfy your organization or personal requires and specifications.

Form popularity

FAQ

?Contingent payment clause? means a provision in a contract for construction management, or for the construction of improvements to real property or the furnishing of materials for the construction, that provides that the contingent payor's receipt of payment from another is a condition precedent to the obligation of ...

On private projects in Texas, the property owner must make payment to the prime contractor within 35 days of invoice receipt. Once the prime contractor receives payment from the property owner, they must pay their subs and suppliers within 7 days.

On private projects in Texas, the property owner must make payment to the prime contractor within 35 days of invoice receipt. Once the prime contractor receives payment from the property owner, they must pay their subs and suppliers within 7 days.

Without a contract clause or state statute[i] addressing payment obligations, payment for construction work is due on substantial completion of the work. Under the majority view[viii], a pay-if-paid clause is a condition precedent to payment and a pay-when-paid clause is merely a timing provision.

(a) A merchant must provide a consumer with a complete receipt or copy of a contract pertaining to the consumer transaction at the time of its execution.

Texas Business and Commerce Code Section 56.051 ? Enforcement of Clause Prohibited to Extent Certain Contractual Obligations Not Met.

The purpose of the clause usually is to protect prime contractors from assuming debt. For instance, the phrase might read: ?The Subcontractor shall be paid within ten (10) days after the Prime Contractor receives payment for subcontract work from the Owner.?

Texas allows pay-if-paid clauses, but are enforceable only if certain statutory requirements are fulfilled. The Texas Business and Commerce Code, Chapter 56 statutorily defines and regulates contingent payment clauses.