The Texas Assignment of Domain Name in Conjunction with Asset Purchase Agreement is a legal document that pertains to the transfer of a domain name from one entity to another in the context of an asset purchase. This agreement is specifically relevant to individuals and businesses situated in Texas, as it adheres to the legal framework and regulations of the state. In simple terms, when a company or individual purchases assets from another company, such as intellectual property, equipment, and domain names, this agreement ensures that the assigned domain name is properly transferred to the buyer. This process safeguards the buyer's rights and ownership of the domain name, ensuring that they have complete control and all associated benefits. Different types of Texas Assignment of Domain Name in Conjunction with Asset Purchase Agreement include: 1. Unilateral Assignment: This type of agreement occurs when only one party is transferring the domain name to the other party. In this case, the buyer is the recipient of the domain name, while the seller is the assignor. The agreement outlines the terms and conditions for the transfer, including any warranties or guarantees provided by the seller. 2. Bilateral Assignment: This type of agreement occurs when both parties agree to transfer domain names to each other simultaneously. It is commonly seen in situations where companies are merging or establishing joint ventures. This ensures an equitable exchange of domain names and prevents any disputes or legal complications in the future. 3. Inclusion in Asset Schedule: This refers to a situation where the domain name to be assigned is specifically listed and described in the asset schedule of the Asset Purchase Agreement. This provides clear identification and ensures the domain name's inclusion in the overall transaction, facilitating a seamless transfer. 4. Indemnification and Representations: This type of assignment agreement includes provisions related to indemnification and representations made by the seller. The seller assures the buyer that they have full authority to assign the domain name and that it is not encumbered by any third-party rights or obligations. If any claims arise in the future, the seller agrees to hold the buyer harmless and reimburse any expenses incurred due to such claims. A Texas Assignment of Domain Name in Conjunction with Asset Purchase Agreement is a crucial legal document that ensures the rightful transfer of domain names between parties involved in an asset purchase in Texas. It helps protect the interests of the buyer and guarantees a smooth transition of ownership, avoiding disputes or potential issues related to domain name ownership in the future.

Texas Assignment of Domain Name in Conjunction with Asset Purchase Agreement

Description

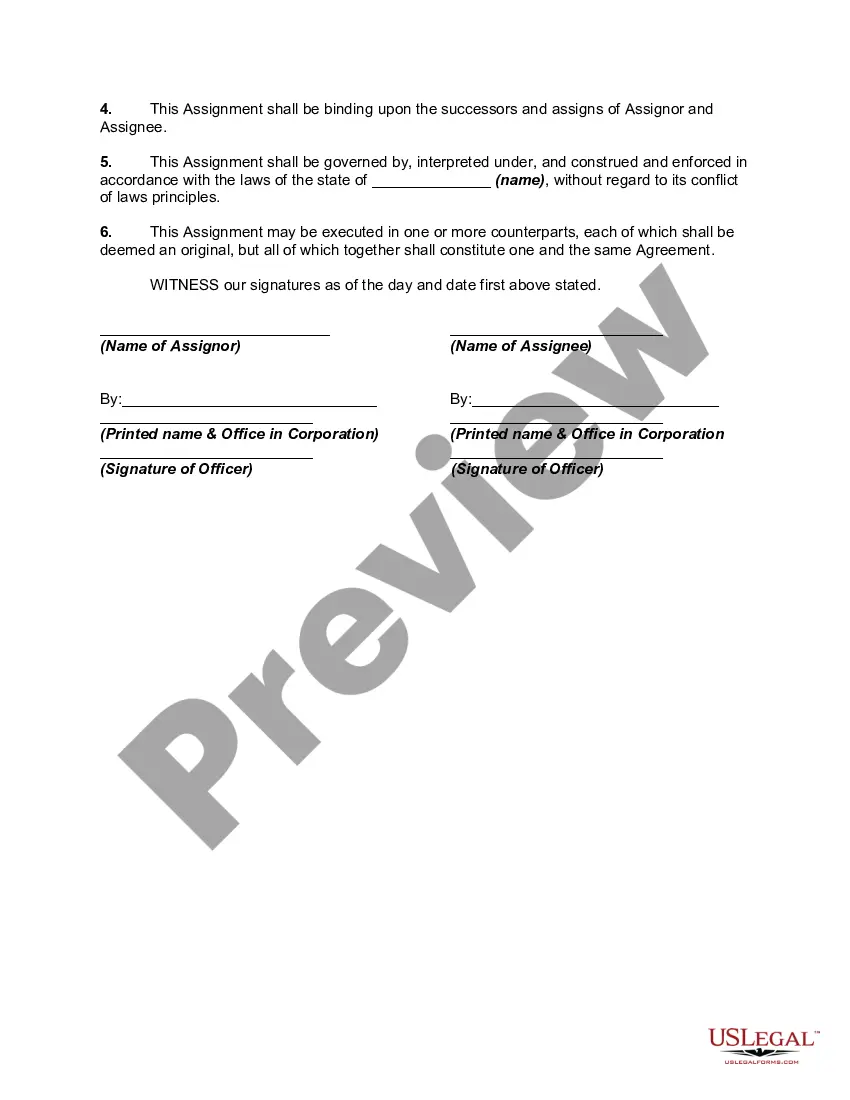

How to fill out Texas Assignment Of Domain Name In Conjunction With Asset Purchase Agreement?

US Legal Forms - among the largest repositories of legal forms in the United States - provides a variety of legal document formats that you can download or print.

By using the site, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the Texas Assignment of Domain Name in Conjunction with Asset Purchase Agreement within minutes.

Check the form's description to confirm that you have selected the right form.

If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you already have an account, Log In to download the Texas Assignment of Domain Name in Conjunction with Asset Purchase Agreement from the US Legal Forms library.

- The Download option will appear on each form you view.

- You can access all previously acquired forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are some straightforward steps to get started.

- Ensure you have chosen the correct form for your city/state.

- Select the Review option to examine the form's content.

Form popularity

FAQ

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

A domain name sale agreement expresses the current owner's desire to sell all rights, interests, and the title of the domain to the purchaser. On the other hand, the purchaser acknowledges the desire to acquire the rights, interests, and the title of the domain from the seller.

Any change in control of Party X resulting from a merger, consolidation, stock transfer or asset sale shall be deemed an assignment or transfer for purposes of this Agreement that requires Party Y's prior written consent.

Voting Rights and OwnershipUnlike an asset purchase, where the buyer simply buys the assets of the company, an equity purchaser actually buys the company itself, which can be beneficial if the company is performing well or has additional value as a going concern.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset purchase transaction, the vendor is the company that owns the assets. The vendor sells some or all of its assets to the purchaser resulting in a transfer of such assets, including those desired contracts to which the company is a party to. Such transfer of the contracts will be done by way of an assignment.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

More info

THE TRANSFER OR TRANSFER INTO THE TRANSFEROR'S PROPERTY of the domain name(s) and all related and neighboring rights relating to such domain names for consideration of 100,000 in cash and a number of shares of the registrar, for a nominal consideration of 0.25 to be paid within 14 days from the date of this Agreement. THE TRANSFER BY THE TRANSFEROR INTO THE TRANSFEROR'S PROPERTY of the domain name(s) and all related and neighboring rights relating to such domain names for consideration of 100,000 in cash and four shares of the registrar, for a nominal consideration of 0.25 to be paid within 14 days from the date of this Agreement. THE TRANSFEROR has responsible to give written notice of such transfer to: The Internet Corporation for Assigned Names and Numbers (“ICANN”), the sole member and agent of the Internet Assigned Numbers Authority, Inc., 25 Liberty Street, 19th Floor, Los Angeles, California 90, whose domain name is .org.