Texas Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

It is feasible to devote time online looking for the legal documents web template that satisfies the federal and state standards you require. US Legal Forms provides a vast array of legal forms that are evaluated by professionals.

You can conveniently obtain or print the Texas Consumer Loan Application - Personal Loan Agreement from the service. If you possess a US Legal Forms account, you can Log In and click the Download button. Subsequently, you can fill out, modify, print, or sign the Texas Consumer Loan Application - Personal Loan Agreement.

Every legal document web template you acquire is yours indefinitely. To retrieve an additional copy of a purchased form, navigate to the My documents section and select the appropriate option. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have chosen the correct document web template for the area/town of your preference. Review the form description to confirm that you have selected the right form. If available, utilize the Review option to examine the document web template as well.

Utilize professional and state-specific templates to address your business or personal needs.

- If you wish to find another version of the form, use the Search area to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make adjustments to the document if necessary. You can fill out, modify, sign, and print the Texas Consumer Loan Application - Personal Loan Agreement.

- Download and print a multitude of document web templates using the US Legal Forms website, which offers the largest collection of legal forms.

Form popularity

FAQ

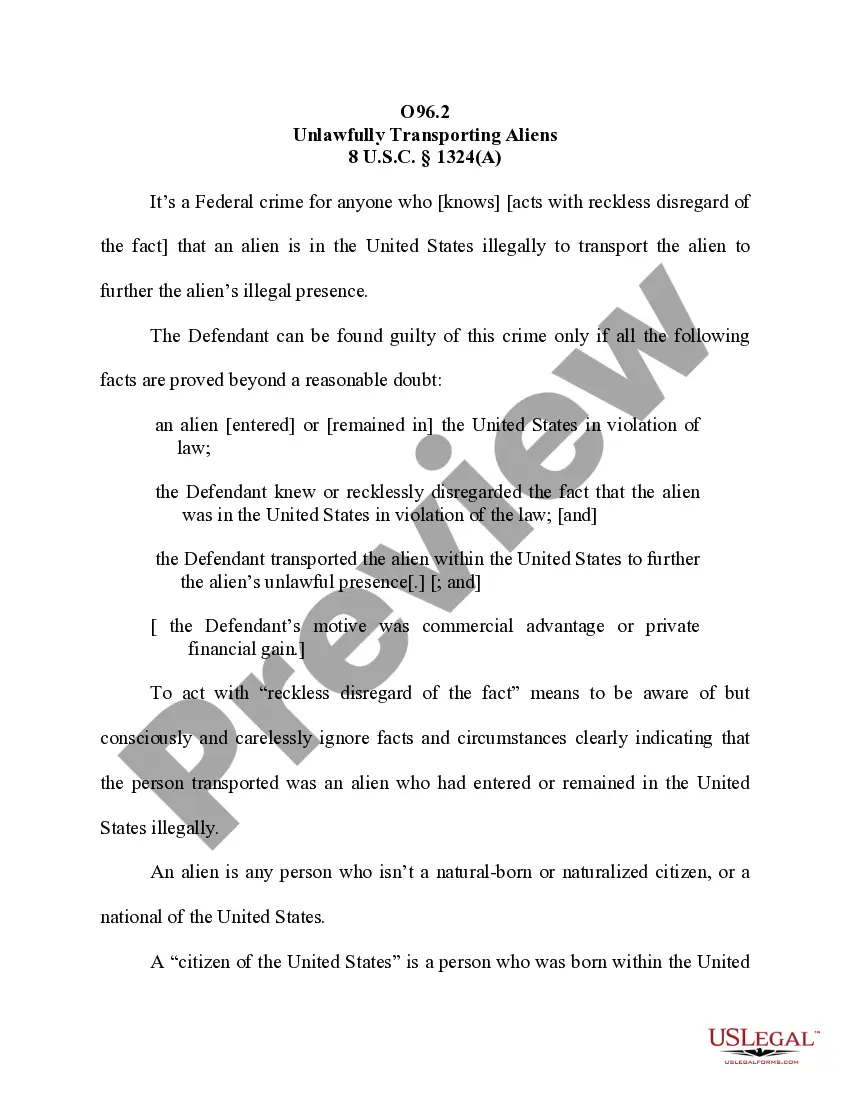

Consumer installment loans, including car loans, student loans, and home mortgage loans, are examples of consumer loans. Other examples of consumer loans include certain revolving credit products, such as consumer credit cards and personal lines of credit.

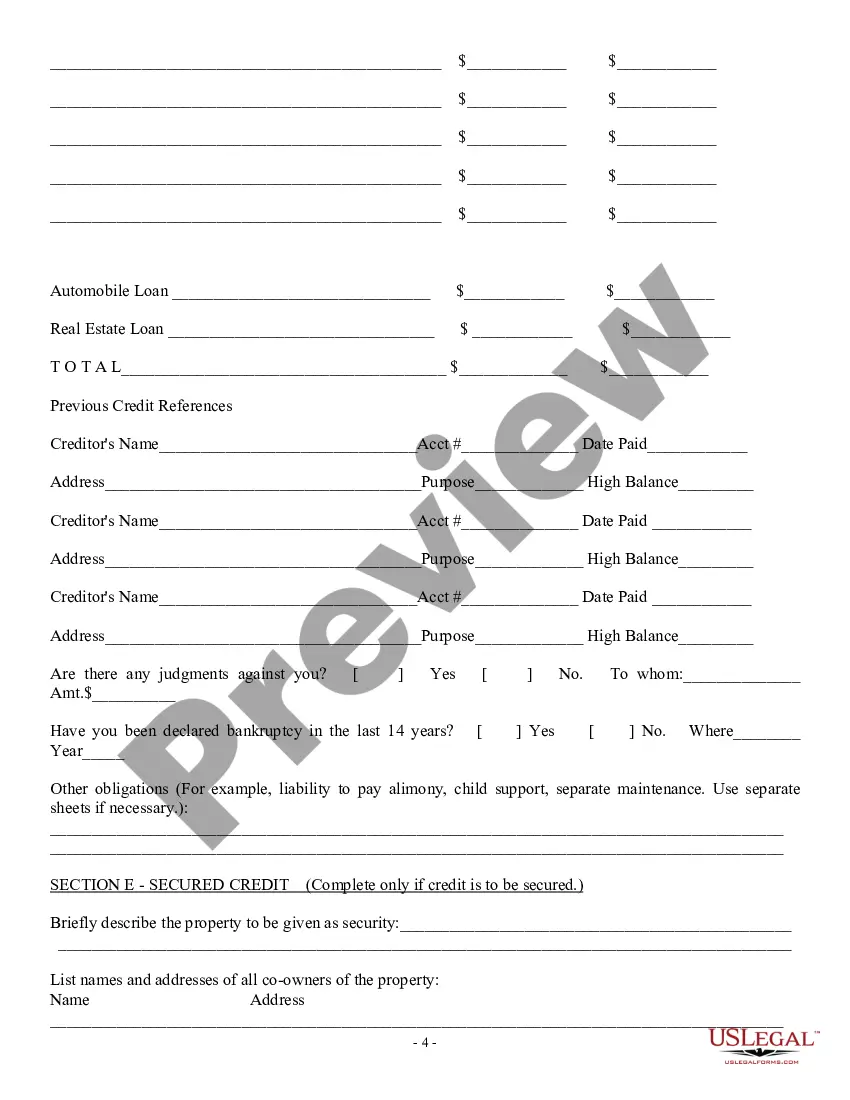

An agreement, promise, or commitment to loan more than $50,000 MUST BE IN WRITING AND SIGNED BY THE LENDER OR IT WILL BE UNENFORCEABLE. The written loan agreement will be the ONLY source of rights and obligations for agreements to lend more than $50,000.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

Consumer loans are structured in one of two key ways: either as a fixed loan that is repaid over a set period of time or as a revolving credit account that you can use at your own discretion. Closed loans are structured with a fixed interest rate, monthly payment amount, and repayment term.

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

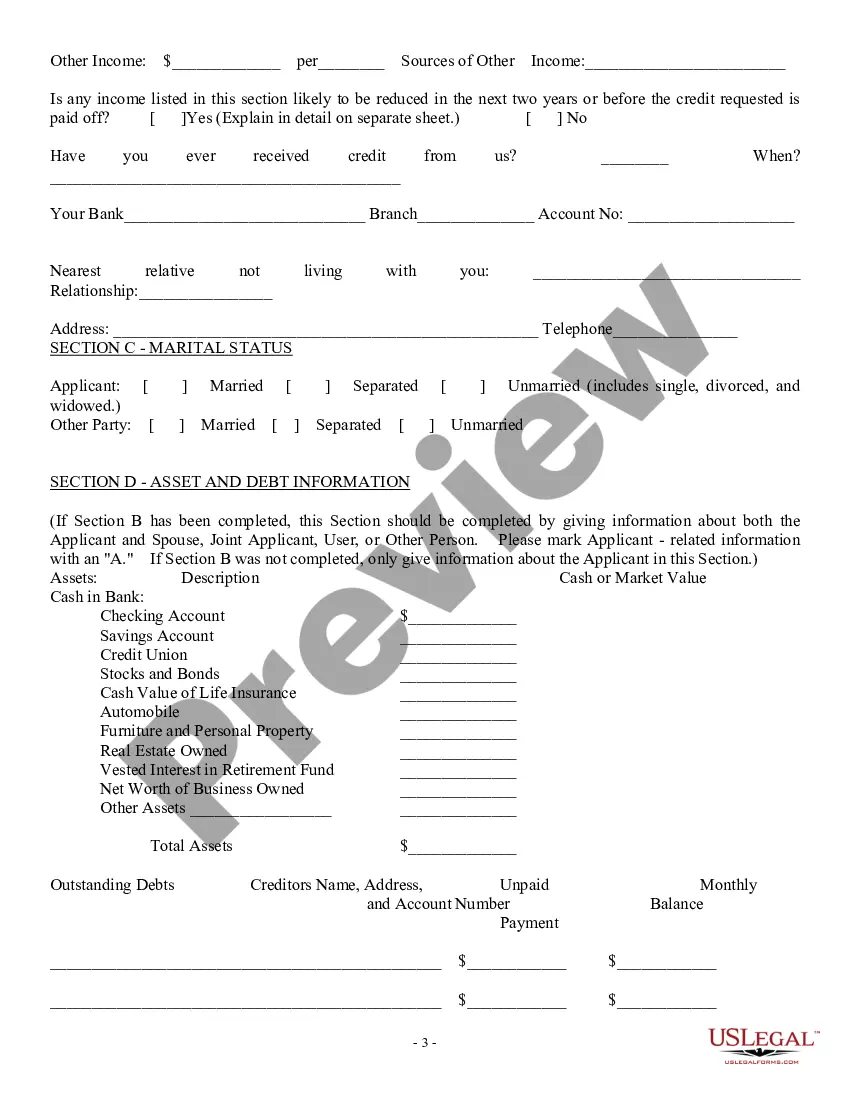

Lenders offer two types of consumer loans ? secured and unsecured ? that are based on the amount of risk both parties are willing to take.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

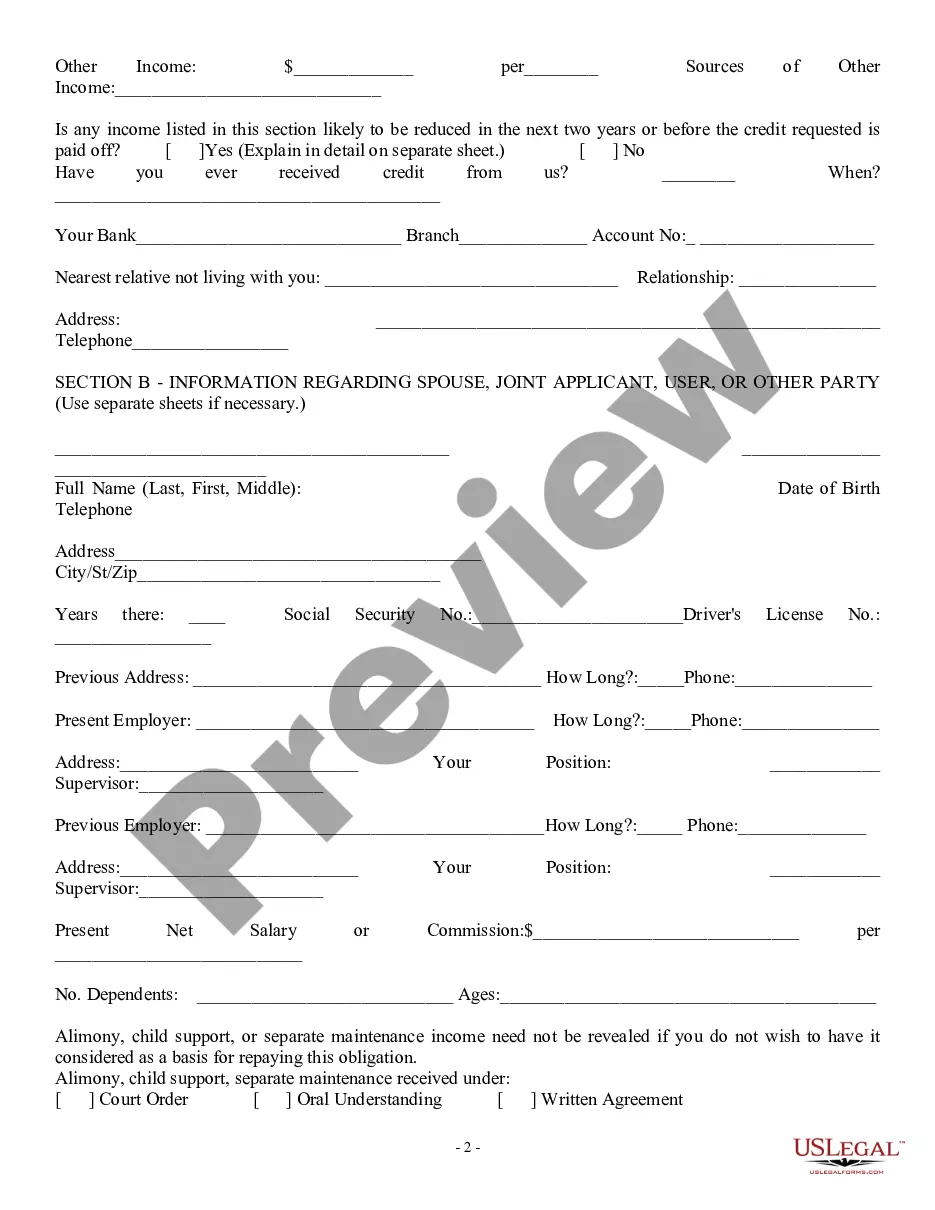

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.