This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

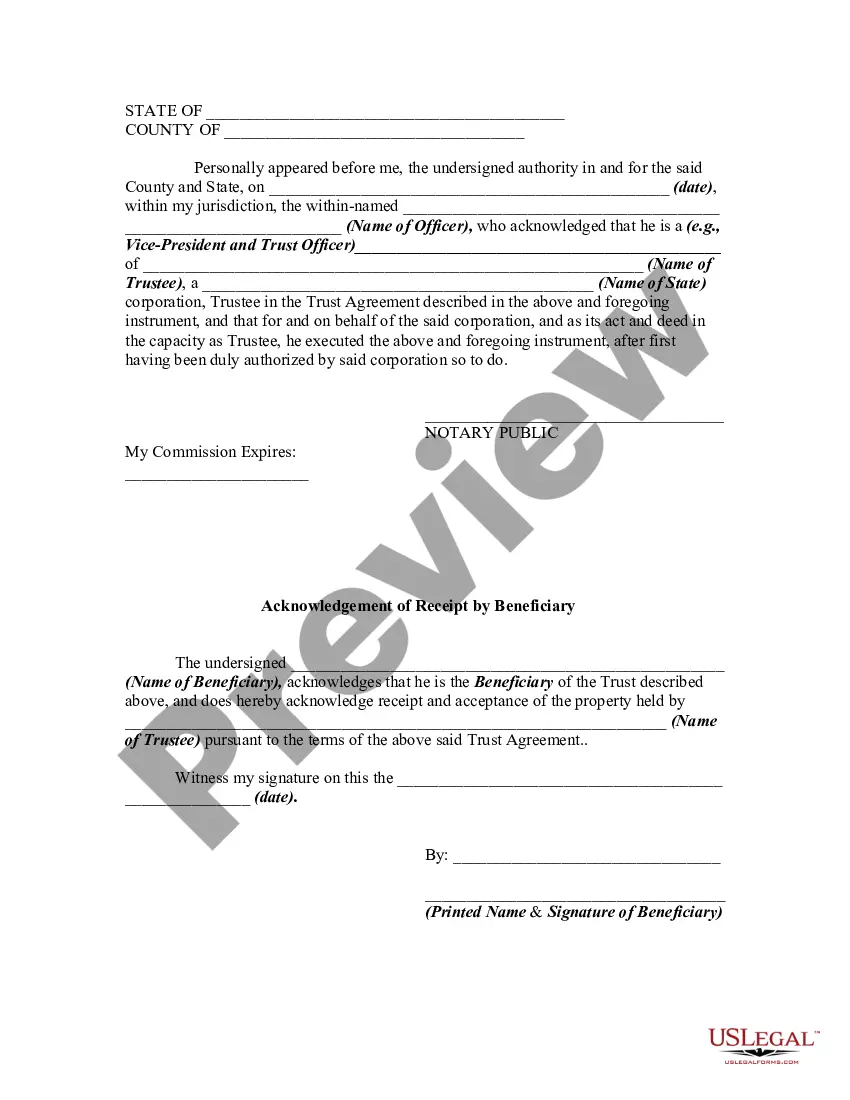

Texas Release by Trustee to Beneficiary is a legal document that signifies the completion of a trust and the transfer of trust assets to the beneficiaries. This crucial document provides protection to trustees and ensures that all beneficiaries receive their respective shares. It confirms the trustee's fulfillment of their duties and the beneficiaries' acceptance of assets received. There are several types of Texas Release by Trustee to Beneficiary, each designed to address various scenarios and requirements. Some notable ones include: 1. General Release: This type of release is commonly used when the trust has successfully reached its objectives, and the trustee has distributed all assets to the beneficiaries according to the trust's terms. It releases the trustee from further liability and confirms the beneficiary's receipt of assets. 2. Partial Release: In situations when the trust has multiple stages or distribution periods, a partial release may be necessary. This allows the trustee to release a portion of the trust assets to beneficiaries, while retaining the remaining assets for future distributions. 3. Conditional Release: A conditional release is utilized when specific conditions must be met before assets can be disbursed to the beneficiaries. For instance, the trust instrument may specify that the beneficiary should attain a particular age or reach a certain milestone before receiving their share. 4. Release with Reservations: In some cases, the trustee may release assets to beneficiaries but with certain reservations. For instance, the trustee could impose limitations on how the assets can be used or request the beneficiaries to sign additional agreements before receiving their share. Regardless of the type, a Texas Release by Trustee to Beneficiary contains certain essential elements. These typically include: a. Detailed identification of both the trustee and beneficiary, including their full legal names and addresses. b. Reference to the trust agreement or document governing the distribution of assets. c. Clear description of the trust property being distributed. d. Statement confirming that the trustee has fulfilled their obligations under the trust. e. Acknowledgment by the beneficiary of having received the designated trust assets. f. Explicit release of the trustee from any further claims, demands, or liability regarding the distribution. g. Notarization and signatures of the trustee, beneficiaries, and witnesses. A Texas Receipt from Beneficiary could be considered as an accompanying document to the Release by Trustee. It serves as a confirmation of the beneficiary's receipt of assets from the trust, acknowledging that they have received their rightful share. The key purpose of the receipt is to avoid any future disputes or claims by the beneficiary against the trustee. In conclusion, a Texas Release by Trustee to Beneficiary is a crucial legal document that finalizes the trust and ensures the orderly transfer of assets. Its various types cater to different trust scenarios, ensuring a smooth distribution process. When accompanied by a Receipt from Beneficiary, both documents provide a comprehensive record and protection for all parties involved.