Forfeiture occurs when a person is in breach of a legal obligation, and the breach causes something to be lost or surrendered as a result of the breach. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

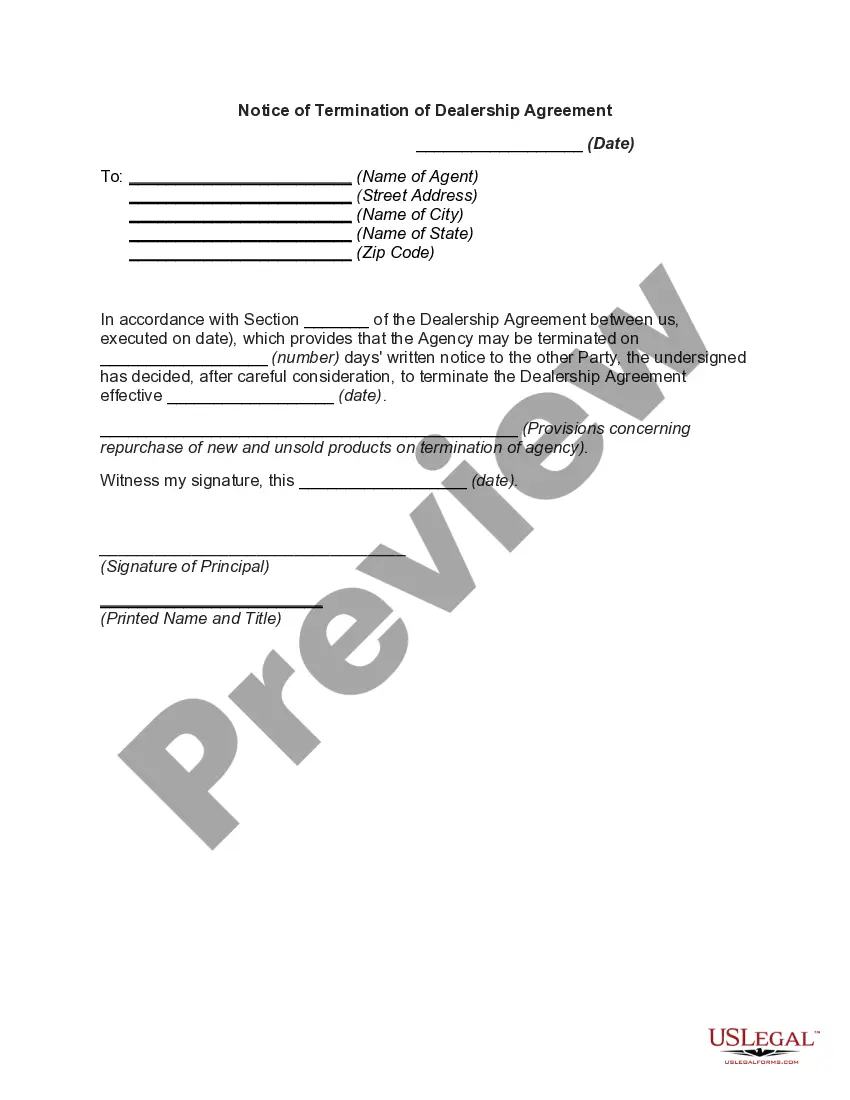

Texas Notice of Declaration of Forfeiture of Agreement

Description

How to fill out Notice Of Declaration Of Forfeiture Of Agreement?

Selecting the ideal legal document template can be a challenge.

Clearly, there is a multitude of templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Texas Notice of Declaration of Forfeiture of Agreement, which can be utilized for business and personal purposes.

You can browse the form using the Preview button and read the form description to confirm it's the right one for you.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and then click the Download button to obtain the Texas Notice of Declaration of Forfeiture of Agreement.

- Use your account to explore the legal forms you have previously acquired.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, make sure you have chosen the correct form for your region.

Form popularity

FAQ

When an LLC is forfeited in Texas, it loses its legal status and cannot conduct business until it is reinstated. This forfeiture often stems from failing to comply with state regulations or not paying franchise taxes. Additionally, the Texas Notice of Declaration of Forfeiture of Agreement serves as a formal notification of this status change. If you need help navigating this process, USLegalForms offers resources to assist in understanding your obligations and options.

A notice of intent to forfeit right in Texas alerts a business that it may lose its legal right to operate if it does not resolve compliance issues promptly. This notice is a proactive measure that highlights the need for immediate attention to business obligations. Responding effectively can prevent the issuance of a Texas Notice of Declaration of Forfeiture of Agreement, protecting your business's operations.

To reinstate a forfeited existence in Texas, you must first identify the reasons for the forfeiture. This often involves correcting any issues such as outstanding fees, reports, or documents. Platforms like US Legal Forms provide a streamlined process to help you navigate the requirements, ensuring adherence to the Texas Notice of Declaration of Forfeiture of Agreement.

A notice of intent to forfeit the right to transact in Texas is a formal warning issued to businesses that are not in compliance with state regulations. This notice serves as a crucial reminder that action is needed to maintain good standing. If ignored, it may lead to the issuance of a Texas Notice of Declaration of Forfeiture of Agreement, which can halt business operations.

Forfeiture of a company in Texas means that the business has not met specific legal obligations, leading to the loss of its right to conduct business. This can occur due to various reasons, such as missed filings or unpaid fees. The Texas Notice of Declaration of Forfeiture of Agreement is typically issued to inform the company of this status, highlighting the need for timely compliance to avoid complications.

To reinstate the right to transact business in Texas, a company must address any issues that led to the forfeiture. This involves filing the necessary documents with the Texas Secretary of State and paying any outstanding fees or taxes. Utilizing the resources available on platforms such as US Legal Forms can guide you through this process, ensuring compliance with the Texas Notice of Declaration of Forfeiture of Agreement.

When a bond is forfeited in Texas, it typically means that the party responsible has failed to meet the obligations set by the bond agreement. This forfeiture can lead to financial penalties and the potential loss of business rights. The Texas Notice of Declaration of Forfeiture of Agreement serves as a formal notification regarding this issue and emphasizes the importance of being compliant with Texas laws.

In Texas, the 'right to transact business' refers to a company's legal ability to operate and conduct its activities within the state. This right is crucial for maintaining good standing and compliance with state regulations. When a business loses this right, it can face penalties, which may include a Texas Notice of Declaration of Forfeiture of Agreement. It's essential to stay informed about your business's status to avoid disruptions.

A Texas notice of intent to forfeit is a formal document notifying a party that their agreement is at risk of cancellation. This notice outlines the specific reasons for the potential forfeiture and sets a timeframe within which the party can rectify the issue. Understanding this notice is crucial, as it directly relates to the Texas Notice of Declaration of Forfeiture of Agreement. By addressing the concerns stated in the notice, parties can often avoid further legal actions.

Yes, if your Texas business is closing, you must file a final Texas franchise tax return. This ensures that all applicable taxes are settled before the formal dissolution of the entity. Neglecting to file can lead to complications, such as receiving a Texas Notice of Declaration of Forfeiture of Agreement, which can impact your business's status.