Texas Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

If you intend to compile, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents available online.

Employ the site`s simple and efficient search to locate the forms you need.

A multitude of templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have located the form you need, click the Acquire now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Process the payment. You may utilize your credit card or PayPal account to complete the purchase.Step 6. Choose the format of the legal document and download it to your device.Step 7. Complete, edit, and print or sign the Texas Agreement for Purchase of Business Assets from a Corporation.

- Utilize US Legal Forms to find the Texas Agreement for Purchase of Business Assets from a Corporation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire option to locate the Texas Agreement for Purchase of Business Assets from a Corporation.

- You can also retrieve documents you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the description.

- Step 3. If you are unsatisfied with the type, utilize the Search box at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

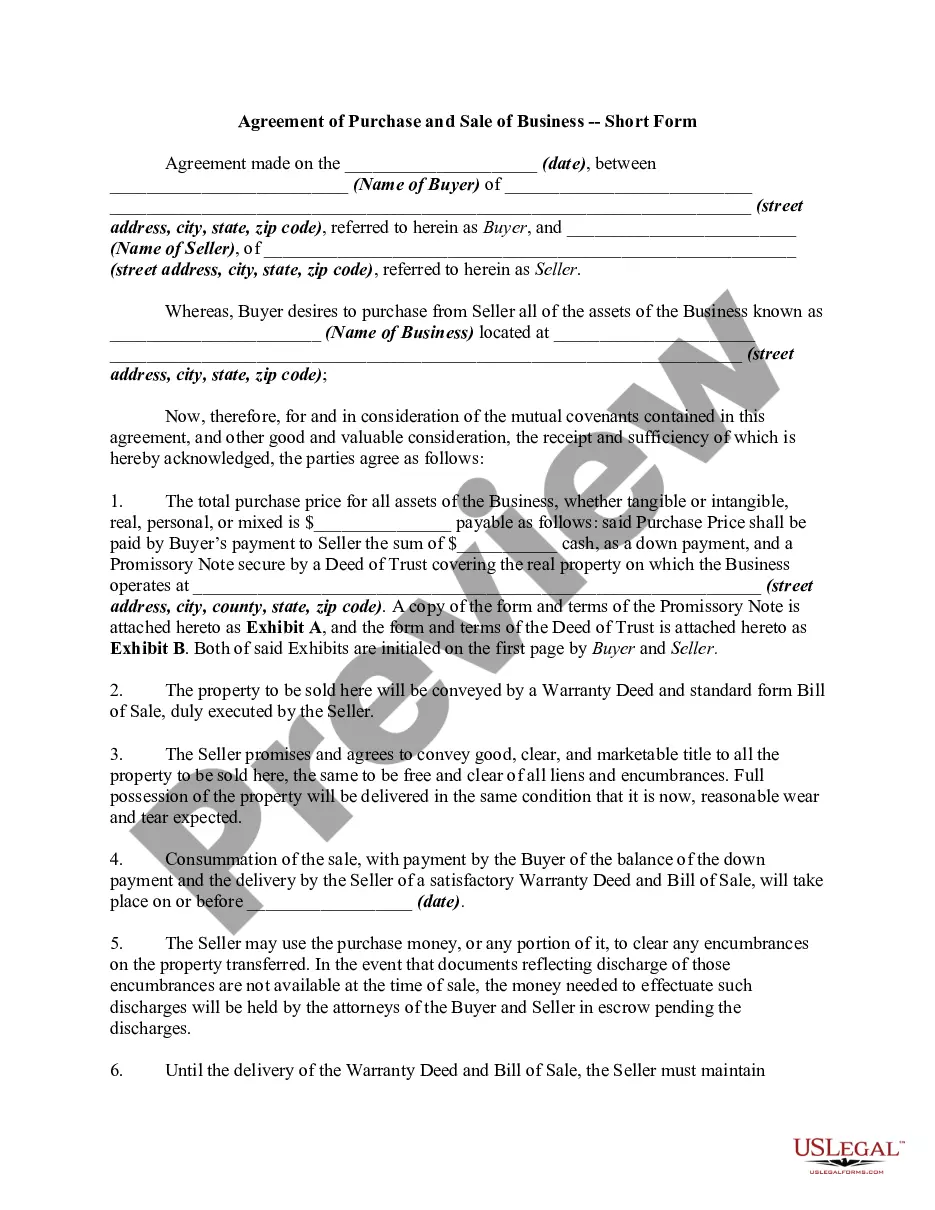

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

A business usually has many assets. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade. The gain or loss on each asset is figured separately.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

Your company will also still exist after an asset sale, and administratively you will still need to take steps to dissolve the company and deal with any remaining liabilities and assets. Unlike a stock sale, 100% of the interests of a company can usually be transferred without the consent of all of the stockholders.