Texas Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

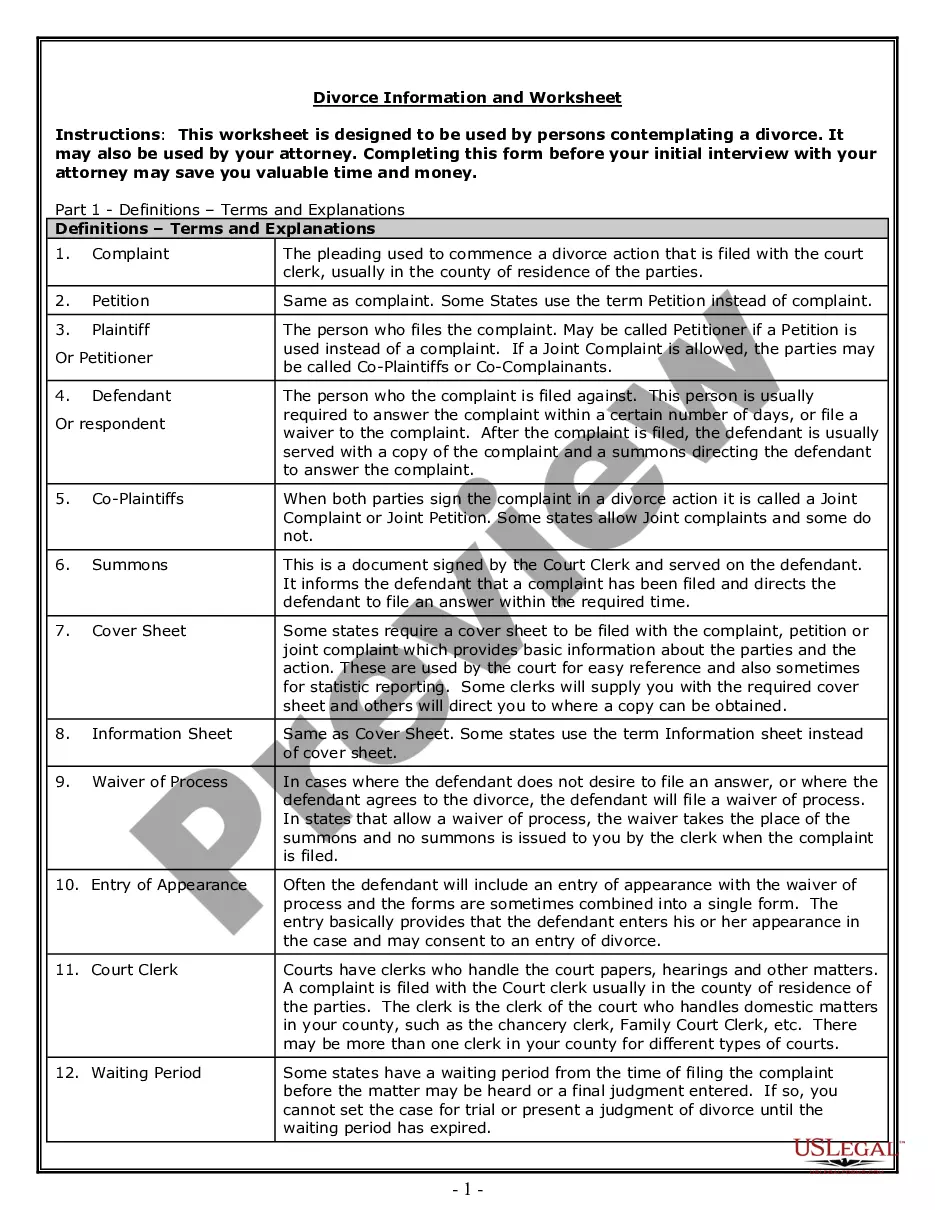

How to fill out Terminate S Corporation Status - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a selection of legal document templates you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the Texas Terminate S Corporation Status - Resolution Form - Corporate Resolutions in moments.

If you already have an account, Log In and download the Texas Terminate S Corporation Status - Resolution Form - Corporate Resolutions from the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the purchase using your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Then, Make modifications: fill out, edit, print, and sign the downloaded Texas Terminate S Corporation Status - Resolution Form - Corporate Resolutions. Every template you add to your account has no expiration date and belongs to you permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Texas Terminate S Corporation Status - Resolution Form - Corporate Resolutions with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the form's details.

- Check the form information to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

The entity must:Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.

Typically, your shareholders will have to vote to dissolve the S-Corp. The decision to dissolve the business has to be a majority vote. Some states only require a simple majority, while others call for a supermajority or something else, like a two-thirds majority.

Such processes can be laid out in a corporate resolution form, usually known as the operating agreement. The agreement can also specify whether or not the decision-making is to be agreed upon by all members or a majority of members.

To dissolve a corporation in Texas, you need to file a Certificate of Termination with the Texas Secretary of State. The Certificate of Termination must be accompanied by a Certificate of Account Status for Dissolution/Termination, which is issued by the Texas Comptroller of Public Accounts (CPA).

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Corporation Filing Requirements (Includes S Corporations) You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

To dissolve a corporation in Texas, you need to file a Certificate of Termination with the Texas Secretary of State. The Certificate of Termination must be accompanied by a Certificate of Account Status for Dissolution/Termination, which is issued by the Texas Comptroller of Public Accounts (CPA).

For an S corporation you must:File Form 1120-S, U.S. Income Tax Return for an S Corporation for the year you close the business.Report capital gains and losses on Schedule D (Form 1120-S).Check the "final return" box on Schedule K-1, Shareholder's Share of Income, Deductions, Credits, Etc.14-Mar-2022