Texas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

If you have to comprehensive, down load, or produce lawful file templates, use US Legal Forms, the largest selection of lawful forms, that can be found on the Internet. Use the site`s basic and hassle-free lookup to find the paperwork you will need. A variety of templates for enterprise and person functions are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to find the Texas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) in just a couple of clicks.

When you are previously a US Legal Forms client, log in in your account and then click the Download switch to have the Texas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). You can even access forms you in the past delivered electronically in the My Forms tab of your respective account.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for the appropriate town/region.

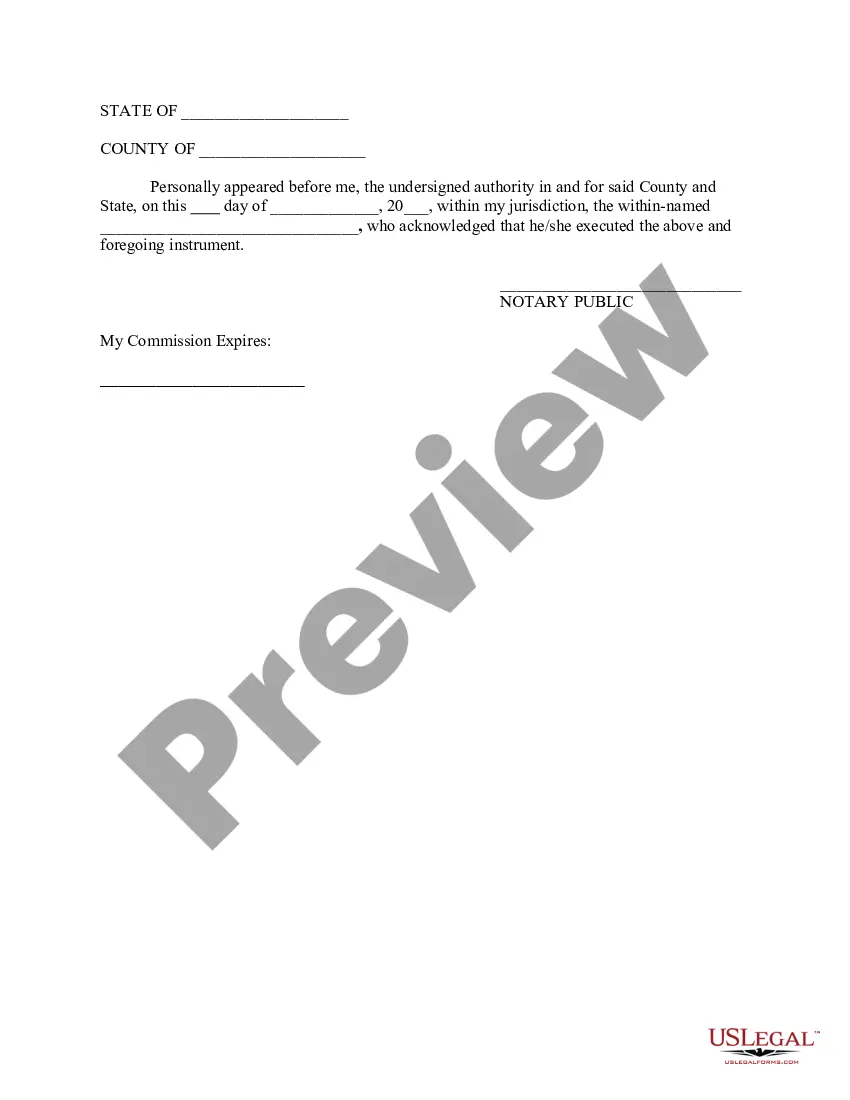

- Step 2. Use the Preview solution to look over the form`s information. Do not forget to read through the explanation.

- Step 3. When you are not happy together with the form, utilize the Research industry near the top of the monitor to discover other variations of your lawful form format.

- Step 4. Once you have found the shape you will need, click on the Acquire now switch. Pick the costs prepare you like and add your references to register to have an account.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Pick the structure of your lawful form and down load it on the product.

- Step 7. Total, modify and produce or indicator the Texas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

Every single lawful file format you get is the one you have for a long time. You possess acces to each form you delivered electronically in your acccount. Click the My Forms section and choose a form to produce or down load again.

Remain competitive and down load, and produce the Texas Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) with US Legal Forms. There are many specialist and condition-particular forms you can use for your enterprise or person requires.

Form popularity

FAQ

In addition to completing Form 130-U, Application for Texas Title and/or Registration (PDF), both the donor and person receiving the motor vehicle must complete a required joint notarized Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and ...

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2022 is $16,000 per year per recipient, increasing to $17,000 in 2023.

Although the Texas Affidavit of Heirship for Motor Vehicles allows you to pass your vehicle to your legal heirs without probate, it's sometimes impractical because your legal heirs, those who are entitled to inherit from you under the state's intestacy statutes, may not be the one who you wish to inherit your vehicle.

The title ?transfer? process can be solely performed by the buyer at the TX DMV if the vehicle title was properly signed over to them by the seller. The seller does not need to accompany the buyer to the TX DMV if it is.

If there isn't a will or if there is a will, but there isn't a need to go through the time and expense of probating the will, then the heirs or heirs of the person who died can get the title transferred by using Form 130-U along with Form VTR-262 ?Affidavit of Heirship for a Motor Vehicle?.

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

To title and register a vehicle through heirship, you will need: Affidavit(s) of Heirship (Form VTR-262). If there is more than one heir, each of you must sign the form and have the signatures notarized. Heirs may fill out individual Affidavits of Heirship and must have each affidavit notarized.

Fees one can expect to pay when buying a car in Texas are as follows: Sales Tax: 6.25% of the total vehicle purchase price. Title Transfer Fee: $28 to $33 (varies by county)