Texas Release of Oil and Gas Lease

Definition and meaning

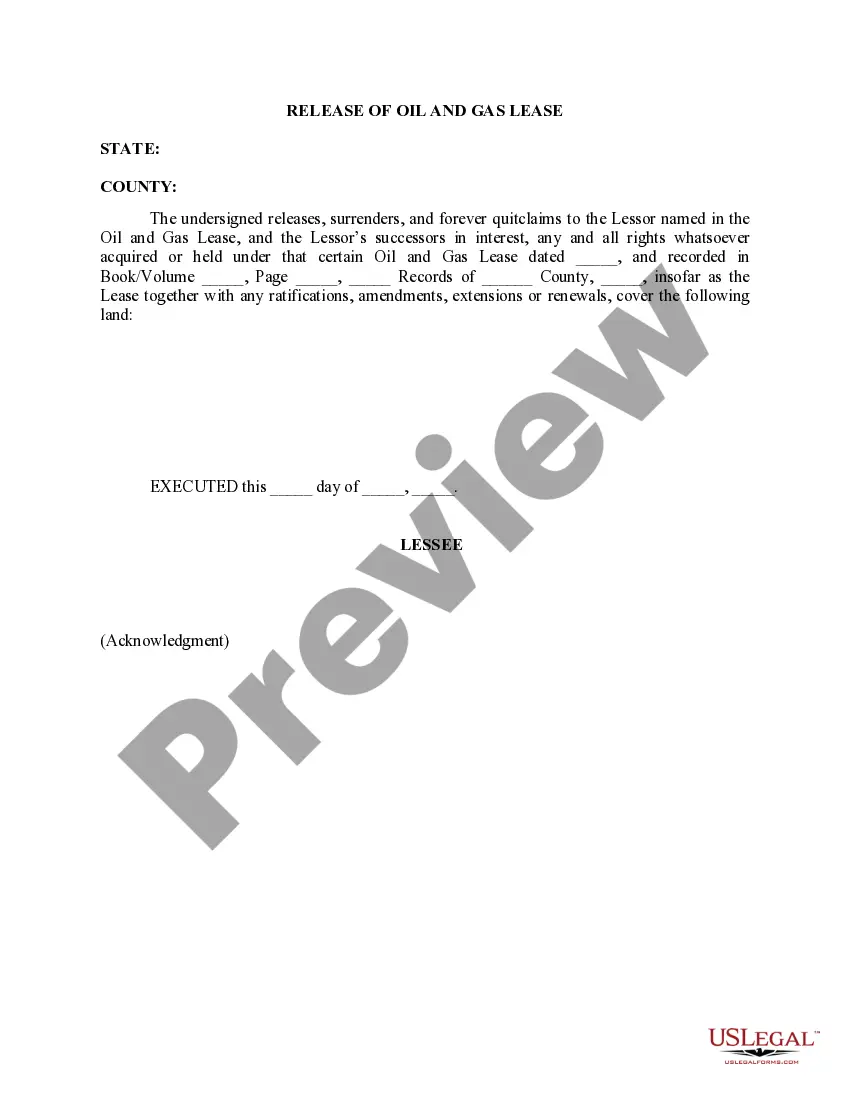

The Texas Release of Oil and Gas Lease is a legal document used to formally relinquish or terminate the rights associated with an oil and gas lease. When a lessee wishes to end their obligations under a lease agreement, this form serves to release them from any claims or liabilities that were established when the lease was signed. This is essential for both the lessor and lessee, as it clarifies the status of the lease and ensures that future transactions or agreements can occur without confusion.

Who should use this form

This form is typically used by those who have entered into an oil and gas lease in Texas and wish to terminate it. Key parties include:

- Lessee: The individual or entity that holds the lease and wishes to release it.

- Lessor: The landowner or entity that granted the lease rights.

- Successors in interest: Any legal successors who may also be impacted by the release.

It is crucial for anyone involved in oil and gas leasing to understand when and how to utilize this form accurately.

How to complete a form

Completing the Texas Release of Oil and Gas Lease requires careful attention to detail. Follow these steps:

- Begin by filling in the state and county where the lease was executed.

- Specify the date of the original oil and gas lease along with its recording details, such as Book/Volume and Page.

- Clearly describe the land covered by the lease, ensuring all relevant details are included.

- Provide the date of execution for the release form.

- Sign the form as the lessee, and consider adding an acknowledgment section if required by local law.

Make sure to review all entries for accuracy before submission.

Key components of the form

Understanding the essential elements of the Texas Release of Oil and Gas Lease is vital for effective use. Key components include:

- Lessee Information: The details of the individual or entity releasing the lease.

- Lessor Information: The landowner's details or the entity that granted the lease.

- Lease Details: Original lease date, recording book, and page number.

- Description of Land: A precise description of the land associated with the lease.

- Execution Date: The date when the release is signed.

Each component plays a crucial role in ensuring the validity and accuracy of the legal release.

Benefits of using this form online

Utilizing online resources for the Texas Release of Oil and Gas Lease provides several advantages:

- Accessibility: Users can access templates from anywhere, at any time.

- Convenience: Filling out and printing forms online can save time and reduce errors.

- Guidance: Online platforms often provide step-by-step instructions, ensuring users understand the process.

- Legal Assurance: Many online forms are prepared by licensed attorneys, offering peace of mind regarding compliance with state laws.

Using this form online enhances user experience and ensures a smoother completion process.

Common mistakes to avoid when using this form

When completing the Texas Release of Oil and Gas Lease, users should be aware of common errors that can lead to complications:

- Incomplete Information: Ensure all required fields are filled out accurately.

- Incorrect Dates: Double-check that all dates, especially the lease date and execution date, are correct.

- Missing Signatures: The lessee must sign the document for it to be effective.

- Notarization: Confirm if notarization is required for your specific case; omitting it can invalidate the release.

Avoiding these mistakes contributes to a smoother legal process and ensures clarity in lease termination.

Form popularity

FAQ

: a deed by which a landowner authorizes exploration for and production of oil and gas on his land usually in consideration of a royalty.

A lease may provide for the payment of "delay rental" during the primary term.If a lease is a "paid-up" lease, then the lease will remain in effect during the entire primary term with no further payments to the Lessor unless and until actual production of oil or gas is established.

The leases issued by BLM have a primary term of ten years. This is the period of time during which the lessee may explore for oil and gas deposits and attempt to bring them into production.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

An oil lease is essentially an agreement between parties to allow a Lessee (the oil and gas company and their production crew) to have access to the property and minerals (oil and gas) on the property of the Lessor. The lease agreement is a legal contract of terms.It establishes the primary term of the lease.

A Pugh Clause is meant to prevent a lessee from declaring all lands under an oil and gas lease as being held by production, even if production only occurs on a fraction of the property.

Calculating net revenue interest formula To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.