Texas Certification About a Financial Management Course

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Certification About A Financial Management Course?

If you’re searching for a way to appropriately complete the Texas Certification About a Financial Management Course without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of documentation you find on our web service is drafted in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Texas Certification About a Financial Management Course:

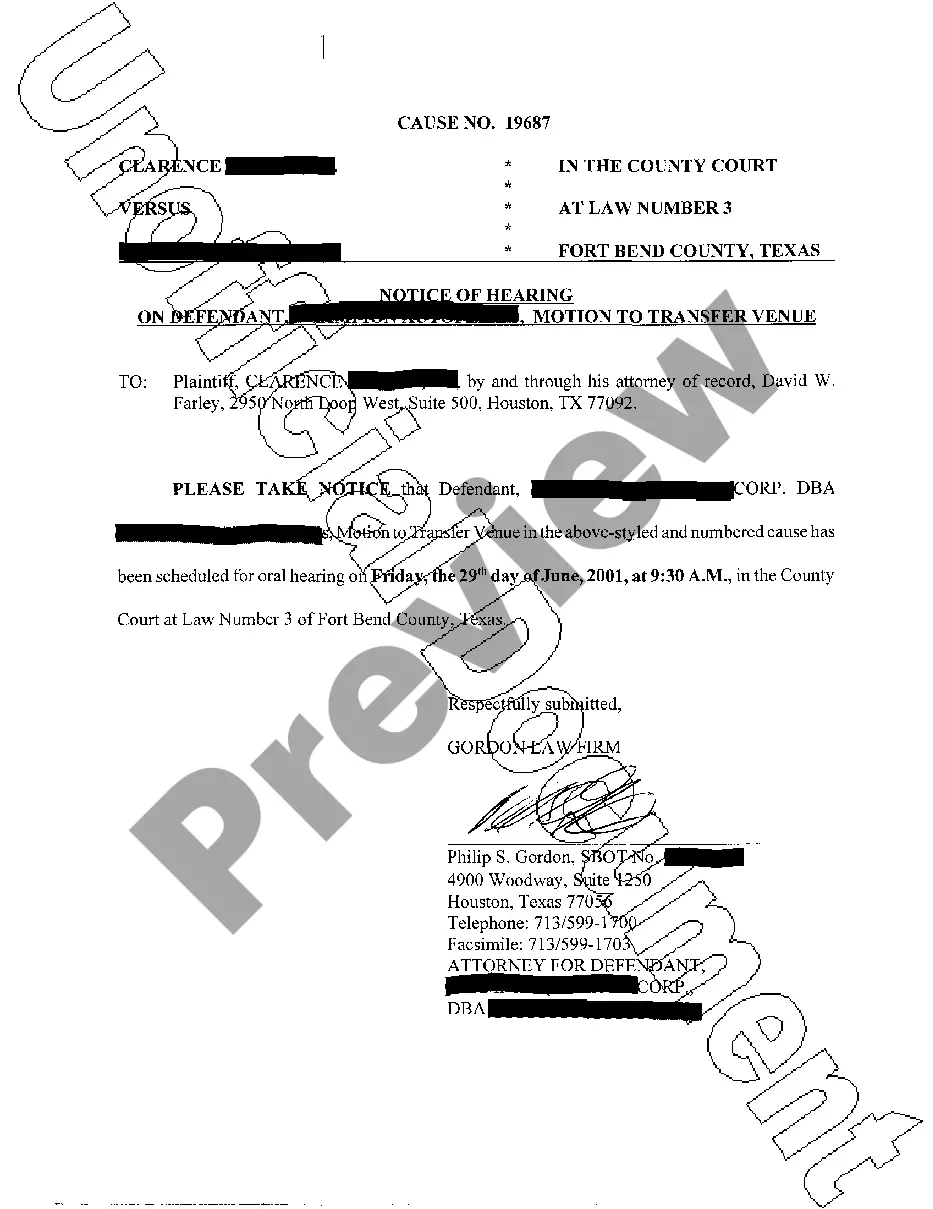

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Texas Certification About a Financial Management Course and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Which Finance Certifications Course Is The Best? Chartered Financial Analyst (CFA) certification. Certified Public Accountant (CPA) certification. Financial Modeling & Valuation Analyst (FMVA) certification. Chartered Alternative Investment Analyst (CAIA) designation. Certified Financial Planner (CFP) designation.

In the U.S., CFA charterholders vary in the range of $56,500 and $120,500 per annum, with an average salary of $95,494. On the other hand, the salary of CFPs varies in the range of $62,500 and $94,500 per annum, with an average salary of $83,123.

Choose Your Path to Certification Earn 4-Year Degree. A bachelor's degree in any discipline is required.Complete CFP® certification coursework.Pass CFP® Exam.Accumulate experience.Meet Ethics Requirement.Earn CFP® Certification.

While there is some overlap between the two credentials, they have different focus areas. A CFP® professional focuses on helping individuals with their personal investments, whereas a CFA charter holder generally specializes in selecting investments for institutional investors.

Financial certifications are signifiers of expertise in a certain aspect of the financial industry. Advisors seeking a certification typically need to complete hours of coursework and then pass an exam. They also need to abide by professional ethics standards in most cases.

If you are someone more inclined towards personal financial planning and helping individuals and families achieve their financial goals, CFP might be the one for you. The CFA designation is held in high regard in the finance industry and can lead to a variety of job opportunities and career paths.

Overall, the CFP program is shorter and less rigorous than the CFA program. If you think this could be the program for you, you can learn more about CFP certification requirements here.

If you intend to build a career in the financial domain of accounting, then CPA is a better credential for you. On the other hand, if you are interested in portfolio management or corporate finance, CFA suits you better.