The Tennessee State of Delaware Limited Partnership Tax Notice is an important document that outlines the tax obligations and requirements for limited partnerships formed in the state of Delaware, but doing business or having investments in Tennessee. This notice serves as a notification to limited partners and partnership representatives about their obligations to file tax returns, pay taxes, and meet other associated requirements. Limited partnerships are a popular business structure that offers some unique benefits, combining the liability protection of a corporation with the flexibility and tax advantages of a partnership. However, these partnerships are subject to specific tax laws and regulations, which can vary from state to state. In the case of limited partnerships formed in Delaware but conducting activities in Tennessee, the Tennessee State of Delaware Limited Partnership Tax Notice serves as a comprehensive guide to understanding and complying with the state-specific tax obligations. This notice is released by the Tennessee Department of Revenue to inform limited partners about their obligations under the Tennessee tax code. Key aspects covered in the Tennessee State of Delaware Limited Partnership Tax Notice include: 1. Filing Requirements: The notice details the necessary forms and deadlines for filing tax returns for limited partnerships operating in Tennessee. It outlines requirements for both annual and quarterly filings. 2. Tax Payment Obligations: This notice provides information on the payment of taxes owed by the limited partnership. It explains the various tax types applicable to limited partnerships, such as income tax, sales tax, and franchise tax, along with instructions on calculating and remitting payments. 3. Deduction and Credit Opportunities: The notice covers deductions and credits available to limited partnerships operating in Tennessee. It provides guidance on eligible deductions, exemptions, credits, and other tax incentives that may help reduce the partnership's overall tax liability. 4. Record-Keeping Requirements: The notice emphasizes the importance of maintaining accurate and complete financial records to ensure compliance with Tennessee tax laws. It provides guidelines on the type of records that should be kept and the retention period required. 5. Partnership Representative and Reporting: Limited partnerships are required to designate a partnership representative responsible for corresponding with the Tennessee Department of Revenue. The notice outlines the representative's roles and responsibilities and explains the procedures for reporting changes in partnership information or structure. Different Types of Tennessee State of Delaware Limited Partnership Tax Notices: 1. Tennessee State of Delaware Limited Partnership Income Tax Notice: This notice specifically focuses on the income tax obligations of limited partnerships operating within Tennessee. 2. Tennessee State of Delaware Limited Partnership Sales and Use Tax Notice: This notice primarily addresses the sales and use tax obligations applicable to limited partnerships conducting sales or engaging in taxable services in Tennessee. 3. Tennessee State of Delaware Limited Partnership Franchise Tax Notice: This notice informs limited partnerships about the requirements and procedures for paying franchise tax in Tennessee. By adhering to the guidelines specified in the Tennessee State of Delaware Limited Partnership Tax Notice, limited partnerships can ensure compliance with Tennessee tax laws, meet their tax obligations, and avoid potential penalties or legal issues. It is crucial for limited partners and partnership representatives to carefully review and understand the content of this notice to navigate the complexities of the Tennessee tax system effectively.

Tennessee State of Delaware Limited Partnership Tax Notice

Description

How to fill out Tennessee State Of Delaware Limited Partnership Tax Notice?

If you want to complete, acquire, or print lawful papers layouts, use US Legal Forms, the biggest assortment of lawful types, that can be found on-line. Utilize the site`s simple and easy hassle-free search to obtain the documents you require. Various layouts for organization and individual functions are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the Tennessee State of Delaware Limited Partnership Tax Notice in a number of clicks.

If you are currently a US Legal Forms client, log in to the bank account and then click the Acquire key to obtain the Tennessee State of Delaware Limited Partnership Tax Notice. You can even entry types you in the past downloaded in the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that proper town/region.

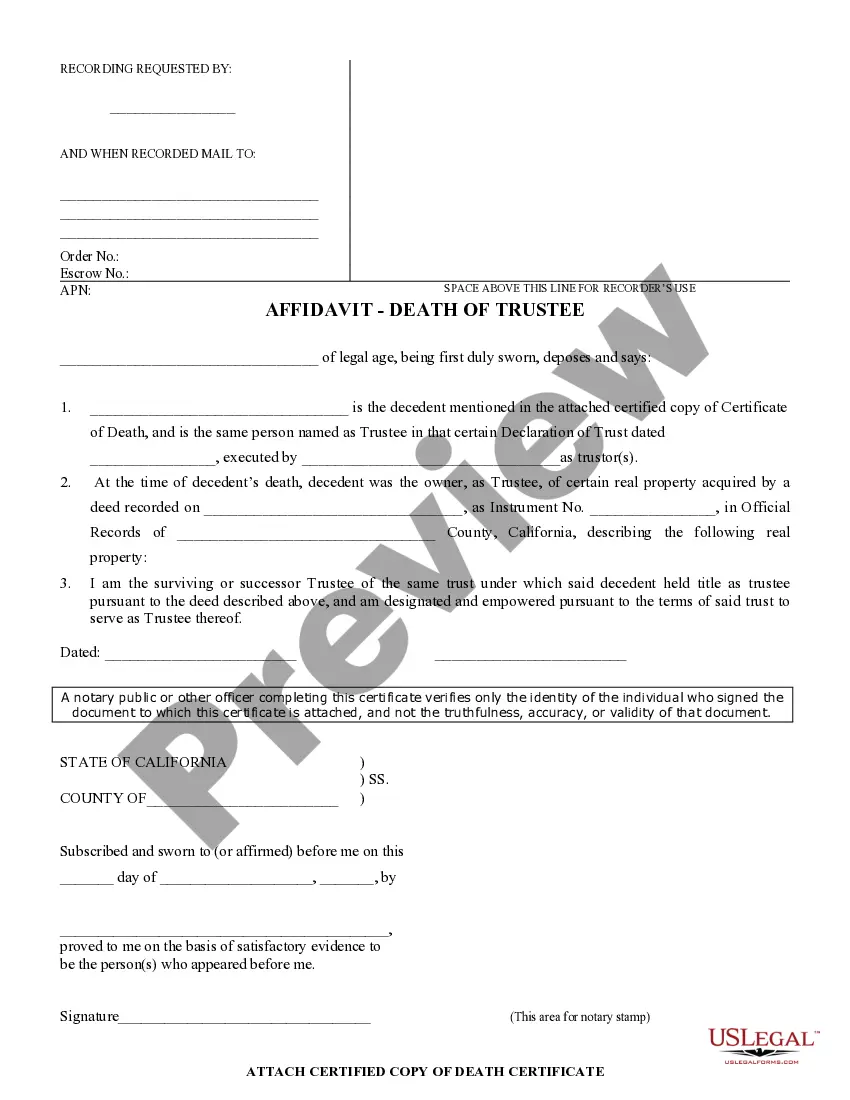

- Step 2. Utilize the Preview solution to look over the form`s content material. Don`t forget about to read the explanation.

- Step 3. If you are not happy using the form, utilize the Look for industry near the top of the display to locate other variations of the lawful form format.

- Step 4. Once you have located the form you require, go through the Get now key. Opt for the rates program you choose and add your credentials to register to have an bank account.

- Step 5. Method the transaction. You can use your bank card or PayPal bank account to perform the transaction.

- Step 6. Select the file format of the lawful form and acquire it in your gadget.

- Step 7. Comprehensive, change and print or indication the Tennessee State of Delaware Limited Partnership Tax Notice.

Each lawful papers format you purchase is your own permanently. You may have acces to each and every form you downloaded inside your acccount. Select the My Forms portion and choose a form to print or acquire once again.

Compete and acquire, and print the Tennessee State of Delaware Limited Partnership Tax Notice with US Legal Forms. There are millions of skilled and condition-certain types you can utilize to your organization or individual needs.