Tennessee Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

Are you in a position where you need documentation for both professional or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding versions you can trust is not straightforward.

US Legal Forms provides a vast array of form templates, such as the Tennessee Self-Employed Independent Contractor Consideration For Hire Form, that are designed to comply with federal and state regulations.

Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Tennessee Self-Employed Independent Contractor Consideration For Hire Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

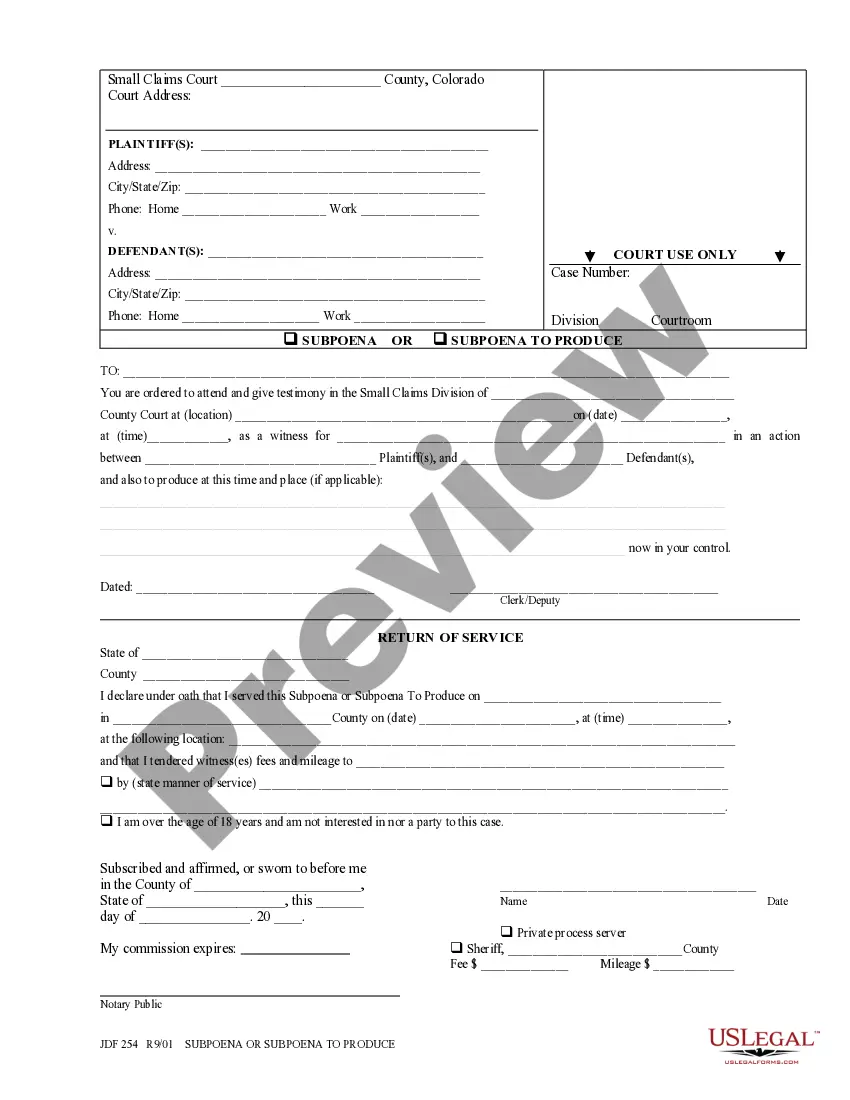

- Utilize the Preview button to review the form.

- Check the description to confirm that you have chosen the right form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs and requirements.

- Once you have the correct form, click on Get now.

- Select the pricing plan you desire, fill in the required information to create your account, and purchase an order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Find all the document templates you have acquired in the My documents menu. You can download an additional copy of the Tennessee Self-Employed Independent Contractor Consideration For Hire Form anytime, if necessary. Just select the needed form to download or print the document template.

Form popularity

FAQ

The primary consideration in determining if a hired person is an independent contractor revolves around the level of control. If the individual has the freedom to decide how to perform their work without significant oversight, they are likely classified as an independent contractor. Factors such as the nature of the work relationship, the method of payment, and the duration of the engagement also play a role.

Independent contractors can provide proof of employment through contracts, invoices, and payment records. These documents demonstrate the nature of the work performed and the compensation received. Additionally, having a Tennessee Self-Employed Independent Contractor Consideration For Hire Form can further validate their status, especially for tax purposes.

To hire an independent contractor, you need to complete a Tennessee Self-Employed Independent Contractor Consideration For Hire Form, a W-9 form, and a detailed contract. This paperwork ensures that both parties understand their obligations and helps protect your business legally. Proper documentation is essential for a smooth working relationship.

Legal requirements for independent contractors can vary by state, but generally, they must have a written agreement outlining the work to be performed. The agreement should include details such as payment terms, deadlines, and scope of work. Additionally, independent contractors must manage their own taxes and adhere to any industry-specific regulations that apply to their services.

The W-9 form is used by independent contractors to provide their taxpayer information, while the 1099 form is issued by clients to report payments made to contractors. It is not a matter of choosing one over the other; both forms serve different purposes in the hiring process. When hiring an independent contractor, you will often need to collect a W-9 to issue a 1099 at the end of the year.

An independent contractor typically needs to fill out a W-9 form for tax purposes and may also need to complete a Tennessee Self-Employed Independent Contractor Consideration For Hire Form. Depending on the nature of their work, additional forms may be required, such as contracts or agreements that outline the terms of the engagement. Ensuring all forms are completed accurately is crucial for compliance.

Yes, an independent contractor is considered self-employed. They operate their own business and provide services to clients without being an employee of any company. This status allows them more flexibility and control over their work, but it also means they are responsible for managing their own taxes and benefits.

To hire an independent contractor, you typically need a Tennessee Self-Employed Independent Contractor Consideration For Hire Form, a W-9 form for tax purposes, and a contract outlining the scope of work. These documents help clarify the nature of the working relationship and ensure compliance with tax regulations. Additionally, you may want to gather any relevant licenses or certifications that pertain to the contractor's work.

To hire independent contractors as a sole proprietor, start by defining the scope of work you need completed. Next, create the Tennessee Self-Employed Independent Contractor Consideration For Hire Form to clarify the expectations and responsibilities of both parties. This form helps ensure compliance with local laws and protects your business interests. Finally, evaluate potential candidates based on their skills and experience, and be ready to discuss payment terms and project deadlines.