Tennessee MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

Have you ever found yourself needing documentation for either business or personal purposes almost every time? There are numerous legal document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of template options, including the Tennessee MHA Request for Short Sale, which can be tailored to adhere to federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. You can then download the Tennessee MHA Request for Short Sale template.

Retrieve all the document templates you have purchased from the My documents menu. You can obtain an additional copy of the Tennessee MHA Request for Short Sale anytime, if needed. Just select the desired document to download or print the template.

Leverage US Legal Forms, which boasts the most extensive selection of legal forms, to save time and prevent errors. The service provides expertly crafted legal document templates suitable for a variety of purposes. Create an account with US Legal Forms and start making your life more manageable.

- Find the document you need and confirm it corresponds to the correct city/state.

- Utilize the Preview button to review the template.

- Check the summary to ensure that you have selected the appropriate document.

- If the document is not what you are looking for, use the Search field to locate a document that satisfies your needs and specifications.

- Once you identify the suitable document, click on Purchase now.

- Select your preferred pricing plan, enter the necessary information to create your account, and complete the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

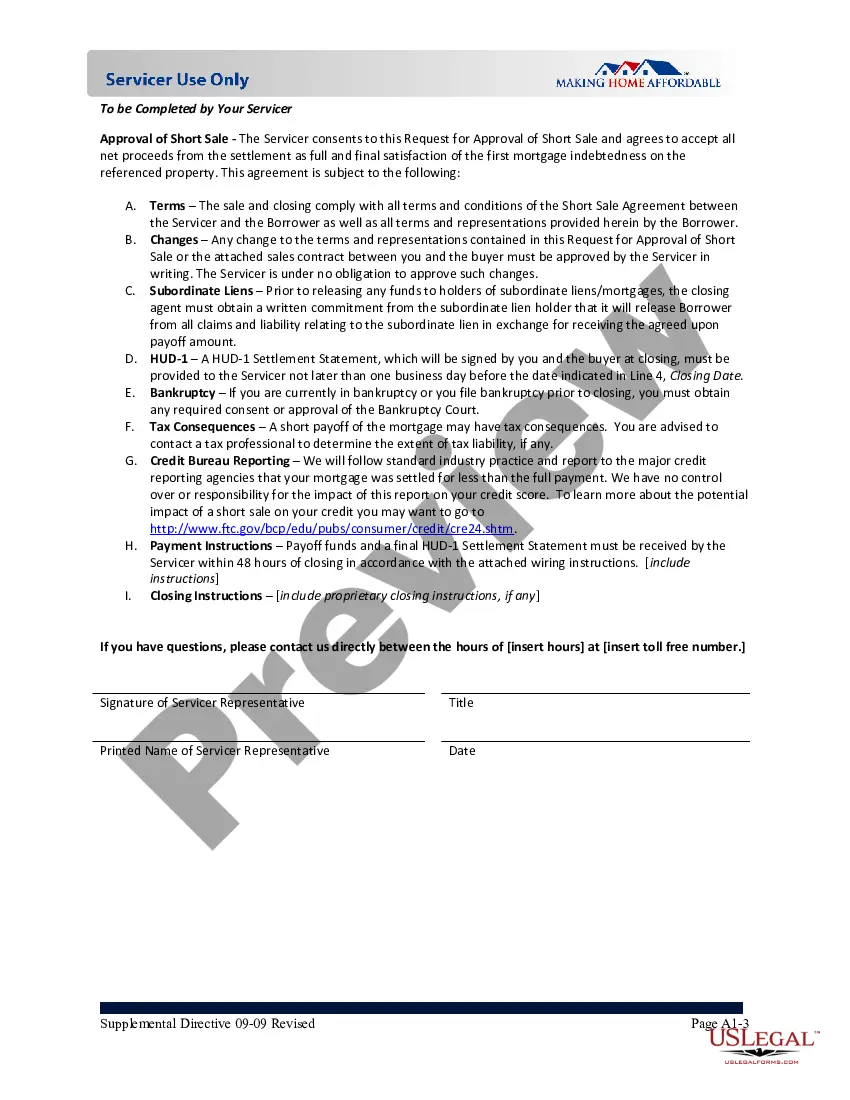

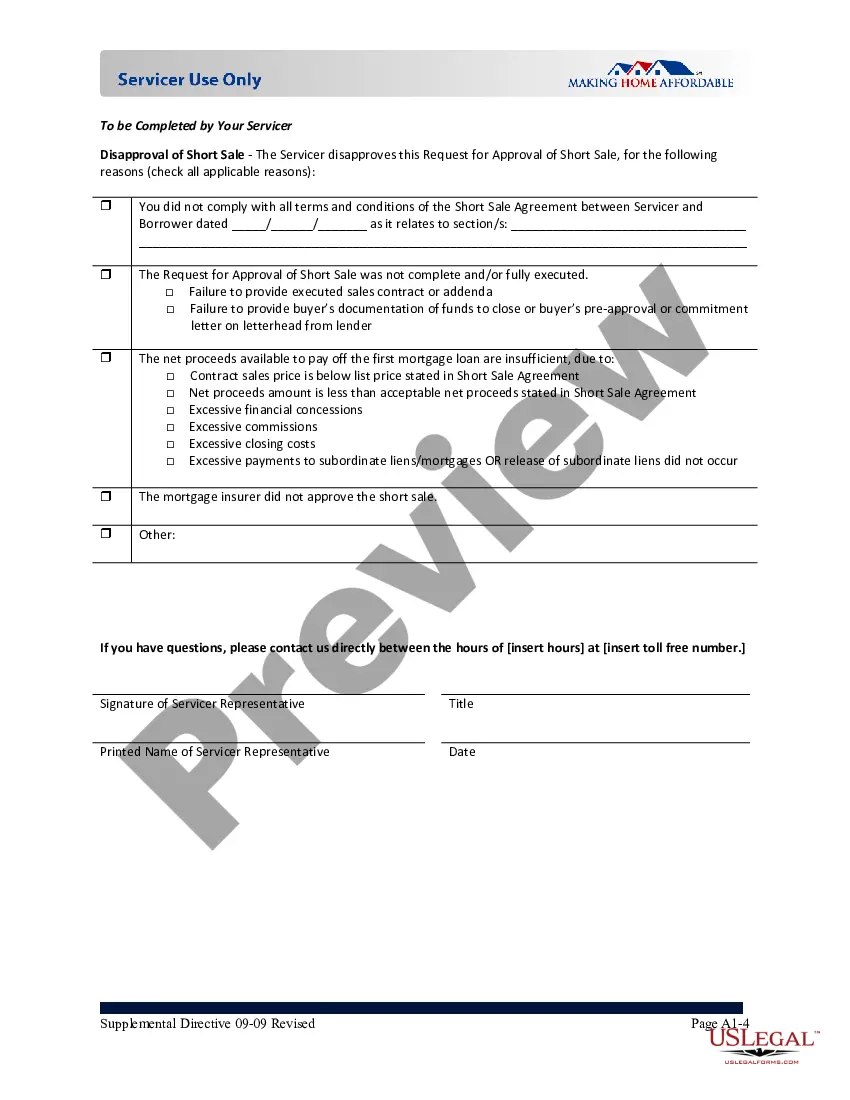

In Tennessee, foreclosures must follow a judicial process, requiring lenders to file a lawsuit before proceeding. Homeowners have a right to defend against foreclosure actions, and there are specific timelines and notices that lenders must follow. If you’re exploring options like the Tennessee MHA Request for Short Sale, addressing foreclosure sooner can help protect your property and finances.

To get approved for a short sale in Tennessee, you must demonstrate financial hardship and provide necessary documentation to your lender. The lender will review your situation and assess your eligibility based on their criteria. Utilizing the Tennessee MHA Request for Short Sale can simplify this process and increase your chances of securing approval.

Tennessee does not have a specific buyer's remorse law that allows buyers to cancel a real estate transaction after closing. However, there are protections in place that give buyers a limited time to address issues that arise with the property. If you’re considering a short sale under the Tennessee MHA Request for Short Sale, understanding your rights can help you navigate the process.

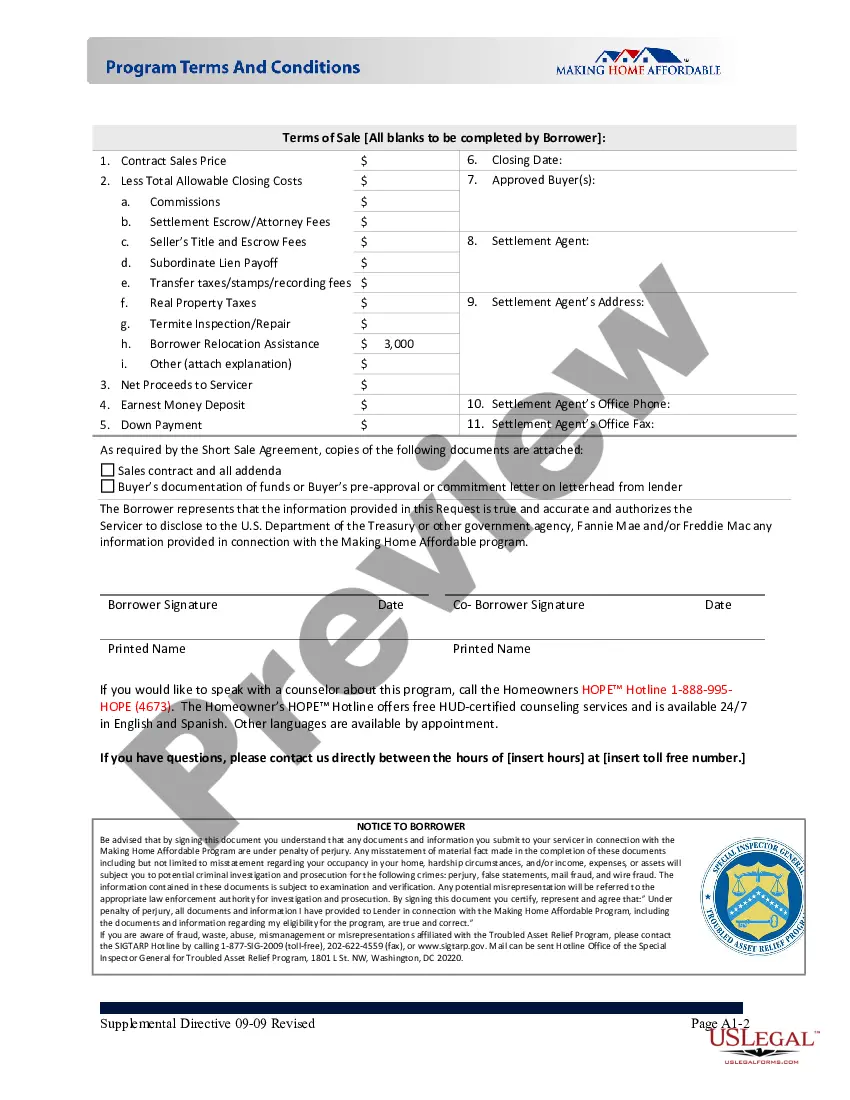

The steps in a short sale begin with preparing a Tennessee MHA Request for Short Sale and gathering necessary financial documents. Next, contact your lender to inform them about your situation and initiate the short sale process. After obtaining lender approval, list your property with a realtor who understands the short sale market. Finally, negotiate with potential buyers to secure the best offer while keeping communication open with your lender throughout the transaction.

Completing a short sale involves submitting a Tennessee MHA Request for Short Sale to your bank, clearly outlining your situation. Include a detailed letter explaining your financial difficulty, along with supporting documentation like income statements and bank statements. Your lender will review this information, and upon approval, you can list your property with a knowledgeable real estate agent. Their expertise will significantly contribute to closing the sale efficiently.

To request a short sale, begin with a Tennessee MHA Request for Short Sale through your lender. Make sure to gather necessary documentation, including your financial statements and a hardship letter. It’s beneficial to have a real estate agent experienced in short sales to guide you through the complexities. By following these steps, you increase your chances of a successful outcome.

Yes, a short sale can impact your credit, but generally less than a foreclosure. While it may lower your score slightly, a Tennessee MHA Request for Short Sale often appears as settled for less than the owed amount rather than a default. This can help minimize damage to your credit over time. With strategic financial planning post-sale, recovery may be quicker than you expect.

To initiate a Tennessee MHA Request for Short Sale, start by contacting your lender or bank directly. Prepare a hardship letter explaining your financial situation and provide supporting documents such as income statements and bills. Clearly express your desire for a short sale, outline the property's condition, and be ready to negotiate. This open communication can pave the way for a smoother process.