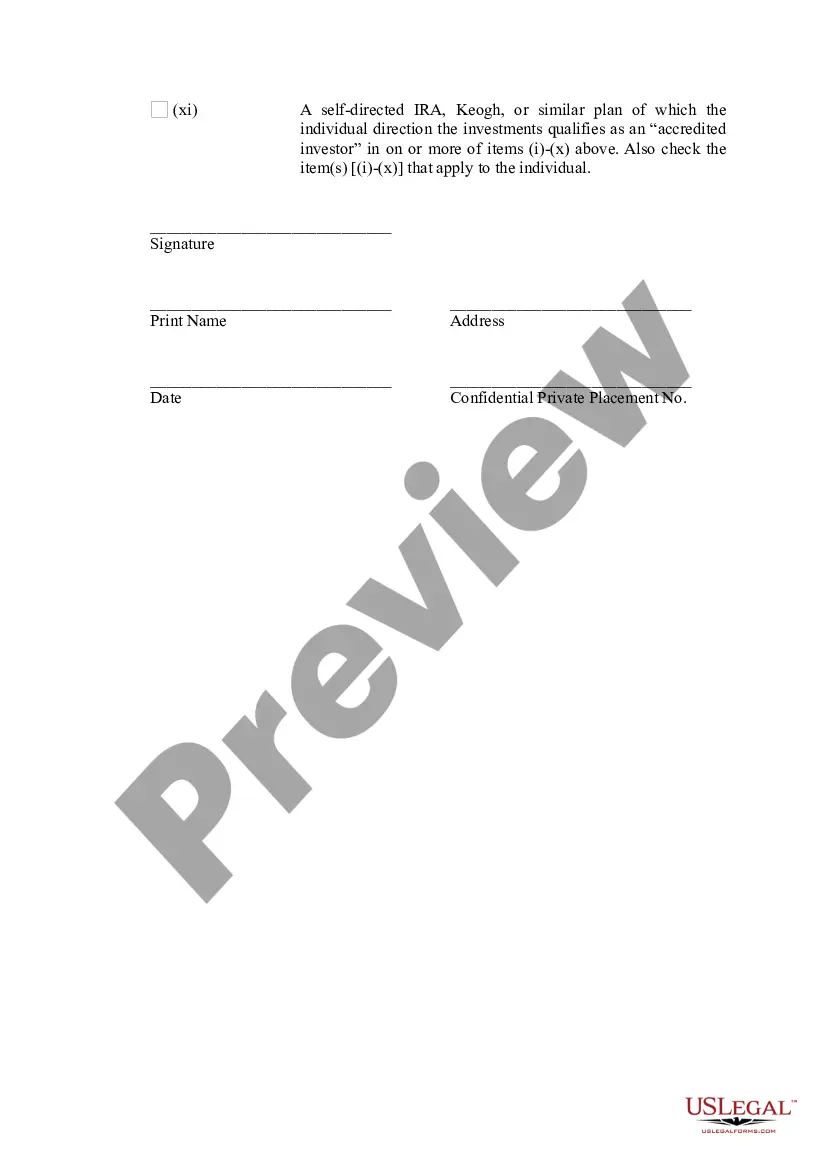

Tennessee Checklist - Certificate of Status as an Accredited Investor

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Checklist - Certificate Of Status As An Accredited Investor?

US Legal Forms - one of many biggest libraries of legitimate varieties in the States - provides a wide array of legitimate file web templates you can down load or print. Making use of the website, you can find a huge number of varieties for company and person functions, categorized by types, suggests, or key phrases.You will find the latest types of varieties such as the Tennessee Checklist - Certificate of Status as an Accredited Investor within minutes.

If you already have a registration, log in and down load Tennessee Checklist - Certificate of Status as an Accredited Investor from the US Legal Forms library. The Download switch will show up on every develop you see. You have accessibility to all formerly delivered electronically varieties from the My Forms tab of your own accounts.

If you wish to use US Legal Forms for the first time, listed below are basic recommendations to help you get started:

- Ensure you have picked out the correct develop to your metropolis/area. Go through the Preview switch to examine the form`s information. Look at the develop information to ensure that you have chosen the appropriate develop.

- In case the develop doesn`t suit your requirements, use the Lookup field on top of the display screen to obtain the one which does.

- If you are satisfied with the shape, validate your option by simply clicking the Buy now switch. Then, choose the pricing plan you like and supply your references to sign up on an accounts.

- Method the financial transaction. Use your bank card or PayPal accounts to perform the financial transaction.

- Find the structure and down load the shape on your own product.

- Make changes. Complete, edit and print and indication the delivered electronically Tennessee Checklist - Certificate of Status as an Accredited Investor.

Every template you included with your money lacks an expiration time and is also the one you have permanently. So, if you wish to down load or print another copy, just visit the My Forms section and then click on the develop you will need.

Get access to the Tennessee Checklist - Certificate of Status as an Accredited Investor with US Legal Forms, probably the most extensive library of legitimate file web templates. Use a huge number of specialist and state-specific web templates that meet your small business or person requirements and requirements.

Form popularity

FAQ

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

We have listed below some of the requirements for becoming an Investor in this section. Financial Knowledge: The first foremost skill that an Investor must have is knowledge of finance. ... Decision-making skills: Investors must have decision-making skills as they provide the best investment strategies to their clients.

1. For Investor Certificate Issuance: Sl. No.Investor Type1 Year- Duration Certificate Fee (Rs)1.Individual Investors, HUFs, Family Trusts, and Sole ProprietorshipRs. 5,000/-2.Partnership FirmsRs. 10,000/-3.Trusts (other than family trusts)Rs. 15,000/-4.Body CorporatesRs. 15,000/-

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

There is no residency or citizenship requirement in the definition of an accredited investor. Many entities and individuals are accredited investors. Rule 501 of Regulation D defines the term.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

A business entity or institution who wishes to invest in listed startups is required to have a net worth of Rs. 25 crore to be considered an accredited investor. Similarly, for an individual to be considered an accredited investor, a liquid net worth of at least Rs. 5 crore and total annual gross of Rs.

A business entity or institution who wishes to invest in listed startups is required to have a net worth of Rs. 25 crore to be considered an accredited investor. Similarly, for an individual to be considered an accredited investor, a liquid net worth of at least Rs. 5 crore and total annual gross of Rs.