Tennessee Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

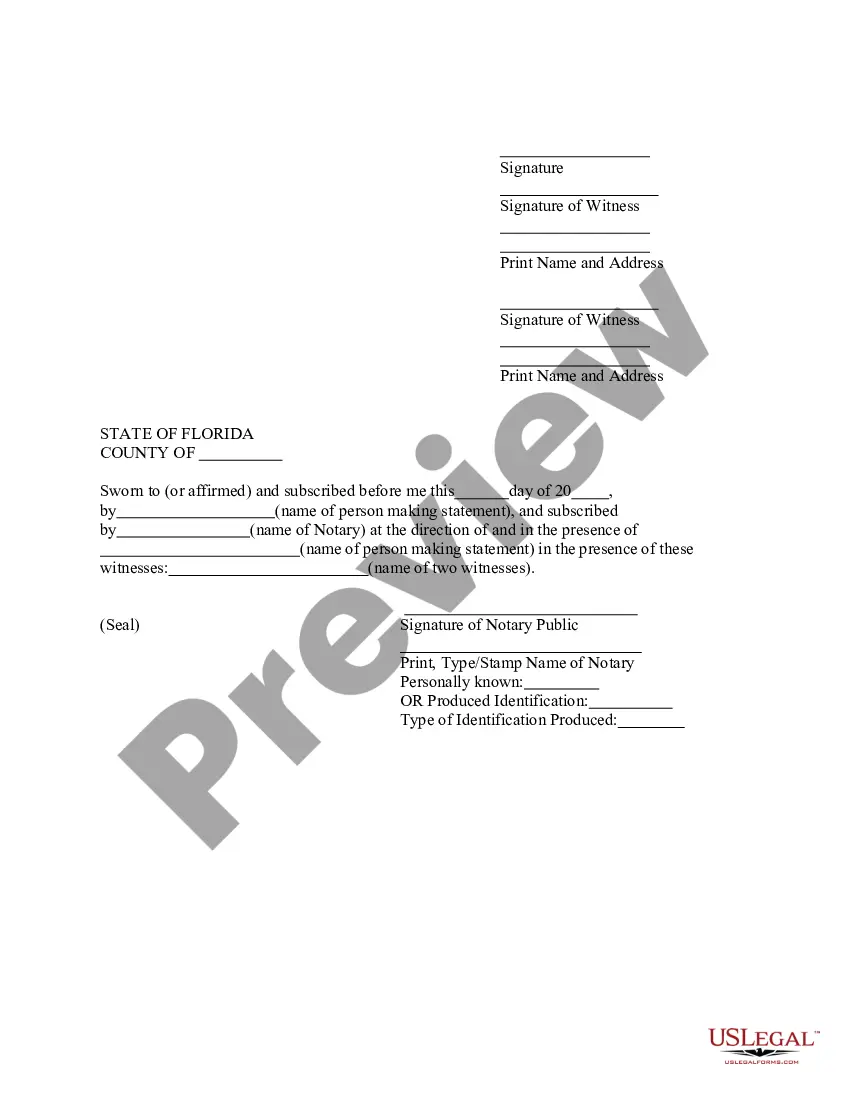

How to fill out Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

US Legal Forms - one of many most significant libraries of lawful forms in the States - offers a wide range of lawful papers web templates it is possible to download or print. Utilizing the web site, you will get a huge number of forms for company and person reasons, categorized by groups, states, or keywords and phrases.You will find the latest versions of forms just like the Tennessee Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit in seconds.

If you have a subscription, log in and download Tennessee Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit from your US Legal Forms library. The Obtain key will appear on every kind you view. You have access to all formerly downloaded forms in the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, allow me to share easy instructions to obtain began:

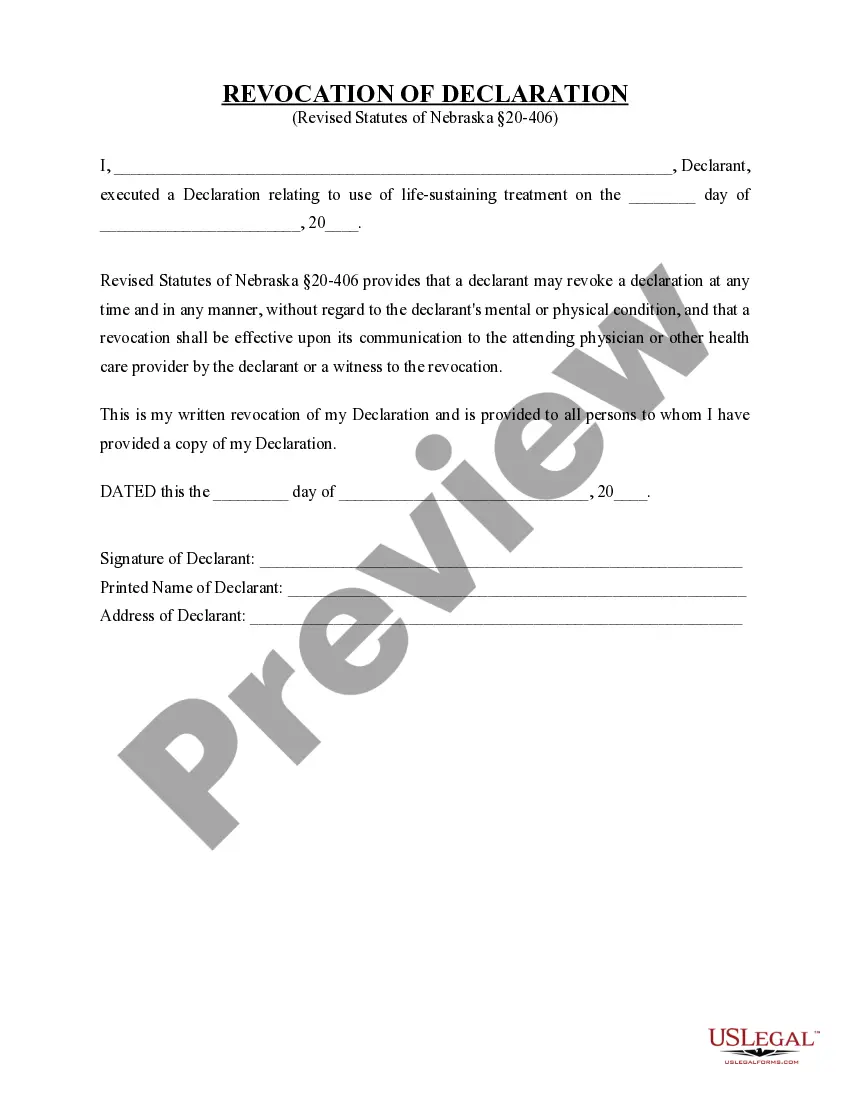

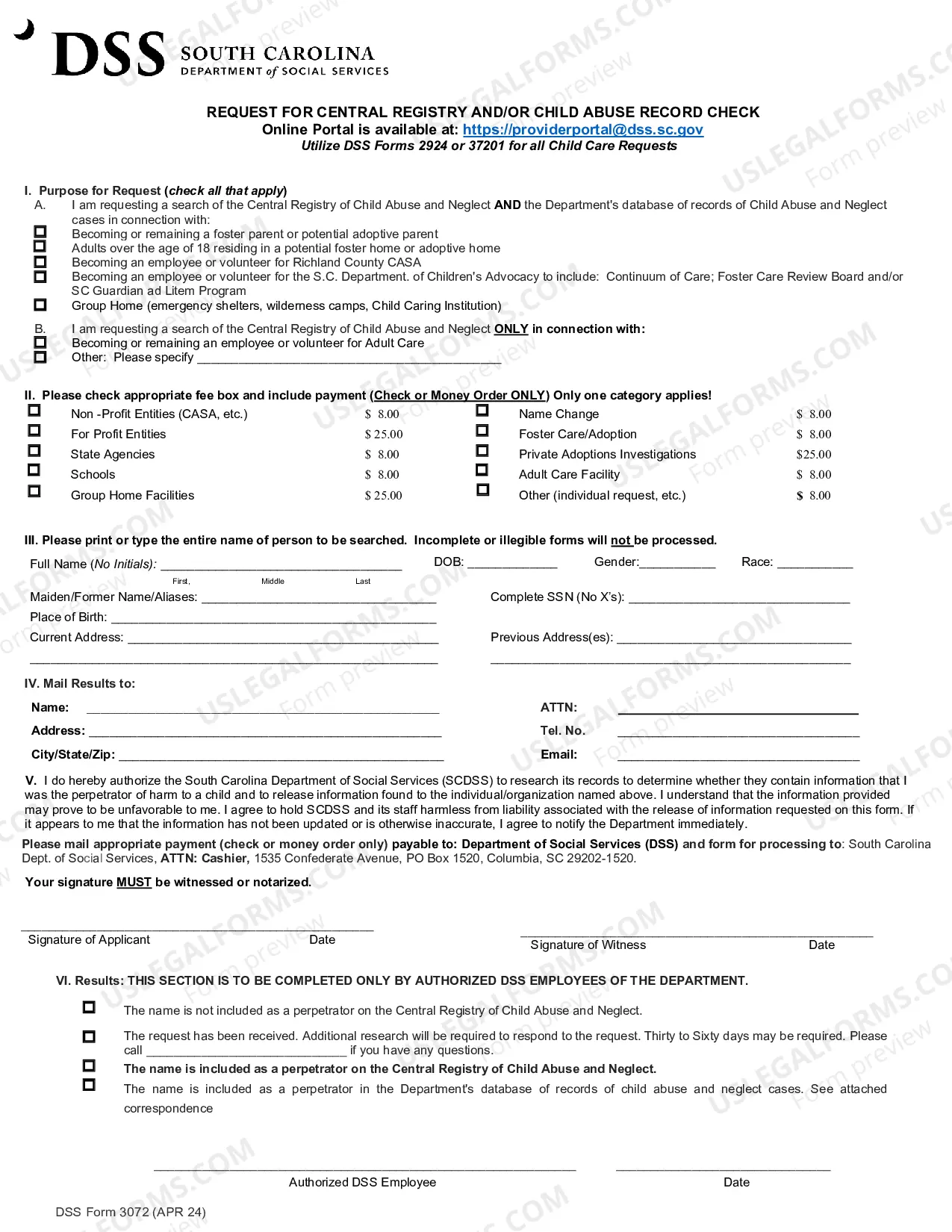

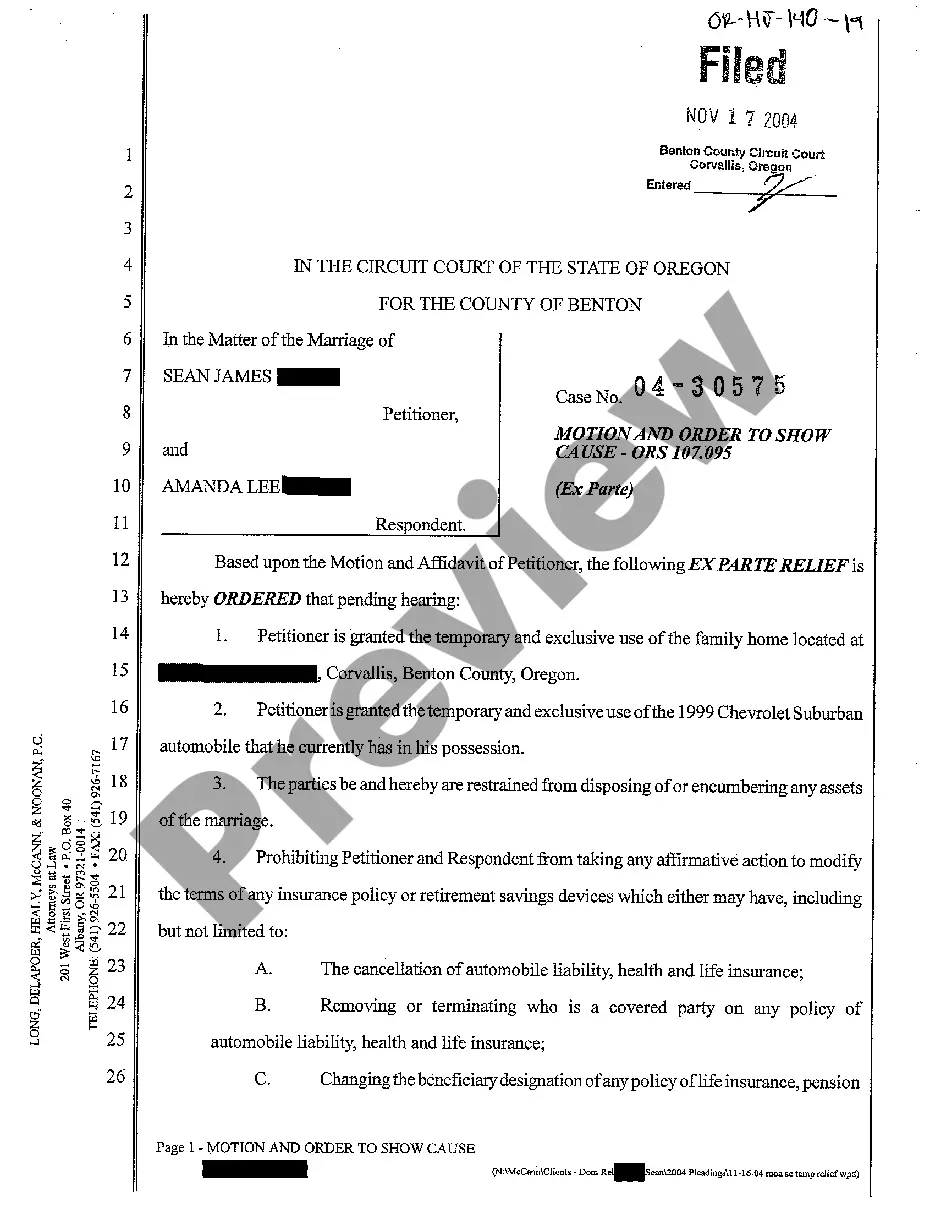

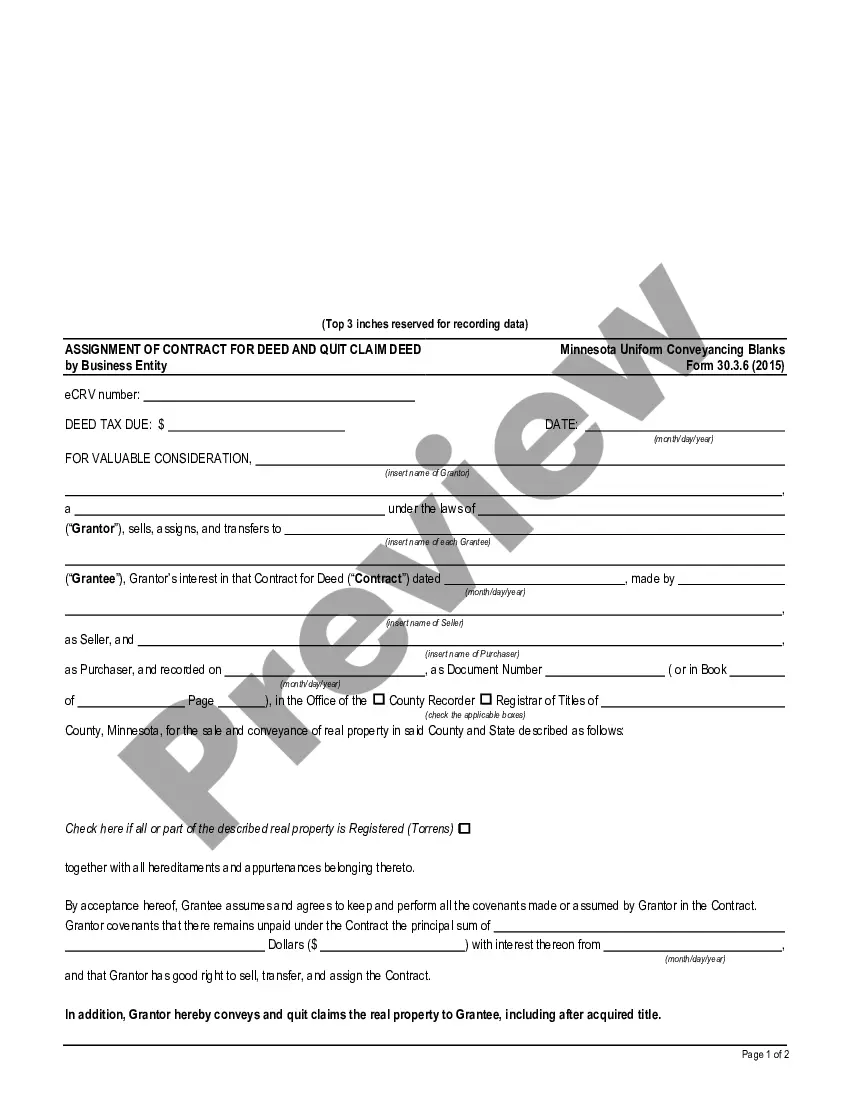

- Be sure to have picked out the best kind for your personal city/county. Click the Preview key to review the form`s content material. Read the kind outline to actually have selected the appropriate kind.

- If the kind doesn`t satisfy your requirements, use the Lookup industry on top of the monitor to obtain the one who does.

- In case you are content with the shape, verify your choice by visiting the Get now key. Then, select the prices prepare you prefer and offer your references to register on an bank account.

- Process the financial transaction. Utilize your charge card or PayPal bank account to finish the financial transaction.

- Pick the structure and download the shape on your gadget.

- Make adjustments. Complete, revise and print and indication the downloaded Tennessee Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit.

Each web template you put into your bank account lacks an expiry particular date and it is the one you have for a long time. So, if you wish to download or print one more version, just proceed to the My Forms area and click on on the kind you will need.

Get access to the Tennessee Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit with US Legal Forms, one of the most extensive library of lawful papers web templates. Use a huge number of specialist and state-specific web templates that fulfill your organization or person requires and requirements.

Form popularity

FAQ

However, despite these reverse splitting firm's efforts to avoid delisting, the majority fail within five years. Out of a sample of 1206 firms that completed a reverse split between 1995 and 2011, only 352, or 29%, survive until the end of the sample period.

Reverse stock splits do not impact a corporation's value, although they usually are a result of its stock having shed substantial value. The negative connotation associated with such an act is often self-defeating as the stock is subject to renewed selling pressure.

However, a reverse split can certainly change investor perception of the company. Stocks that go through reverse splits often see renewed selling pressure afterward, and the number of companies that emerge from reverse splits to produce strong long-term returns is small.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

Positive. Often, companies that use reverse stock splits are in distress. But if a company times the reverse stock split along with significant changes that improve operations, projected earnings and other information important to investors, the higher price may stick and could rise further.

The Bottom Line Reverse stock splits often are viewed negatively since it often is a means of inflating a stock's price without increasing the value of the company.

If a company you invest in announces a reverse stock split, you might wonder how to profit and if you should sell or buy more stocks. The split itself won't impact you, as your investment value will remain the same even if the individual stocks are worth more.

Listing Rule 5250(b)(4) will require companies to provide public notice of a reverse split, using a Reg FD-compliant method, no later than p.m. ET at least two business days prior to the proposed market effective date.