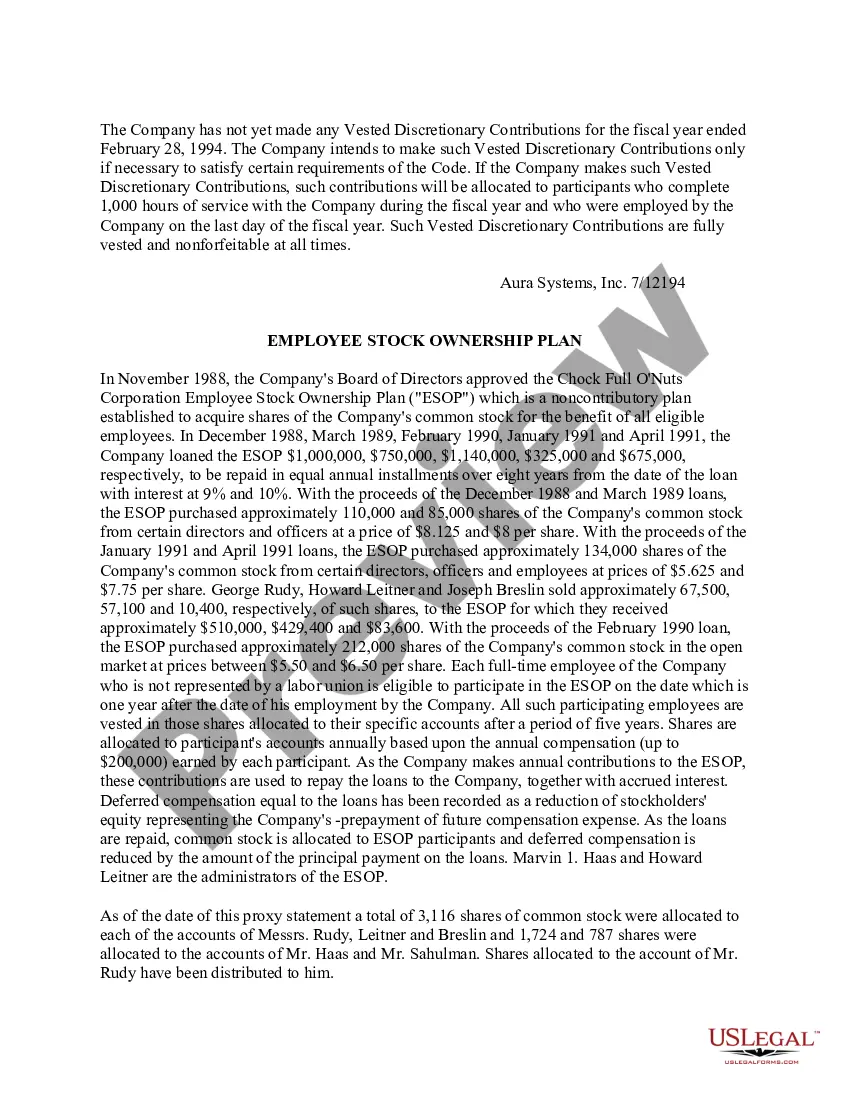

Tennessee Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

US Legal Forms - one of the largest libraries of legal types in America - provides an array of legal file templates it is possible to obtain or print. Utilizing the web site, you can find a large number of types for enterprise and personal uses, sorted by categories, claims, or keywords and phrases.You will find the newest types of types much like the Tennessee Employee Stock Ownership Plan of Aura Systems, Inc. in seconds.

If you have a registration, log in and obtain Tennessee Employee Stock Ownership Plan of Aura Systems, Inc. from the US Legal Forms local library. The Download switch will appear on every kind you look at. You have access to all previously downloaded types inside the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, here are straightforward guidelines to help you get started off:

- Be sure you have picked the correct kind to your area/region. Click the Review switch to analyze the form`s articles. Look at the kind description to ensure that you have selected the correct kind.

- In the event the kind doesn`t fit your needs, use the Lookup area on top of the display to find the one who does.

- When you are satisfied with the form, confirm your selection by visiting the Acquire now switch. Then, choose the costs strategy you favor and supply your references to register to have an bank account.

- Method the financial transaction. Utilize your bank card or PayPal bank account to finish the financial transaction.

- Pick the formatting and obtain the form on the gadget.

- Make changes. Fill out, edit and print and sign the downloaded Tennessee Employee Stock Ownership Plan of Aura Systems, Inc..

Every template you put into your account lacks an expiry time and it is your own property eternally. So, if you wish to obtain or print another version, just proceed to the My Forms section and then click around the kind you will need.

Obtain access to the Tennessee Employee Stock Ownership Plan of Aura Systems, Inc. with US Legal Forms, one of the most comprehensive local library of legal file templates. Use a large number of professional and state-specific templates that fulfill your company or personal demands and needs.

Form popularity

FAQ

In an ESOP, a company sets up an employee benefit trust, which it funds by contributing cash to buy company stock, contributing shares directly, or having the trust borrow money to buy stock.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.

An Employee Share Ownership Plan (ESOP) allows employees, who qualify, to acquire shares in their employer's company, with or without monetary assistance from the company. Employees can acquire shares and ownership through an ESOP that can range from one percent to 100 percent.