Tennessee Management Long Term Incentive Compensation Plan of of SCEcorp

Description

How to fill out Management Long Term Incentive Compensation Plan Of Of SCEcorp?

If you want to complete, obtain, or printing legal papers web templates, use US Legal Forms, the greatest variety of legal types, which can be found on-line. Utilize the site`s simple and easy practical search to obtain the paperwork you need. Different web templates for business and person uses are categorized by groups and says, or search phrases. Use US Legal Forms to obtain the Tennessee Management Long Term Incentive Compensation Plan of of SCEcorp within a few click throughs.

Should you be previously a US Legal Forms customer, log in to the bank account and click the Down load option to get the Tennessee Management Long Term Incentive Compensation Plan of of SCEcorp. You may also entry types you previously delivered electronically inside the My Forms tab of your respective bank account.

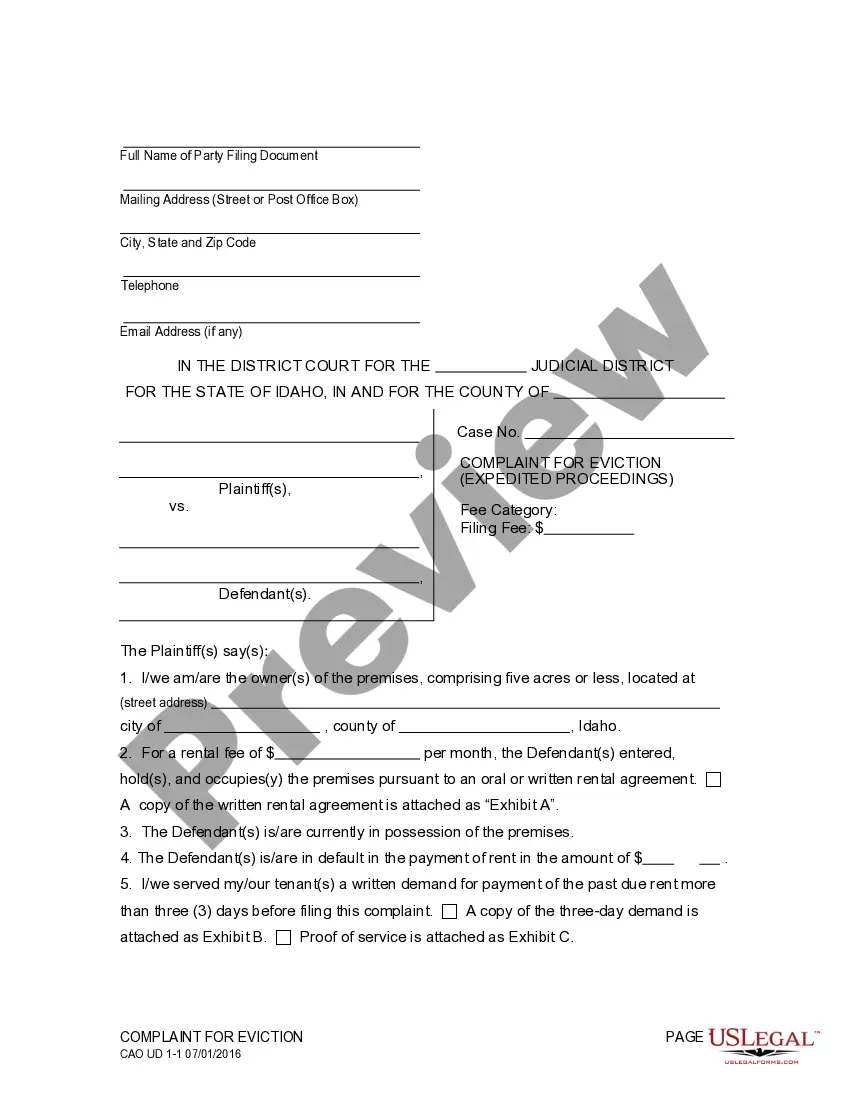

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for the appropriate area/region.

- Step 2. Use the Preview method to examine the form`s content. Don`t forget to learn the description.

- Step 3. Should you be not satisfied with the type, make use of the Look for field at the top of the display screen to locate other versions from the legal type design.

- Step 4. Once you have identified the form you need, go through the Get now option. Choose the rates strategy you favor and add your references to sign up for the bank account.

- Step 5. Approach the purchase. You may use your credit card or PayPal bank account to perform the purchase.

- Step 6. Find the structure from the legal type and obtain it in your product.

- Step 7. Comprehensive, modify and printing or indicator the Tennessee Management Long Term Incentive Compensation Plan of of SCEcorp.

Every legal papers design you acquire is your own permanently. You possess acces to each and every type you delivered electronically in your acccount. Click on the My Forms segment and choose a type to printing or obtain again.

Be competitive and obtain, and printing the Tennessee Management Long Term Incentive Compensation Plan of of SCEcorp with US Legal Forms. There are thousands of expert and express-certain types you can utilize for your business or person requirements.

Form popularity

FAQ

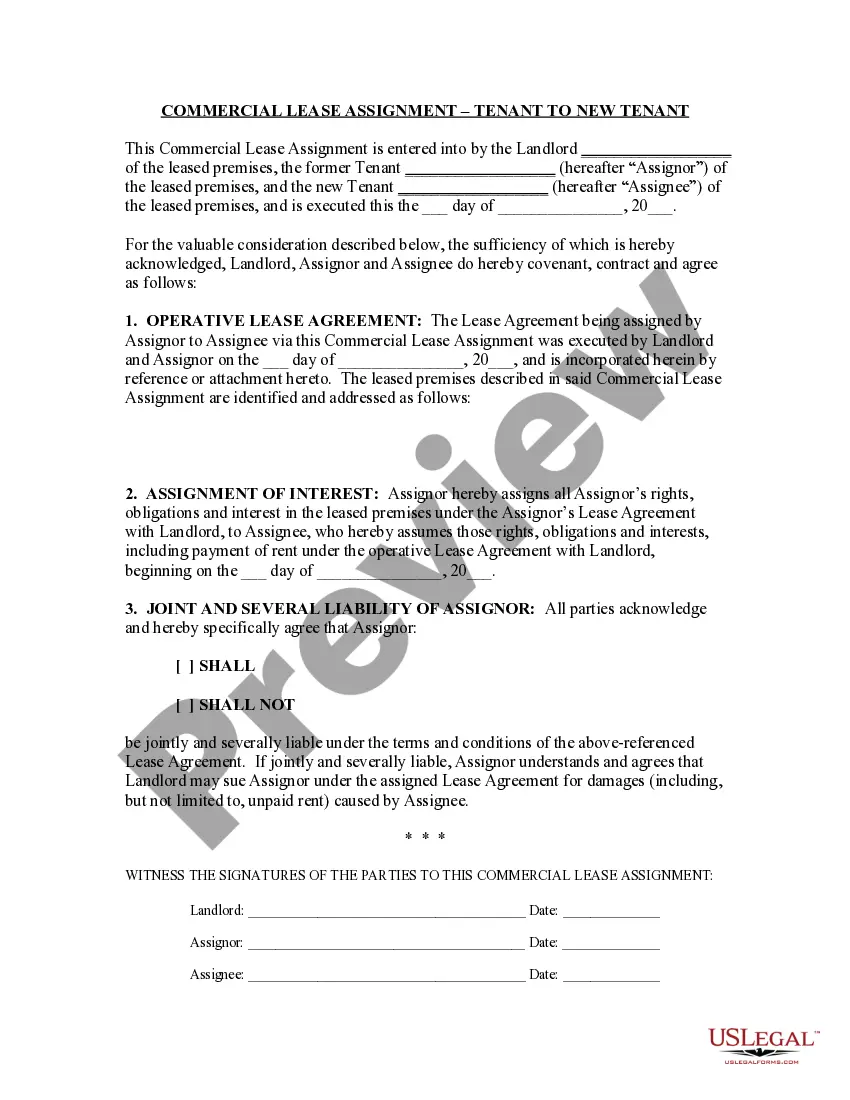

term incentive plan (LTIP or LTI plan) is a deferred compensation strategy to attract, reward and motivate your employees, while also helping your company to retain valued talent and grow. LTIP prevalence: 98% of public companies provide LTIPs while 63% of private companies offer LTIPs. ( Source: SHRM)

Payout Opportunity A Participant's payout target amount under the Plan is determined by pay grade as follows: The range of incentive opportunity for a Plan Participant is 0% to 200% of the Participant's total value target. This means the maximum payout that a Participant can receive from this Plan is 200%.

An incentive pay plan is a 'bonus' pay over and above their hourly wage that an associate can attain if they meet certain pre-set requirements or criteria. Incentive pay can be productivity based, quality based, safety based, etc.

Multiply total sales by total bonus percentage. For example, you make $10,000 in sales, and your company offers you a 5% commission. ... $10,000 x .05 = $500. One employee makes $50,000 per year, and the bonus percentage is 3%. ... $50,000 x .03 = $1,500.

Incentive compensation management is the strategic use of incentives to drive better business outcomes and more closely align sales rep behavior with the organization's goals. Incentives can be structured in multiple ways, including straight commissions, bonuses, prizes, ?spiffs,? awards, and recognition.

An annual incentive plan outlines compensation to be paid to employees when they achieve certain performance-related goals over 12 months. This compensation is in addition to their regular salary ? it may be an employee gift, cash incentive, or another type of bonus or reward.

term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

Different types of long-term incentive plans Appreciation-based awardCash-based awardMeaningIts value depends on how much the company's value increases over timeGiven to employees as a cash bonusExamplesStock options, Stock appreciation rights (SARs)Cash Bonus