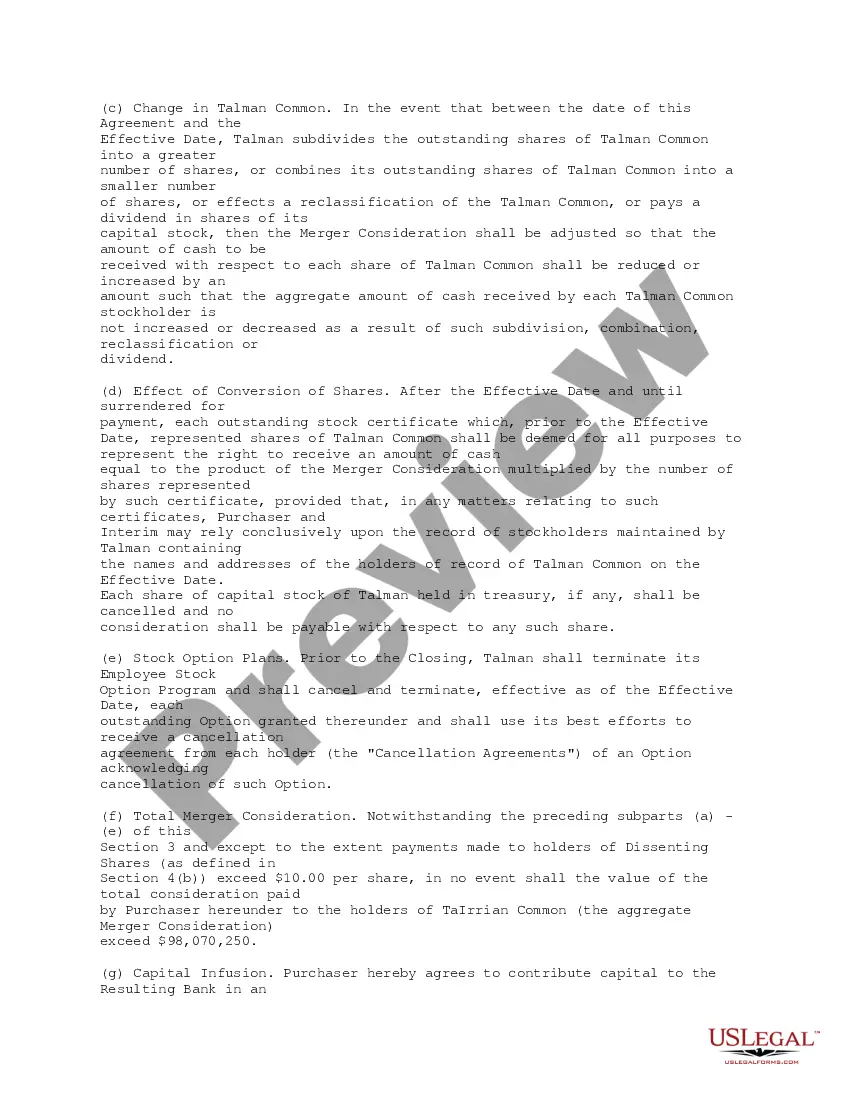

Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL

Description

How to fill out Restated Agreement And Plan Of Merger By ABN AMRO North America, Inc., La Salle Interim Bank, And The Talman Home Federal Savings And Loan Assoc. Of IL?

Finding the appropriate authorized document template can be quite a challenge. Clearly, there are numerous templates accessible online, but how can you obtain the authorized form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, that you can utilize for business and personal needs. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Download button to retrieve the Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL. Use your account to search through the legal forms you have purchased in the past. Visit the My documents tab of your account to obtain another copy of the document you need.

Select the document format and download the legal document template to your device. Complete, edit, print, and sign the finalized Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL. US Legal Forms is the largest repository of legal forms where you can find countless document templates. Utilize the service to download professionally crafted files that adhere to state requirements.

- First, ensure you have selected the correct form for your city/region.

- You can review the form using the Preview button and read the form description to verify this is the right one for you.

- If the form doesn't meet your requirements, use the Search area to locate the appropriate form.

- When you are confident the form is correct, click the Purchase now button to obtain the form.

- Choose the pricing plan you need and enter the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Yes, the integration of Fortis and ABN AMRO was pursued but faced numerous challenges throughout the process. While both entities aimed to combine their strengths, various obstacles impacted the seamless merging of operations. Understanding the implications of the Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL can provide key insights into how these mergers began and evolved. Over time, adjustments were made to enhance efficiency and achieve shared goals.

The mission of Amro focuses on providing top-quality financial services that meet the evolving needs of its clients. By maintaining a strong commitment to customer satisfaction, Amro aims to foster long-term relationships built on trust and transparency. Considering the Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, Amro’s mission emphasizes the importance of understanding and fulfilling customer expectations. This customer-centric approach helps them navigate challenges effectively.

The RFS Consortium aimed to combine three major European banks, creating a financial institution capable of competing on a global scale. Their goal was to enhance market presence and improve financial stability through synergies. The Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL highlights their strategic intent to streamline operations. Ultimately, they sought to deliver better services and products to customers.

Yes, following the financial crisis, ABN AMRO underwent significant restructuring and was partially nationalized by the Dutch government. The government retained ownership to stabilize the bank and ensure its service to customers. However, it is important to understand the implications of the Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL on its ownership structure. Over the years, the bank has gradually returned to private ownership.

RBS acquired ABN AMRO to enhance its global banking capabilities and expand its presence in important markets. The deal aimed to create a financial powerhouse with diverse products and services. The Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, played a crucial role in integrating these entities. This acquisition ultimately aimed to strengthen customer offerings and drive growth.

ABN AMRO Bank was taken over primarily by the consortium of RBS, Fortis, and Santander in 2007. This acquisition aimed to boost their collective market presence and enhance the range of banking services offered. The Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL illustrates how these mergers and acquisitions have influenced the bank's evolution over the years.

As of my last knowledge update, ABN Amro Bank has not been taken over by Kotak. Instead, ABN AMRO focuses on its core operations and partnerships. The Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL affirms that the bank remains an independent and strong entity within the financial sector.

ABN AMRO is widely considered a prestigious financial institution, recognized for its global reach and innovative services. This reputation stems from its rich history and a strong commitment to client service. The Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL showcases how ABN AMRO continues to maintain its standing through strategic partnerships.

The merger between ABN and AMRO officially took place in 1991. This strategic partnership allowed both banks to combine their resources and expertise, enhancing their service offerings. As stated in the Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL, this merger was crucial in solidifying their position in the financial market.

Yes, NatWest Group acquired ABN AMRO in a significant transaction aimed at expanding its footprint. This takeover took place in 2000, reflecting growing competitive pressures within the global banking sector. The Tennessee Restated Agreement and Plan of Merger by ABN AMRO North America, Inc., La Salle Interim Bank, and The Talman Home Federal Savings and Loan Assoc. of IL outlines how this acquisition aimed to better position both banks for success.