Statutory Guidelines [Appendix A(3) IRC 130] regarding certain personal injury liability assignments.

Tennessee Certain Personal Injury Liability Assignments IRS Code 130

Description

How to fill out Certain Personal Injury Liability Assignments IRS Code 130?

Are you in the position that you need to have papers for possibly organization or specific uses nearly every working day? There are a variety of lawful record themes accessible on the Internet, but finding versions you can rely isn`t straightforward. US Legal Forms provides thousands of kind themes, like the Tennessee Certain Personal Injury Liability Assignments IRS Code 130, that happen to be written to satisfy state and federal demands.

If you are previously knowledgeable about US Legal Forms internet site and possess a free account, just log in. Following that, you are able to down load the Tennessee Certain Personal Injury Liability Assignments IRS Code 130 template.

Unless you have an account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the kind you require and make sure it is for the appropriate metropolis/area.

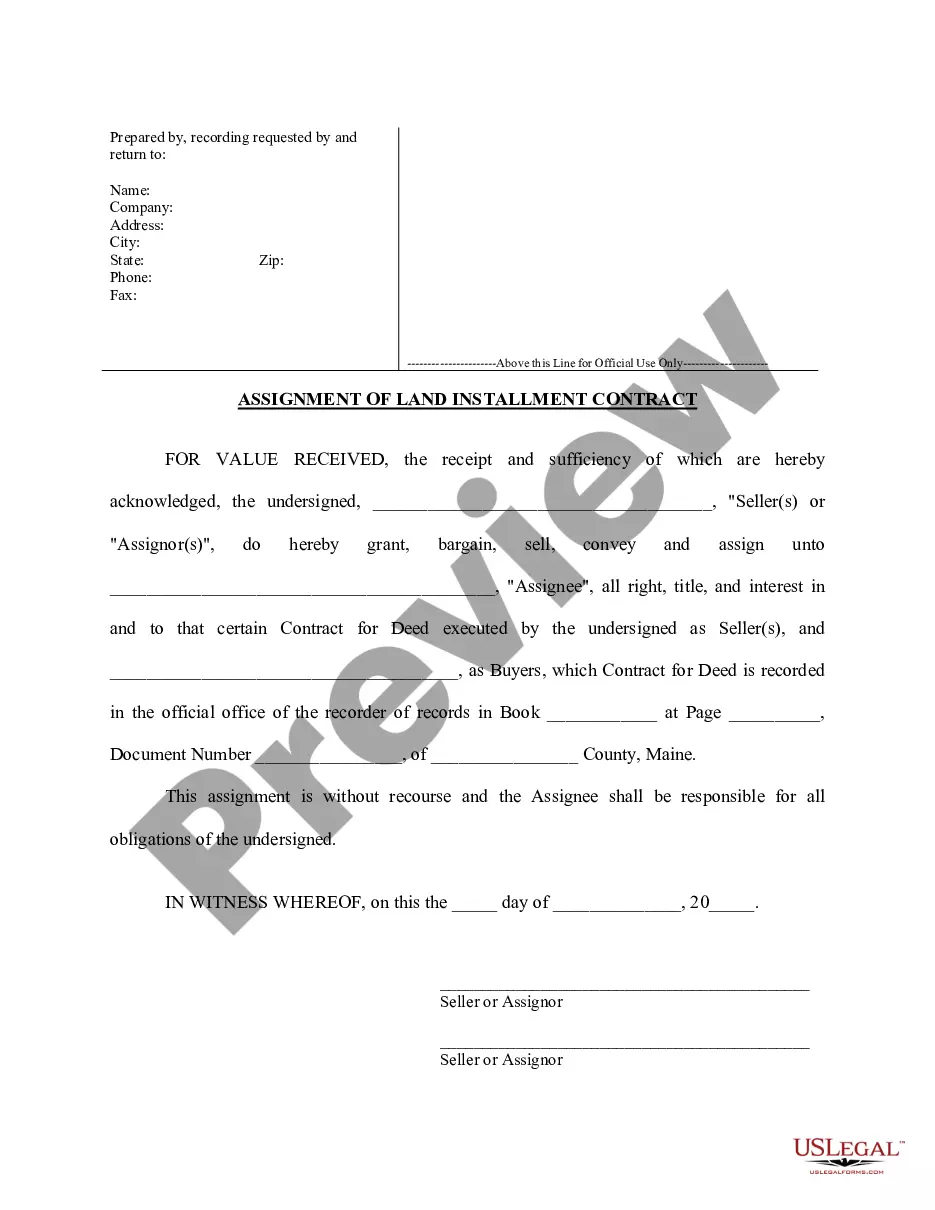

- Make use of the Review switch to examine the form.

- Look at the outline to actually have chosen the right kind.

- If the kind isn`t what you`re searching for, take advantage of the Search field to discover the kind that suits you and demands.

- Once you find the appropriate kind, simply click Get now.

- Pick the rates strategy you would like, submit the necessary details to make your account, and pay for your order utilizing your PayPal or charge card.

- Choose a handy file structure and down load your copy.

Locate all the record themes you may have bought in the My Forms food selection. You can obtain a more copy of Tennessee Certain Personal Injury Liability Assignments IRS Code 130 anytime, if possible. Just select the needed kind to down load or produce the record template.

Use US Legal Forms, the most comprehensive selection of lawful varieties, to conserve time and stay away from mistakes. The support provides appropriately manufactured lawful record themes that you can use for a selection of uses. Produce a free account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

Under a structured settlement, all future payments are completely free from: Federal and state income taxes; Taxes on interest, dividends and capital gains; and. The Alternative Minimum Tax (AMT).

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ... 201435006 - Internal Revenue Service IRS (.gov) ? pub ? irs-wd IRS (.gov) ? pub ? irs-wd PDF

For purposes of this section, the term ?qualified funding asset? means any annuity contract issued by a company licensed to do business as an insurance company under the laws of any State, or any obligation of the United States, if? 130(d)(1) §130(d), Qualified Funding Asset - IRC - CCH AnswerConnect cch.com ? federal ? irc ? current cch.com ? federal ? irc ? current

Cashing out a structured settlement can be a good way to access a significant amount of cash. But before making such a significant decision, review all of the costs carefully. If you decide to proceed with a sale, get offers from at least two to three different buyers to ensure you're getting the best deal possible.

Income tax exemption: Structured settlement payments?including growth?are 100% income tax-free. While lump sum cash settlements are income tax-free for physical injury cases, growth on funds placed in a traditional investment may be taxable. Tax-Free Income with Competitive Returns: Why Your Clients Need to ... sagesettlements.com ? blog ? december ? ta... sagesettlements.com ? blog ? december ? ta...

Ing to the IRS, your taxable income does not include the following: Settlement money you receive from claims involving unspecified physical injuries. Benefit payments you receive from your employer's workers' compensation insurance. Money you get through your health insurance for covered medical expenses.

Disadvantages of Structured Settlement Low relative rate of return: Structured settlement annuities compare well against traditionally safe investments such as bonds. However, when compared to more risky options like securities, structured settlements generally offer a lower rate of return.

The IRS can only pursue those portions of the settlement not intended as reimbursement for property loss or physical injury. So, while this may not always happen, it is possible that the IRS might take at least some of your personal injury settlement. Can the IRS Take my Personal Injury Settlement? - Uplift Legal Funding upliftlegalfunding.com ? can-irs-take-my-personal... upliftlegalfunding.com ? can-irs-take-my-personal...