Tennessee Exempt Survey

Description

How to fill out Exempt Survey?

Finding the appropriate valid document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you obtain the valid form you need.

Utilize the US Legal Forms website.

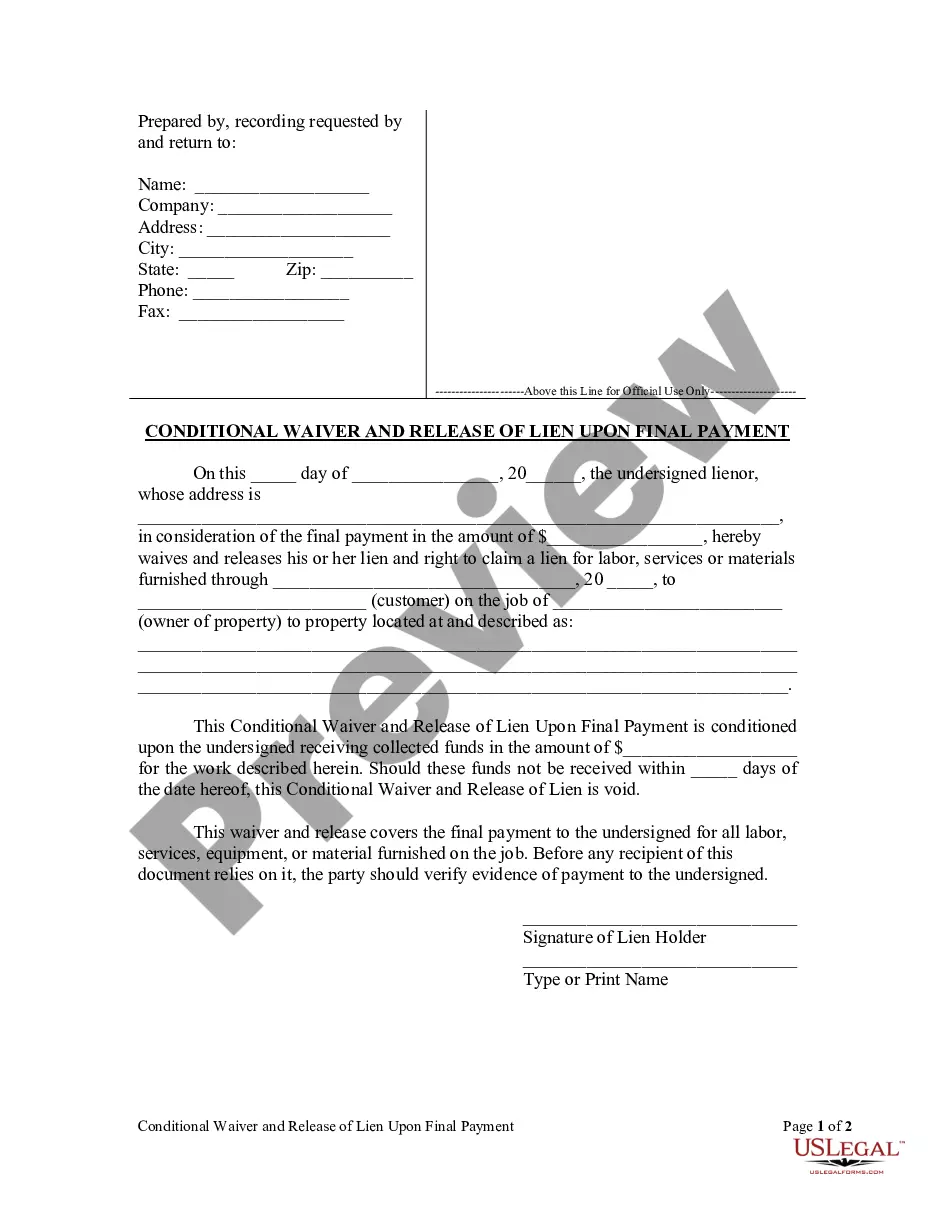

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, make sure you have selected the correct form for your city/region. You can review the document using the Preview button and read the document details to ensure it is suitable for you.

- The service offers a vast array of templates, including the Tennessee Exempt Survey, suitable for business and personal uses.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to download the Tennessee Exempt Survey.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

Form popularity

FAQ

How do I become federally exempt? You can obtain federal tax-exempt status by applying with the IRS, by filing the detailed form 1023 and submitting it with the fee and the many required attachments. The review process will take several months and if you are successful, you will receive the Letter of Determination.

Family-owned, noncorporate entities (FONCEs) that own commercial or industrial real estate, and. Limited liability companies (LLCs) and limited partnerships (LPs) that have been exempt from Tennessee franchise and excise tax.

Non-corporate entities that are at least 95% family owned and at least 66.67% of the entity's income is derived from activities that produce passive investment income or a combination of farming and passive investment income are also exempt.

When calculating Franchise Tax, if the holding entity owns an interest in several other entities, its equity can potentially be taxed more than once. This potential negative tax effect can be avoided for an affiliated group by making a joint election to compute net worth on a consolidated basis.

Typically, though, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year.

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

You can file for an exemption using the Tennessee Taxpayer Access Point (TNTAP), without creating a logon. Visit TNTAP for more information. Seventeen different types of entities are exempt from the franchise and excise taxes.

Tangible personal property, taxable services, amusements, and digital products specifically intended for resale are not subject to tax. Retail sales to the federal government or its agencies and the State of Tennessee or a county or municipality within Tennessee are not subject to tax.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

To avoid the income being taxed twice, the state allows the holding entity to exclude the flow through income or loss from its excise return. Income subject to self-employment tax is also excluded from the excise return, because Tennessee does not have an individual income tax.