Tennessee Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

Are you presently within a situation where you require documents for either business or personal purposes almost daily.

There are numerous legal document templates accessible online, but locating ones you can rely on is challenging.

US Legal Forms provides a wide selection of form templates, such as the Tennessee Agreement to Dissolve and Wind up Partnership with Asset Division among Partners, which can be tailored to satisfy federal and state criteria.

Once you locate the correct form, click on Acquire now.

Select a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Following that, you can download the Tennessee Agreement to Dissolve and Wind up Partnership with Asset Division among Partners template.

- If you do not have an account and wish to start using US Legal Forms, please follow these steps.

- Identify the form you need and ensure it is for the correct city/region.

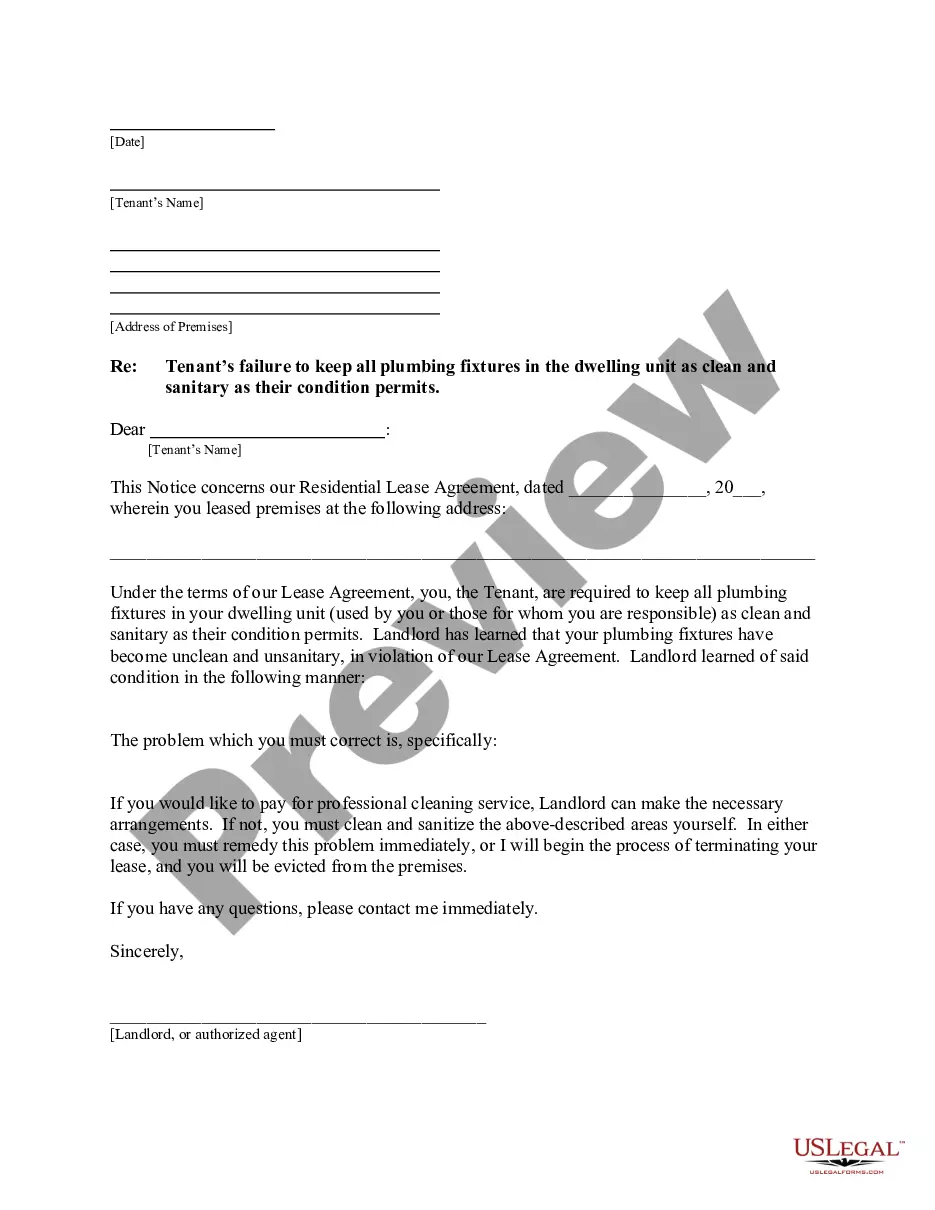

- Use the Review feature to evaluate the document.

- Check the description to confirm that you have selected the accurate form.

- If the form is not what you are looking for, utilize the Search section to find the document that fits your needs and specifications.

Form popularity

FAQ

The procedure of dissolution or winding up of a partnership firm involves several key steps. First, partners must agree on the decision to dissolve the partnership, often laying out the details in a Tennessee Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners. Next, the firm needs to settle all debts and obligations, which may include liquidating assets. Finally, once outstanding matters are resolved, the partnership can formally end and distribute any remaining assets among the partners according to the agreed terms.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Dissolution of partnership means putting an end to a business partnership between all the partners of the firm. Any partnership can be dissolved by the mutual consent of all the partners and is carried out by way of executing a written agreement, referred to as a Partnership Dissolution Agreement.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

In California, a general partnership is an association of two or more persons, acting as co-owners of a business for profit. Any partner in a partnership is free to dissociate, or leave the partnership, at any time.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.

Whatever the context, the partnership must be dissolved if one partner wants to leave, even if the others want to continue. After that, a new partnership can be formed with the remaining members who can then resume operations on their own.