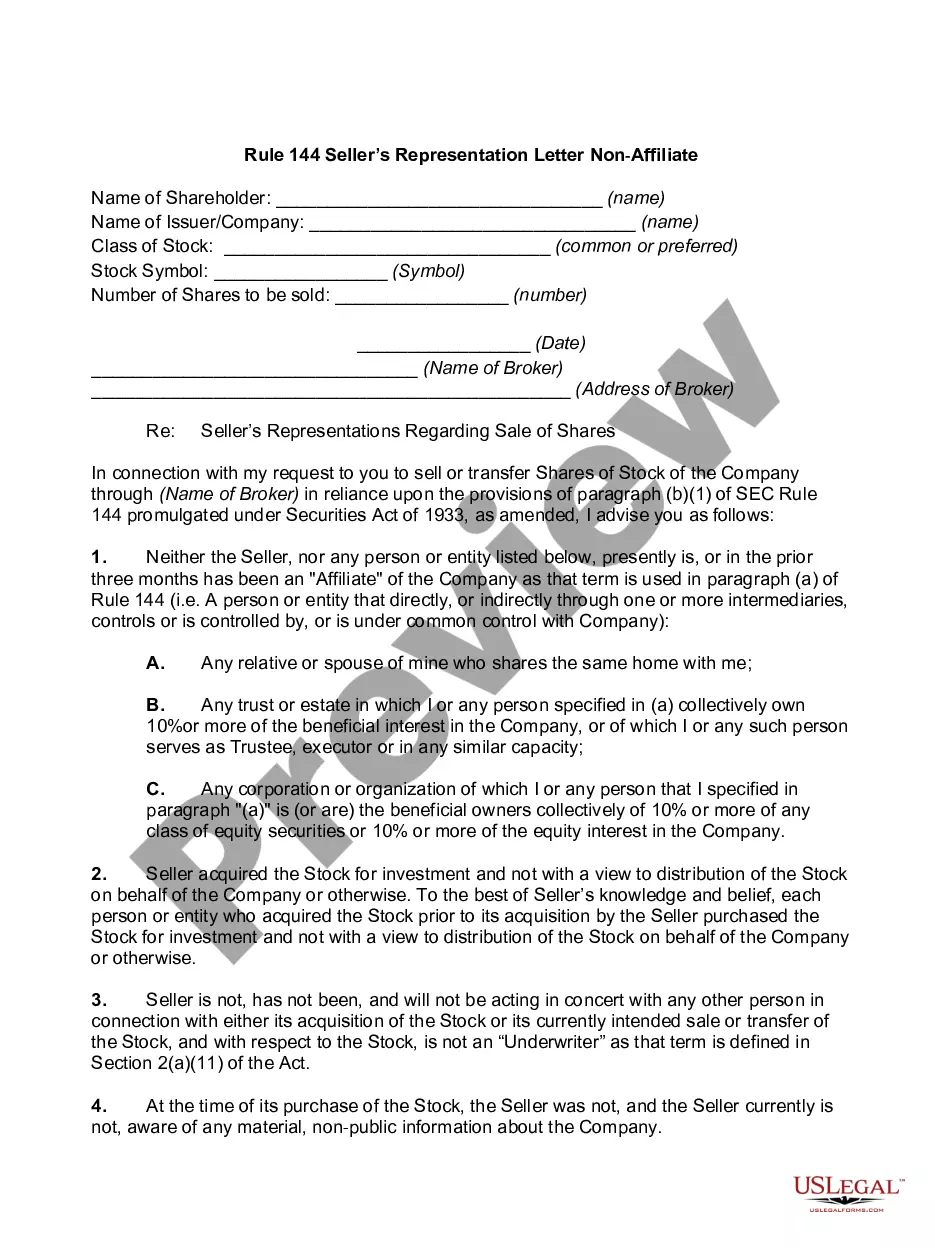

Tennessee Rule 144 Seller's Representation Letter Non-Affiliate

Description

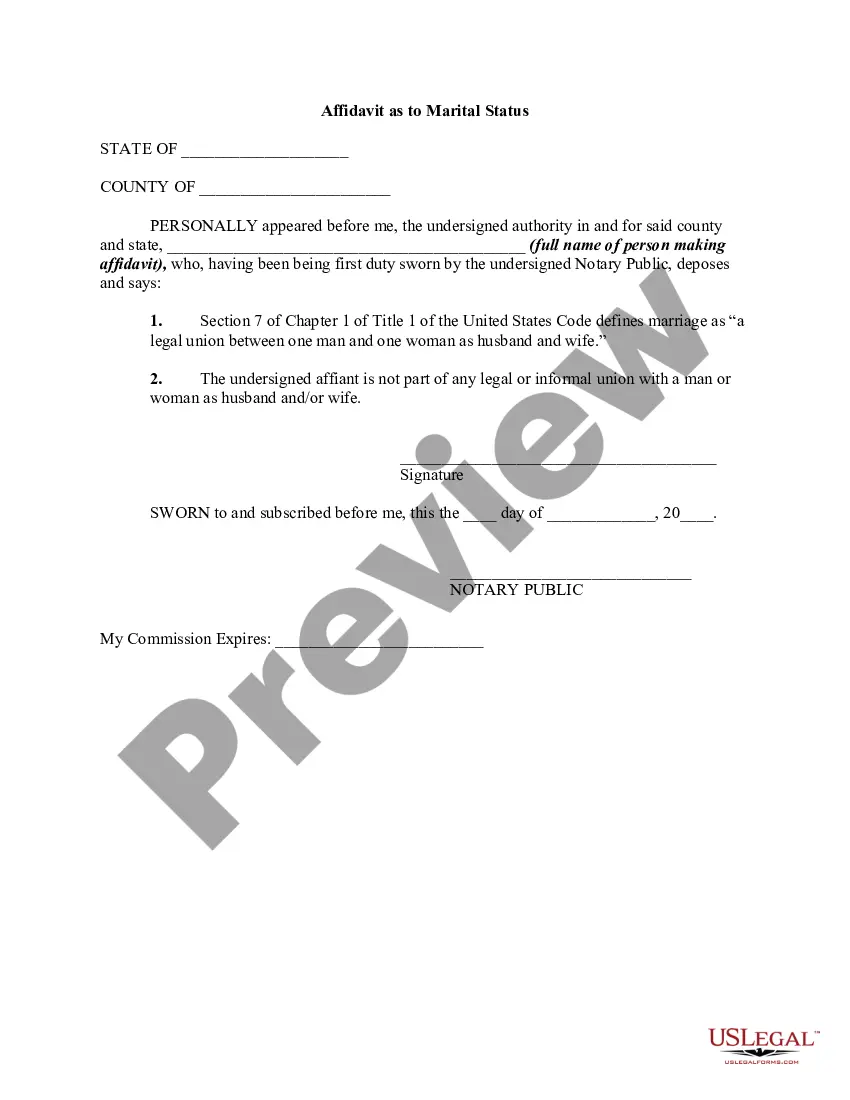

How to fill out Rule 144 Seller's Representation Letter Non-Affiliate?

US Legal Forms - one of the largest collections of legal templates in the country - offers a vast selection of legal document templates that you can easily download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the most current versions of documents like the Tennessee Rule 144 Seller's Representation Letter Non-Affiliate in just a few minutes.

If you already have an account, Log In to download the Tennessee Rule 144 Seller's Representation Letter Non-Affiliate from your US Legal Forms library. The Download option will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Every template you add to your account has no expiration date and belongs to you permanently. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Tennessee Rule 144 Seller's Representation Letter Non-Affiliate through US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

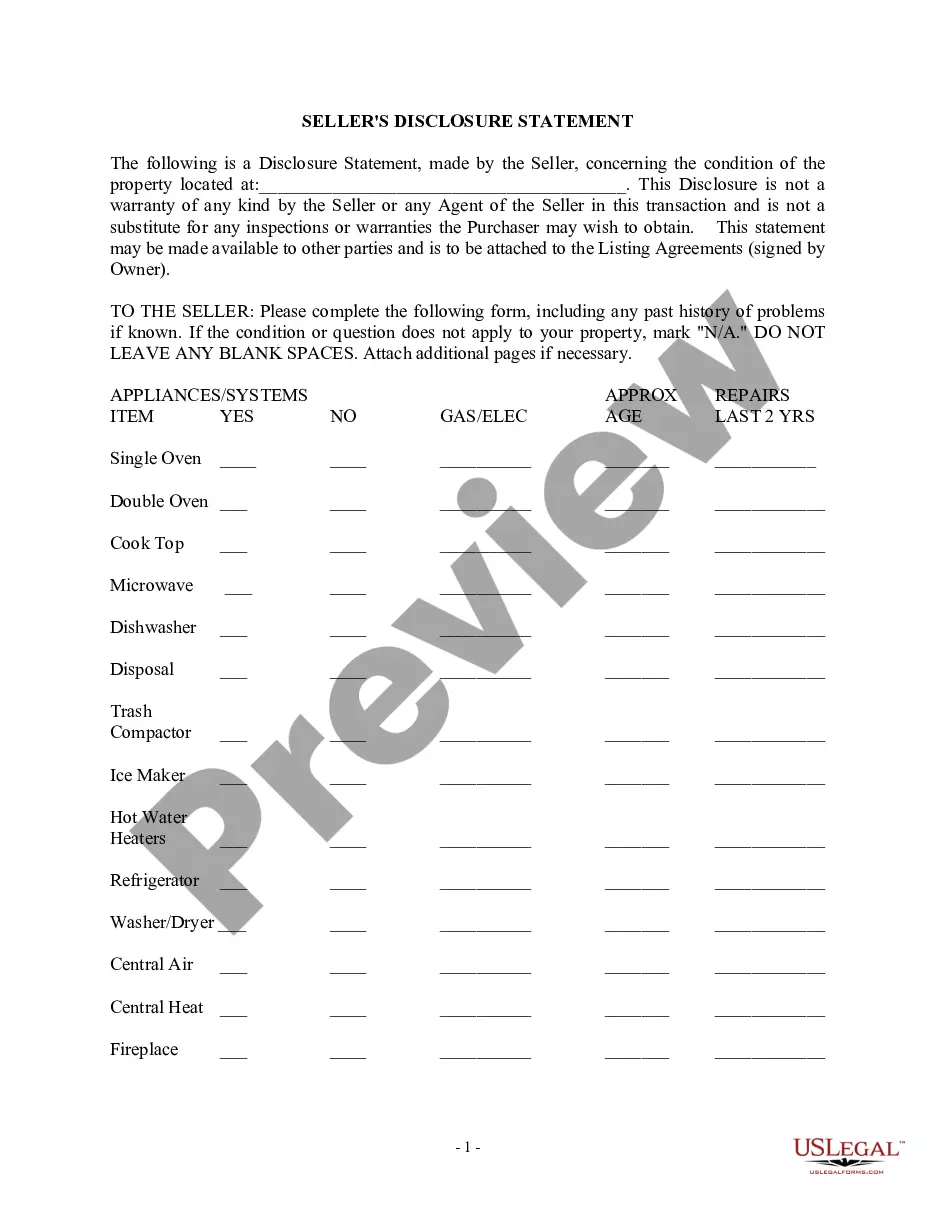

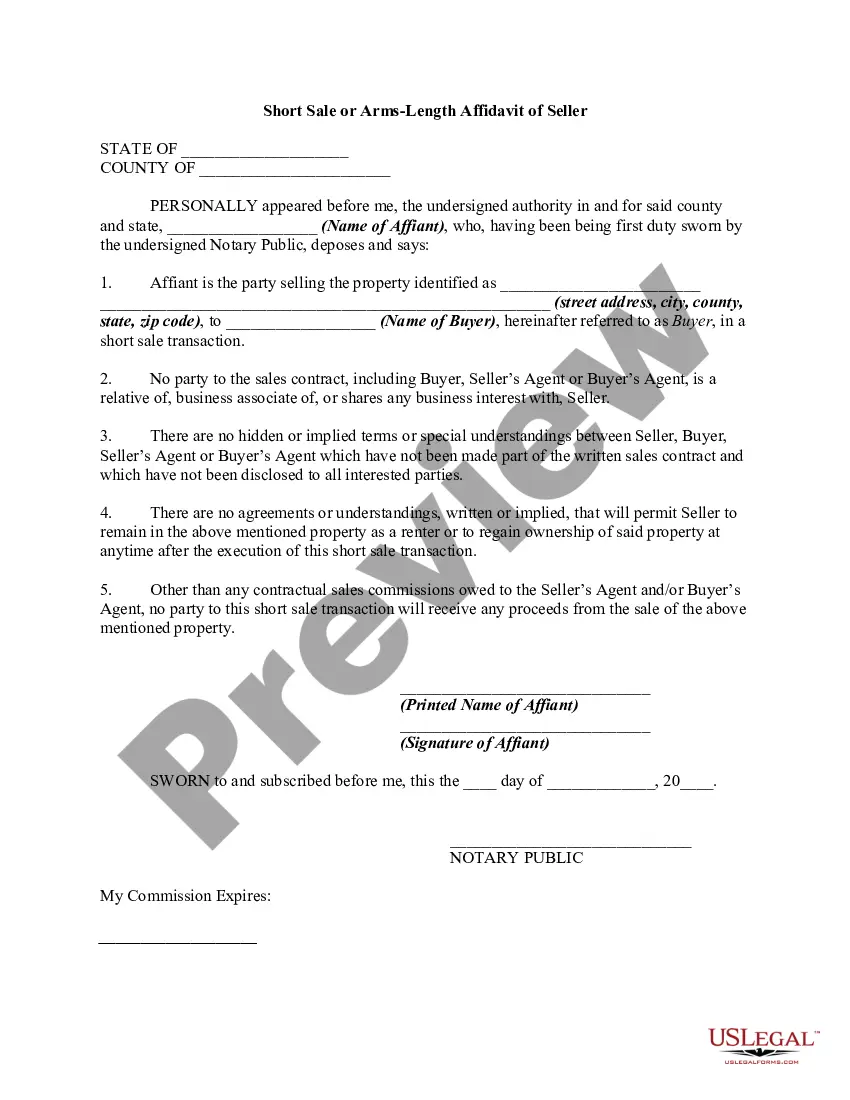

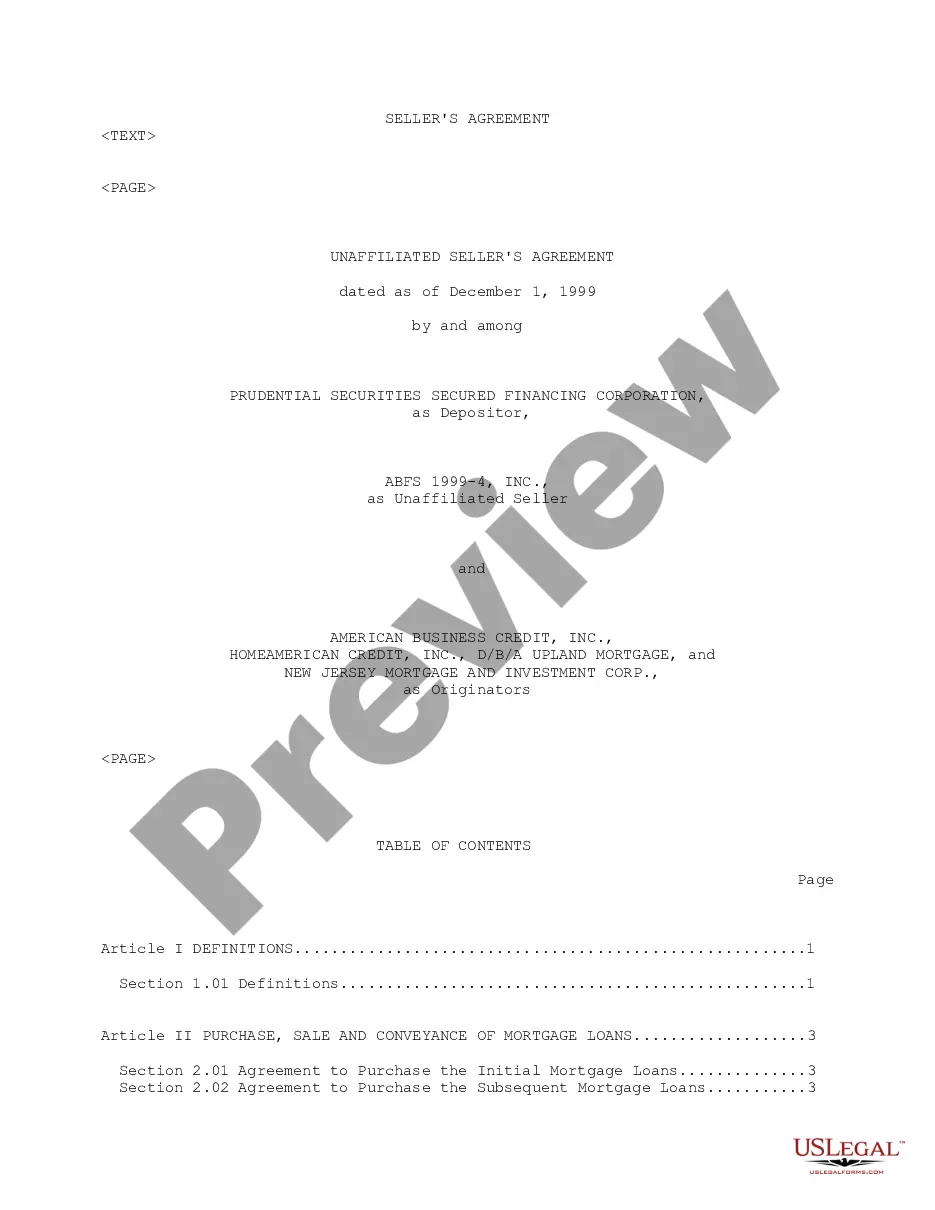

- Ensure that you have selected the correct form for your city/county. Review the Preview option to examine the details of the form. Look at the description of the form to confirm you’ve picked the appropriate one.

- If the form does not meet your requirements, utilize the Lookup field at the top of the screen to find the right one.

- When you are satisfied with the form, confirm your choice by clicking on the Acquire now button. Next, select the pricing plan you want and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Tennessee Rule 144 Seller's Representation Letter Non-Affiliate.

Form popularity

FAQ

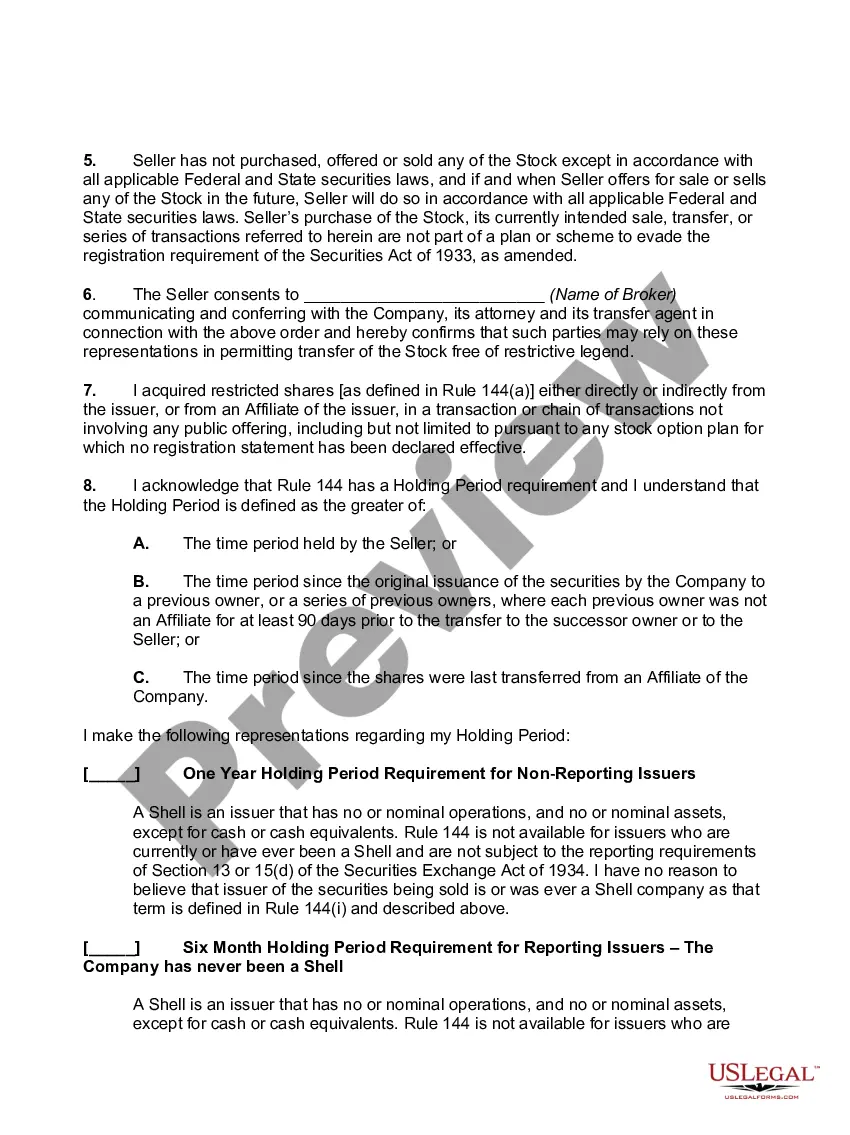

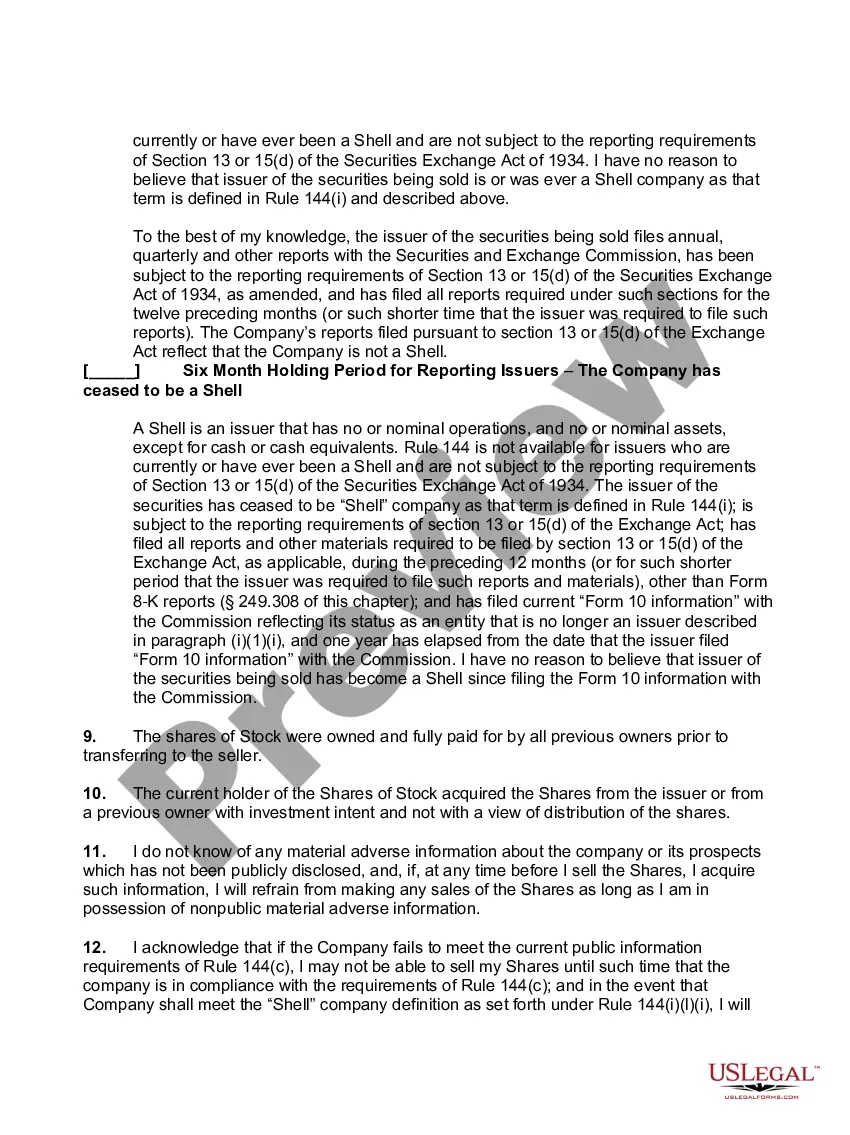

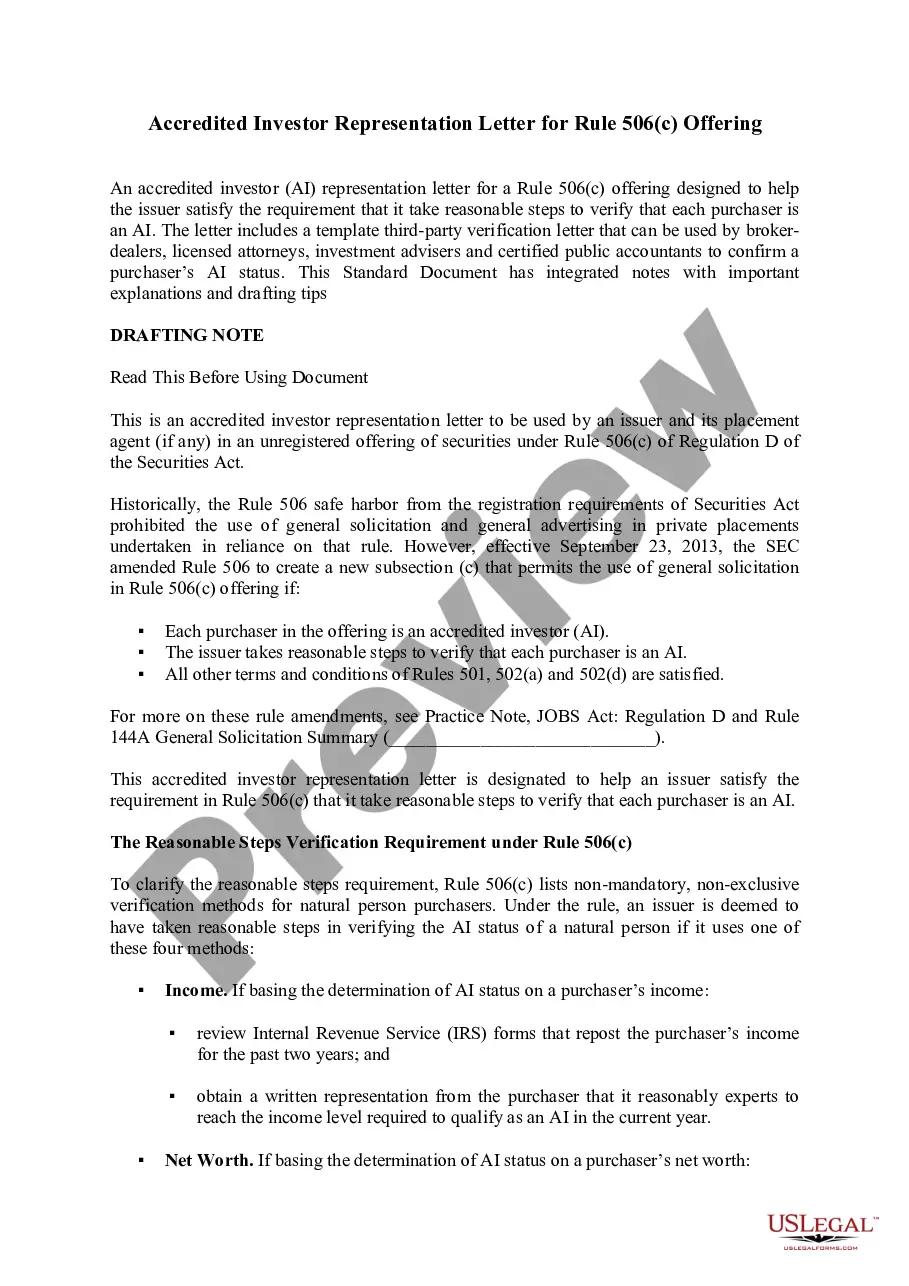

Rule 144 is a safe harbor under Section 4(1) of the 1933 Act, originally adopted in 1972 and amended several times since then, that permits the public or private resale of restricted securities if certain conditions are met, including the satisfaction of applicable holding periods. D.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

Rule 144 applies to the sale into the public securities market of restricted stock by anyone and of unrestricted stock sold by a controlling person (affiliate) of an issuing company. Sales into the public market involve a brokerage firm and are not face-to-face sales negotiated between a seller and a buyer.

affiliate of a nonreporting issuer must hold the securities for one year before any public resale. After one year, a nonaffiliate may freely resell such securities without regard to any of the Rule 144 conditions.

Rule 144 is the most common exemption that allows the resale of unregistered securities in the public stock market, which is otherwise illegal in the U.S. The regulation gives a specific set of conditions that a shareholder must meet in order to sell unregistered, "restricted," or "controlled" securities in the public

Rule 144 applies to the sale into the public securities market of restricted stock by anyone and of unrestricted stock sold by a controlling person (affiliate) of an issuing company. Sales into the public market involve a brokerage firm and are not face-to-face sales negotiated between a seller and a buyer.

Rule 144(a)(3) identifies what sales produce restricted securities. Control securities are those held by an affiliate of the issuing company. An affiliate is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

(Rule 144 Resale) Summary. This form of broker's representation letter may be used in connection with a resale of restricted securities by an affiliate of the issuer in reliance on Rule 144 (17 C.F.R. § 230.144) under the Securities Act of 1933, as amended (Securities Act).

Counsel delivering an opinion as part of a Rule 144 sale typically relies on, among other things, a representation letter from the seller to establish certain facts underlying the opinion, and the seller's broker and the issuer's transfer agent may require a similar representation letter.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.