Tennessee Sample Letter for Date for Hearing

Description

How to fill out Sample Letter For Date For Hearing?

Choosing the right authorized papers format might be a struggle. Of course, there are tons of templates available online, but how would you find the authorized form you require? Make use of the US Legal Forms site. The service provides 1000s of templates, for example the Tennessee Sample Letter for Date for Hearing, which can be used for company and personal requires. All of the forms are checked by professionals and meet up with federal and state specifications.

If you are previously signed up, log in to your accounts and click the Acquire switch to have the Tennessee Sample Letter for Date for Hearing. Utilize your accounts to look throughout the authorized forms you may have purchased previously. Visit the My Forms tab of your own accounts and obtain another copy of the papers you require.

If you are a whole new customer of US Legal Forms, here are easy instructions that you should follow:

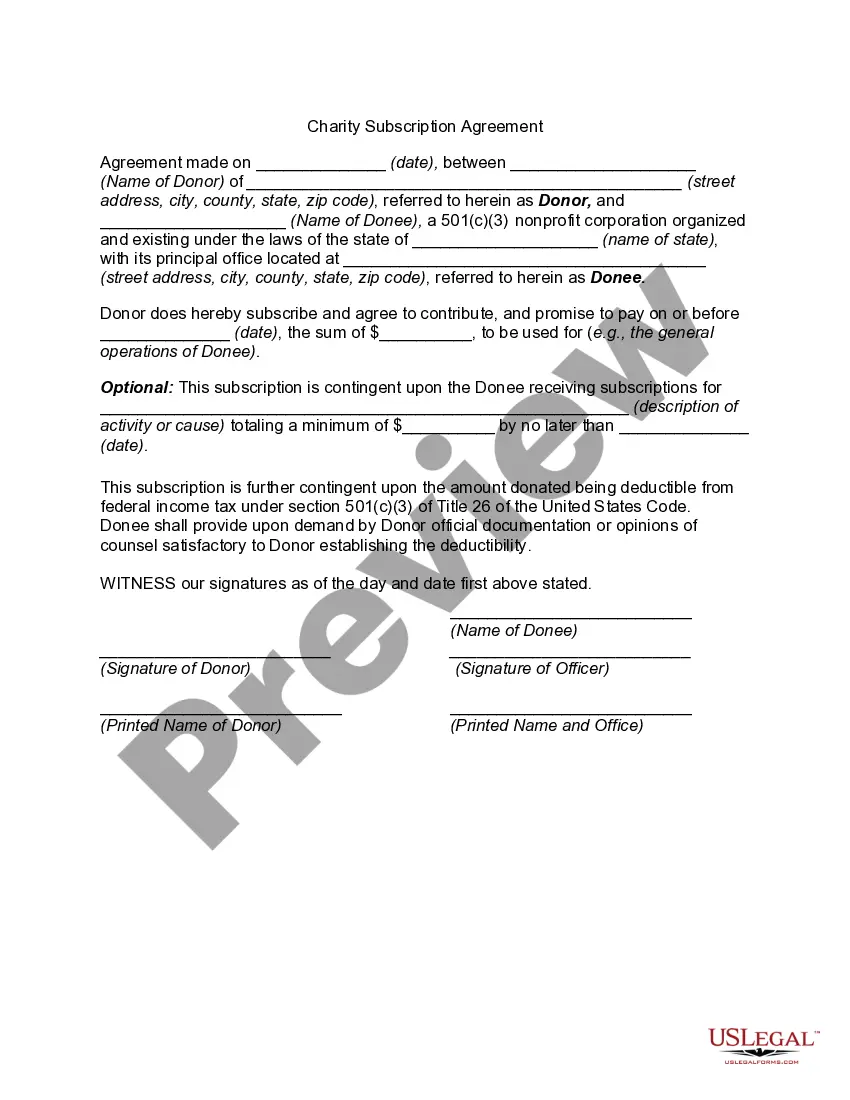

- Very first, make sure you have selected the right form for the city/county. You are able to check out the shape using the Preview switch and read the shape outline to make sure it will be the best for you.

- In case the form fails to meet up with your needs, use the Seach area to obtain the correct form.

- Once you are certain that the shape is acceptable, go through the Buy now switch to have the form.

- Choose the pricing strategy you need and enter in the needed info. Create your accounts and pay money for the order making use of your PayPal accounts or bank card.

- Pick the document structure and acquire the authorized papers format to your system.

- Complete, modify and printing and indicator the obtained Tennessee Sample Letter for Date for Hearing.

US Legal Forms will be the greatest library of authorized forms in which you can find various papers templates. Make use of the service to acquire professionally-created papers that follow condition specifications.

Form popularity

FAQ

Complete an online application and upload required verification documents through the One DHS Customer Portal at .

The Department of Revenue issues two types of notice of assessment letters when the following events occur. A taxpayer has not filed a return when due and the Department of Revenue has generated an estimated return. A taxpayer files a tax return but has not paid the full balance due on that return.

The Department of Revenue offers a toll free tax information line for Tennessee taxpayers. The number is 1-800-342-1003. If calling from Nashville or out-of-state, you may call (615) 253-0600. The Department of Revenue also offers a telecommunications device for the deaf (TDD) line at (615) 741-7398.

Tennessee Department of Revenue. Provides information for Tennessee residents to get tax questions answered, register a business, and title and register a vehicle with military and memorial license plates.

In TNTAP, account numbers are referred to as account IDs. Your account ID can be found on correspondence issued by the Department of Revenue. Account IDs are 10 digits long and followed by a three-letter code which indicates the account type (e.g., 123456789-BUS).

Usually, your appeal is decided within 90 days after you file it. But, if you have an emergency and your health plan agrees that you do, you will get an expedited appeal. An expedited appeal will be decided in about one week.

Tennessee is one of the seven states that does not impose an income tax. Taxpayers are not required to file a state return or pay tax on their wages and monetary bonuses. Where's My State Refund? Check Your Filing Status for Any State.

The Tennessee Administrative Procedure Act is the law governing procedures for state administrative agencies to propose and issue regulations and provides for judicial review of agency adjudications and other final decisions in Tennessee. It can be found in Title 4, Chapter 5 of the Tennessee Code.