Tennessee Startup Costs Worksheet

Description

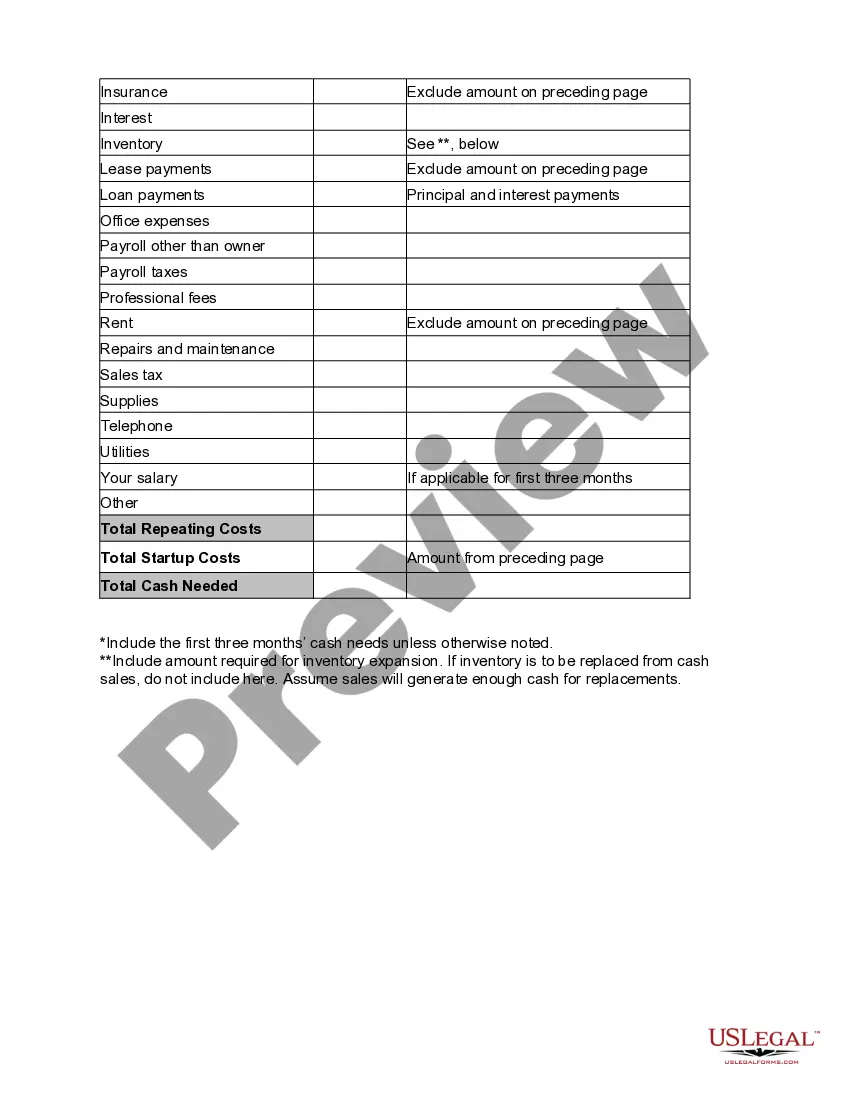

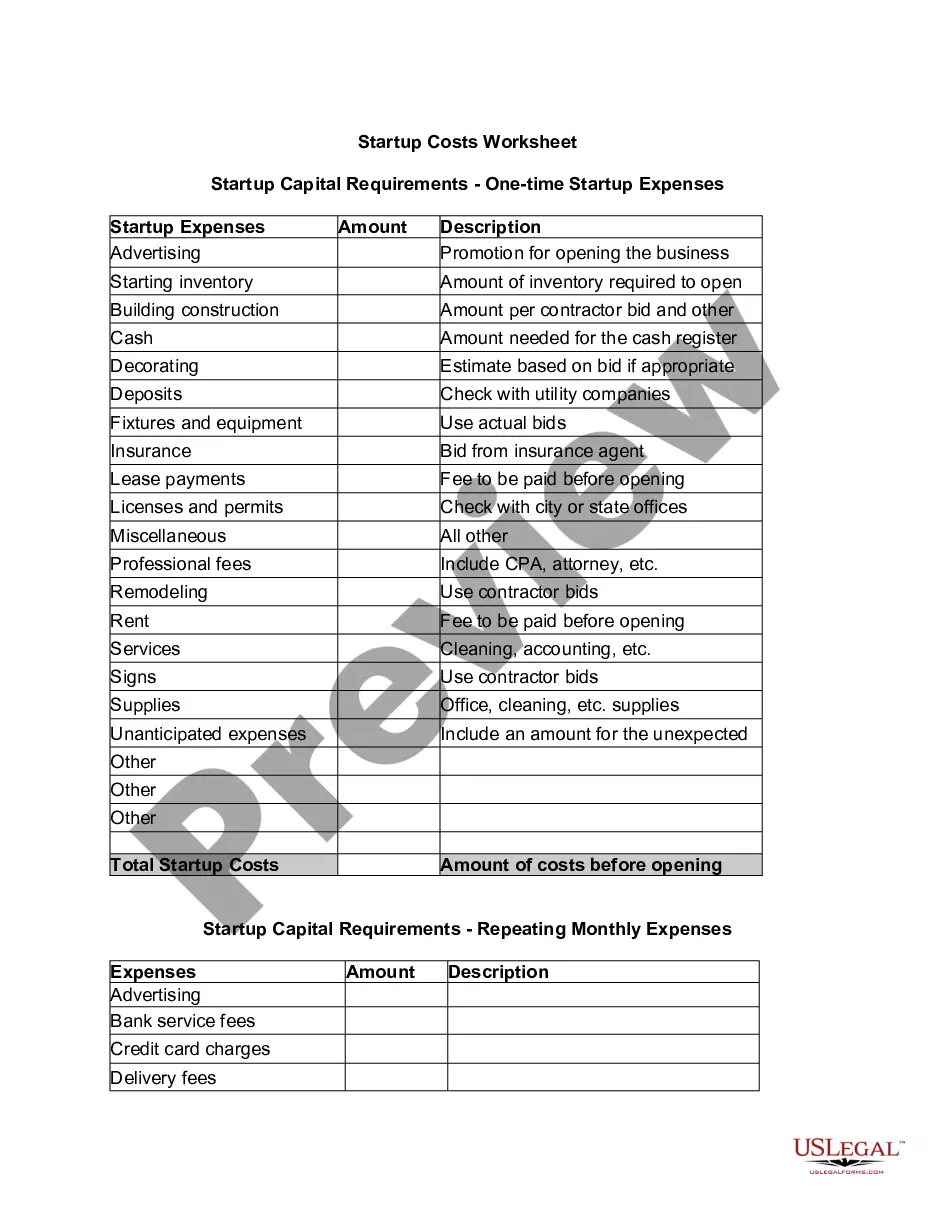

How to fill out Startup Costs Worksheet?

Are you presently in a situation where you need documents for both professional or personal reasons almost every day? There are numerous legal form templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of template forms, such as the Tennessee Startup Costs Worksheet, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Tennessee Startup Costs Worksheet template.

- Locate the form you need and verify it is for the correct city/region.

- Use the Preview button to review the document.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search area to find the form that meets your needs and criteria.

- Once you find the correct form, click Purchase now.

- Select the payment plan you want, complete the necessary information to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- Choose a convenient format and download your copy.

Form popularity

FAQ

One-time expensesNecessary equipment like a cash registers, machinery, or vehicles.Incorporation fees.Permits and licenses, such as city, county, and state licensing, or those related to your specific industry.Computer or technology equipment.Down payment for your office or store.Initial business cards.More items...

Start-Up Expenses are reported in aggregate - one amount equal to the total of all expenses incurred. For active business activities, these costs are entered either under Assets/Depreciation or under Business Expenses depending...

Begin by adding up all your startup costs and costs for organizing your new business. Subtract the costs for the of $5,000 for startup costs and $5,000 for organizational costs that you can deduct in the first year.

Business expenses incurred during the startup phase are capped at a $5,000 deduction in the first year. This limit applies if your costs are $50,000 or less. 3fefffeff So if your startup expenses exceed $50,000, your first-year deduction is reduced by the amount over $50,000.

Start-Up Expenses are reported in aggregate - one amount equal to the total of all expenses incurred. For active business activities, these costs are entered either under Assets/Depreciation or under Business Expenses depending...

Key Takeaways. Startup costs are the expenses incurred during the process of creating a new business. Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology. Post-opening startup costs include advertising, promotion, and employee expenses.

For those companies reporting under US GAAP, Financial Accounting Standards Codification 720 states that start up/organization costs should be expensed as incurred.

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

To qualify as startup costs, the costs must be ones that could be deducted as business expenses if incurred by an existing active business and must be incurred before the active business begins (Sec. 195(c)(1)).

You can enter your startup cost under the Business tab in TurboTax. In the Business Income and Expenses section click "I'll choose what I work on."